Ford and CATL Partnership: Positive for Sector

Listen

On 13 February 2023, Ford announced a US$3.5 billion investment to build a lithium ferro-phosphate (LFP) battery plant in Marshall, Michigan1. Ford’s wholly-owned subsidiary would manufacture LFP battery cells with battery cell knowledge and services provided by CATL. While the company hasn’t disclosed details of the collaboration with CATL, according to previous media reports, CATL will be the technology partner to develop and produce LFP batteries for Ford’s electric vehicles (EVs). In its press conference, Ford emphasized it’ll produce low-cost batteries with fast charging features for American customers, improve North America’s battery supply chain independence, create over 2,500 local jobs, and reflect the central purpose of the Inflation Reduction Act (IRA).

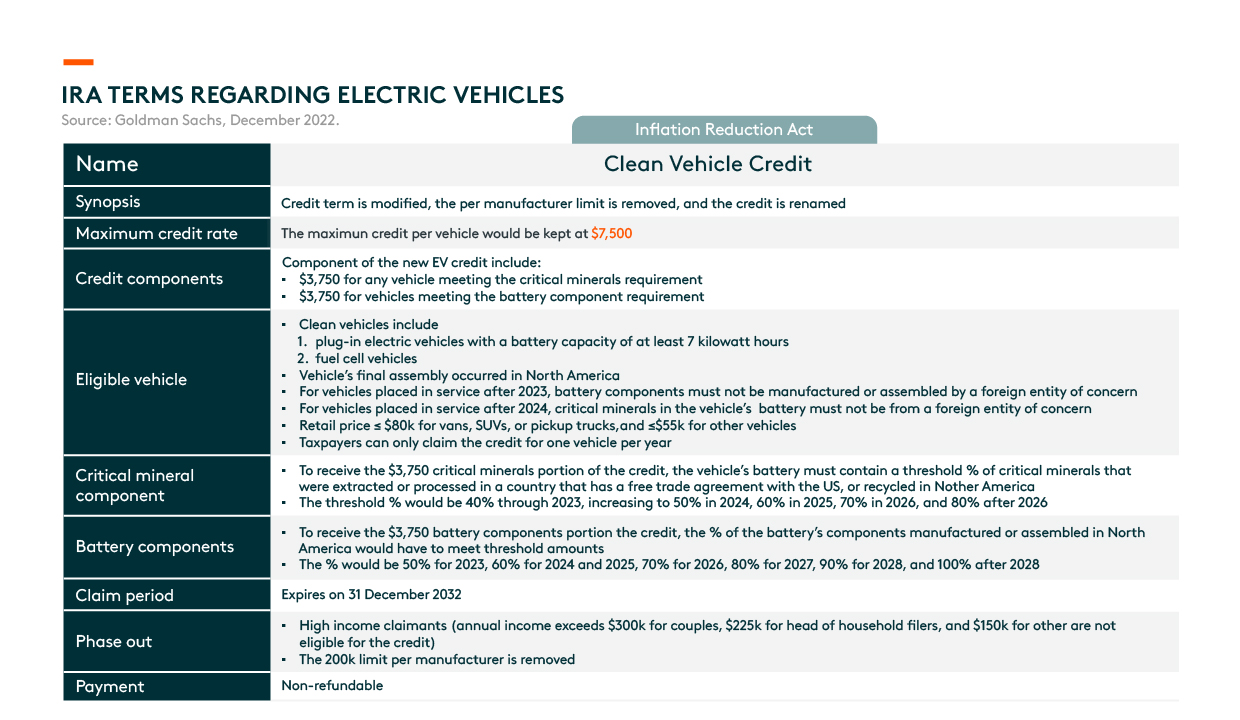

Regarding the key question of the IRA subsidy, firstly, there are no component or materials sourcing requirements to receive tax credits (US$35/kWh for battery cells and US$10/kWh for battery modules). Second, and most importantly, battery components and critical mineral sourcing are required within North America (or countries with a free trade agreement with the US) to receive the consumer tax credit of a max US$7,500 per car, as shown in the chart below. We anticipate Ford’s battery plant site in Michigan will be eligible for IRA terms. As to critical mineral sourcing, the largest part in cost, lithium mining, mostly takes place in Australia and Chile, which already meet IRA requirements. Channel checks show that CATL is seeking nickel mining and production in US-allied countries, which doesn’t include Indonesia, where the bulk of nickel mining activity occurs. Additionally, the largest battery separator maker, Yunnan Energy New Material, one of the closest partners with CATL, is proactively building their separator factory in the US. Consequently, Ford is unlikely to lose out from its collaboration with CATL. Last but not least, commercial vehicles are not under IRA requirements.

