Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of principal. Investor should note:

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Deep Dive into the Global X Hang Seng High Dividend Yield ETF (3110 HKD): Property and Banks

Listen

The most frequent question on the Global X Hang Seng High Dividend Yield ETF (3110 HKD) is the potential payout cut of Chinese banks, considering the sector is one of the biggest constituents of the index and highly correlated to China’s real estate market. While Chinese banks and property names on the index tend to provide higher dividend yield for multiple years, we need to scrutinize the business cycle of banks and review the sustainability of dividend payouts amid property recovery in coming years.

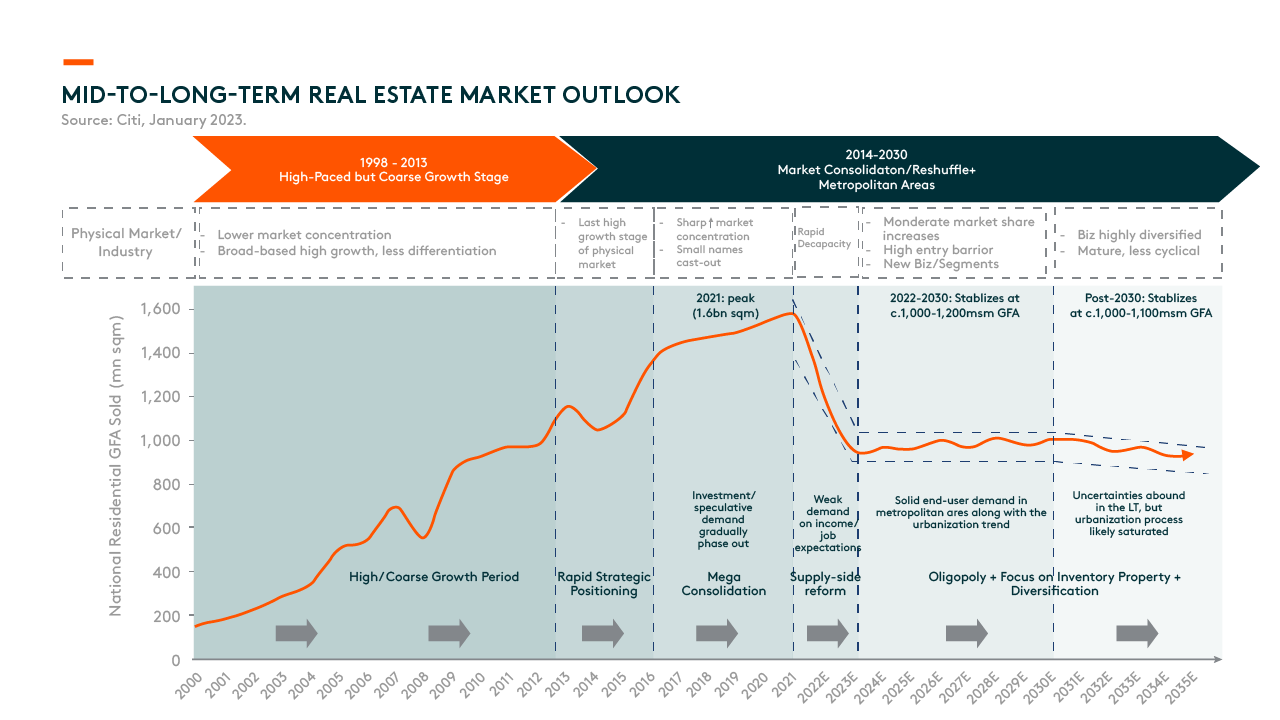

China’s real estate market slumped over the last two years due to policy headwinds, a weak macro environment, lower household incomes during COVID lockdowns, and an urbanization slowdown. Listed developers suffered more as their sales volumes decreased more than the national average level, probably due to the impacts of the three red line rules. As a result, developers turned very cautious in land transactions, which led to stretched local government financing while spending was rampant on COVID testing and lockdowns. The Chinese government, particularly most local governments, began policy easing in late 2022 to rescue troublesome developers.

Separately, after largely eliminating extreme poverty, China has now proposed common prosperity for its next stage of development. We believe real estate would be one of the key components to ensure a balance between economic efficiency and distribution. We’ll unlikely see nationwide property prices soar again to stimulate property demand or speculation.

