Reading the Tea Leaves: Making Sense of Beijing’s Policy Shifts

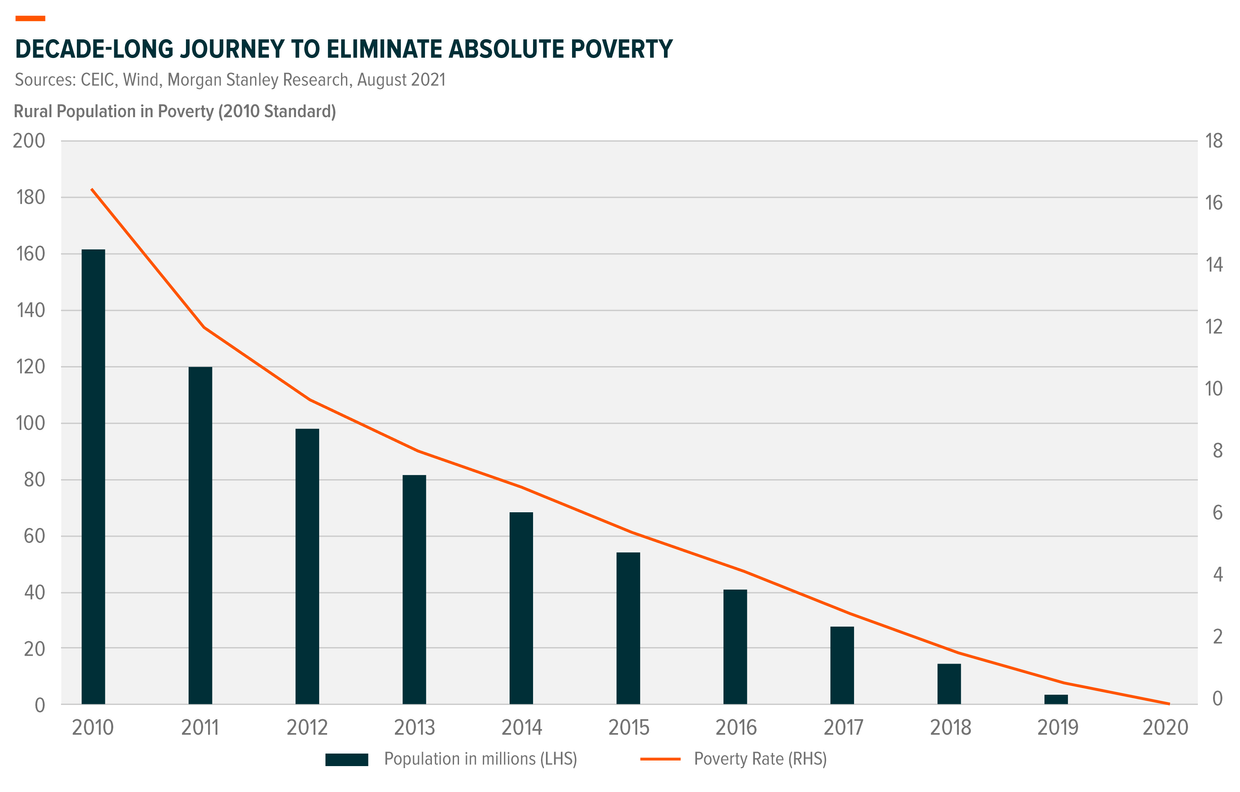

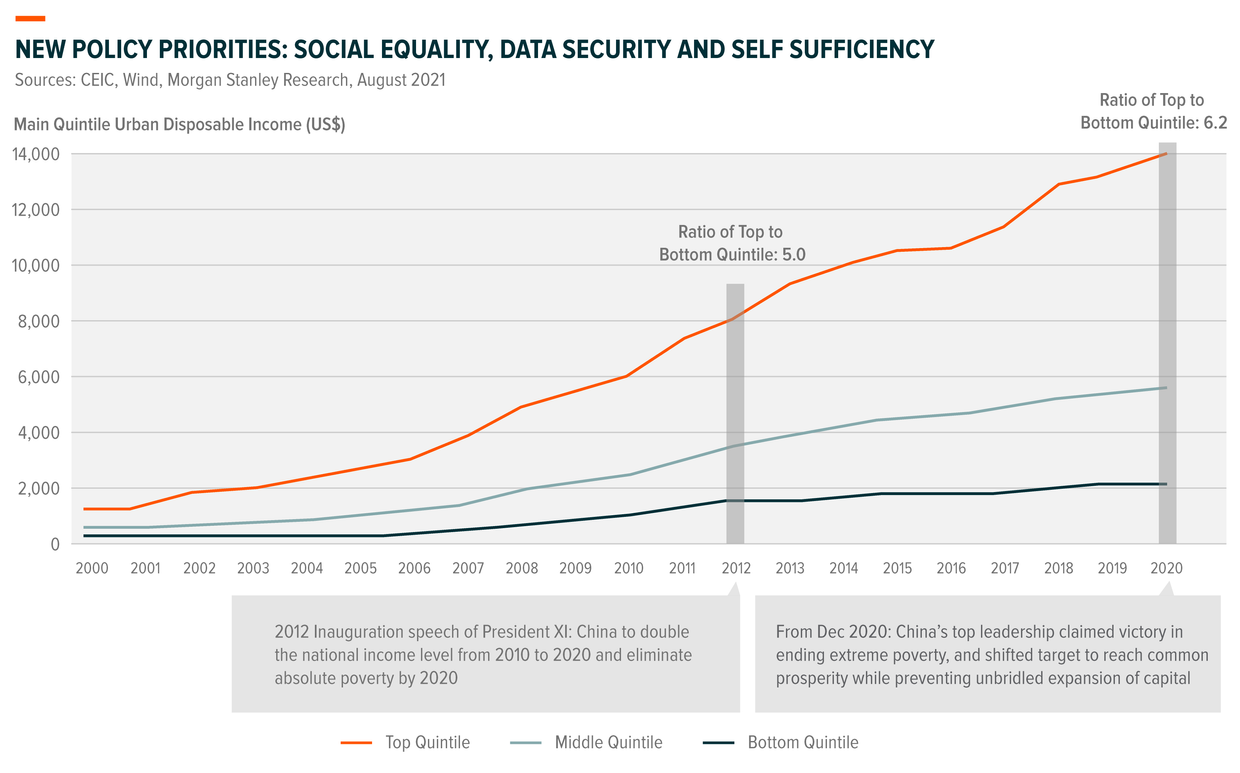

China’s astronomical growth over the last decade is a testament to the country’s will to abolish absolute poverty, driven by Chinese President Xi Jinping’s pledge in 2012 to transform the “impoverished and backward Old China, into the New China”.1 In spite of this monumental achievement, an accelerated economic shift brought income inequality and social issues amid a less regulated environment among emerging sectors. As China shifts its focus onto the next stage of economic development, fast-growing industries now face heightened regulatory scrutiny.

China’s Pivot to Common Prosperity

After years of prioritizing a high-growth economy, Chinese policymakers are keen to pursue common prosperity by striking a balance through security, supply chain self-sufficiency and social equality. The government’s regulatory intentions—all in the name of sustainable growth—is a stark contrast against some investor misconceptions that Chinese policymakers want to wind up internet businesses.

In the past, Chinese policy had been supportive towards innovation, especially for companies within the internet sector. This encouraged China’s digital transformation while cultivating a young, skilled talent pool primed for the technology industry.

However, regulation failed to keep pace with a fast-growing industry, resulting in anti-competitive behavior, social issues, concerns over data security and implications of “disorderly capital expansion”. Big technology platforms had simply grown too big, too quickly. These companies rose in prominence at a time when many small and medium-sized enterprises struggled amid slowing economic growth during the COVID-19-crisis.

