Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

FAQ on Global X China Electric Vehicle and Battery ETF (2845 HKD)

Listen

We summarized the key questions on China electric vehicle (EV) and battery theme and share our thoughts in this article.

Q: Why does the ETF underperform in the last two quarters?

The Global X China EV & Battery ETF has underperformed the MSCI China index for 2 consecutive quarters.1 We concluded into the following three key issues. Firstly, the market stays sceptical about the EV demand in China. Automobile is not the first wave beneficiary after China lockdown reopened. The auto consumption is highly dependent to the pace of economy recovery and consumer purchasing power. Secondly, there were signs of more intensified price competition in the EV and battery supply chain. Tesla announced global auto price cut earlier this year, followed by other Chinese OEMs. There were growing concerns of price competition not only at the OEM (original equipment manufacturer) level but also at parts and battery level. Thirdly, the unstable China US relationship caused volatility to the sector valuation. The market placed low probability to the Chinese corporates being qualified to capture the US Inflation Reduction Act (IRA) benefits and access to the US market.

Q: What has been EV demand in past years and what do you expect in 2023 onward?

We saw the EV demand in China and the globe have rallied sharply in the past 2 years. The China EV sales grew by 172% and 78% in 2021 and 2022 respectively and reached annual sales of 5.9mn units.2 The EV penetration to total passenger car reached 33% in the fourth quarter of 20223. First two months the China EV sales grew by 21% yoy4.

At the beginning of every year, it is common to raise concern on whether the fast growth of EV sales can sustain or not. For 2023, the China Passenger Car Association (CPCA) estimated the 2023 China EV sales to reach 8.5mn units (+45% vs. 2022).5 It is tough to predict the number at the beginning of every year. We acknowledged there are many reasons to be bearish such as the removal of subsidy, the recent price competition delaying buying interest, the already high EV penetration in certain cities, and the affordability issues shortly after the economy reopen. But we would also note three positive angles being the buying behaviour is likely delayed but not disappeared; policy upside potential is still there and the penetration is likely just going to increase further.

We assess the demand appetite from two angles. One is whether the pace of economy is recovered fast enough to bring consumption back on track. Second is the attractiveness of EV. With lower lithium costs, and more intensified price competition, the cost competitive of EV is getting higher. With many more new auto brands and models being launched in the rest of the year, we think it is still too early to build the pessimistic outlook on China demand.

Q: What could be real impact of IRA on China battery stocks ?

First, there is still no clarity as to whether Chinese corporates can participate into the US market or not. The Ford-CATL potential collaboration is a smart way for Chinese corporates to gain access through technology collaboration without direct equity ownership. If there is no official exclusion of Chinese corporates’ participation, it will be a positive case to many stakeholders, as the Chinese can use a similar format to participate in the supply chain. Contrary to the market expectation of Chinese having zero exposure to the US IRA subsidy, we think it is still premature to conclude that and any further clarification only presents upside risk than downside.

Secondly is that the potential benefit of US IRA are bigger shorter term but small in the long run. To begin with, it is a tough assumption to say the US IRA subsidy policy will remain effective until 2031 after passing rounds of political power changes. But let say the rules and standard are unchanged, new battery factory can only qualify for the US subsidy and benefit at the early years of operation. Assume the newly announced battery plants were announced today and commissioned in 2027, they can only earn 4 years of subsidy, still looks small compared to a battery factory useful life of 15-20 years.

Q: China started to export EV overseas. how much potential it has ?

