Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of principal. Investor should note:

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

BYD 3Q24 Results

Solid Beat on Profitability

BYD reported solid 3Q24 results on October 30 after market. 3Q24 revenue was Rmb201.1bn, +24.0% YoY and +14.2% QoQ. Notably, BYD’s quarterly revenue tops Tesla for the first time and becomes the largest EV company globally (in terms of quarterly sales). Group GPM was 21.9%, +3.2ppts QoQ, and GP per vehicle increased by 16.7% QoQ to Rmb35.6k. The strong profitability is bolstered by expanding unit sales and margin-enhancing DM-i 5.0 deliveries. BYD continues to demonstrate strong R&D commitment with R&D expenses expanding by 52% QoQ and 23% YoY as the company accelerated investment in EV technology and intelligent driving. 3Q24 net profit of Rmb11.6bn was +28% QoQ and 11% YoY, reaching a new historical high.

Outlook

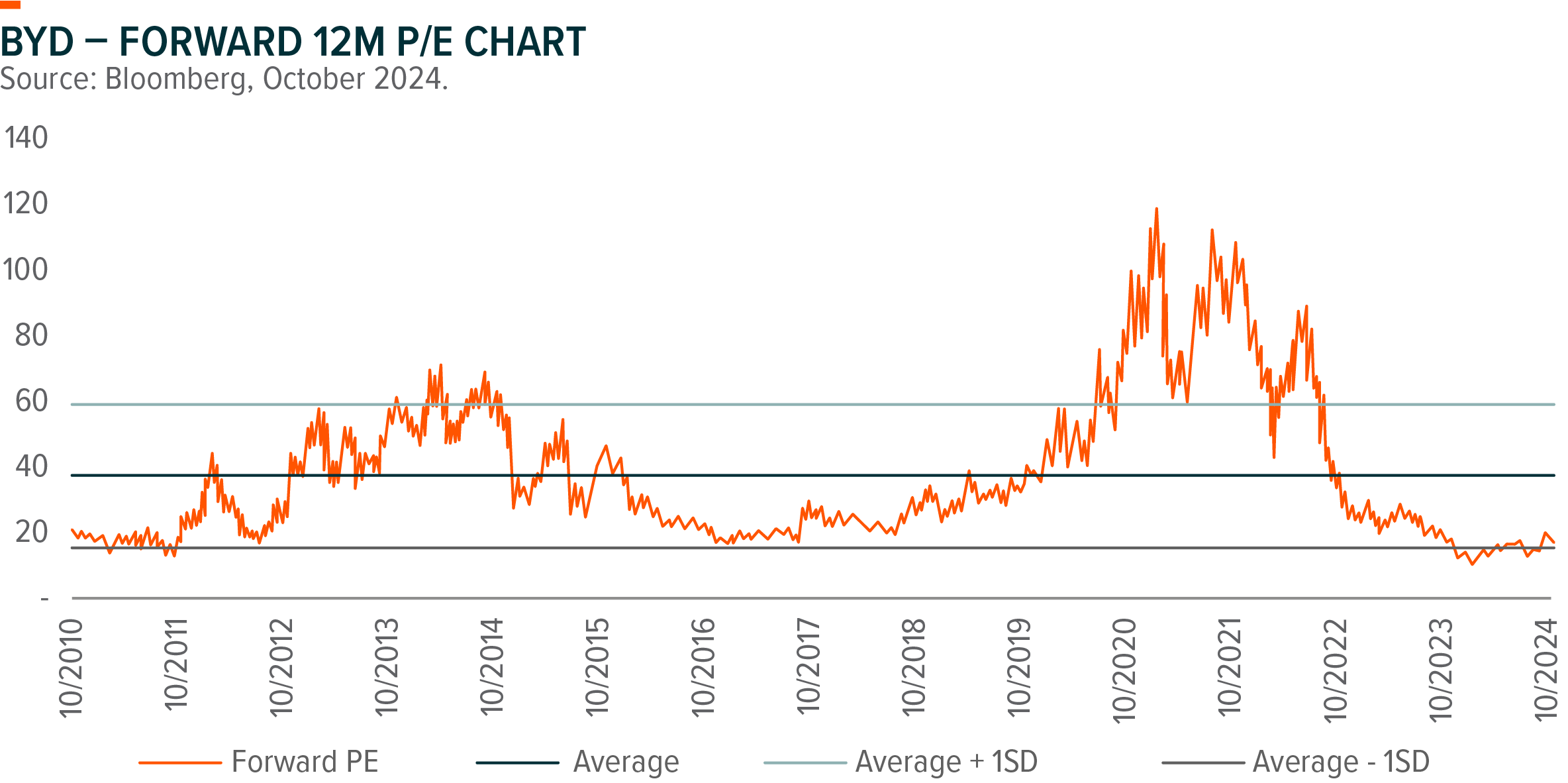

BYD maintained a solid 35% market share in 3Q24 thanks to its product competitiveness and strong execution. Auto trade-in program and seasonality should support a robust EV demand towards year end. In the longer term, BYD will continue to benefit from the solid PHEV opportunity both domestically and overseas. The solid new launch pipeline in 2025E should help BYD to maintain its dominant position in PHEV market. The continued pickup in overseas retail sales momentum, together with the start of local production should drive an accelerated overseas revenue growth. Despite strong growth momentum, BYD is still trading at the lower end of historical valuation.

