Diving into Japan Global Leaders: Key Questions & Answers

Listen

1. Why was Japan lost for decades?

The term “Lost Decades” is commonly used to describe the prolonged period of economic slowdown in Japan from the 1990s to the 2020s. Our research highlights three key factors contributing to the “Lost Decades”:

1) Rapid currency appreciation: In 1985, Japan signed the Plaza Accord, causing the Japanese yen to appreciate by nearly 200% against the USD within a decade. As Japan heavily relied on export growth, the strong yen significantly undermined the competitiveness of its goods in the global market.

2) Policy Timing: In the late 1980s, the Bank of Japan tightened the money supply, which eventually led to the burst of the financial market bubble. Following the equity market collapse, the Bank of Japan continued to raise interest rates to cool down the overheated real estate market. These higher rates ultimately pushed the overall economy into a downward spiral. Although the Bank of Japan later reversed its course, it proved to be insufficient and too late.

3) Deflation: After the burst of the financial market, investor confidence in earning higher returns waned, prompting a shift towards holding cash. Simultaneously, households became less willing to spend during the economic downturn. This led to a liquidity trap and eventual deflation. The situation worsened as Japanese banks tightened their lending requirements to repair their reserves after the real estate crisis. The limited lending and credit crunch further contributed to deflation.

2. Is Japan breaking free of the cycle?

In comparison to the “Lost Decades” period, Japan has entered a completely different phase of its economy. The country is now well-positioned for robust growth due to its ultra-loose monetary policies. Japan’s policy interest rate stands at -0.1%, while other developed economies are in a rate-hiking cycle with rates ranging from 4% to 6%.1

Thanks to the Bank of Japan’s yield curve control policy, the yield on Japan’s 10-year government bonds remains below 1%, whereas the U.S. 10-year Treasury bond is trading at around 5%.2 This low government yield, which serves as the earning discount rate, acts as a significant tailwind for the Japanese equity market, particularly for growth companies.

The deflationary pressure in Japan appears to have subsided. We have observed that Japan’s inflation rate has consistently remained above 0% since late 2021. One of the primary reasons for this is the near-full participation of Japan’s labor force. Despite the country’s aging demographic, Japan only reached full employment in 2020.3 Wage growth has been a driving force behind inflation in recent years, which is a positive signal for the economy.

3. What does “Japan Global Leaders” mean? Which companies are considered key players? Why should one invest in Japan Global Leaders?