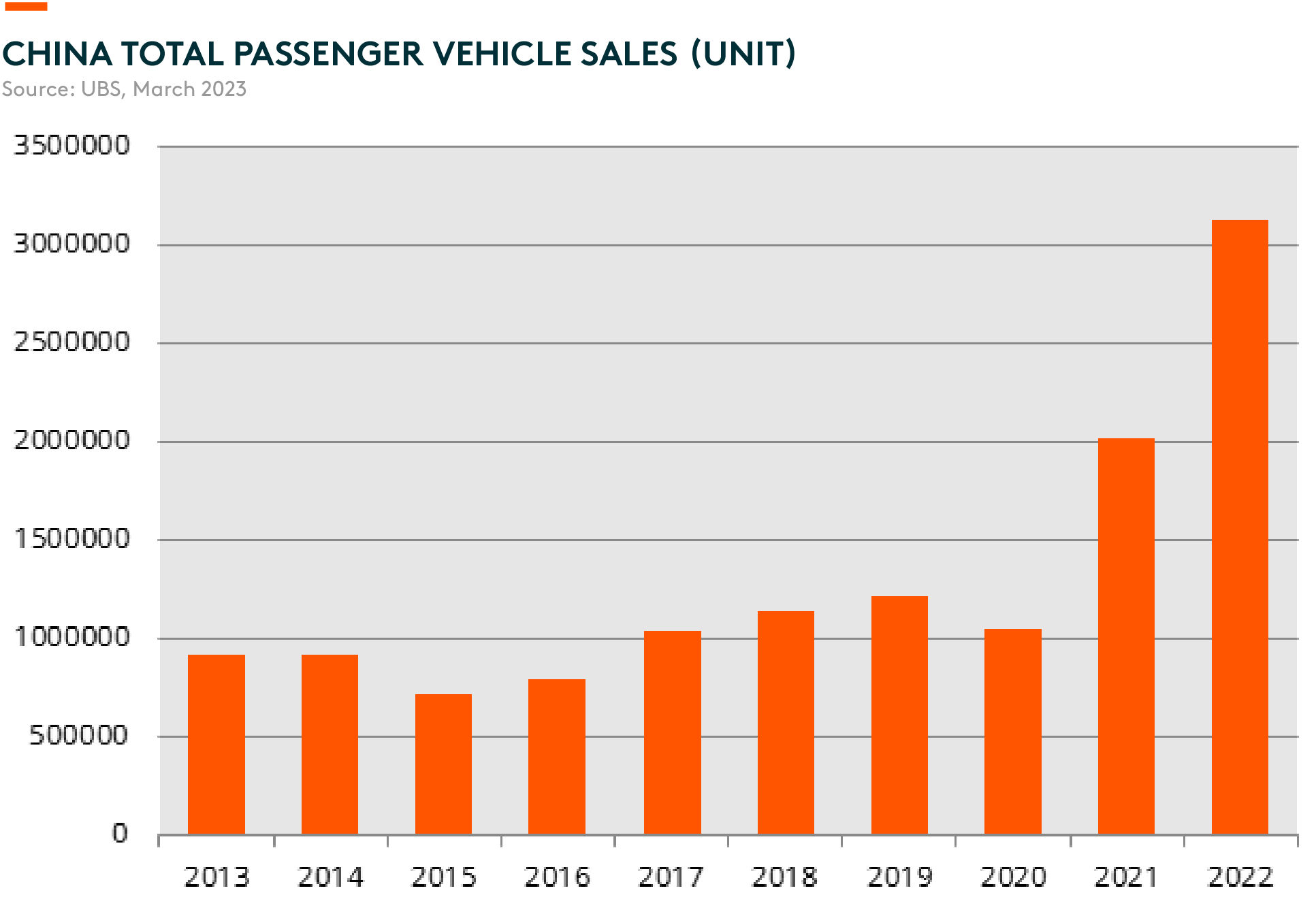

We think it is still early stage of Chinese auto manufacturers exporting to overseas market. China increased its vehicle exports by more than 54% in 2022 and reached 3.11million units,6 being the second largest exporter, surpassing Germany and behind Japan. China’s export footprints have expanded from the traditional African and Middle Eastern market into the markets in North America and Europe. BYD mentioned in their latest results briefing7 that they want to access to countries without major domestic auto makers (mostly developing countries). The Chinese EV makers have already passed the product testing phase, and entered into sales and distribution development stage. Leading Chinese auto players are actively building sales channels and setting aggressive incentive plans to expand their presence overseas. We believe it is a good start for the Chinese EV supply chain, signalling the Chinese presence in the global auto supply chain, where they do not have much presence back in the internal combustion engine (ICE) stage.

Q: What’s the valuation of key stocks? is it expensive ?

