Potential Market Contagion: One Company’s Default is Not Necessarily a “Lehman Moment”

As investors digest the events surrounding the Evergrande Group’s 2 trillion yuan (US$300 billion) cash shortage, market commentators are concerned about the potential fallout, and implications for the global economy.1

Many market makers sold off Chinese property stocks and piled into safe-havens, as developments surrounding China’s second-largest property developer brought on recollections of the broader market contagion on the back of the Lehman Brothers’ collapse—an investment bank considered too big to fail at the time.

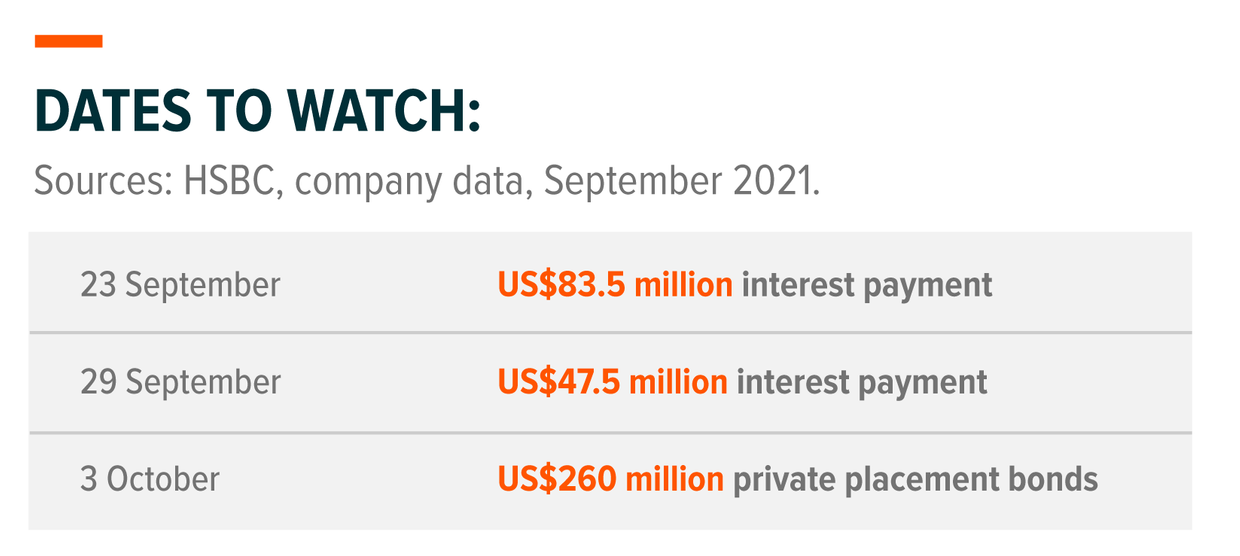

However, a “Lehman moment” is unlikely, in our view. The Chinese government has shown that it is keeping a close eye on the developments. Regulators had already warned major lenders not to expect Evergrande to meet its interest repayments due 20 September, which suggests to us that the Chinese government could be laying the groundwork for a debt restructuring package and step in to facilitate an orderly wind-down process. That said, given the company’s size, set up and obligations to banks, suppliers, buyers and investors, restructuring may be carried out over a prolonged period.

Looking ahead, it could be a long, back-and-forth process as the company deals with the fallout, between negotiating with the government and repaying investors with its wealth management products—including physical assets such as real estate. That said, in the event of a liquidation, we believe non-cash assets could be traded at a deep discount.

Beyond the Headlines: Market Size Matters

In our view, as a one-off event, there is limited systemic risk for China’s financial system. Consider the potential strain on the financial system—according to our own calculations, Evergrande’s combination of 1.5 trillion yuan in short-term liabilities, in addition to 450 billion yuan in long-term liabilities, equates to just 0.68% of total credit in China.2

