What are Covered Call ETFs?

Covered call ETFs typically invest in a diversified portfolio of stocks and utilize the covered call writing strategy on a portion of their holdings. By employing this strategy, the ETF can generate additional income for investors while still providing exposure to the underlying stocks in the portfolio.

This strategy aims to reduce volatility and provide a steady income stream. The ETF invests in stocks and sells call options, giving buyers the right to purchase the stocks at a predetermined price. If the stock price doesn't reach that price at the expiry date, the ETF keeps the premium as income. If the price does reach the predetermined level at the expiry date, the ETF raises cash to settle the option but still keeps the premium. While this strategy limits potential gains, it provides relative stability and income for investors.*

Why Covered Call ETFs?

FAQ

How Does Covered Call ETFs Work?

Covered call ETFs invest in stocks and sell call options on some of those stocks. Call options give buyers the right to buy the stock at a set price by a specific date. In exchange for selling the call options, the ETF receives a payment called a premium. If the stock price doesn't reach the set price before the expiration date, the call option expires without value, and the ETF keeps the premium as income. But if the stock price reaches or exceeds the set price, the ETF has to raise cash to settle the option at that price, while still keeping the premium. This strategy reduces portfolio volatility, provides income, and protects against market downturns.

Join Dennis Fok, Head of ETF Portfolio Management at Global X ETFs Hong Kong, as he explains the covered call strategy and how to utilise it hedge market downturns and generate potential income.

Advantages of Adopting a Covered Call Strategy

Risk of Adopting a Covered Call Strategy

- Limited upside potential: Profits from an increase in the value of the underlying securities are capped at the strike price of the call options, plus the premium received.

- Obligation to the purchaser: By writing call options, the investor gives the purchaser the right to receive a cash payment if the underlying securities' value exceeds the strike price at expiration. This may result in missed opportunities for further gains.

- Underperformance during rapid rallies: When the value of the underlying securities rises rapidly above the strike prices of the call options, the strategy is expected to underperform the market.

How Will the Strike Price of the Written Call Options Impact the Covered Call Strategy?

- Premium Received: A higher strike price means that there is a lower probability that the option will be exercised, so the amount of premium received by the investor for selling the option is reduced.

- Downside Cushion: At-the-money options provide more downside protection because the strike price is close to or equal to the current price of the stock, and if the stock price falls, the investor can partially offset the loss by retaining the premium. Whereas, an out-of-the-money option (where the strike price is higher than the current price of the stock) may offer better upside return potential, but correspondingly less downside protection.

- Trade-off Between Premium and Upside Potential: Choosing a strike price involves a trade-off between the amount of the premium (which provides a downside cushion) and the limits on potential upside returns. A lower strike price may provide higher premium income, but it may also limit potential upside returns. Conversely, a higher strike price may reduce premium income, but also provides greater potential for upside returns.

Benefit of Investing in ETF

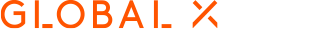

3419 Global X HSI

Global X HSI

Components Covered Call Active ETF

| Stock Code | 3419 (HKD) 1 |

Ongoing Charges Over A Year 2 | 0.75% |

| Inception Date | 28 Feb 2024 |

1 Investment involves risk. Before making any investment decision to invest in the Fund, investors should read the Fund’s Prospectus for details and the risk factors. Visit Global X ETFs Hong Kong website for more details relating to this Fund (including but not limited to the Fund’s iNAV, market price, performance, daily holdings and tracking difference / error). | |

3416 Global X HSCEI

Global X HSCEI

Components Covered Call Active ETF

| Stock Code | 3416 (HKD) 1 |

Ongoing Charges Over A Year 2 | 0.75% |

| Inception Date | 28 Feb 2024 |

1 Investment involves risk. Before making any investment decision to invest in the Fund, investors should read the Fund’s Prospectus for details and the risk factors. Visit Global X ETFs Hong Kong website for more details relating to this Fund (including but not limited to the Fund’s iNAV, market price, performance, daily holdings and tracking difference / error). | |

