Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X China Semiconductor ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet China Semiconductor Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

NVIDIA Orders Halt to H20 Chip Production (China Semiconductor ETF (3191))

NVIDIA ordered some component suppliers to suspend production of its H20 AI chip, according to report the information. This came after U.S. Commerce Secretary Howard Lutnick’s offensive remarks on CNBC, increasing the geopolitical tensions. The market turns more positive on the domestic AI semiconductor supply chain, sending key names like Cambricon, Hygon and SMIC higher.

China’s domestic semiconductor supply chain has undergone significant expansion and transformation driven by localization demand. Companies across the supply chain, from foundries, equipment to fabless, continue to build domestic solutions to service the large local semiconductor demand.

Rapid AI Development Drives Semiconductor Demand In China

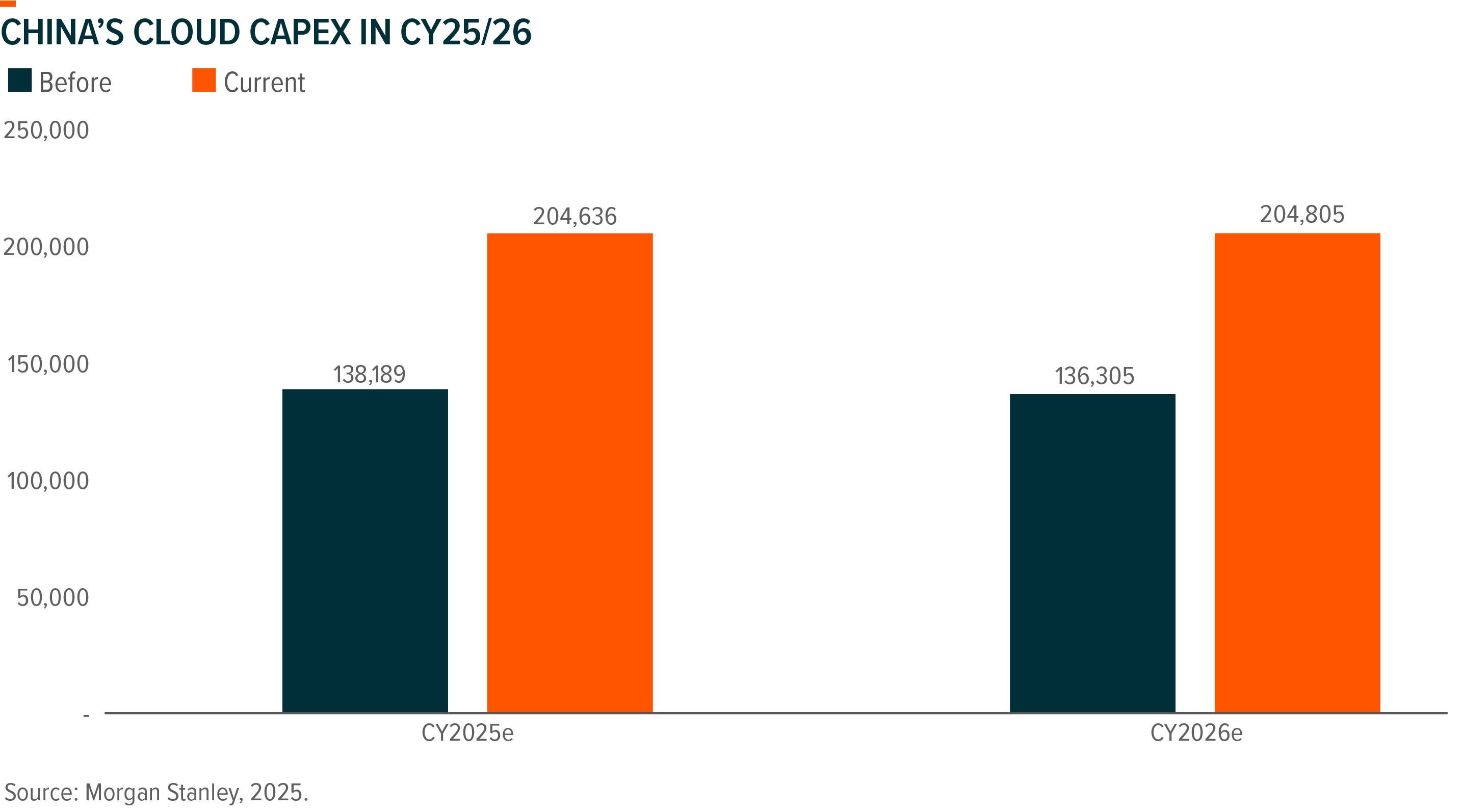

The rapid development of front-tier AI models and AI applications in China drives significant growth in AI compute demand locally. The acceleration of AI spending has raised China’s cloud capex by 48% in C2025E and 50% in C2026E (MS 2025)

The compute demand crisis has catalysed innovation in algorithmic efficiency, hardware alternatives, and energy management. As China continues to pursue AI leadership while navigating constraints, the world is witnessing the emergence of a distinct AI ecosystem with unique characteristics and capabilities that will likely influence global AI development for years to come. Domestic AI semiconductor solutions are positioned to benefit from the growing demand, especially when imported solutions such as H20 are restricted.