Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Little Giant ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies which may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies which are characterised by relatively higher volatility in price performance. The Sub-Fund may be exposed to risks associated with different sectors and themes including semiconductor, industrial, pharmaceutical, energy and technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Sub-Fund.

- Some of the companies classified as the Little Giants have a relatively short operating history. Such companies also face intense competition and rapid changes could render the products and services offered by these companies obsolete, which may have an adverse effect on profit margins.

- They may be more susceptible to risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences affecting those companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which

- may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

Monthly Commentary

China Thematic ETFs – Jan 2025

Global X China Electric Vehicle and Battery ETF (2845 HK)

Industry Update

- December EV sales another record high: According to CPCA estimates, December NEV wholesale volume reached another historical high level of 1.5mn, +35% YoY1, as driven by supportive trade-in policies. Major EV Brands delivered record-breaking December sales. BYD reported December NEV PV sales of 509k units, +50% YoY, with PHEV continuing to record strong growth. 2024 full year sales reached 4.25mn units, exceeding 4mn annual sales target. Xpeng (+73% YoY), Nio (+73% YoY), and Li Auto (+16% YoY) all delivered record-high sales in December. Xiaomi SU7 delivery exceeded 130k units in 2024, and targets 300k units delivery in 2025. (for reference only, abovementioned stocks are not necessarily in the constituent list of the ETF). Based on insurance registration, new energy vehicle (NEV) penetration declined slightly MoM to 47% in the last week of December.2

- Auto trade-in program expires on 31 Dec, all eyes on policy extension: Current trade-in stimulus expires on 31 Dec. By mid Dec, the Ministry of Commerce trade-in information platform has received 2.7mn+ applications for the auto trade-in subsidy program. Ministry of Commerce commented in an industry conference that plans for trade-in policies in 2025 is being formulated, though no further details have been disclosed at current stage. As 1Q is a traditionally slow season for auto market when the stimulus could be less effective, and part of the demand could have been front-loaded into 4Q24, trade-in subsidy could resume in 2Q25 after the March Two Sessions Meetings when further details might be disclosed.

- EU Tariff: Media reported at end-Nov that EU and China are nearing a solution over tariffs on Chinese electric vehicle (EV) imports, but this was later denied by EU officials.3 Though uncertainty still prevails, the EU tariff deals present potential upside for China EV market if materializes, as EU is the second largest EV market globally.

- Battery material costs further declined: China’s Battery grade lithium carbonate price Battery grade lithium carbonate price was Rmb75.9k/ton, -0.7% wow, -48%/-26%/-29%/-7% vs. average of 4Q23/1Q24/2Q24/3Q24. 4. Battery materials prices have decreased by over 80% from its peak in 2022, supporting the continued cost optimization for battery makers and EV manufacturers.

Stock Comments

- Fuyao Glass recorded 11% gain in December, a key contributor to the ETF. Fuyao Glass is the largest auto glass maker globally, commanding over 30% of global market share, and is a beneficiary of China’s strong EV sales in the past months. Fuyao’s operational and manufacturing strength brings higher-than-peer margin, and its effective R&D process allows continuous rollout of competitive new products that help to capture market share.

- Ganfeng Lithium recorded 17% loss in December, a detractor to the ETF. Though lithium demand recovers on the back of strong EV and ESS demand, the excess capacity issue still persists, capping the lithium price upside. Lithium supply-demand dynamics and price outlook has yet to turn to a level that can support a fundamental turnaround for major players like Ganfeng.

Preview

We remain positive on the long term growth potential for EV and battery value chain, along with the upward EV penetration trajectory. Domestic old car replacement demand, as stimulated by scaled-up auto trade-in program (which is likely to be extended in 2025), together with export sales, should support China’s resilient auto momentum and benefit leading domestic brands. We expect the China auto market to stay competitive with strong new product line-up and technology innovations from leading EV and battery brands, and new entrants such as Xiaomi. Geopolitical tensions remain the key risks, but China EV models will still remain competitive under new tariff landscape thanks to its cost advantages. Localized production will be the longer term solution for Chinese brands.

