Asia Innovator Active: Q1 2022 Review

Tough Start to Year for Growth-Style Stocks

The first quarter of 2022 was another tough period for Asian growth-style investments. Many of our holdings suffered from the weakened growth outlook and battered sentiment as growth slowed down due to the resurgence of COVID-19 in China. Raw material inflation, which started in the second half of 2021, has been exacerbated by the recent geopolitical tensions and directly impacted Asia’s manufacturing sector. Despite this, we still maintain a strong conviction that Asia will deliver high growth in newly emerging manufacturing businesses such as the battery, solar, and automation, thanks to the region’s large talent pools.

While in recent months, these favored sectors have also suffered from elevated commodity prices, the structural trend within these sectors has shown that demand remains resilient. As such, despite the recent headwinds, we have not been compelled to make any significant or rash changes to the portfolio, as most of our holdings are now trading at an attractive price point.

Internet Platform Companies Exiting Bottom of the Cycle

For internet platform companies like Tencent and Alibaba, one of the biggest risks was the potential drag in regulation, which created uncertainty for their future growth outlook and impacted near-term earnings. However, following a pivotal meeting convened by the Vice Premier, Liu He, we now believe that these companies have exited the bottom of the cycle. One of his key messages was that ministries and agencies should be careful not to harm the development of capital markets and that any sensitive regulations should be conducted in coordination with the economic minister before being rolled out. This is what we have long anticipated.

Over the last few quarters, regulations on internet platform companies have been released without sophisticated coordination or calculation on the sector and the economy. It seemed as if there were no control towers or coordinators among the different ministries, which was likely due to the government’s strong will toward curbing any malpractice and problems which initially arose during the reckless expansion of internet platform’s over the last decade. But now, the Vice Premier’s message has signaled for the government to consider policy coordination, to reduce the impact on the market and economy.

Thus, we expect this will support the share prices of Chinese internet platform companies going forward. Overall, however, we are less bullish on the sector from a long-term perspective, as we have seen signs of fierce competition amongst them to capture more share within the ad and e-commerce space. In conclusion, we are happy to hold internet platform companies for now, but will unlikely be aggressive in adding to our exposures following the regulatory cycle change.

Geopolitical Tensions Have Spooked Asian Markets

In mid-March, the Hong Kong market was further spooked by the news of Russia’s request to China for military support and the potential sanctions that may fall on China if they were to respond. However, in our view and also according to experts in China, the chances of China supporting Russia’s military effort is low, given its need to balance relations with Europe – its largest trading partner. Moreover, when considering the US-China tensions, we believe that China would look to maintain Europe a neutral stance on this front. As such, if China were to provide military support to Russia, then Europe could potentially be lost as a balancing act.

According to The Economist in early March, Chinese defense companies linked to the government had rejected requests from Russia to provide gear components for Russian fighter jets. So, the sensitivity of Hong Kong market participants to the news of Russia’s request, compared to mainland investors, came as a surprise.

Omicron Outbreak Intensifies in China

There are increasing market fears that the latest Omicron outbreak in China, and especially within Shanghai, might result in significant disruptions to economic activity, given China continues to maintain a strict zero-COVID approach. Since 27th March, Shanghai, a city of 25 million people, has been effectively in lockdown for a month.