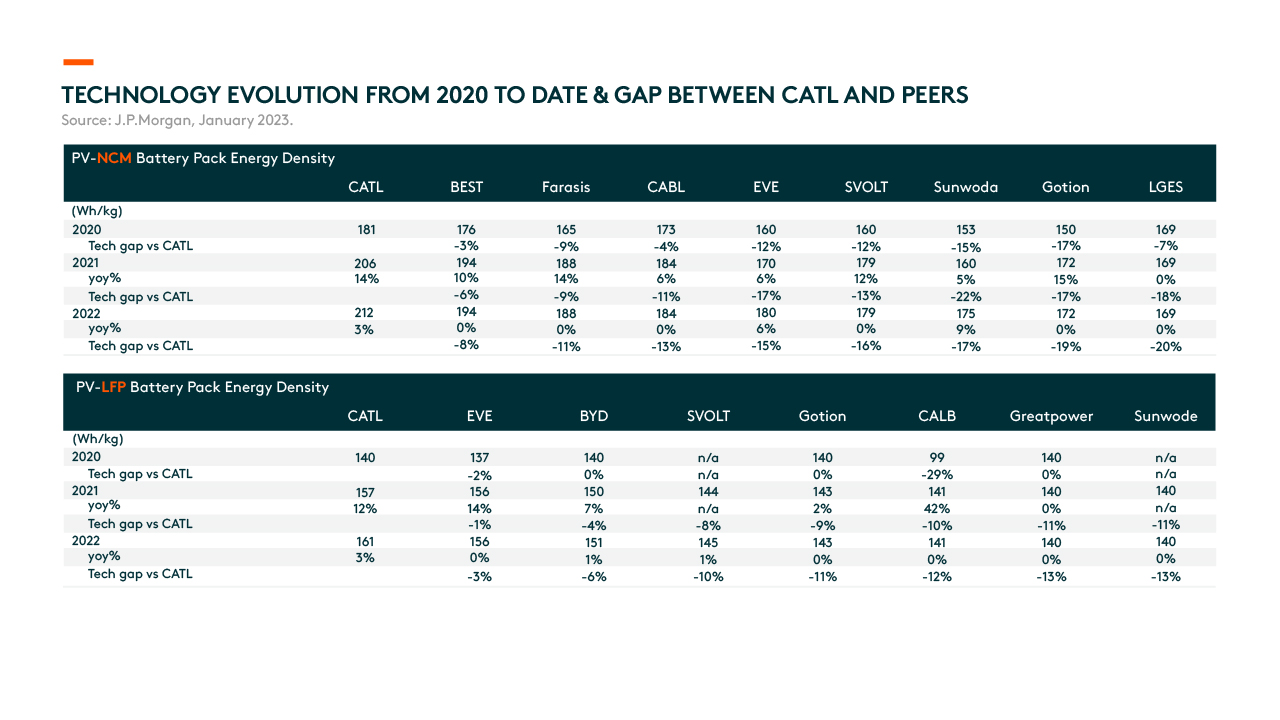

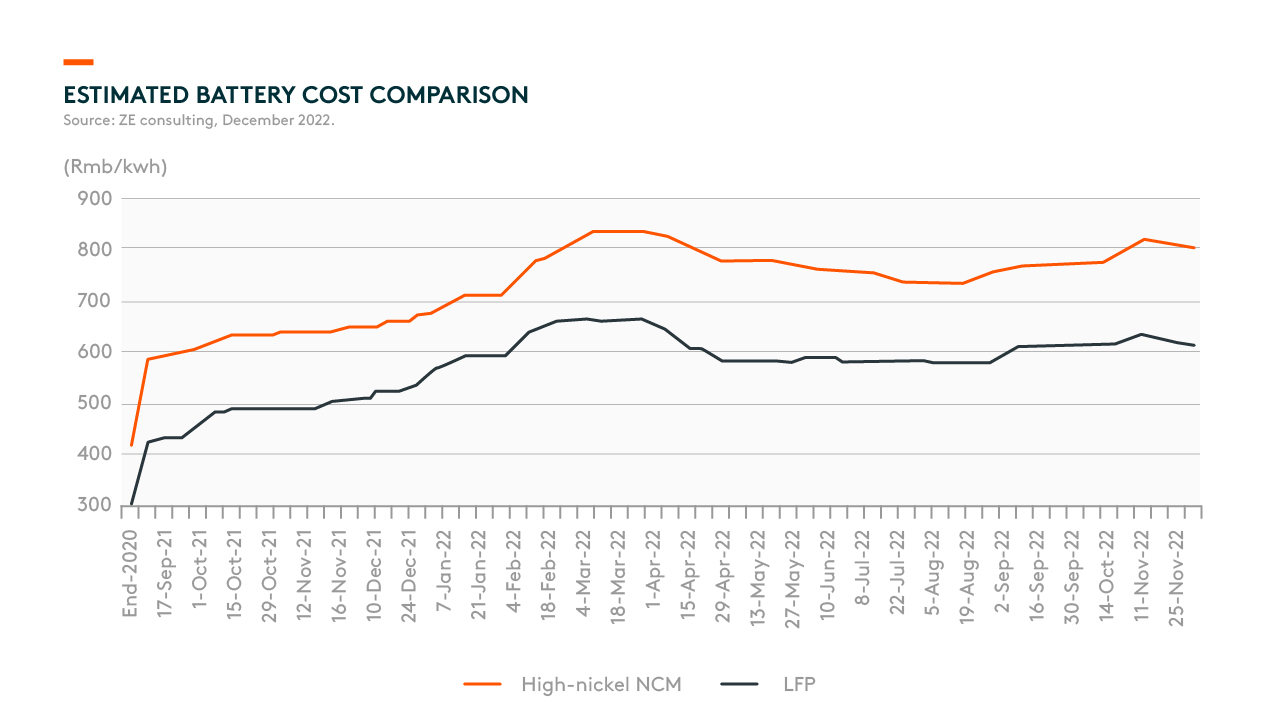

Besides subsidies, the new battery plant supported by CATL will strengthen Ford’s competitiveness in the global electric vehicle market. Leading in battery technology, CATL has reduced the price of LFP battery packs below US$80/kWh and battery cells below US$60/kWh2. This is well below the US$100/kWh level that is seen as an inflection point to reach cost parity with internal combustion engine (ICE) vehicles. Mustang’s Mach-E is now widely sold in 37 countries in 2023, up from 22 in the vehicle’s first year. In addition, 9 in 10 Mach-E customers in Europe purchased the Mustang Mach-E to replace an ICE vehicle. Ford’s commercial vehicles have been the No. 1 European commercial vehicle brand for eight years straight. As the company emphasized, LFP batteries from CATL will help Ford contain or even further reduce battery costs and EV prices, powering a variety of affordable passenger vehicles and trucks. Ford announced an EV production run rate of 600,000 units by 2023, of which: 270,000 Mustang Mach-Es will be sold in North America, Europe, and China; 150,000 transit EVs will be sold in North America and Europe; and an additional 30,000 new mid-sized SUVs will be exported to Europe. The company will ramp up its EV production and sales to 2 million units by 2026, after the new battery plant is operational, which is nearly half of Ford’s total vehicle production in 2021. We anticipate the company will accelerate EV exports to Europe and other regions globally going forward.

The unique structure of the partnership also implies a way in which Chinese battery players can tap into the US market. We saw from the move that Chinese vendors are warmly welcomed by American original equipment manufacturers (OEMs) and local states, despite ongoing geopolitical tensions between the US and China. If this form of arrangement works, other Chinese cell makers with a competitive production edge would also have the opportunity to gain US exposure in a similar fashion. In addition, it will benefit Chinese battery equipment makers and materials makers that are not restricted under the IRA and are closely tied with CATL. Ford’s practice also proves LFP batteries can be applied to pickup trucks with higher energy density requirements. Overall, we view the news as a positive for Ford, CATL, and even the Chinese battery supply chain.