Global X Hang Seng TECH ETF (2837 HK)

Industry Update

Global X Hang Seng Tech ETF (2837 HK) recorded positive return in December. Concerns over escalating US-China geopolitical tensions under Trump presidency and policy supports for domestic chip development continue to drive the elevated sentiments on China semiconductor sector, leading to outperformance of leading domestic players like SMIC. Major internet companies reported 3Q results, mostly with in-line revenue and better-than-expected profits. With a clear change in policymaker stance, the gradual rollout of stimulus policies could support a revived consumer sentiments that will benefit sectors including ecommerce, advertising, EV, and 3C electronics. Online gaming sector remains less macro-dependent and continued to record solid revenue supported by high quality games.

Stock Comments

- Xiaomi recorded 24% gain in December, a key contributor to the ETF. Xiaomi’s first EV model SU7 posted 130k delivery in 2024, and targets 300k delivery in 2025. In December, Xiaomi also unveiled its highly anticipated SUV model, YU7, to be launched in mid 2025. Successful launch of SU7 has fuelled the revenue growth outlook and triggered re-rating for the stock, leading to over 130% share price gain since its launch in March 2024.

- Kuaishou recorded 14% loss in December, a detractor to the ETF. Kuaishou reported in-line 3Q24 results, but there are concerns that Kuaishou’s live streaming eCommerce business is entering a structurally slower growth stage as merchants and brands could be shifting their operational focus and ad budget back to traditional EC platforms. Competition from Douyin and Weixin Video Accounts remains fierce, which could undermine Kuaishou’s user and commercialization potential.

Preview

Hang Seng Technology Index constituents are well positioned to benefit from the policy stimulus by central government. We see unique positioning of Hang Seng Tech thanks to its attractive valuation, ongoing margin expansion, and continued ramp up in shareholder returns. With well-established ecosystem containing large user base and leading technology in place, we see further upside potential for these leading technology companies coming from the rapid development of structural growth themes such as EV, Semiconductor and AI in China.

Global X China Clean Energy ETF (2809 HK)