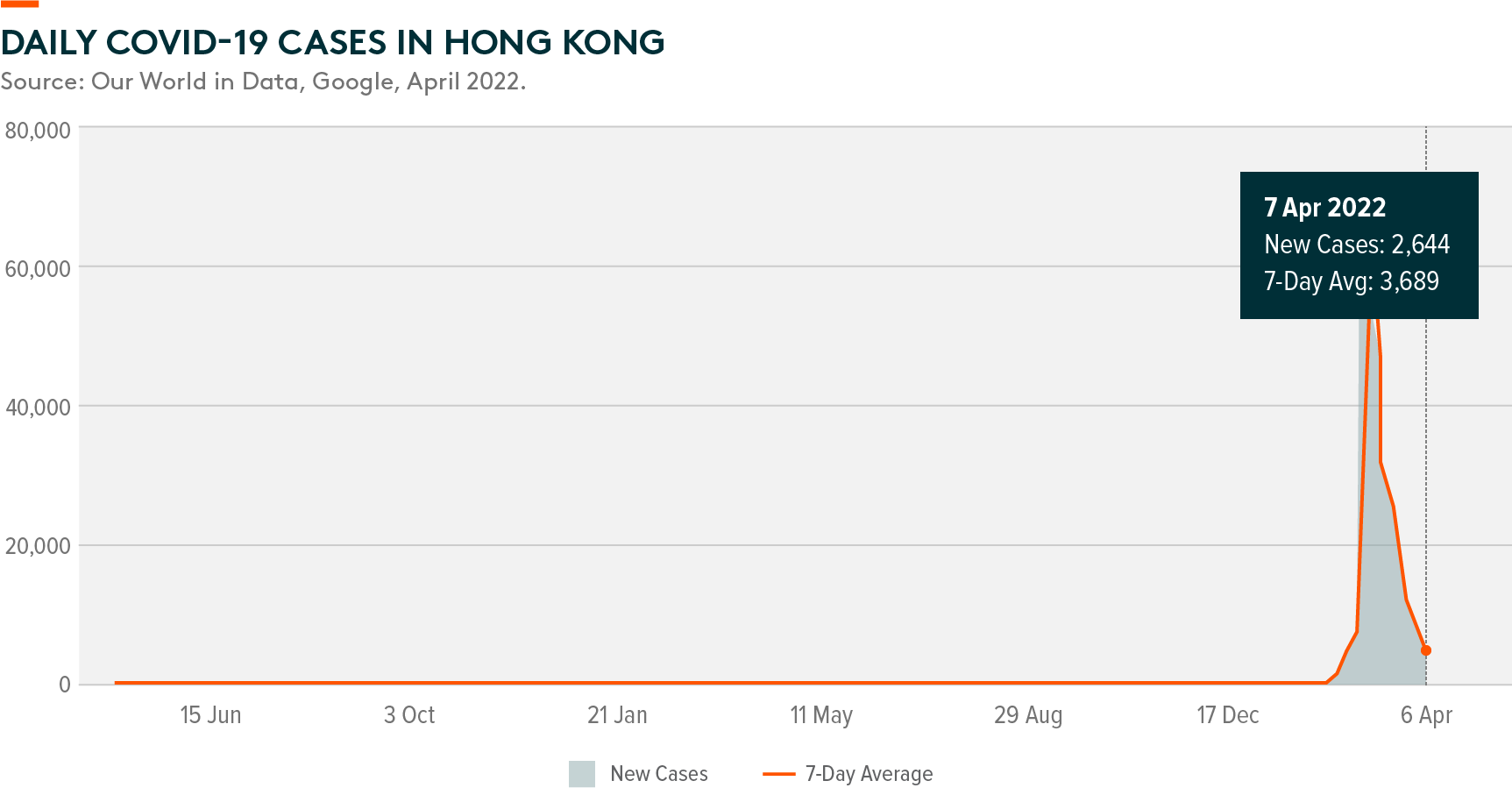

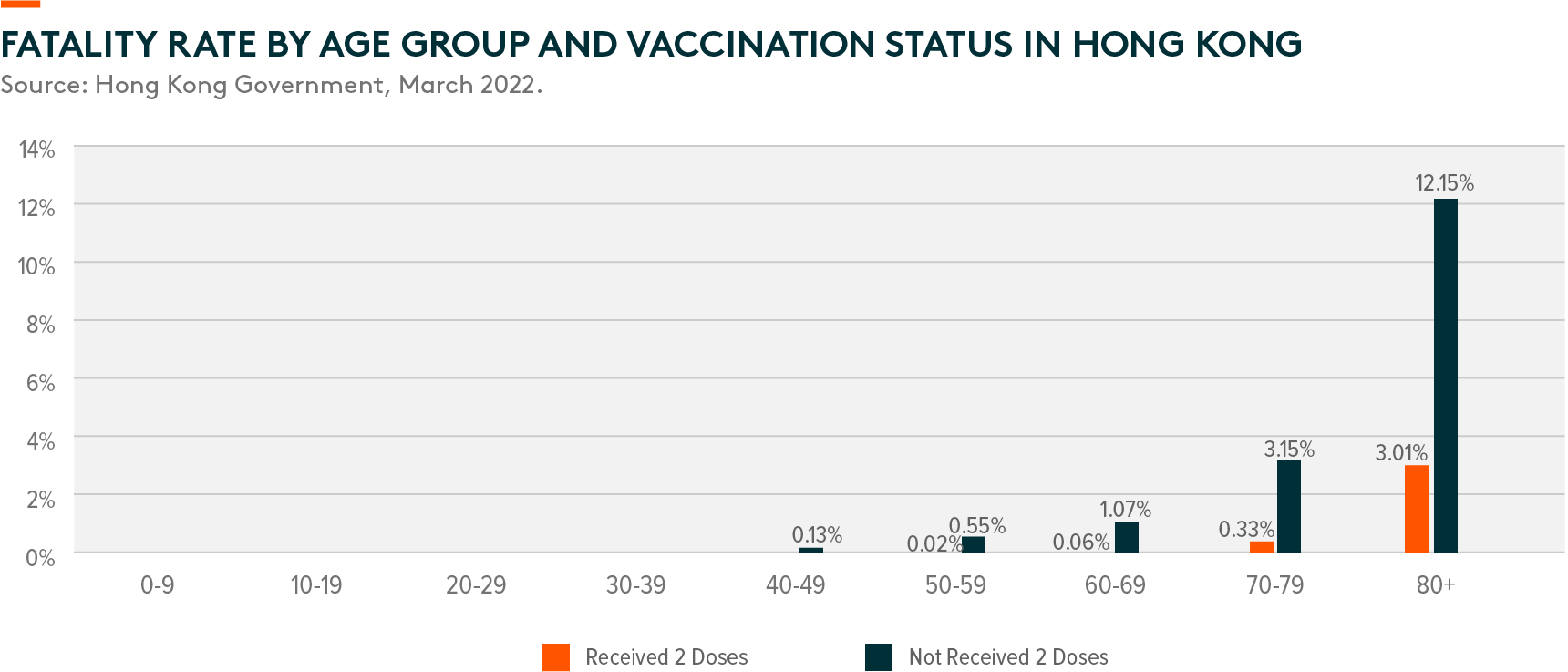

Some have suggested that China may keep its strict pandemic policies until the National Party Congress in the second half of 2022. In the meantime, however, we’ve seen positive signals from Hong Kong’s experience of Omicron over the last few months, which provides valuable lessons to China in managing the spread. Since the start of the pandemic, there have been 1.2 million confirmed cases in Hong Kong and over 9,000 deaths; implying a fatality rate of 0.8%.1 However, the Hong Kong government reported that 90% of fatalities came from those who were unvaccinated.2

