Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X China Clean Energy ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Clean Energy Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Electric Vehicle and Battery ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Electric Vehicle and Battery Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X Hang Seng High Dividend Yield ETF (the “Fund”) is to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng High Dividend Yield Index.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Fund may invest in mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The Fund invests in the emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The investment objective of Global X EV and Humanoid Robot Active ETF (the “Fund”) is to achieve long term capital growth by primarily investing in companies which are directly or indirectly involved in electric vehicle or electric vehicle-related battery businesses (the “EV/Battery Business”), humanoid robots and robot-related automation businesses (the “Humanoid Robotic Business”).

- The Fund does not seek to track any index or benchmark, it may fail to meet its objective as a result of the Manager’s selection of investment, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may invest in small and/or mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Fund’s ability to invest in A-Shares or access the PRC markets through the programme will be adversely affected.

- Investors should note that Shareholders will only receive distributions in USD and not HKD, Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X Innovative Bluechip Top 10 ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset Global Innovative Bluechip Top 10 Index.

- The Underlying Index is an equal weighted index . The Fund may hold larger positions in smaller-cap constituents than a market-cap weighted index, leading to higher risks and potential underperformance.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investors should note that Shareholders will only receive distributions in USD and not HKD, Shareholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

December Investment Review

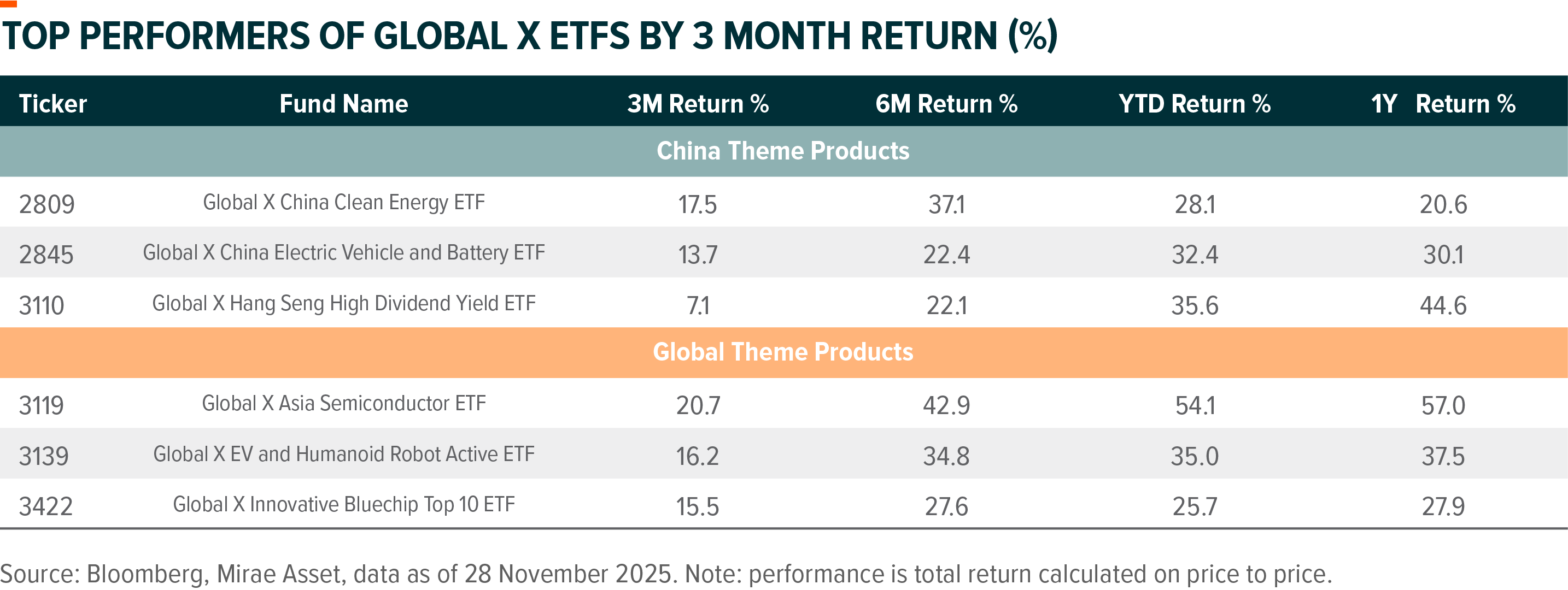

In this article, we highlight the top performers of Global X ETFs over the past three months. By the end of November, Global X China Clean Energy ETF (2809), Global X China Electric Vehicle and Battery ETF (2845) and Global X Hang Seng High Dividend Yield ETF (3110) led the performance among China products, while Global X Asia Semiconductor ETF (3119), Global X EV and Humanoid Robot Active ETF (3139) and Global X Innovative Bluechip Top 10 ETF (3422) outperformed among global products. Below, we delve into the key drivers fueling their recent growth.

Past performance information is not indicative of future performance. Investors may not get back the full amount invested. These figures show by how much the Fund increased or decreased in value during the calendar year shown. Where no past performance is shown, there was insufficient data available in that year to provide performance.

China Top Performers:

Global X China Clean Energy ETF (2809) offers diversified exposure to broader clean energy industries including solar, wind, hydro, power and grid equipment. The ETF is well positioned to benefit from the improving solar sector sentiments under China’s anti-involution campaign, and will continue to ride on the ongoing green energy transition trend in the long run.