Industry Update

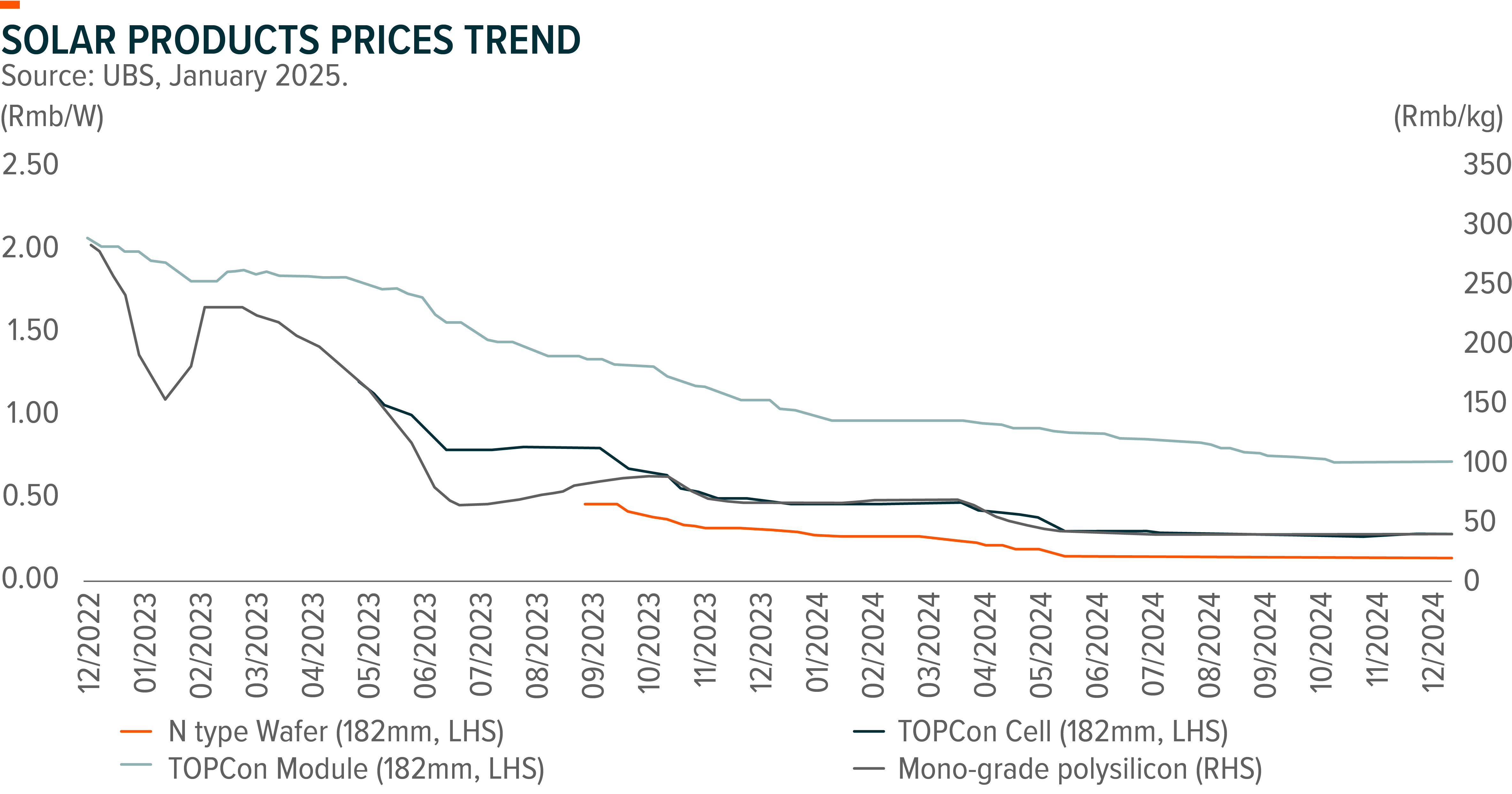

China solar installation was accelerating in November, adding 25GW vs 20GW in October, sending 11M24 the total solar installation to 206GW, +26%yoy. EU-27 2024 solar installations are estimated at roughly 65.5GW, +4.3%yoy. The solar industry is demonstrating mixed signals at the beginning of 2025, with polysilicon and solar glass destocking but significant prices recovery remaining challenging. The supply-side policies appear not effective enough to help the industry get out of the woods, especially in the upcoming low season in January and February. Channel checks implied the utilization along solar value chain came down to less than 50% or even lower during the Chinese lunar new year holiday.

China wind installation added 5.95GW in November, +46%yoy and -11%mom, sending 11M24 accumulated wind installation to 51.8GW, +25%yoy. China’s grid infrastructure investment as of 11M24 ended at Rmb529bn, +18.7%yoy, in which November investment was Rmb78.8bn, +8.39%yoy.

Stock Comments

- China Yangtze Power Co., Ltd Class A: The company has a solid track record of earnings delivery thanks to the high-quality hydropower business model. Stock rally in December may be mainly to the market turning to the high-dividend play by the year end.

- Hainan Jinpan Smart Technology Co., Ltd. Class A: Company is one of the key beneficiaries from power equipment exports to the US market, while December exports to the US was accelerating.

- Longi Green Energy Technology Co., Ltd. Class A: The company’ stock price rallied a lot due to the high expectation on the supply-side policies, which turned out disappointing.

Preview

We expect a modest growth rate for the European solar power market, mainly because the residential solar demand slowed down for the decreasing ROI as electricity prices normalized and the impacts of the energy crisis faded. China’s supply-side policies on solar may take more time to play out, despite the worst time behind. We are constructive on China’s wind equipment exporting for better profitability. We remain constructive on the global clean energy growth and the trend of energy transition, just staying cautious about the near-term broad mismatch between supply and demand.