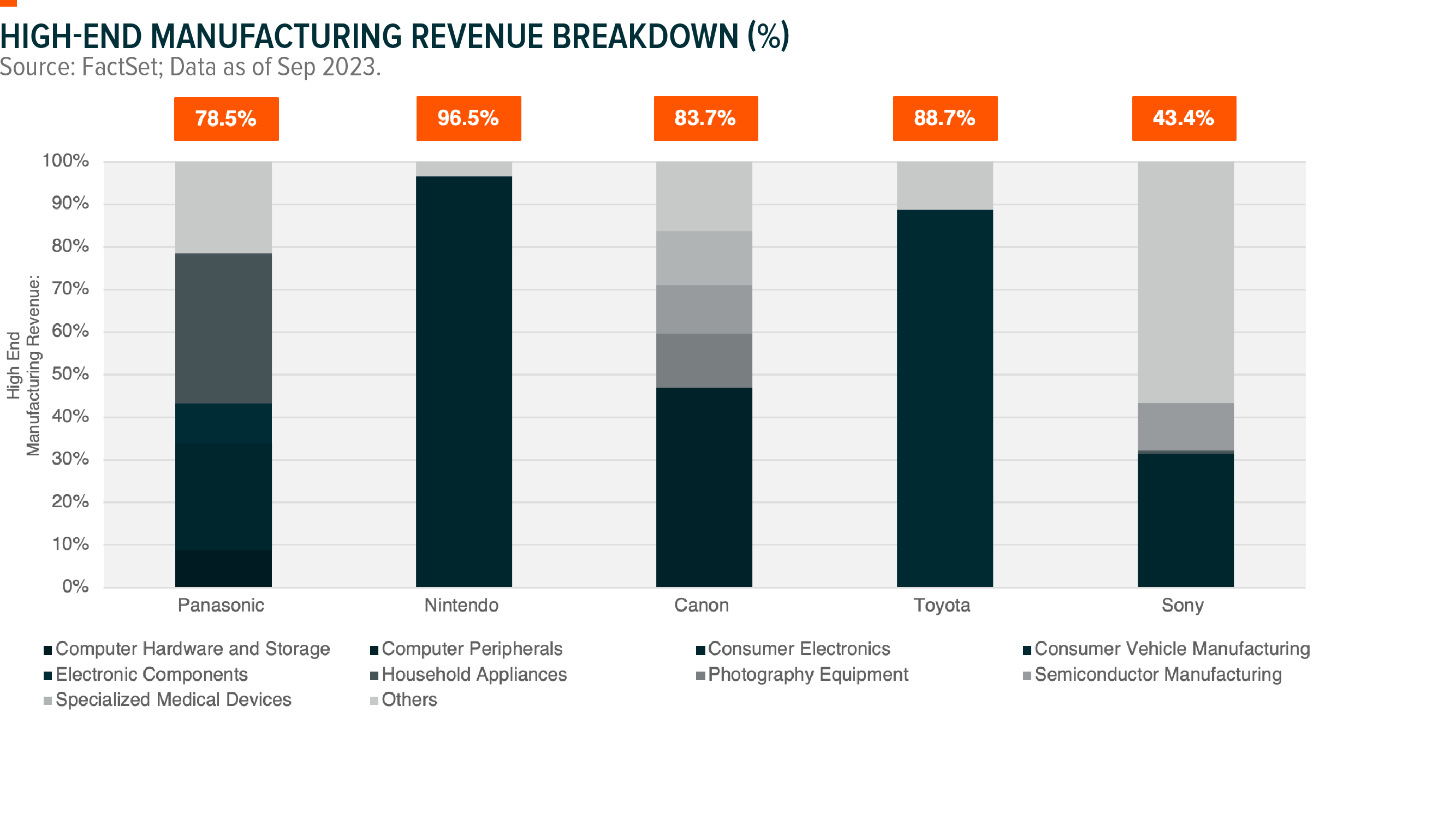

Japan is home to the world’s largest high-end manufacturers, from consumer electronics, computer, consumer vehicle, semiconductor to medical devices. Japan Global Leaders refers to Japanese leading companies that have demonstrated strong global competitiveness and ranked in top 3, in term of global market share, in their respective business segments.

Japanese leading export companies are even more competitive given the weak Yen. As investors eye prospects of higher rate for longer in the rest of the world, the Bank of Japan remains wedded to its ultra-loose monetary policies. Japan’s real effective exchange rate is now as low as it was in 1970s, right before their exponential growth in exports in 1980s.4 The weak Yen today serves as a strong tailwind to Japan’s exporters.

Japan Global Leaders include the leading automobile manufacturer – Toyota Motor. Toyota has held the position of Japan’s largest global automaker in both internal combustion engine and hybrid electric vehicles for decades, with annual global sales of approximately 10 million vehicles.5

Another example is Sony Group, a Japanese conglomerate and a key player in the manufacturing of consumer electronics products such as TVs, audio-related electronics, cameras, and game consoles. Sony is also a leader in entertainment businesses, including films, music, and games.

Similarly, Nintendo holds the global leadership position in console devices and game development. The company’s strong content pipeline has driven steady console sales, continuous growth in subscription services, and increasing profit margins due to a higher mix of content sales.

These aforementioned companies represent global leaders in high-end manufacturing, headquartered in Japan. They possess strong pricing power, which means that even if the Japanese yen were to rebound in the future, their global competitiveness would not be easily replaceable.