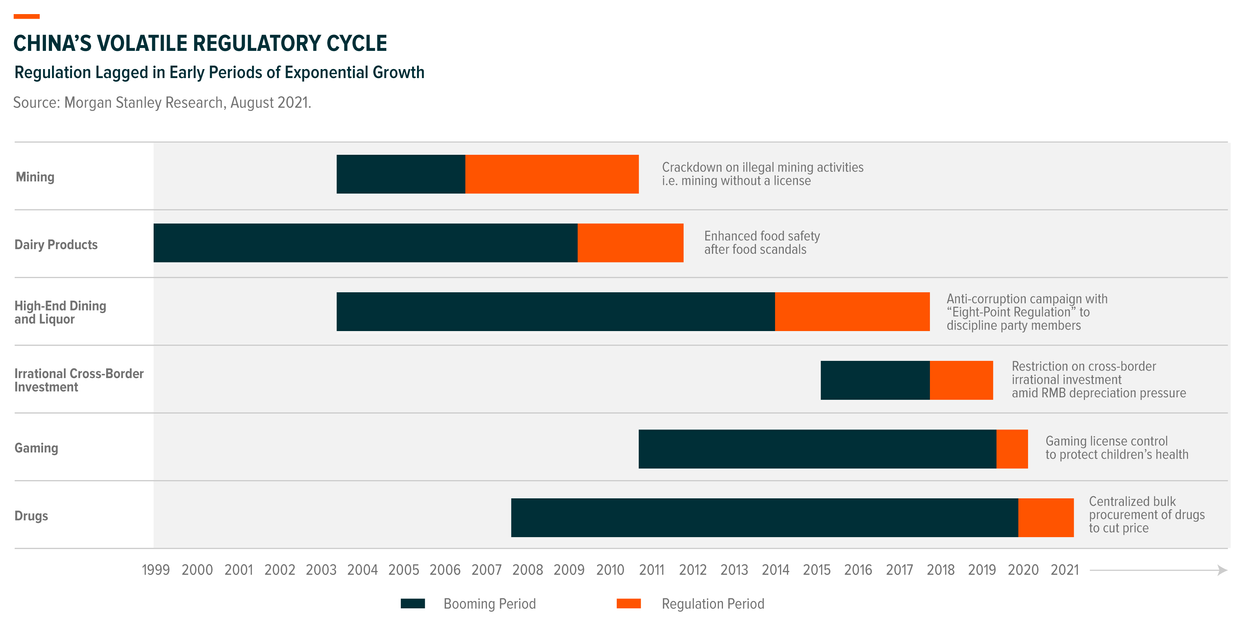

That said, Beijing’s regulatory crackdown should not come as a surprise to investors. The Chinese government has long been aligning its sectors with its sustainable growth blueprint.

For example, news that education giants will be heavily regulated and should not expand aggressively to ease the financial pressures of childcare, had already been flagged by the Chinese State Council in 2018.2 The creation of a minimum wage for food-delivery drivers had long been in the making, since delivery employees’ working conditions were exposed in 2020.3 While hefty fines for big tech firms came swiftly after an investigation revealed tech platforms imposed penalties for merchants that sold goods on rival sites.

Re-Balancing Corporate Influence

New regulatory requirements for data, fintech, carbon emissions, after-school tutoring and property are set to re-shuffle the amount of influence corporates had on markets, as they will need to re-position their businesses. The move will likely support smaller businesses that were previously squeezed by large corporates that had greater access to capital. These changes fall directly in track with the party line of “improving livelihoods”, especially for low to mid-income groups.

Conversely, regulators are set to start rolling back the very tax incentives that allowed big internet platforms to thrive, implementing higher tax levies in the country’s latest move to rein in the internet giants. At the same time, we expect government to focus more on strategic sectors as electric vehicles, clean energy, semiconductors.

While internet platform companies involved in areas crucial to day-to-day living will fall under more scrutiny, it doesn’t necessarily mean other business will be impacted. Market concerns that similar measures will spread to other sectors, are mostly overdone.

Regulatory Precedence Sets a Roadmap for Industries

Increased regulatory scrutiny is not a new concept, nor is it exclusive to China. E-commerce and social networking giants in the US also face tighter regulation, with the prospect of being broken up for violating anti-trust laws.

In 2017, China’s regulation on “irrational” cross-border investment guided companies on investing overseas to prevent unhealthy competition and corruption.4 While a large-scale decline in Chinese overseas investment ensued, the crackdown resulted in greater emphasis on the quality of overseas investment projects, over pace.

Likewise, the gaming industry has seen its fair share of regulatory measures. Most recently in August 2021, China ordered online gaming companies to restrict gameplay to an hour for children on Fridays, weekends and public holidays, a significant escalation in the country’s protection of minors since 2019.5 The move follows from a huge online gaming overhaul between 2018-2019, where policymakers introduced new game approval processes to regulate content in line with Chinese values, and restricted the number of digital gaming licenses issued.

Overall, regulatory crackdowns on the gaming sector show that the Chinese government has been fairly consistent with its aim to protect the mental and physical wellbeing of children.

Less News Might be Good News

The essence of common prosperity is to elevate living standards for low-income groups to address the wealth gap, rather than target equal wealth. Income inequality in China is a serious issue that the government is addressing. Despite some investor misconceptions that Beijing wants to redistribute or equalize wealth, China’s policy decision is not pegged to the Gini coefficient—typically used as a measure of income inequality—and is primarily focused on reducing everyday spending in housing, education and healthcare, while reforming income distribution.

Regulatory concerns over monopolistic practices and data privacy, along with revisions to tax and employment benefits have been largely priced in by the market. While policy implementation this time round has had widespread market impact, further changes may be more considerate towards capital markets, and may include high-level consultation with industry leaders.

While the direction of these policies may not change, we largely expect less policy noise in the near term which could become an encouraging tailwind for Chinese equities. As the government focuses on supporting other industrial sectors such as electric vehicles, clean energy and semiconductors, we’ll be closely observing sectors favored by the latest policy amendments.