Global X China Consumer Brand ETF (2806 HKD)

Industry Update

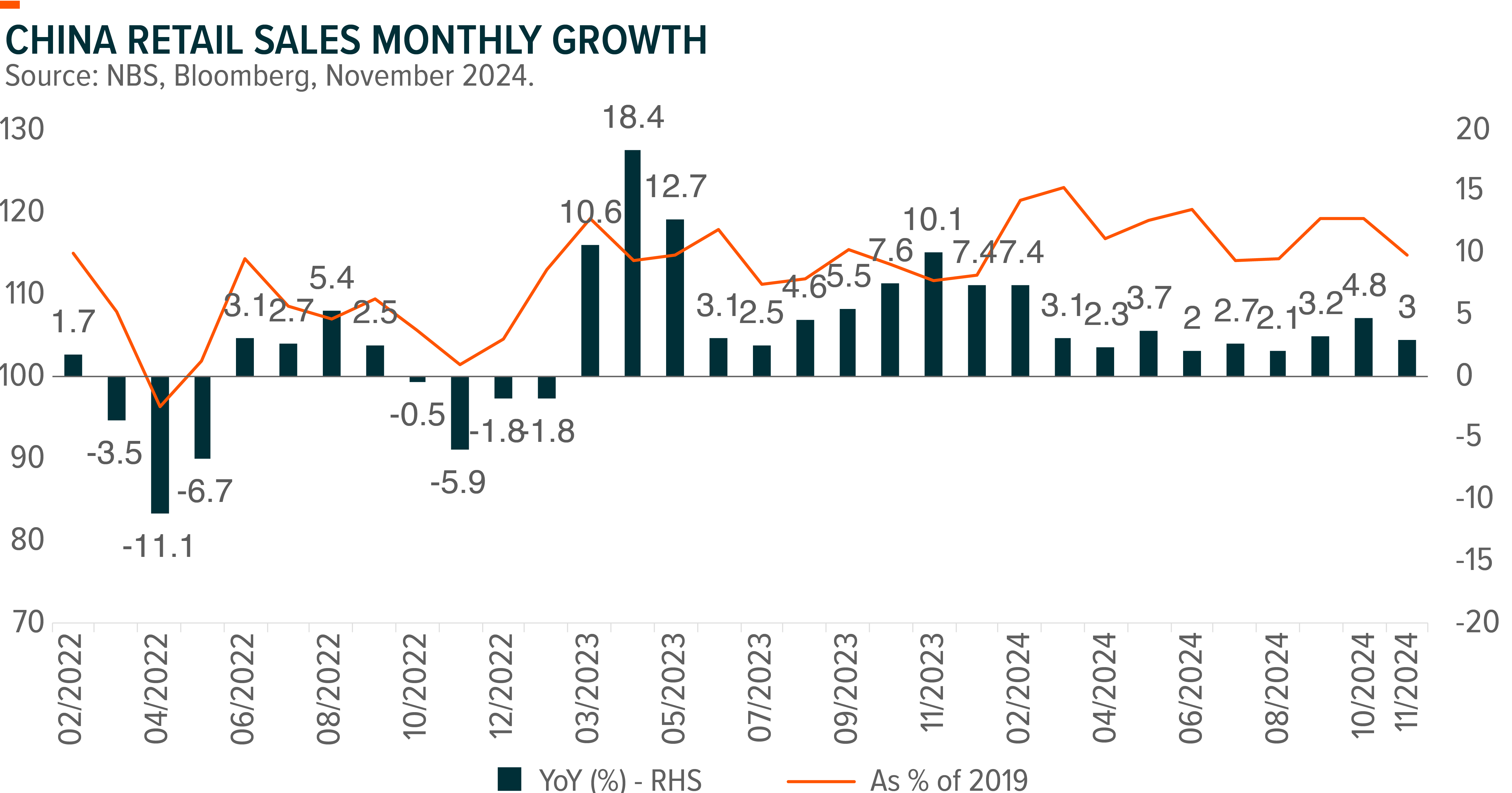

The key theme for China consumers in 2024 will be ‘Policy.’ Since 2H24, both central and local governments have consistently provided support to stimulate consumption. The central government has identified consumption as a critical policy priority. Despite policy efforts, household consumption in China remained weak in 2024 overall. The contribution of final consumption expenditure to headline GDP growth declined, falling to only 29% in Q3, down from 47% in Q2 and 59% in pre-Covid levels in 2019. In November, total retail sales grew by 3.0% YoY, down from 4.8% in October, bringing a YTD increase of 3.5% for 11M24. This slowdown in November’s retail sales growth can be partially attributed to a diminished Double-11 effect, as many transactions were shifted to October. We believe that the ongoing lackluster consumption data will necessitate additional stimulus policies in 2025.

Stock Comments

- Trip.com (TCOM US): Trip.com achieved 8% return in December. The company’s global presence is the key differentiator from other domestic OTAs. Trip.com’s recent track record suggests that its strategy—focusing on the APAC region, leveraging its mobile app, maintaining competitive take-rates, and delivering high-quality customer service in international markets—is proving highly effective. Going forward, overseas revenue (c.10% of group revenue in 2024) are expected to be the key growth driver in 2025, supported by increased marketing investments since 4Q24 and more favorable inbound travel policies (e.g. visa-free entry).

- Midea Group (000333 CH): Midea recorded 8% return in December. NDRC recently revealed the details of the 2025 consumer goods trade-in program. Key highlights include: 1) coverage categories expanded from 8 to 12, with microwaves, water purifiers, dishwashers and rice cookers newly added; 2) the number of air conditioners eligible for subsidies per consumer will increase from one to three. We believe industry leaders like Midea, with high domestic exposure and high premium product mix tend to benefit more than peers under the extended consumer goods trade-in program.