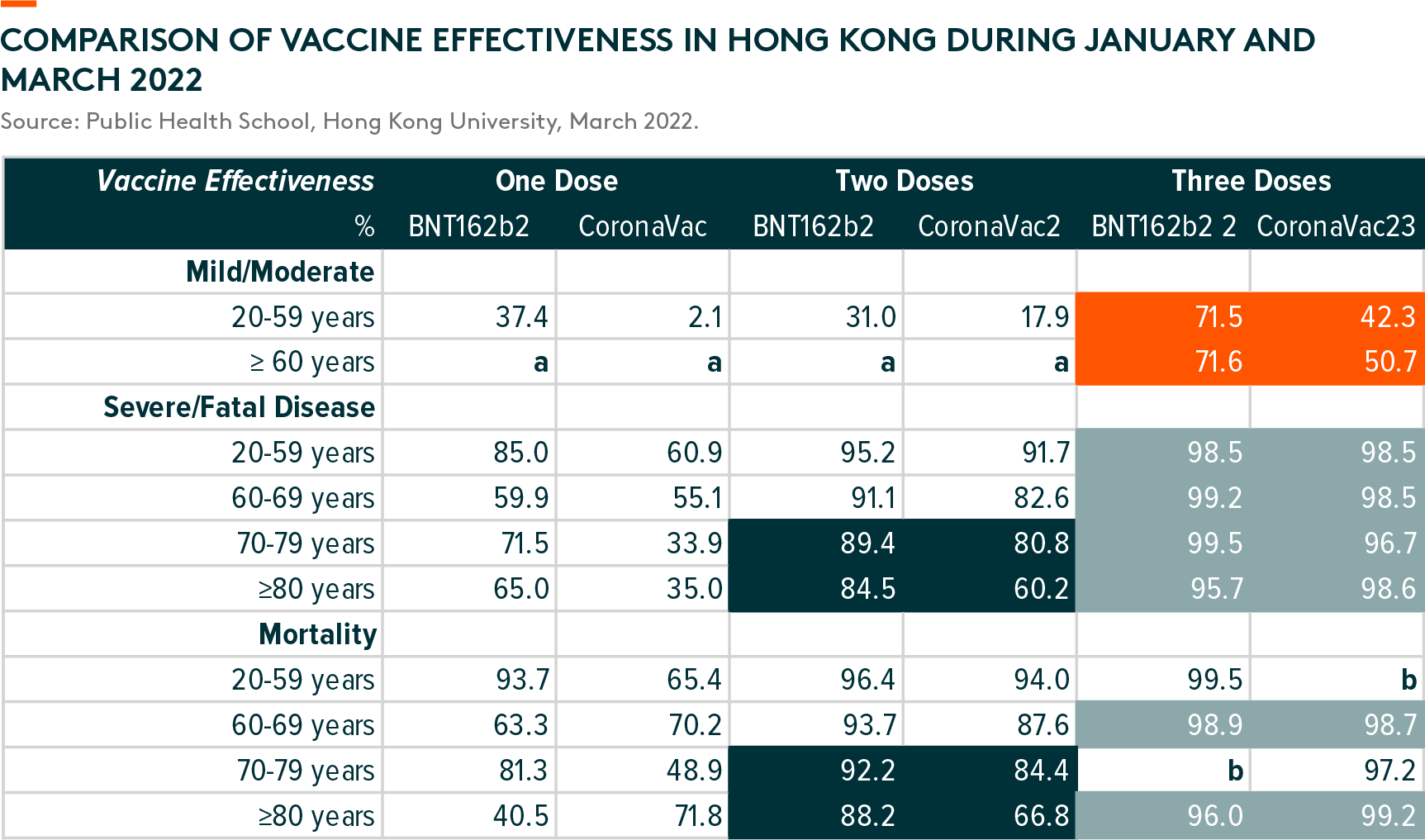

Also, according to the analysis conducted by the Public Health School at Hong Kong University, both the BioNTech and Sinovac vaccines are highly effective in reducing the severity of the virus and protecting against death if a third dose has been administered.3 As such, long-held concerns that Chinese-developed vaccines like Sinovac have low protection against Omicron have now been proven to be wrong. We believe that if China is able to accelerate its vaccination program and increase the rate of booster shots, then the country will be in a better position to relax its control measures. As of the end of March, around 88% of China’s population has received two doses, while only around 48% have received a booster.4

In conclusion, we expect the current lockdown of certain cities like Shanghai will lead to a contraction in retail sales, industrial production, and trade activity over the coming months, but the country will be ready to embrace COVID-19 as an endemic once the ratio of booster shots has achieved critical mass.

Inflation Impacting Battery and EV

Battery cost inflation has been another concern as lithium and cobalt prices rallied on the back of Russia’s invasion of Ukraine. This triggered a correction of stocks within the EV and battery supply chain sectors. However, compared to the market, we are less concerned about the issue.

Firstly, according to our channel checks, spot prices are not the actual prices paid, as the blended lithium prices which major companies pay are often significantly lower than that. Additionally, major battery and EV companies have managed to pass through most of their cost inflation. Over the last couple of months, many Chinese players, including Tesla and BYD, have increased their manufacturer’s suggested retail price (MSRP) to offset the cost pressure. Investors are now waiting to see the impact on demand in subsequent months; however, initial data indicate that order intakes are still strong.

Secondly, gasoline and diesel price hikes (25% year-on-year in China in March) and consumer expectations of further increases in fuel costs will encourage greater consideration and adoption of EVs rather than ICE models.