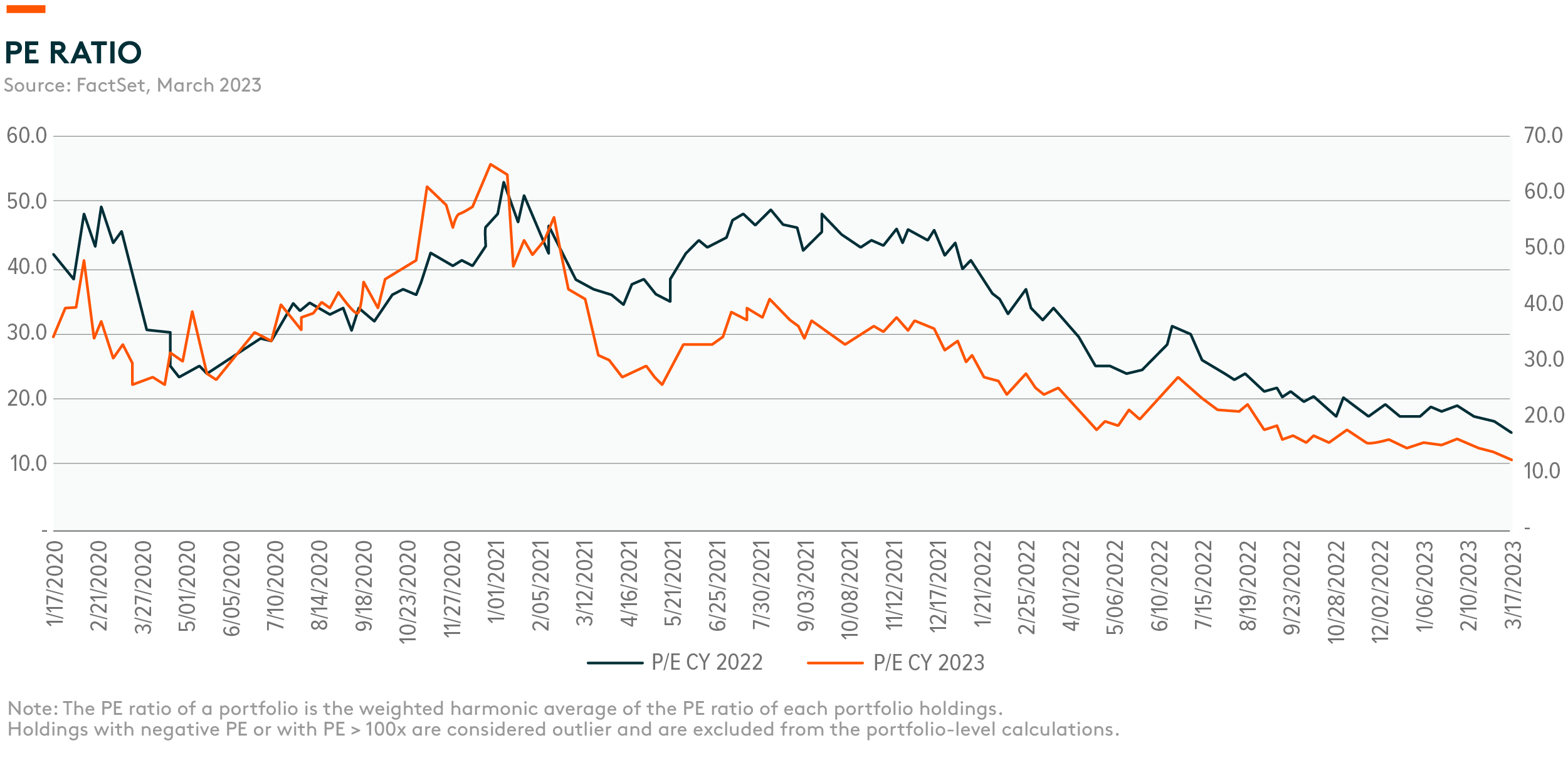

The Global X China EV & Battery ETF trades at 14X 2023 P/E vs. the EPS growth of 43% and 25% in 2023 and 2024 respectively, based on FactSet consensus estimates8. This implies a PEG ratio of much less than 1X. We believe the key top holdings all shared a similar valuation profile.

Q: What could be catalyst to see stock recovery ?

Firstly on demand, we believe the April Shanghai auto show to be a critical event in the first half of this year to monitor the market reception of the newly launched auto car brands. The recent price competition at the OEM level and the falling commodity prices are likely delaying customer purchase behaviour. We believe with more auto OEMs announced price protection scheme; the buying interest might come back along with new auto models.

Secondly is the China US relationship. There are generally pessimistic views about the chance of Chinese EV and battery players entering to the US market. We believe any potential green lights in the Ford-CATL collaboration to be positive catalyst to rerate the sector.

Finally, we reiterate our constructive view to the EV and battery sector development in China. We are only at the early stage of vehicle electrification in China and in the globe. The global electrification allows China to win a bigger role in the global auto industry, which was traditionally dominated by the developed markets. We see early signs of China export success from the Chinese OEMs, offering cost competitive EV models. This also benefits the auto parts and auto supply chain accordingly. On the battery front, we highlight the leading Chinese batteries companies’ technology excellence and continued R&D effort. The recent lithium price correction also offer very good tailwinds to EV competitiveness.