- Wuliangye Yibin (000858 CH): WLY experienced 4% loss in December. WLY held its annual distributor conference and investor meetings on Dec 18, where management acknowledged the challenges in achieving the DD% YoY sales growth target for 2024 but assured that positive growth is still expected. Company remains cautious about 2025 outlook under the difficult macroeconomic environment, while aiming to steadily enhance its market share and brand equity. WLY did not disclose its 2025 sales growth plan at the meeting, while we expect a mid to high SD growth driven by 1) Puwu’s 5% price hike in end-2024 for c.20%+ distributor quota, and 80% will likely impact 2025; 2) robust retail sales momentum in 1618 under banquet scenarios, ongoing cultivation of Classic Wuliangye in key markets and further growth from series spirits as well as other non-Puwu products.

Preview

We believe policy stimulus remains key to enhancing consumer sentiment and bolstering stock performance for China consumer in 2025. We expect that macroeconomic recovery, supported by supportive policies, presents the largest upside risk for China’s consumer sector in 2025, especially given that demand was under pressure across nearly all subsectors in 2024. However, the path of policy rollout remains unclear. Therefore, we expect consumption recovery to unfold gradually, with a more noticeable improvement likely in 2H25. More time will be needed before fundamentals improve under the current policy setup. Key events to watch include the Two Sessions in March 25. By subsector, we like sectors that are direct focus of stimulus policies, such as home appliance under extended consumer goods trade-in programs, as well as sectors sensitive to macroeconomic changes, such as Baijiu.

Global X China Robotics and AI ETF (2807 HK)

