China Green Shoots: Positive Policy Pivots

Listen

China Green Shoots on Policy Pivots

In just a short amount of time following the 20th Party Congress, we’ve seen multiple green shoots in the Chinese market. Among them, the most important ones are the pivot on China’s zero-Covid policy and more concerted property rescue measures. We are also seeing signs of more regulatory easing for big tech (such as fintech IPOs and gaming license approvals) and some de-escalation of geopolitical tensions following the recent G20 meeting. Contrary to the market’s gloomy view, we think this shows that Xi and his new team are now focusing on economic recovery. With Xi finally forming his own cabinet after a 10-year power struggle, we believe policy implementation should also be more effective and efficient.

Key Takeaways

- New measures to relax Covid control guidelines reflect a policy pivot toward prioritization of growth and signal the beginning of the end of zero-Covid. The shift is critical to China’s recovery, given the services sector accounts for over half of the country’s GDP.1

- The property sector has also seen a slew of new measures, ultimately lowering the chance of potential defaults and systematic risks to overall financial markets.

- With the shift in tone following the 20th Party Congress, we are now more optimistic about China’s market recovery as the new measures should support earnings recovery in 2023 and 2024.

Property Policy Pivot

After the Party Congress, we also see coherent policy support in the property sector. For example, in November, the People’s Bank of China (PBOC) and the China Banking and Insurance Regulatory Commission (CBIRC) announced 16 measures to support the property market. These include 1) providing financing support to property developers to ensure housing delivery, to help dispose of risky projects, to homebuyers with liquidity difficulties, and 2) extending the grace period for banks to fulfill the property/mortgage cap. In addition, relaxed escrow account management also allows developers to withdraw up to 30% of the project construction cost with a letter of guarantee by commercial banks.

According to estimates by Jefferies (November 2022), recent policies/guidance, together with the package, will inject RMB 1.3 trillion of credit into the property sector. This will significantly ease private developers’ liquidity and cover their public bond and trust products to be matured by the end of 2023 (c. RMB 1 trillion).

Private developers may still face insolvency risk as property prices are capped by the sentiment that “property is for living, not for speculation”, while the recovery of housing sales is still dependent on the economic outlook, which is affected by the progress of China’s zero-Covid pivot. However, the recent policy measures can effectively ease developers’ overall liquidity risk and buy time for the property market to stabilize. Hence, this lowers the chance of potential defaults and systematic risks to overall financial markets.

