Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X AI & Innovative Technology Active ETF (the “Fund”)’s investment objective is to achieve long term capital growth by primarily investing in equities of exchange-listed companies globally, which fall within the investment theme of artificial intelligence (“AI”) and innovative technologies.

- The Fund will invest primarily (i.e. at least 70% of its net asset value (the “Net Asset Value”)) in equity securities and equity-related securities (such as common shares, preferred stock as well as American depositary receipts (“ADRs”), global depositary receipts (“GDRs”) and participation notes) of companies which (i) create, design and develop, or (ii) benefit from the advancement of, AI and Innovative Technologies Companies. Risk associated with AI and Innovative Technologies Companies include Operational and business risk, Changes in technology risk, Governmental intervention risk, Regulatory risk, Intellectual property risk, Significant capital investment risk, Cyberattack risk.

- The performance of the Fund may be exposed to risks associated with different sectors including but not limited to industrial, consumer discretionary, financial services, information technology, semiconductor, communication services, entertainment and healthcare. Fluctuations in the business for companies in these sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund employs an actively managed investment strategy. The Fund does not seek to track any index or benchmark, and there is no replication or representative sampling conducted by the Manager. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- There is no industry sector requirement and the Fund may from time to time concentrate in a particular sector. The performance of the Fund may be exposed to risks associated with different sectors and themes, including but not limited to industrial, consumer discretionary, financial services including fintech, information technology, semiconductor, communication services, entertainment, and healthcare. The Fund may experience relatively higher volatility in price performance when compared to other economic sectors.

- Securities lending transactions may involve the risk that the borrower may fail to return the securities lent out in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- The trading price of the Listed Class of Units on the SEHK is driven by market factors such as the demand for and supply of the Listed Class of Units. Therefore, the Listed Class of Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- The Fund may invest in financial derivative instruments (“FDIs”) for non-hedging (i.e. investment) and/or hedging purposes, in order to achieve efficient portfolio management. Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

Implications of DeepSeek on

Global X AI & Innovative Technology Active ETF (3006)

High-Performance Low-Cost Open Source LLM is Positive for AI Software and Applications

The launch of DeepSeek V3 further lowers the cost of LLM adoption. DeepSeek V3/R1 runs on lower inference cost with comparable performance vs leading models like Llama 3.1 405B / GPT4o and o1 (artificial analysis 2025). It is the leading model in terms of performance/cost. Startups leveraging these models, such as Perplexity and Glean, can achieve faster ROI by avoiding the prohibitive API fees associated with closed models and redirecting capital toward product differentiation and market penetration. Simultaneously, enterprise giants like Salesforce gain leverage to reduce dependency on costly closed-source APIs, accelerating in-house AI integration. We therefore turn more positive on the software sector and increase the funds exposure on the sector by adding weights on software names like Salesforce.