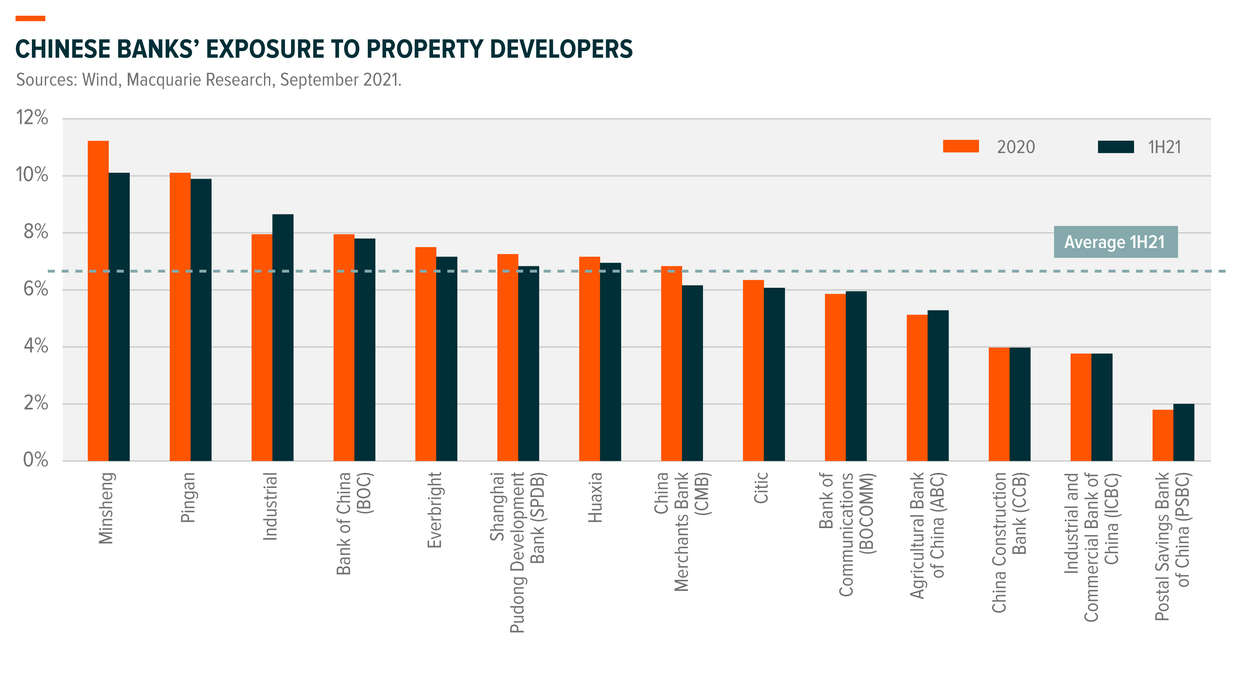

On top of this, banks’ total exposure to property developers averages around 8%, with key banks’ exposure to property developers falling below this figure.3 Despite the doom and gloom headlines predict, we think China’s banks’ risks exposure to developers should be manageable during this volatile period.

A similar logic applies to the way we consider the property sector. Evergrande makes up just 4% of China’s total property market.4 While the market has already started to feel some pain from a slowing property market, we are encouraged by the tools the regulator has at hand that could drive a loosening in policy over the fourth quarter, on the back of tight property curbs we have seen rise in China. The restrictions had a knock-on effect and impacted the sale of construction materials, furniture and home appliances.

For the broader property market, we have yet to see a direct Evergrande-led deterioration in home sales figures. Evergrande’s discounting has not had much of an impact on direct competitors’ operations, according to conversations we have had as part of our on-the-ground research.

China’s Pledge Towards Sustainable Growth

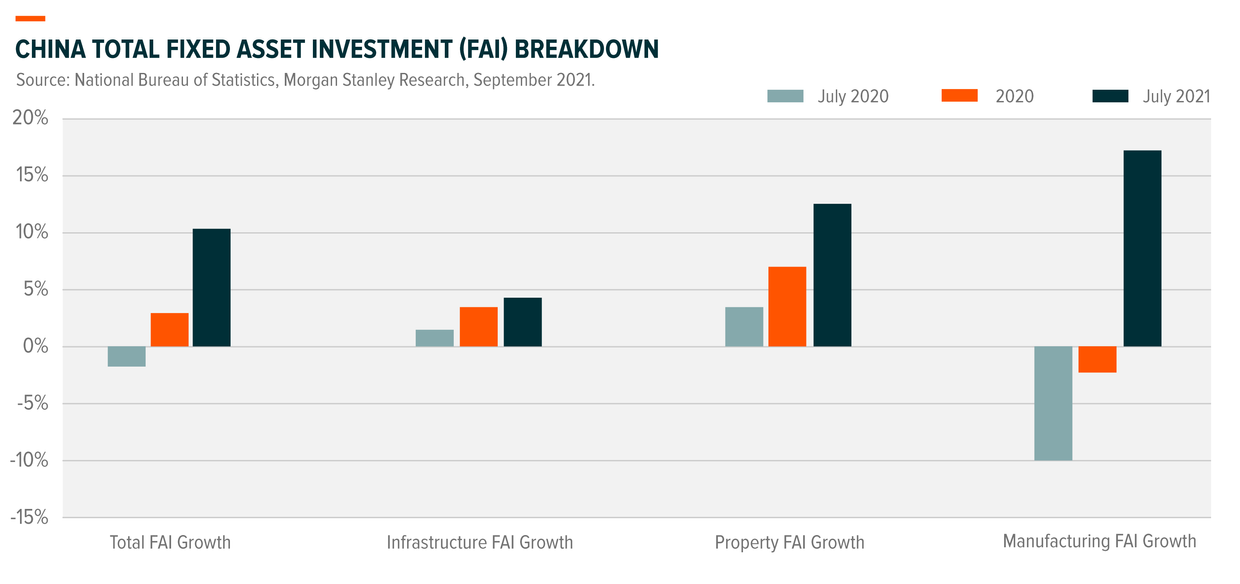

The property market takes just shy of a fifth of China’s total fixed asset investment.5 While the ripple effects of the Evergrande situation on the property market and banking system are largely contained, investors are reminded that the bigger picture lies with China’s approach on using fixed asset investments to fuel sustainable growth.

Manufacturing and infrastructure investments, which made up 29% and 33% of fixed asset investments respectively in 2020, are projected to be two key drivers for the remainder of the year.6 In manufacturing, the Chinese government has offered tax incentives to players in the industrial sector, including those involved in manufacturing advanced and high-tech solutions. We also see a strong push in for small- to medium-sized enterprises (SMEs) and green sectors, in a bid to meet the country’s aim to become a global leader for technological innovation and upgrade its sprawling manufacturing capabilities.

Yet the government is not just fine-tuning the economy with supportive policies in manufacturing sectors. Fiscal policy, especially infrastructure investment, has also been identified as a leading factor in supporting economic stability, on the back of the government’s latest remarks addressing a need to “control on-budget investments and local government bond issuance to generate tangible projects by early next year”

So, in spite of the rhetoric we see dominating headlines, credit contagion fears for China—while valid—are unlikely to come to fruition and develop into a full-blown Lehman event reminiscent of 2008, since the regulators are watching ongoing developments closely.