Zero-Covid Policy Pivot

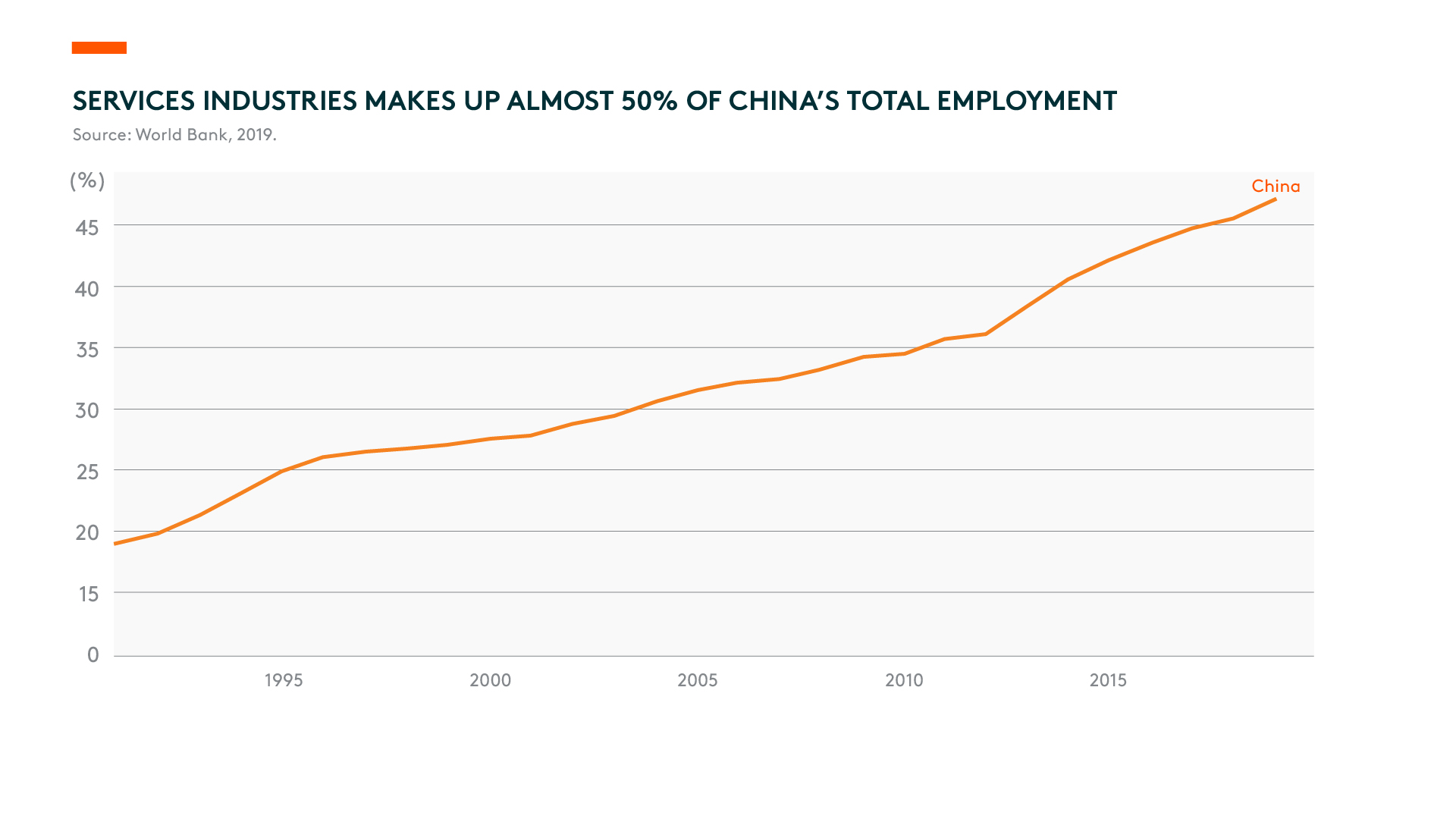

China’s services sector accounted for more than half of the country’s GDP2 and nearly 50% of China’s total employment3. However, as the zero-Covid policy has significantly restricted services industries, the impact on employment and consumer confidence has negatively fed into consumption and other economic activities, causing a vicious downward spiral.

However, we see a clear and coherent signal on the pivot of China’s zero-Covid policy following the 20th Party Congress. Specifically, China’s National Health Commission (NHS) delivered 20 new measures in November to relax Covid control guidelines, including 1) cutting quarantine requirements for close contacts and inbound travel restrictions, and fine-tuning the administration of mass testing; 2) requiring more targeted mobility restrictions; 3) drawing up plans to accelerate vaccination, particularly for the elderly; and 4) ramping up Covid-specific medical capacities with a tiered medical response system for Omicron cases.

We believe these measures reflect a policy pivot toward prioritization of growth. Although the dynamic zero-Covid headline remains unchanged, the new guidelines and measures implicitly shift away from the draconian zero-covid policy. Instead, the policy now focuses more on flattening the curve and boosting medical capabilities to minimize further economic disruption, which would pave the way for an eventual reopening. Though the reopening pathway could be bumpy, we are already at the beginning of the end of zero-Covid.

As mentioned in our previous article, we believe that China is poised for reopening, given that the latest mutations of the Omicron variant appear milder and less severe than earlier Covid variants. Moreover, China’s domestically developed vaccines appear to be just as effective in reducing the severity of symptoms if a booster dose has been administered, meaning the population is probably more protected than most initially perceived. We believe these factors give policymakers the confidence to continue down the path of reopening, despite any short-term bumps that could be expected along the way.

Conclusion

We see policy pivots in two of the most important areas for China – the zero-Covid policy and the property sector. The new direction should support earnings recovery in 2023 and 2024. Along with potential regulatory easing on big tech and de-escalation of geopolitical tensions, we believe these will provide a strong foundation for China’s market recovery.