Industry Update

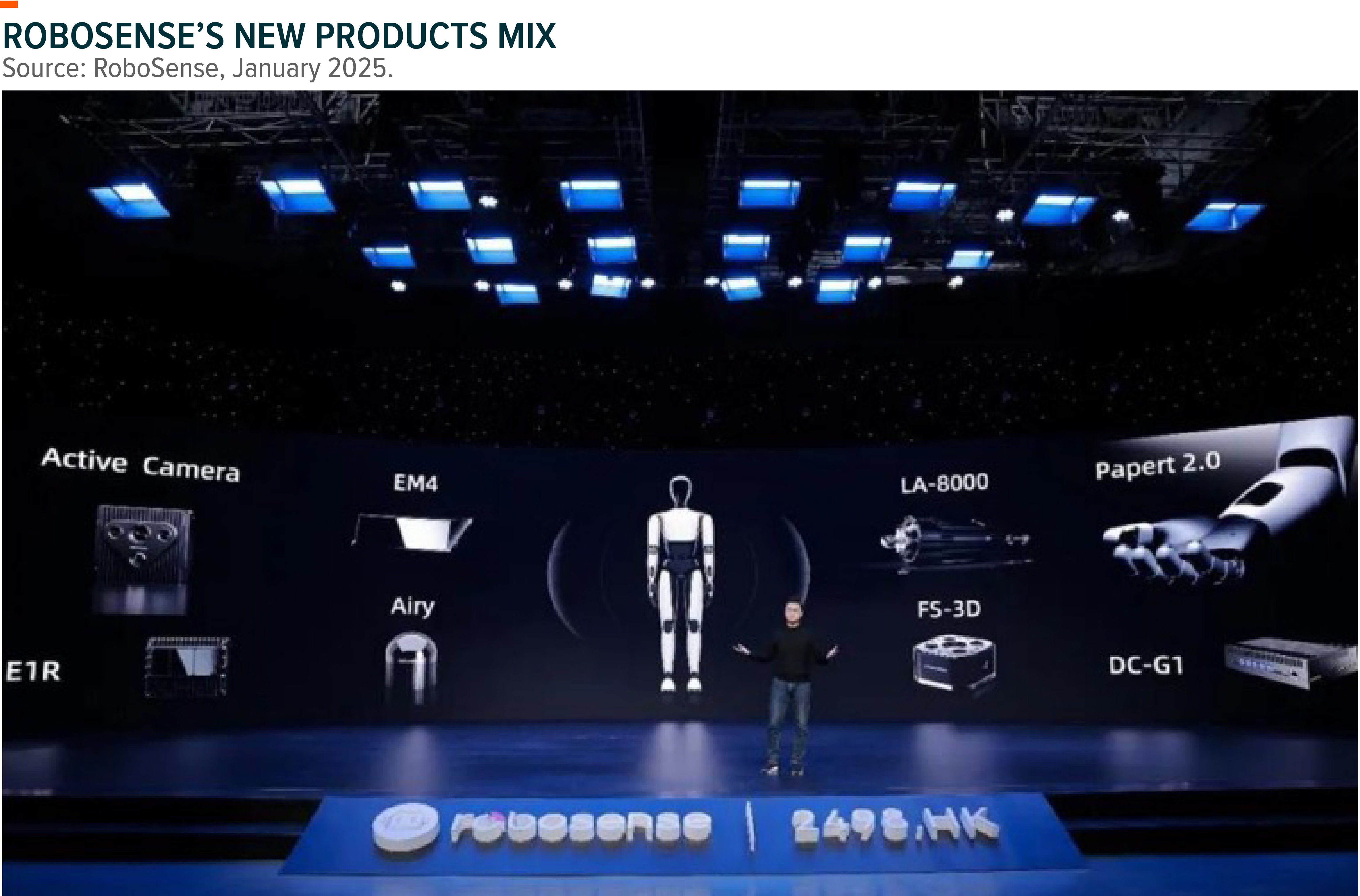

RoboSense, one of the leading Chinese AI-driven robotics companies, released three new digital lidar(EM4, E1R and AIRY) and a number of robot incremental parts and components including active camera fusion perception device, domain controller DC-G1, high-power density motor and force sensor FS-3D on January 3, 2025. Digital lidar, the new parts and components will enable a comprehensive upgrade of in-vehicle and robot perception capabilities, and promote multi-scene application of robots. Early in the summer of 2024, another leading company, Unitree Robotics released the updated version of its G1 humanoid robot slash AI avatar, which is ready for mass production and priced starting from Rmb99,000 per unit. The robot can hammer nails precisely, prepare meals with pots and pans, crack nuts and do many jobs by simulating human hands. We have witnessed a great step forward in robotics and AI in China in the last two years that improved the features significantly and could be applied to some simplified production scenario. For example, AI technology on the cars would be one of the few spotlights with will see meaningful improvement in the next twelve to eighteen months. Some leading electric vehicle companies have been investing and will invest more in the intelligent car technologies, aiming at competitive products development in the long run.