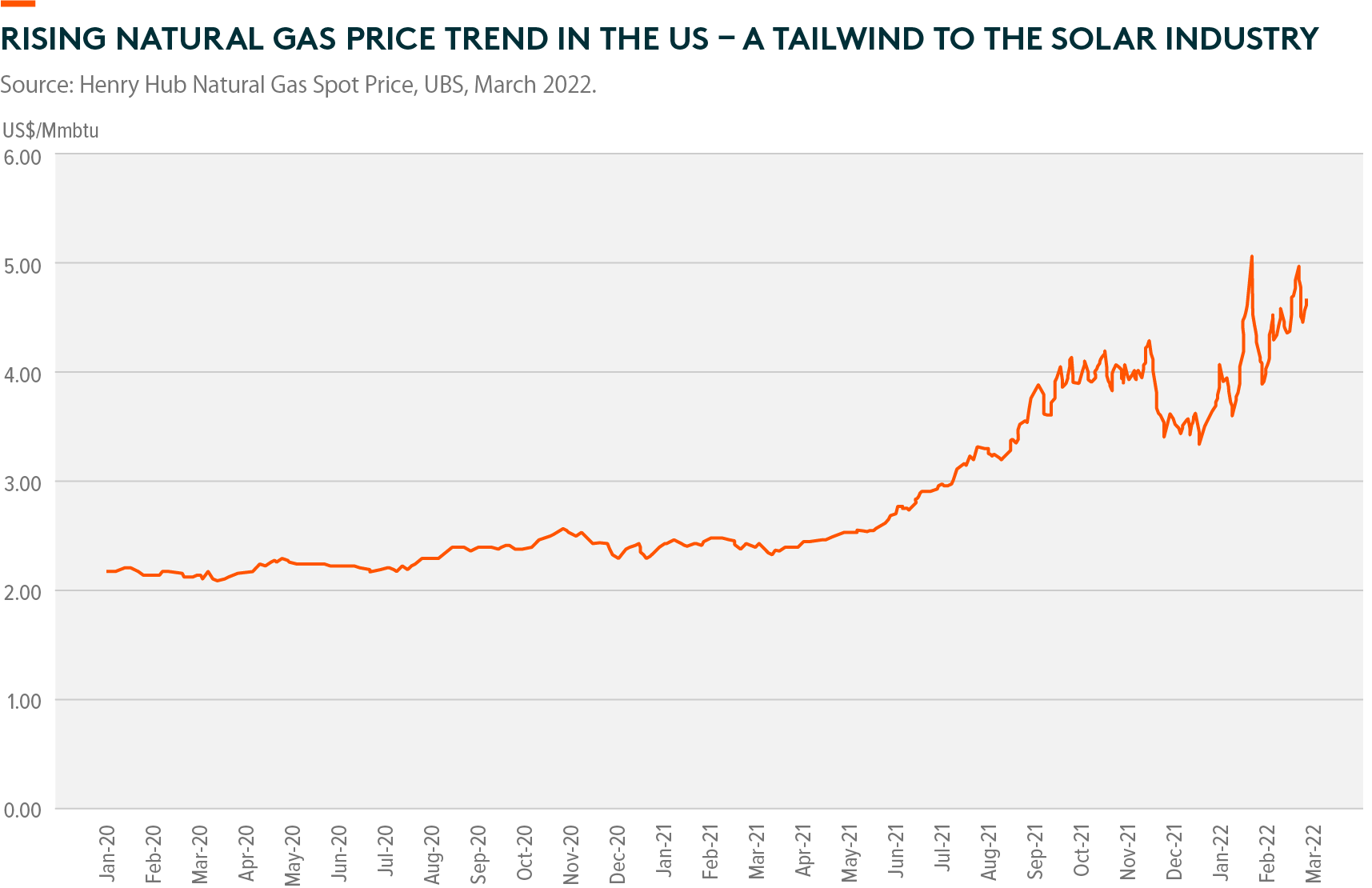

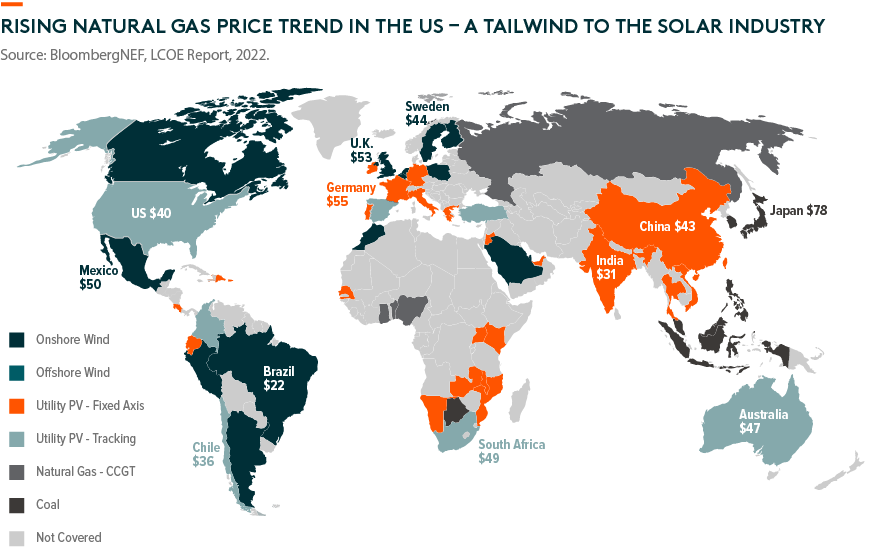

Rising Energy Prices and the Solar Industry

We believe that higher energy price for natural gas and coal provides a significant tailwind to the solar module industry, as natural gas and coal is the direct competing power source. This is especially true in the US, where natural gas has been abundant, and solar power has struggled to compete with cheap natural gas. However, given the supply shortage of natural gas following the Russia-Ukraine tensions, gas power generation in the US is no longer cost-competitive compared to solar. According to Bloomberg NEF in 2021, solar has already become the cheapest energy source in four of the highest energy consumption markets like China, the US, Europe, and India.5 As such, we maintain our bullish view on the solar supply chain on account that its growth will accelerate in the next couple of years.