Too Early to Call for the End of the Scaling Law of Large Language Models

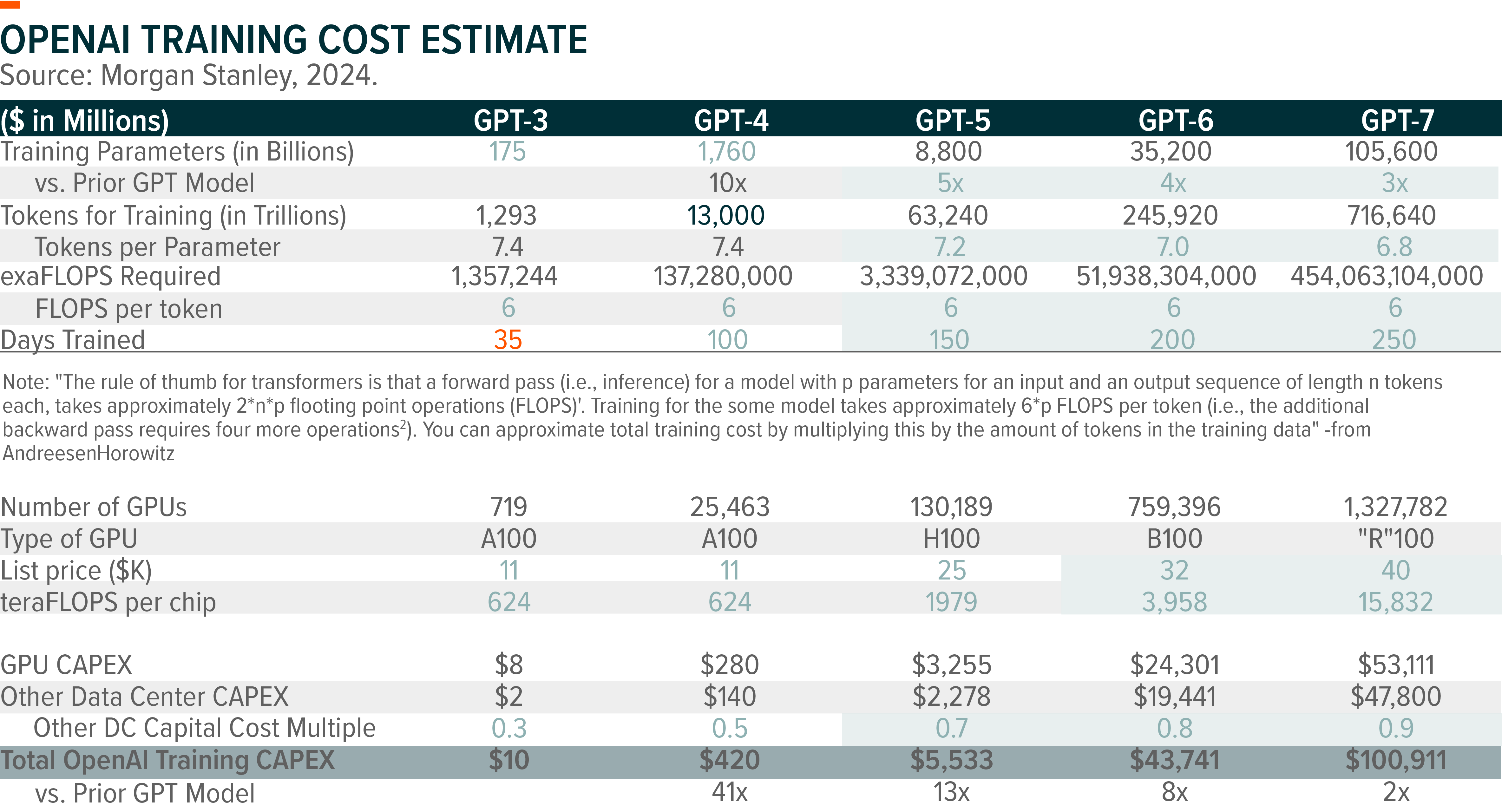

Our view is that while DeepSeek V3 demonstrate algorithmic and architecture innovation, it is too early to call the end of scaling law in LLM given the projected size of next-generation model training clusters. DeepSeek V3 is trained on 2048 H800 GPU over 60 days with a total cost of 5.6m USD, which is significantly lower verses other front-tier LLMs with similar performance. (DeepSeek 2025) GPT4 was trained on 25,000 NVIDIA A100 GPUs, Llama 3.1 was trained on 16,000 H100 GPUs, both likely cost 100s of millions to train.

However, note that the front-tier model today such as GPT4 is trained on last-generation NVIDIA chips (Ampere) with a relatively small cluster vs the size of investment we see today. It is important to recognize the time lag in infrastructure investment today and the launch of a new front-tier pre-trained model, i.e. the GPU investment today is used for models launching in 6 months to 1 year from now. We therefore keep our overweight in AI infrastructure play such as TSMC.

Lower Costs Increase Demand for Inference Compute

DeepSeek V3 launch significantly reduces the cost of inference, this creates a Jevons Paradox effect—when technological advancement results in efficiency improvement, overall demand increases as the cost of using the resource drops. This affordability encourages experimentation, expands use cases (e.g., high-volume tasks previously deemed uneconomical), and accelerates adoption across industries. The fund maintains its exposure to AI ASIC names such as Broadcom and MediaTek.

| Global X AI & Innovative Technology Active ETF (2815 HK) | |

|---|---|

| Listing Date | 21 March 2022 |

| Primary Exchange | Hong Kong Stock Exchange |

| Ongoing Charges Over A Year1 | 0.75% p.a. |

| Product Page | Link |

Source: Mirae Asset; Data as of February 2025

1. The Fund adopts a single management fee structure, whereby a single flat fee will be paid out of the assets of the Fund to cover all of the costs, fees and expenses of the Fund. The ongoing charges figure is an annualised figure based on the ongoing expenses of the Fund, expressed as a percentage of the Fund’s average net asset value over the same period. It may be different upon actual operation of the Fund and may vary from year to year. As the Fund adopts a single management fee structure, the ongoing charges of the Fund will be equal to the amount of the single management fee, which is capped at 0.75% of the average Net Asset Value of the Fund. Any ongoing expenses exceeding 0.75% of the average Net Asset Value of the Fund will be borne by the Manager and will not be charged to the Fund. Please refer to the Product Key Facts and the Prospectus for further details.