Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Global Leaders ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The Fund may invest in small and/or mid-sized companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general. The Fund’s investments are concentrated in companies which are either headquartered or incorporated in Mainland China, Hong Kong or Macau. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

China 2025 Two Sessions:

Economic target in line; Emphasizing Technology Developments and Consumption Supports

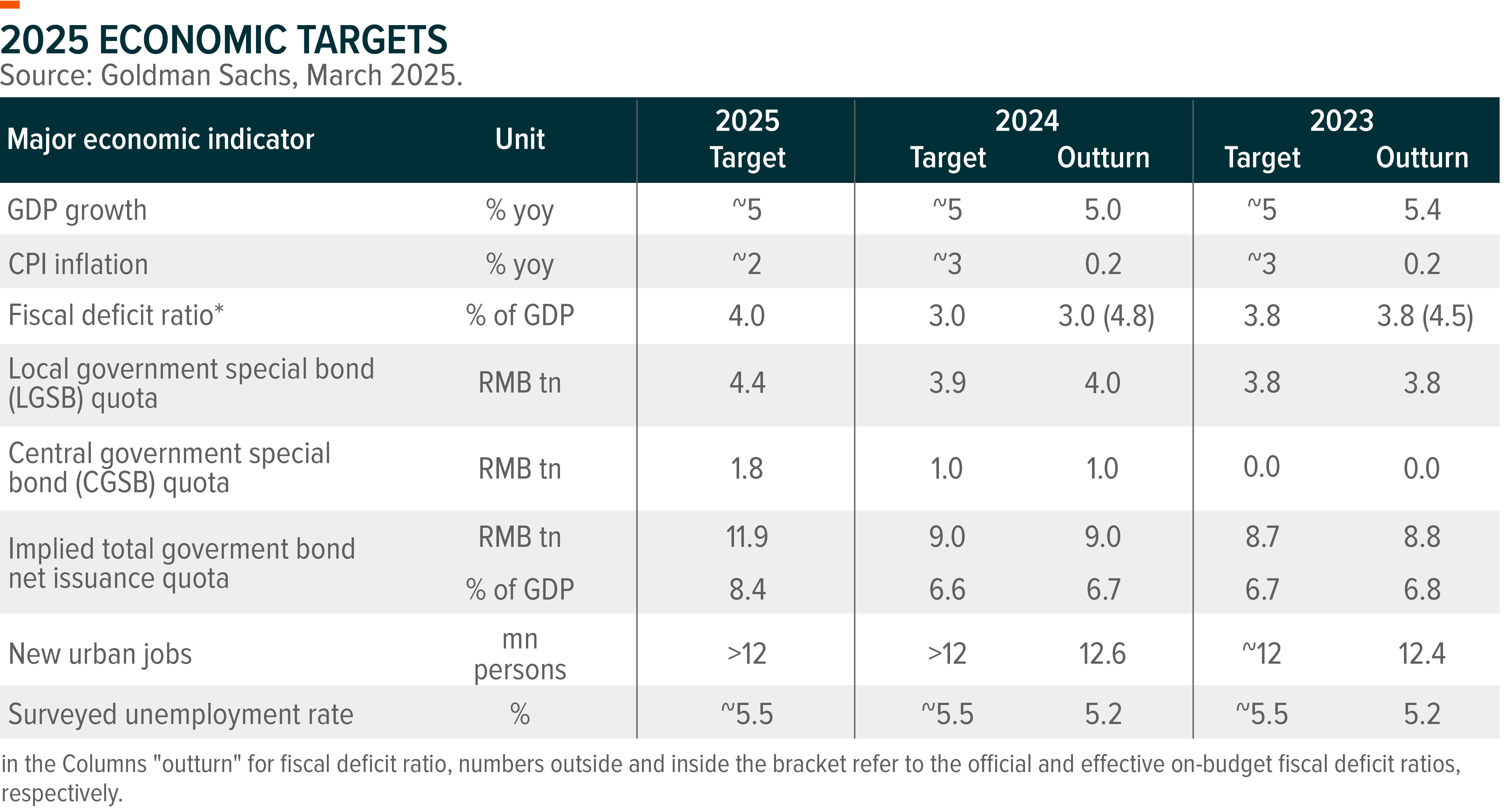

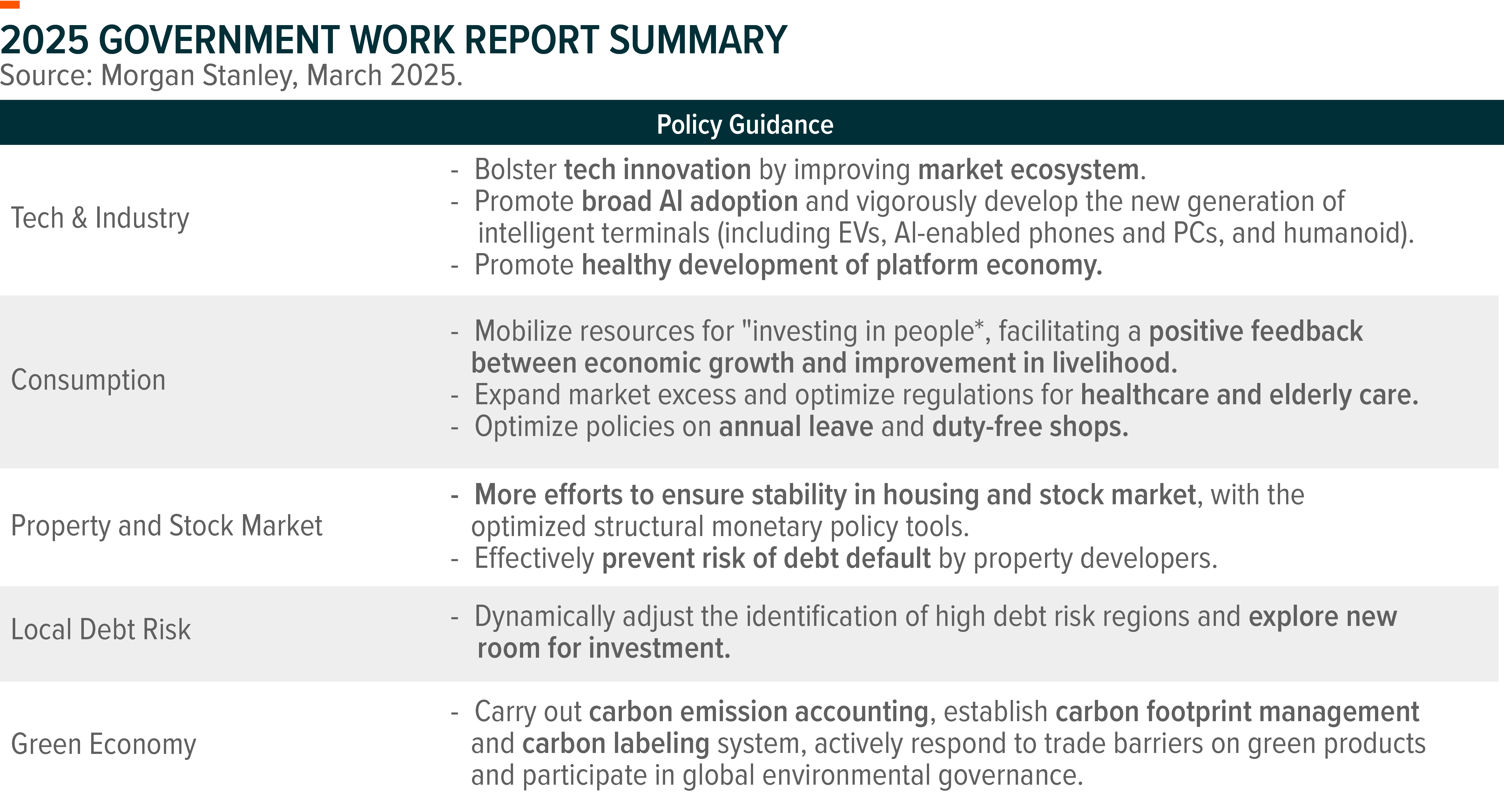

China’s 2025 National People’s Congress started on 5 March, and Premier Li Qiang delivered the Government Work Report (GWR) in the morning. Generally, economic targets including 2025 GDP growth (~5% YoY), inflation (~2%) and official fiscal deficit (4.0% of GDP) targets are in-line with market expectations. Central government showcased its efforts to drive technology innovation by improving market ecosystem, promoting AI adoption and intelligent terminals developments, and encouraging healthy development of platform economy. Additionally, policymakers announced a series of consumption supporting policies including Rmb300bn consumption trade-in program (vs. Rmb150bn in 2024), a wage hike for civil servants (~Rmb200bn annually) and a rise in basic pension payout and medical insurance subsidies (~Rmb50bn annually). GWR also touched on other key topics including property market, stock market, and debt restructuring, with key messages summarized below.