However, on the bright side, national property sales ended with a significant scale of over one billion square meters in 2022 despite an extremely challenging environment.1 In the foreseeable future, organic demand for property is expected to remain above one billion square meters on the back of new marriages, urbanization rate of 65% and above, and city-level shanty town development. We expect the younger generation to continuously gather in higher-tier cities, provincial capitals, or metropolitan cities, while urbanization will continue to be the key driver for new housing demand.

Currently, local governments are providing lower premium lands in better regions to avoid land auction failure. Therefore, we may see margin improvement for leading developers with healthy balance sheets despite some scale-down. Compared to their prime days, development businesses will more closely resemble a fixed-margin manufacturing business on a relatively smaller. Companywise, developers not involved with public debt defaults or have completed debt extensions/restructurings will be better positioned going forward, while weaker companies are consolidated or exit.

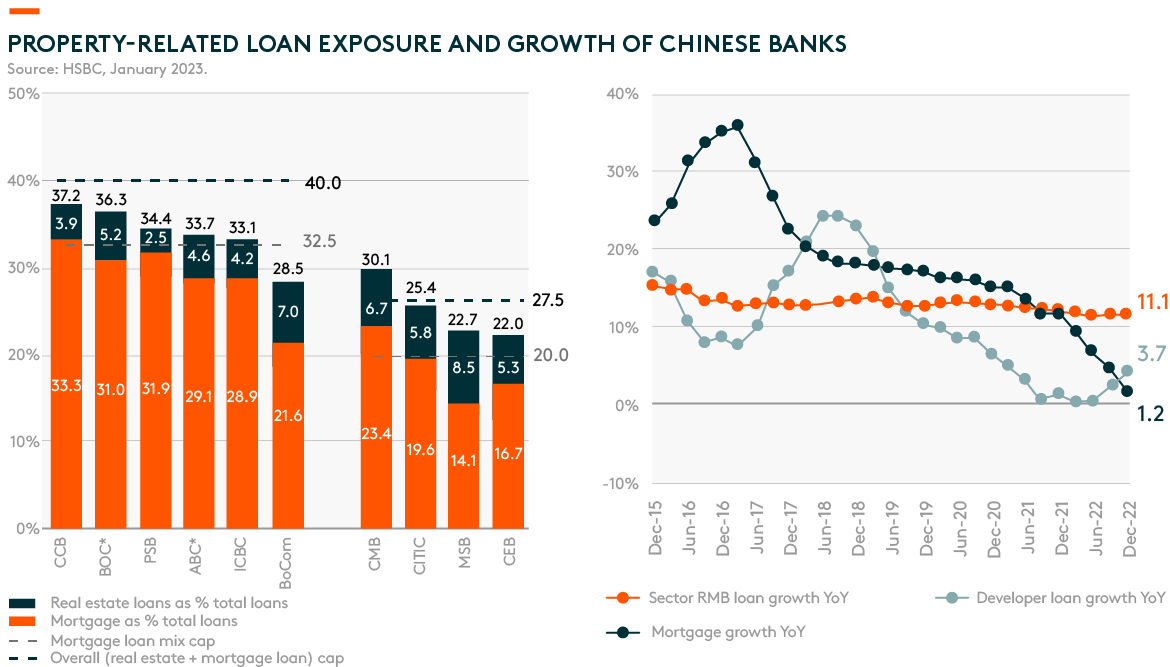

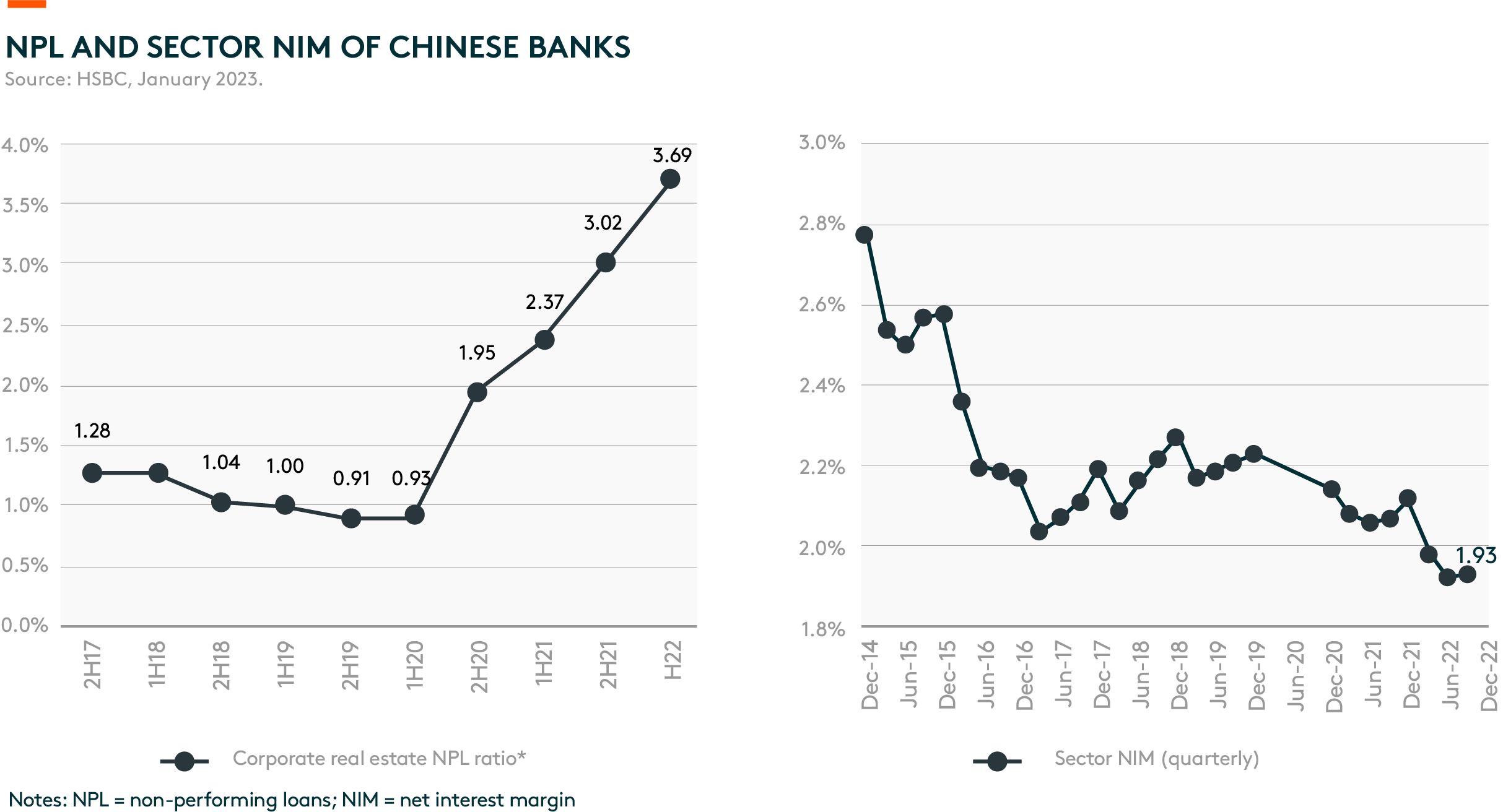

The worst time for Chinese banks will also be behind us when the property industry steps out of trouble. Chinese banks are closely intertwined with the broader property ecosystem: large banks have approximately one-fifth to one-third of mortgage loans and a single-digit of developer loans; the broader property ecosystem takes the largest part of China’s GDP.2 A better-than-expected property recovery would lead to, firstly and most importantly, fewer bad loans and a lower non-performing loan (NPL) ratio; secondly, improved mortgage demand and a reduced need for further monetary easing; and lastly, better sentiment within the economy, implying general fee income potential.

With the Chinese government stepping up efforts to assure the delivery of property projects, NPL pressure from buyer-initiated mortgage payment halts could be largely removed. Additionally, recent stimulus policies should help developers improve their liquidity and strengthen their capability to raise funds by themselves. A sustained recovery in property sales would also positively impact the land market, making credit risks from local government financial vehicles manageable. We also anticipate China’s economic reliance on the property market to fall from here, with developers and local governments developing new growth models less dependent on property sales and land transactions. As a result, the economy would be more sustainable with reduced leverage from a long-term perspective. Accordingly, it implies better revenue quality for Chinese banks and less valuation discounts applied in the long run.

Sector valuation for property and banks has declined to a historical low point. Most high-quality names are trading far lower than a 1.0x price-to-book (P/B) ratio, which shows the degree of overconcern. Companies with healthy balance sheets could deliver high single-digit dividend yields after the extreme sector correction of share prices in 2022, which makes them very attractive as a dividend product.

As China’s property market steps out of the extremely dark time, we expect a moderate sector recovery carrying forward. Leading companies will be better off as the market consolidates, with less competition and policy tailwinds. Consequently, the dividend yield should remain solid in the coming years. Overall, we are confident about the sustainability of dividend payouts going forward.