4. What value does Warren Buffet see in Japan?

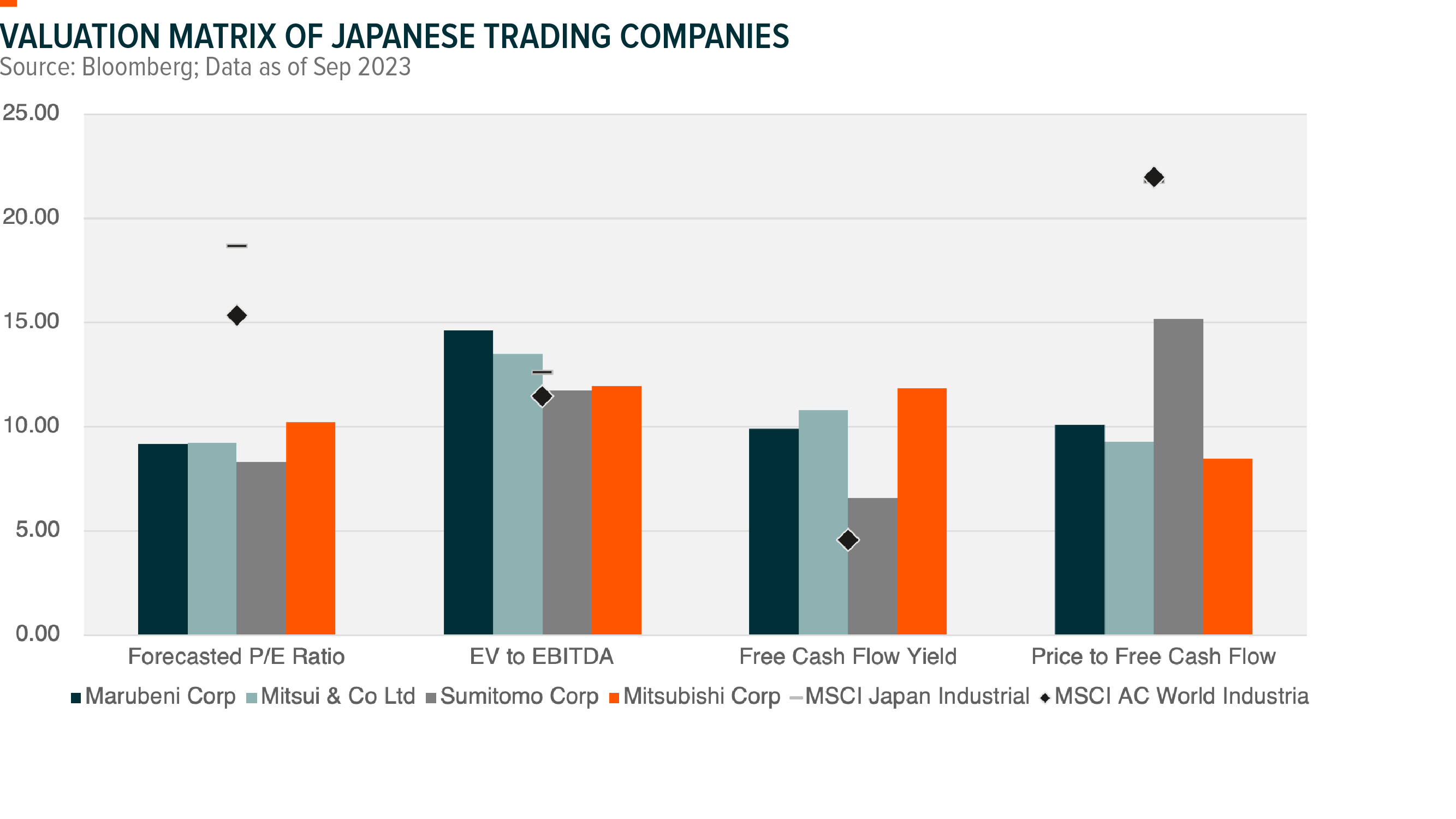

Berkshire Hathaway, the US investment company led by Warren Buffett, began investing in Japanese stocks in 2020 and has consistently added to its holdings since then. The stocks Buffett invested in primarily belong to Japanese trading companies, including Mitsubishi Corp., Mitsui & Co., Itochu, Marubeni, and Sumitomo Corp.

Warren Buffett is renowned as a value investor, and these trading companies are trading at a significant discount compared to the industry average. Moreover, these companies have demonstrated strong cash flow generation capabilities relative to their peers. We believe that Warren Buffett finds the solid fundamental characteristics of these Japanese trading companies appealing.

In Japan, trading companies function as private equity funds. They leverage their extensive networks to identify new investment opportunities and diversify their businesses across various industries, such as mining, food and beverage, retail, and agriculture. This implies that Warren Buffett has exposure to Japanese materials, consumer staples, and the energy sector through just these five trading companies.

These trading companies heavily rely on export growth. With the Japanese yen at a historically low level, Japanese goods have become highly competitive in global markets. Additionally, Japan’s inflation had remained subdued, if not negative, for decades prior to COVID-19, indicating that the prices of Japanese goods have not significantly increased over an extended period of time.

5. What is the view on the Japanese Yen? Are there any implications for Japan Global Leaders?

The Japanese Yen has faced pressure as investors anticipate higher interest rates in other parts of the world, while the Bank of Japan remains committed to its ultra-loose monetary policy. However, we believe that most of the downside risk is already factored into the currency’s valuation. Japan’s real effective exchange rate is currently as low as it was in the 1970s, just before the country experienced exponential export growth in the 1980s.6

While a weak Yen provides a significant boost to exports, Japanese authorities now view the extremely weak yen as problematic. Despite being a leading exporter, Japan also relies on imports for goods such as fuel, raw materials, and machinery parts. The weak Yen makes imports much more expensive, not to mention the impact of persistently high inflation in other developed markets. As a result, Japanese authorities have taken actions to intervene in the currency market by purchasing Yen in 2022. The Bank of Japan has also adjusted its rate policy by loosening its yield curve buffer zone. We believe that the current Yen level is close to the bottom line of tolerance for Japanese policymakers, suggesting limited downside risk and significant upside potential for the currency.

Regarding Japan Global Leaders, we believe they possess strong pricing power due to their global competitiveness in high-end manufacturing. Even if the Yen were to rebound in the future, their products cannot be easily replaced.