Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of principal. Investor should note:

- Global X Hang Seng High Dividend Yield ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer specific factors.

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Hang Seng High Dividend Yield Index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the Net Asset Value per Unit.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

China’s Mid-Year Politburo Meeting: New Housing Regimes

Listen

China’s Concerted Effort to Revive Property Sector After Mid-Year Politburo Meeting

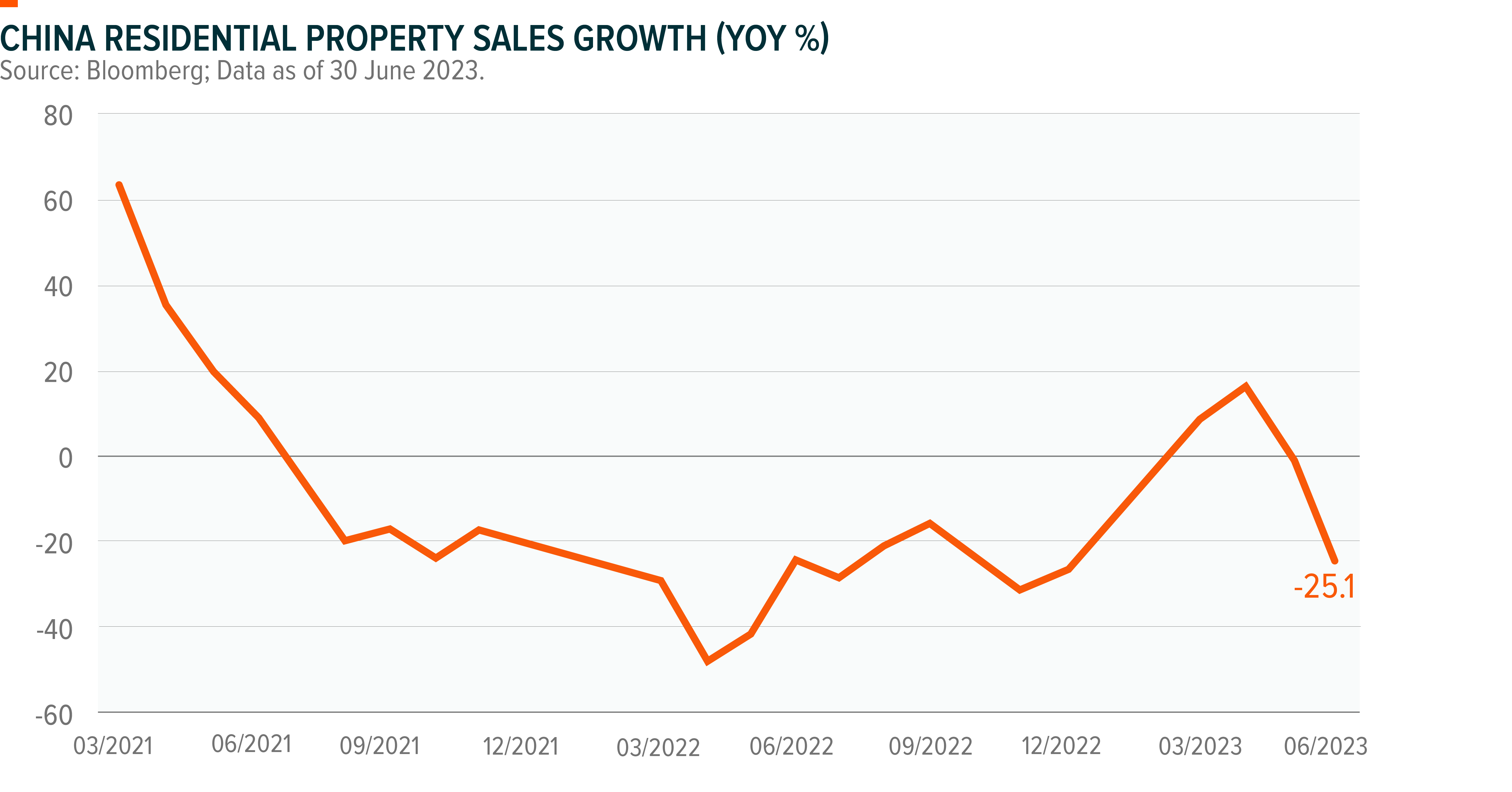

China’s post-COVID recovery had been bumpy in the first half of 2023 amid global economic slowdown and a weakening real estate sector. The decline in property sales, default from real estate developers, and lack of investor confidence have been a major drag to the Chinese real estate sector. While China is still on track to meet its annual economic growth target of 5%, further weakness in the property sector and the spillover effect could bring more headwinds for China’s growth. Accounting for around 20% of the Chinese economy, real estate is undoubtedly a critical sector for growth. The uncertainties prompted China top leaders to roll out a set of targeted supportive measures to revive the property sector, after the China’s Politburo mid-year meeting in 2023.

Easing Housing Purchase Restriction

Beijing has been upholding the principle of “housing is for living but not for speculation” since 2017. This principle no longer appears to be part of the nation’s core real estate policy given a fundamental shift in supply-demand dynamics. After the 2023 mid-year Politburo meeting, top leaders advocated to fine-tune the housing policy to release pent-up demand and stabilize markets. Local governments are given more flexibility to use policy tools to stimulate the sector, especially first home purchases and home upgrades. Furthermore, we expect the down payment requirement to be lowered as well as housing purchase restrictions in Tier 1 to 2 cities to be eased in the coming months.

Urban Redevelopment Led by Government

Earlier in July, the Chairman of the State Council, Premier Li Qiang, called to ramp up support for real estate sector through urban redevelopment. Hundreds of urban villages exist in China’s top-tier cities from Beijing, Shanghai to Shenzhen. China aims to drive up urbanization and improve livelihood by redeveloping the densely populated neighbourhoods in order to make room for new residential and commercial complexes. China’s urbanisation rate has rapidly increased from less than 20% in 1980s to 65% in 20221, meaning around two-thirds of the population already live in cities. As a result, China is now transitioning to the next stage of urbanisation: urban redevelopment instead of city borders expansion. As land is a finite resource in top-tier cities, renovating run-down areas is expected to drive up demand.

