Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Comments on Latest Rally of China Semiconductor

Global X China Semiconductor ETF

The recent rally in the Chinese semiconductor industry has been driven by three key factors. First, stronger than expected demand for domestic equipment suppliers driven by domestic logic foundry and memory CAPEX. Second, healthy inventory level in consumer electronics-related semiconductor facilitate restocking demand. Third, clear policy support to build domestic data center capacities.

China Wafer Fab Equipment (WFE) is expected to grow driven by logic foundry and memory CAPEX, domestic equipment suppliers are well positioned to benefit from this trend.

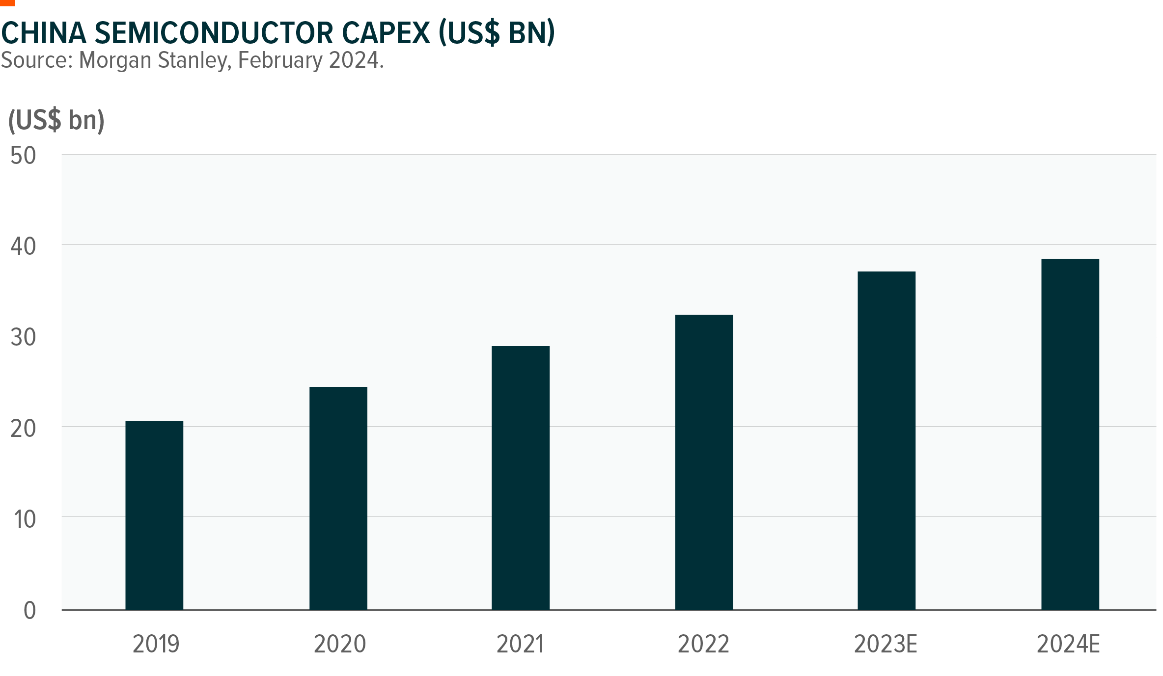

China semiconductor CAPEX is projected to grow in 2024 (MS 2024) driven by capacity expansion in logic foundries and memory suppliers. MS expects key IDM and foundry capacity will grow 14% in 2024 after 19% growth in 2023. Domestic equipment suppliers like Naura, AMEC, ACM Research will benefit from the strong CAPEX spending and equipment localization trend.

In 2024-25, China’s fabrication (fab) industry is expected to focus on expanding its production capacity in mature node foundries. Despite adequate overall supply, the majority of fabs are aiming to increase their capacity to support the localization of power semiconductors, display driver ICs, microcontrollers, and CMOS image sensors, as well as to prepare for the next market upswing.