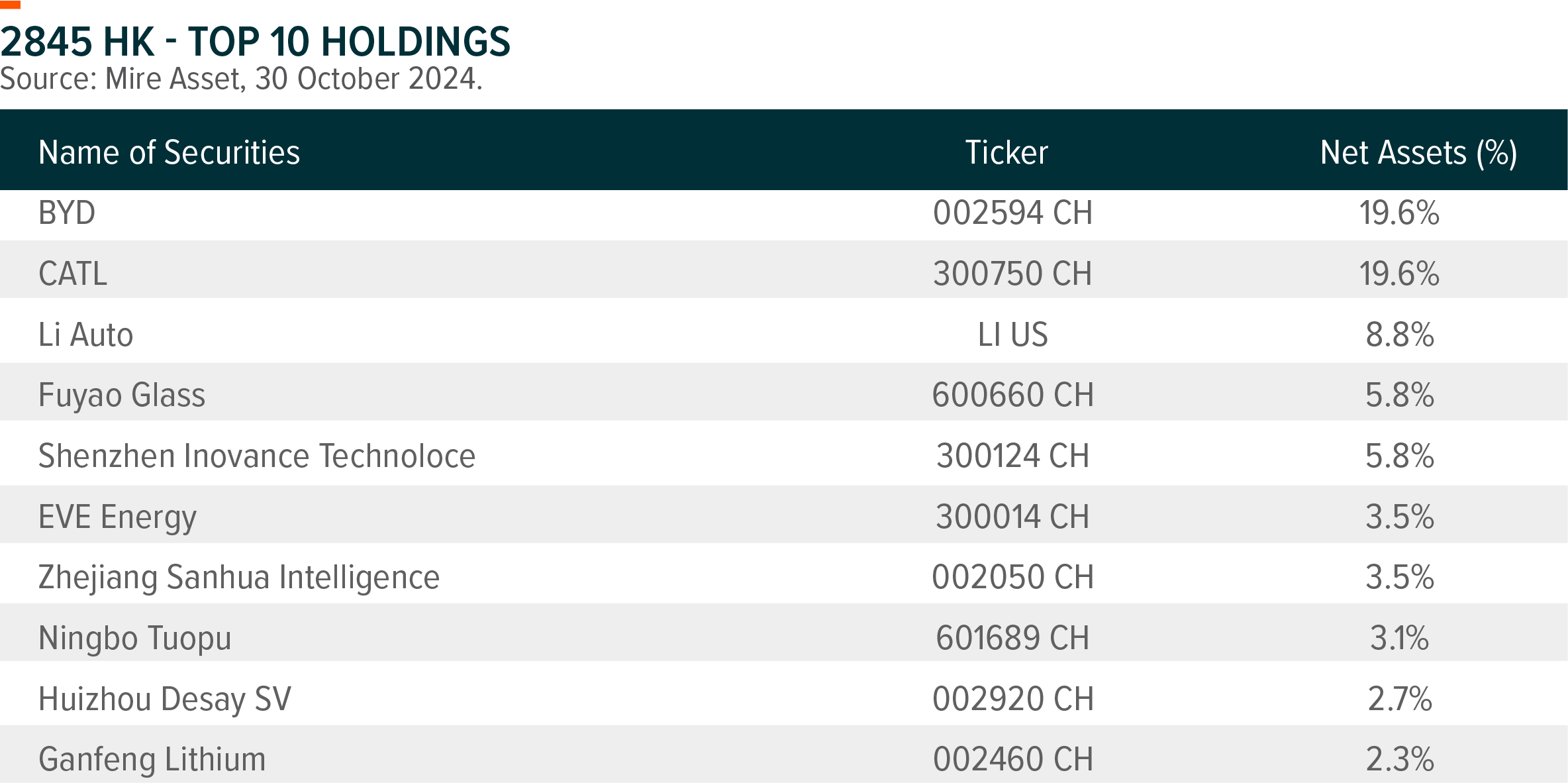

Global X Electric Vehicle and Battery ETF (2845 / 9845) is well positioned to ride on the strong EV sales momentum and improving battery industry landscape in China. In addition, the continue decrease in lithium prices should also lower the costs for battery and automakers and thus support better profitability outlook across the value chain. CATL also reported 3Q24 results with strong profitability as driven by product mix premiumization and cost savings from manufacturing advantages. CATL and BYD are the top 2 holdings for the ETF with combined weighting of c.40%. See our previous note on CATL results here.

Related Global X ETF

| Global X China Electric Vehicle and Battery ETF (2845 / 9845 HK) | |

|---|---|

| SEHK Listing Date | 17 Jan 2020 |

| Reference Index | Solactive China Electric Vehicle and Battery Index NTR |

| Primary Exchange | Hong Kong Stock Exchange |

| Ongoing Charges Over A Year | 0.68%.p.a.1 |

| Product page | Link |

Source: Mirae Asset, 31 Oct 2024.