Chinese policymakers are stepping up efforts to curb “involution” (内卷), which refers to excessive competition that often comes with aggressive pricing and excess capacity issues. Starting from the CFEAC meeting on July 1, policy momentum accelerated with key industrial regulators like MIIT, NDRC, and SAMR issuing high-level proposals. The July Politburo meeting reaffirmed the campaign’s priority. Albeit still at an early stage, anti-involution campaign would prompt regulation of low-price competition and promote outdated capacity exit, driving higher Poly prices and earlier profitability inflection for major solar companies.

China President Xi Jinping unveiled China’s 2035 Nationally Determined Contributions (NDCs) on Sep end, pledging to expand installed capacity of wind and solar power to 3600GW, over sixfold of 2020 levels. We estimate the new target could imply at least 200GW annual installation for solar and wind in the coming 10 years. Achieving this will require robust, parallel growth in energy storage and grid infrastructure. We expect energy storage to become mandatory for managing the intermittency of renewables, while significant grid expansion, including accelerated investment in UHV transmission and smart grid upgrades, will be a fundamental prerequisite.

Global X China Electric Vehicle and Battery ETF (2845) invests in in key companies across EV and battery value chain including EV OEMs, Battery makers, Battery component makers, Autopart companies, Lithium companies, and others. Additionally, many of the ETF constituents have exposure to humanoid robot theme.

We believe China EV volume growth could accelerate in the 4Q peak season, while battery demand remains solid and battery material costs stay low. According to CABIA, EV battery installations rose 32% YoY and 12% MoM to 62.5GWh, while ESS battery sales held high at 35.6GWh, up 49% YoY. (China Automotive Battery Innovation Alliance, Mirae Asset, September 2025). Battery materials prices have decreased by over 80% from its peak in 2022, supporting the continued cost optimization for battery makers and EV manufacturers. (Goldman Sachs, October 2025)

Global X Hang Seng High Dividend Yield ETF (3110) invests in 50 high dividend Hong Kong listed stocks selected and weighted based on dividend yield. The ETF offers an attractive dividend yield (6.3% as of August 2025) and tracks Hang Seng High Dividend Yield Index. This Index is likely to outperform broader market in current volatile environment thanks to its low valuation and domestic demand-focused sector distribution.

High dividend strategy has been outperforming the broader market since October 2025. Following a tech-driven rally earlier this year, the Hong Kong/China market is now entering into a consolidation phase amidst a confluence of factors, such as the re-escalation of US-China trade tensions, investor profit-taking, central government meeting, and the onset of the 3Q25 reporting season. More investors are rotating from growth/tech to value/dividend amid market volatility. Although US-China trade talk at end-October yielded positive results that lowered trade policy uncertainty, the prolonged shutdown of US government is draining market liquidity and leads to sell down of global risk assets at the start of November. Defensive strategies such as high-dividend stocks offer a more robust position for investors to navigate the current market volatility.