Stock Comments

- Huagong Tech Co., Ltd. Class A: As one of the key beneficiaries from the AI capex cycle, 3Q24 revenue grew robustly on computing power demand. The company’s exposure to non-China markets is expected increasing by 1Q25.

- Zhejiang Shuanghuan Driveline Co., Ltd. Class A: The company is expanding their reducer capacity to fulfill the increasing demand from the major electric vehicle customers. They also increased their exposure in BYD recently.

- Suzhou TFC Optical Communication Co., Ltd. Class A: The company delivered solid earnings performance and the new product development remained on track. Investors take profits after strong stock rallied in November.

Preview

China’s FAI in advanced manufacturing and technology have been strong despite the overall economy slowdown. Automation, robotics and AI are one of the key beneficiaries from both the government’s stimulus measures in the near term and the economy transition goal in the long run. We have seen the signs of stabilizing pricing trend and demand bottom-out in automation sector recently, as the large-size replacement program is starting to translate into the initiation of new investments/projects. Domestic manufacturers continue gaining market share on the back of customized products across emerging industries, fast delivery and advanced post-sale services, while foreign brands keep losing market share in China. In humanoid robotics and AI (especially AI hardware) sector, China is much more leading in products R&D and mass production.

Global X China Semiconductor ETF (3191 HK)

Stock Comments

- SMIC +5.02% Domestic foundry utilization continues to recover on restocking orders. Market turn more positive on China semiconductor demand after the government announced stimulus package. SMIC has projected a 13-15% Q/Q revenue growth for 3Q24. 3Q gross margin guidance of 18-20% exceeds expectations, due to rising ASP, given a higher 12-inch wafer shipment mix. .

- Will Semi +6.06% China is looking to roll out subsidies program to include smartphones and more consumer electronics. Will semi is a key smartphone CIS supplier, well positioned to benefit should the smartphone sales grow in 2025 driven by new subsidies.

Preview

Increasing AI adoption in the data centre and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI-enabled devices have much higher semi-content. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2025. (Mirae 2025)

Global X China Little Giant ETF (2815 HK)

Market Update

Global X China Little Giant ETF experienced loss in December 2024. The key overhangs in the near term are the tariff and US policies, which might reinforce the top leadership’s commitment to enhancing supply chain upgrades and achieving self-sufficiency. We still expect promoting emerging industries to climb up technology tree and supporting domestic substitution remain policies priorities in 2025. Therefore, these specialized and sophisticated SMEs play a crucial role in China’s transition to high quality development. As a high-quality, small-cap fund, Global X China Little Giant ETF is likely to benefit more than large-cap funds if the economy turns to strong recovery in 2025.

Stock Comments

Rockchip covers a wide range of intelligent application processor chips which support intelligent speech processing and AI vision computing, to meet the growing demand for AIoT products. Its chip products are widely used in the field of application, covering smart business display, smart financial retail, machine vision, education office equipment, cloud computing & cloud terminals, automotive electronics, smart industrial equipment and other scenarios; smart speakers, sweeping robots, dictionary pens, tablet computers, TV boxes, smart home appliances and other intelligent hardware.

With a increase of AI hype in China (Bytedance announced that its Doubao reached #2 AI application MAU after OpenAI by November 2024, AIoT related names (such as AI glass) rallied strongly. As CES will be held in LA in January 2025, AI glasses and other AIoT are expected to be a highlight of the event, while Rockchip is likely benefit from this.

Imeik underperformed in December, partly due to 1) worse than expected 3Q results (ie. margins); 2) weak aesthetic medicine demand as economy remain weak while competition also heat up. Going forward, both new product launch and macro would affect share performance.