Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of principal. Investor should note:

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Deep Dive into the Global X Hang Seng High Dividend Yield ETF(3110 HKD) : Materials

Listen

The sustainability of profitability and dividend payouts from basic materials companies is a frequent question we get for the Global X Hang Seng High Dividend Yield ETF (3110 HKD), as commodities are cyclical in nature. Thus, in this article, we discuss the demand outlook for major commodities and explain why they remain in an upcycle.

Basic materials prices witnessed a strong momentum since mid-2020 due to 1) supply disruptions, 2) global central banks’ monetary easing, and 3) global demand recovery. Most basic metal prices had a short-period correction in 2022 thanks to concerns arising from the Fed’s hawkish stance and China’s sluggish property demand. However, prices bounced back sharply since November 2022 following China’s COVID policy U-turn. The rapid reopening of China’s economy from the zero-COVID policy improved the demand outlook for 2023, which is seen to counter Western recession risks.

As China’s property market steps out of the extremely dark time, the property sector recovery should be much better than expected. The latest new home sales in February recorded double-digit year-on-year growth, while it wasn’t initially expected to turn positive until April. Home buyers are actively getting back into the property market after loosening home purchase conditions, lower mortgage rates and down payments, as well as incentive spending from developers. Therefore, materials demand slowdown from the property side could be limited.

Regarding another key source of demand for infrastructure, China recorded stronger-than-ever issuance of local government special bonds in 2022 to boost the economy. Infrastructure fixed asset investments (FAI) recorded positive growth last year. However, some of these investments have not yet converted into real demand for commodities due to local government leadership changes, funding flow delays, and interruptions of COVID, which will be carried over into 2023. Additionally, China’s State Council has set the 2023 deficit-to-GDP ratio at a 3% deficit target and year-on-year growing special local government bond quota. Therefore, we anticipate infrastructure investment activities to accelerate carrying forward, leading to strong demand for commodities. In particular, the inventory level of copper and aluminium remains historically low, largely due to less capex in the last decade and production control due to ESG reasons, which provided a further cushion for prices.

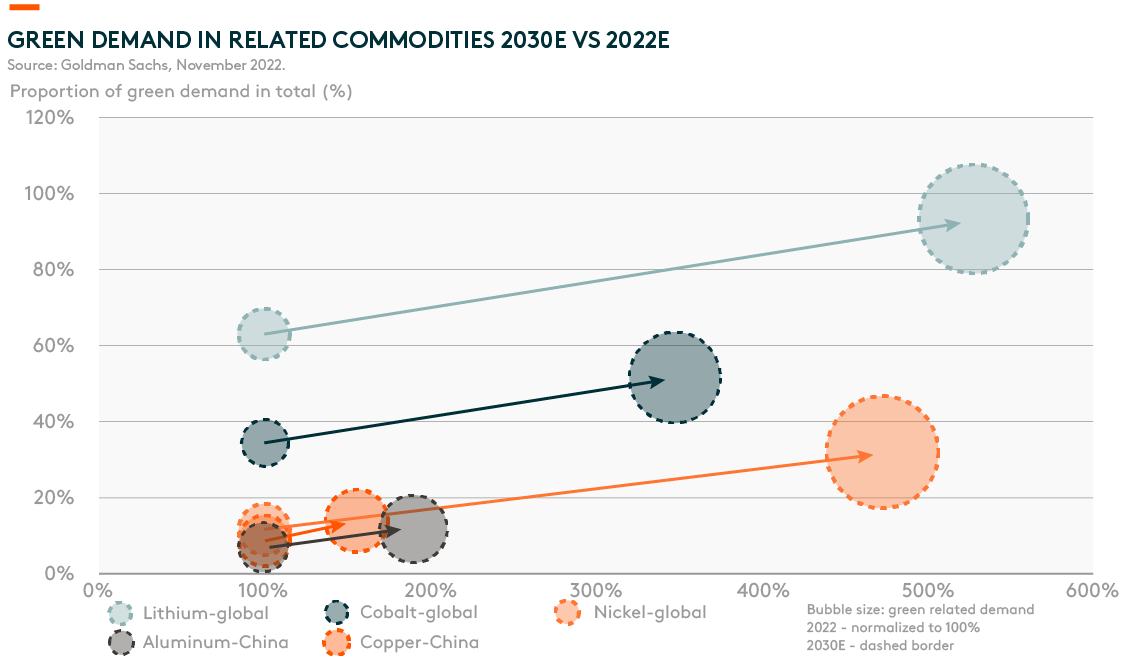

In addition, China’s energy security and transition pathway imply a delayed coal exit and robust green energy demand in related commodities. Coal prices increased in the last two years after years of capex cuts and supply-side reforms. The temporary power shortages across China also highlighted the importance of thermal power in stabilizing the energy supply. There is a policy shift over the medium term in the context of energy security, though China remains committed to its long-term carbon neutrality target. China’s focus on energy security and transition generates secular demand for related commodities. From renewable power generation to electric vehicles and energy storage, green demand will be robust in the coming years, complementing property as a new growth driver for related commodities.

To summarize the above, we expect demand for basic materials to remain solid despite property decelerating. For most commodities companies, their return on equity (ROE) ratios are at historically high levels, while stocks are trading at low-level valuations, meaning high dividend yields are well cushioned. Thus, there should be less doubt about the sustainability of dividend payouts in the coming years.