Alongside the shifting investor preferences recently, we identify compelling investment cases for the high-dividend strategy within the Hong Kong/China market over the long term. Fundamentally, Chinese listed companies have the ability to enhance shareholder returns, bolstered by high cash positions, robust free cash flow, and a presently low payout ratio. This theme is further bolstered by policy support delineated in the Nine Measures of April 2024 and the PBOC’s initiative in September 2024 to encourage corporate buybacks. In terms of fund flow dynamics, the high yield and low volatility characteristics of the high dividend strategy align well with insurers’ investment requirements. This strategy is poised to draw increased interest from insurers over the long term, particularly given the persistently low deposit rates and bond yields in China. Likewise, this dynamic applies to China’s household savings pools, which may increasingly channel into the equity market as individuals pursue higher returns amid a low-interest-rate environment.

Global Top Performers:

Global X Asia Semiconductor ETF (3119) seeks to invest in 40 Asian leaders across Korea, Japan, China and Taiwan markets that involved in the production and development of semiconductors including companies active in industries such as integrated circuit design (fabless), manufacturing (foundry), semiconductor production equipment (SPE), and semiconductor materials.

Asia has established itself as the undisputed center of the global semiconductor ecosystem, particularly for AI enabler. The AI boom massive investments in hardware, where Asia demonstrates a marked edge. Industry leaders like TSMC, the backbone of global chip production, and SK Hynix, a key figure in memory supply, are major components of this growth. While US hyperscalers have certainly been key contributors in global AI capex, Asian nations like China have escalated its AI investments, betting on self-reliance to bolster its domestic semiconductor industry.

Korea: Korean semi stocks rallied YTD driven by a memory super cycle due to capacity shortage as lots of memory supply is occupied by AI level memory upgrading. Korea semiconductor stocks performance is highly correlated to the memory industry, Samsung and SK Hynix are two of the largest memory suppliers globally. First, demand for HBM (high bandwidth memory) used in AI chips is growing at a rapid pace, while the bit density of HBM in next generation AI platforms continue to move higher. HBM chips have larger die size and lower yield per wafer which consumes more wafer i.e. DRAM capacity compared to standard DRAM. This results in tight supply in DRAM supporting DRAM price. Second, top memory makers scheduled to phase out DDR4 rapidly, however many products such as a portion of the smartphone market still relies on DDR4, the demand supply mismatch drove DDR4 price to rally meaningfully YTD. Third, prudent supply strategy in NAND globally combined with demand for eSSD driven by hyperscalers provide support to NAND pricing.

China: China semiconductor self-sufficiency trend is accelerating and gaining traction. We continue to see sizable gap between the China CSP’s AI capex vs the revenue of domestic chip makers which suggest significant upside for domestic AI chips as Nvidia inventory runs lower. Cambricon, one of the key domestic AI chip makers for example is on track to deliver more than 400% revenue growth in 2025.

Global X EV and Humanoid Robot Active ETF (3139): 2025 is seen as humanoid robotics’ breakout year with a major breakthrough in practical and affordable robot products and visible mass production. Elon Musk’s bullish guidance of humanoid robot shipment in early 2025 brought Chinese robots components supply chain in the spotlight, coupled with Unitree robots dance show in Spring Festival Gala. Based on the talks with companies in the humanoid supply chain, the industry is moving towards developing lightweight, flexible and easily deployable robots that can enhance operational efficiency and reduce costs. Competition in some key components including reducer, motor, screw, sensor sounded intensified, which implies cost cutting could be faster than expected and monetization more visible, especially in industrial and residential scenarios. (Mirae Asset, September 2025).

Global X Innovative Bluechip Top 10 ETF (3422) comprises leading companies driving the wave of Disruptive Technology, is for investors who are seeking exposure to the evolving and innovative technology industry. With a strong research team and expertise in investing in disruptive technologies, we are pioneers in creating ETFs focused on this burgeoning field.

Google recently announced the release of the Gemini 3 Pro model, which includes tools like Deep Think and generative user interfaces, highlighting its competitive position in the AI landscape. The model is trained using Google’s own TPUs, and the company also announced the general availability of Ironwood TPUs, designed for the “age of inference.” Despite increased spending, Alphabet expanded its pretax profit margins by 7ppts in 3Q, resulting in a 39% growth in pretax profit.