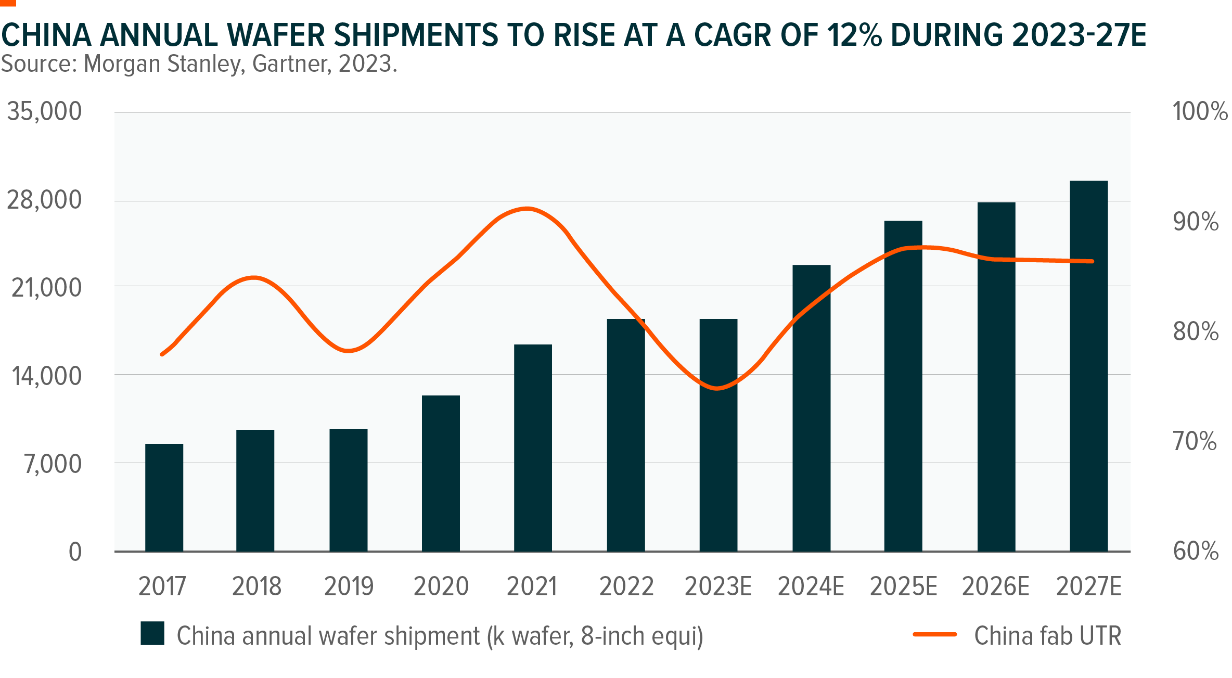

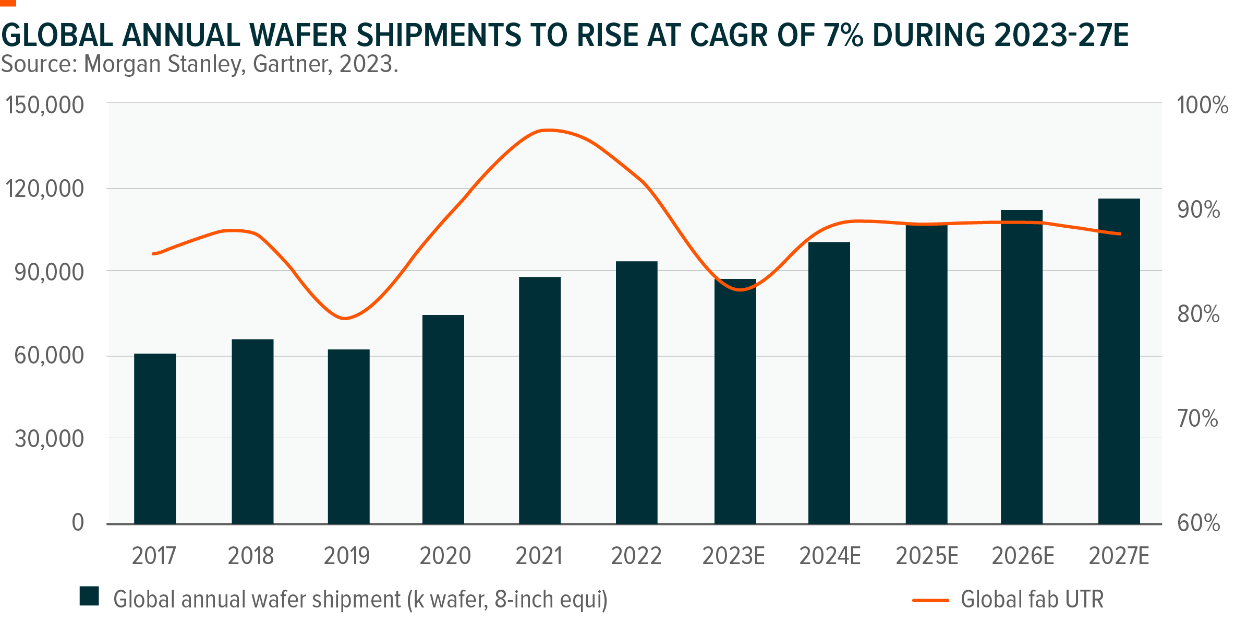

China will continue to outgrow the global market in terms of wafer shipment

The significant investment in semiconductor capacity will translate to higher wafer shipment growth vs the global average. According to Gartner, it forecasts China’s annual wafer shipment to rise at a CAGR of 12% during 2023-27E, stronger than the global TAM GACR of 7%. As a result, China’s wafer market supply share is likely to reach 25% by 2027 compared to 21% in 2023 (Gartner 2023)