Relieving Debt Pressure to Ensure Home Delivery

In July, the People’s Bank of China and National Financial Regulatory Administration, urged banks to relax loan terms for real estate developers. Loans due by the end of 2024, accounting for 30-40% of developers’ total debts2, will be given a one-year repayment extension. Also, project-based special loans provided to property developers before the end of 2024 would not be classified as ‘higher risk’, encouraging banks to support real estate sector financing. These measures are crucial to relieve the debt pressure from developers so that they can focus on delivering of homes under construction, ultimately restoring homebuyers’ confidence.

Easing Monetary Policy

In June 2023, the People’s Bank of China reduced the one-year and five-year prime loan rate by 10 bps respectively. Although the rate cut was relatively small, it was impactful to the property sector as almost all of the country’s mortgages are referenced to the two policy rates. Furthermore, policymakers indicated monetary rates have further room to be reduced after the politburo meeting. Homebuyers would be able to borrow at a lower mortgage rate or renegotiate the current mortgage contracts to free up cashflow.

Opportunities to Capture the Reversal Potential

Chinese real estate sector suffered a significant correction of 65%3 since a set of restrictive policies rolled out in 2020. A fundamental shift in the nation’s real estate policy, now represents a great entry opportunity for investors to capture the rebound potential.

Real estate is one of the largest sectors in the Global X Hang Seng High Dividend Yield ETF. The ETF does not invest in the entire sector but selectively invests in companies which can deliver sustained higher dividend yield and exhibit less volatility. As China’s property market steps out of the extremely dark time, we expect leading real estate companies will be better off amid market consolidation and policy tailwinds and their dividend would remain solid in the coming years. The latest dividend yield of the Global X Hang Seng High Dividend Yield is above 7%4, representing investment of high income potential to income-seeking investors.