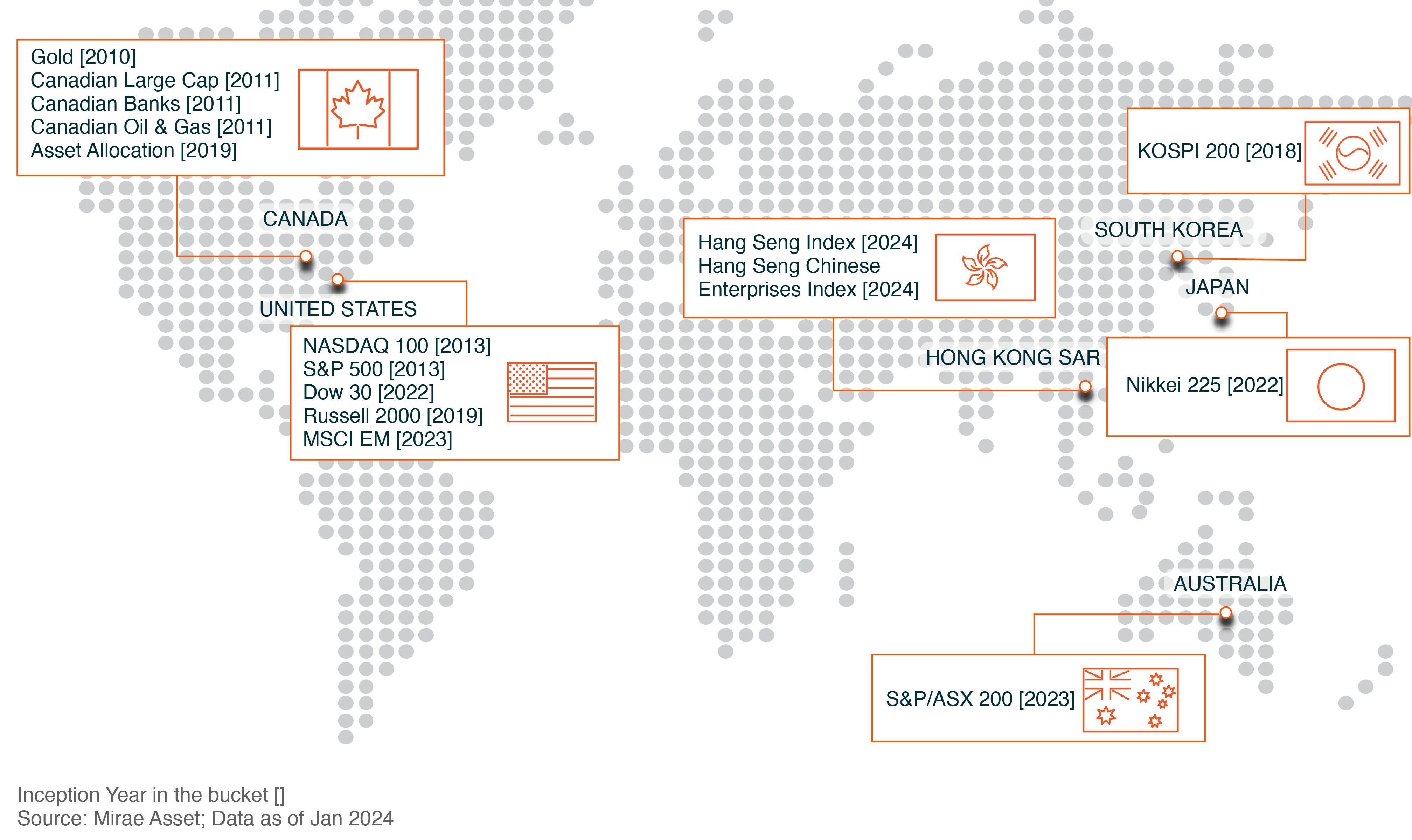

Global Covered Call Leader for More Than a Decade