Implication on Global X ETFs

As a continuation of strong private sector support as we have seen over the past months, Technology development is one of the key focuses for Two sessions this year. Central government pledges to support AI applications and new generation of intelligent terminals, including NEVs, AI-enabled phones and PCs, and humanoid robots, and also showcases its supportive stance towards platform economy. Additionally, the positive stance to support consumption also bode well for consumer related names. We also expect positive implications on banking sectors from government’s SOE bank capital replenish program, which should support the performance of high dividend theme. We identify relevant Global X ETFs below that are well positioned to benefit from supportive policy stance.

Global X China Consumer Brand ETF (2806)

Central government announced a series of supportive consumption policies, including Rmb300bn Central Government Special Bonds funding for trade-in program, increase of minimum standard of basic pension for urban and rural residents, wage hike for civil servants, increase of the basic pension plan for retirees, and enhancement of childcare related services, which we view as positive to consumption recovery and sentiment improvement. Government also mentioned that that a new consumption stimulus package is expected to be announced soon, reaffirming its supportive stance toward the consumer sector. Despite that, improvements in the macroeconomy, stemming from the stabilization of the property market and debt restructuring, are likely to directly enhance consumer sentiment.

Among key holdings, EV and home appliance companies are poised to gain from the extension of trade-in programs. The catering, Baijiu, and beverage sectors stand to benefit from the resurgence in consumer sentiment. Moreover, travel-related industries like OTAs and hotels are expected to profit from the Chinese government’s initiatives to enhance the annual leave system and stimulate the travel economy.

Global X China Global Leaders ETF (3050)

Global X China Global Leaders ETF invests in leading Chinese companies across various high-tech sectors, aligning with the government’s clear focus on supporting technology and innovation. We see multifaceted positive implications for 3050 HK: 1) Major internet platforms, such as Alibaba and Tencent, are direct beneficiaries of government’s explicit supports for platform economy; 2) Intelligent edge-device makers, including EV OEM BYD and smartphone/EV maker Xiaomi, will benefit from government’s pledge to support AI applications and new generation of intelligent terminals; 3) Consumption related names will benefit: Home appliance makers including Midea, Gree etc., will continue to be boosted by consumption trade-in policy; OTA like Trip.com will benefit from government’s effort to refine annual leave system in China and boost traveling economy; Internet platforms with large scale ecommerce (Alibaba) or payment business (Alibaba, Tencent) will benefit from consumption recovery under policy supports.

Global X China Electric Vehicle and Battery ETF (2845)

The ETF invests in sector leaders across whole EV supply chain, including EV OEMs, Battery markers, Autopart makers, and upstream lithium makers. We remain optimistic on China EV and battery market as bolstered by extended trade-in policy support, continued technology and product innovation, further rollout and application of intelligent features, and improving EV ecosystems. ~60% of the constituents are related to humanoid robot supply chain, positioning the ETF to capitalize on the favorable developments within the humanoid robot theme. Additionally, BYD is bringing smart driving features to its mass-market models, which will accelerate smart driving adoption in China.

Global X China Robotics and AI ETF (2807)

We see robotic as one of the most important AI applications. With advanced dexterity and intelligence, humanoid robots could potentially transform existing workforces and tap into the vast labor market. Current localization rate for industrial robot, especially in high-end components, is still low, leaving room for domestic leaders to gain share. Recent rapid development of humanoid robots attract massive attention to the sector, and we see best investment opportunities for humanoid robot in China reside in the supply chain. Similar to what we have seen in EV and battery industry, Chinese companies are building an ecosystem across key supply chain elements, and leading technology companies also announced respective humanoid projects, potentially tapping into the sector.

Global X Hang Seng High Dividend Yield ETF (3110)

The Government Work Report includes Rmb 500bn special government bonds to replenish SOE banks’ capital, which should improve the capitalize structure of large SOE banks and enhance capability to support economy growth. Additionally, with local government debt resolution and domestic economy stimulus in play, bank asset quality could further improve in 2025, supporting a fundamental turnaround. Banking is the largest sector for 3110 HK, accounting for 24% of total weighting.