Important Information

Investors should not base investment decisions on this website/material alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Electric Vehicle and Battery Active ETF (the “Fund”) invests in equity to achieve long term capital growth by primarily investing in companies which are directly or indirectly involved in electric vehicle or electric vehicle-related battery businesses.

- The Fund employs an actively managed investment strategy and does not seek to track any index or benchmark. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investments are concentrated in companies involved in the EV/Battery Business, which may experience relatively higher volatility in price performance when compared to other economic sectors. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments and may be more susceptible to adverse economic, political, policy, liquidity, tax, legal or regulatory event affecting the relevant sector.

- Electric vehicle companies and electric vehicle-related battery companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of electric vehicle companies and electric vehicle-related battery companies may be significantly impacted by technological changes, changing government regulations and intense competition from competitors.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- The trading price of the Fund unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

Global X Electric Vehicle and Battery Active ETF (3139) Outlook 2025

In the first ten months of 2024, electric vehicle sales in key regions (Europe, China, US) ended at 13 million units, +22%yoy (vs PV market +2%yoy), in which non-China markets accounts for 4.66 million units, 36% of total sales. BEV sales ended at 8.1 million units, +11%yoy, while PHEV sales 4.9 million units, +51%yoy, respectively. PHEV sales are much faster growing in China this year, thanks to more successful new car models, efficient fuel consumption, less charging anxiety and competitive pricing. Global electric vehicle penetration arrived at 27.7% in 10M24, +4.7ppt yoy. In October 2024, global EV penetration hit a new high at 33.7%, up by 8.0ppt yoy, largely driven by China EV sales surge to 54.4%, up by 16.7ppt yoy.

We have witnessed some interesting trend in the last two to three years. Firstly, the sales volume of Chinese automakers is rapidly catching up thanks to globally the well-acknowledged electrification trend, which was very difficult to compete with JV brands in ICE era. Not only BYD, as the chart below shows, Geely, SAIC-MG, Changan and Li Auto ranked within Top10 this year. We are not doubtful that some of them will further accelerate the sales in 2025 to surpass the legacy automakers. Secondly, Chinese leading players are accelerating their exporting strategy in many emerging markets and continuously gaining market share globally. For example, BYD, Geely and Great Wall have expanded their footprint in ASEAN and Latin America countries via local production. There could be some near-term concerns on margins and geopolitical pushback, which, we believe, will be ultimately removed, citing the internationalization experiences of legacy auto brands decades ago. Last but not the least, we have seen global auto companies are increasing their exposure to China EV supply chain, by either shifting R&D and production centers to China, or collaborating with local EV brands to better utilize the latter ones’ knowhow in product design and intelligent driving system.

Heading to 2025, we expect China electric vehicle sales will keep the fast-growing pace by +40%yoy to 15 million units, in which PHEV accounts for half or even more of the total sales. EV demand in Europe in 2025 largely relies on whether carbon emission policies be postponed. We are currently expecting mild demand growth of 5%yoy to ~4.6 million units. Should carbon emission policies be on track, we are likely seeing significant EV sales pick-up. EV demand in the US is also unclear owing to Trump’s stance on IRA, which plays a key role in automakers’ EV strategy and production in the coming few years. Lastly, EV demand in all the other markets could be nearly 1 million units, in which Thailand, Indonesia, Oceania, Latin America and India would be the key contributors.

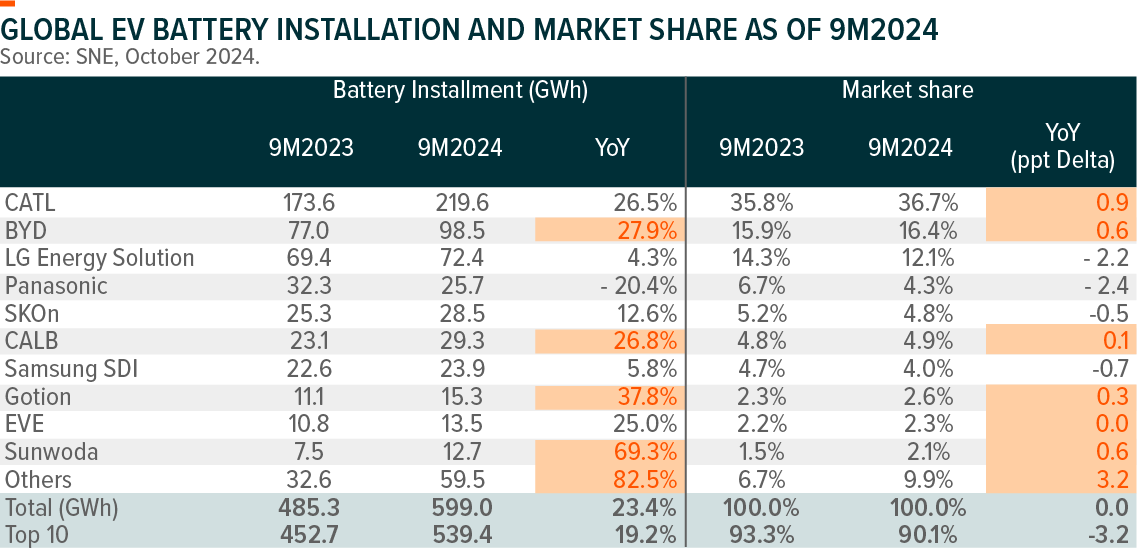

As a result of fast-growing EV sales, global EV battery installations reached 599GWh in the first nine months of 2024, further accelerating to +23.4%yoy. CATL led the growth with 220GWh, +26.5%yoy, with a market share of 36.7%. BYD has surpassed LG Energy Solution, becoming the No.2 in battery production this year, thanks to its integrated remarkable EV sales. EV battery installation by BYD and LG Energy Solution are 98.5GWh and 72.4GWh in 9M24, with the market share of 16.4% and 12%, respectively. Global energy storage battery production ended at 267GWh in the first ten months of 2024, +50%yoy, in which Chinese manufacturers took 97% of the global share. China domestic demand accounts for ~50% of the total ESS battery shipment, followed by the US(17%), Europe(14%) and other regions (~18%). Interestingly, we have seen fast growing demand of hybrid power generation projects, for example, solar, wind and ESS in India and ME regions, driven by power outages and improving economics with great sunlight irradiation in the local areas, declining solar panel costs and less requirement on constructions.

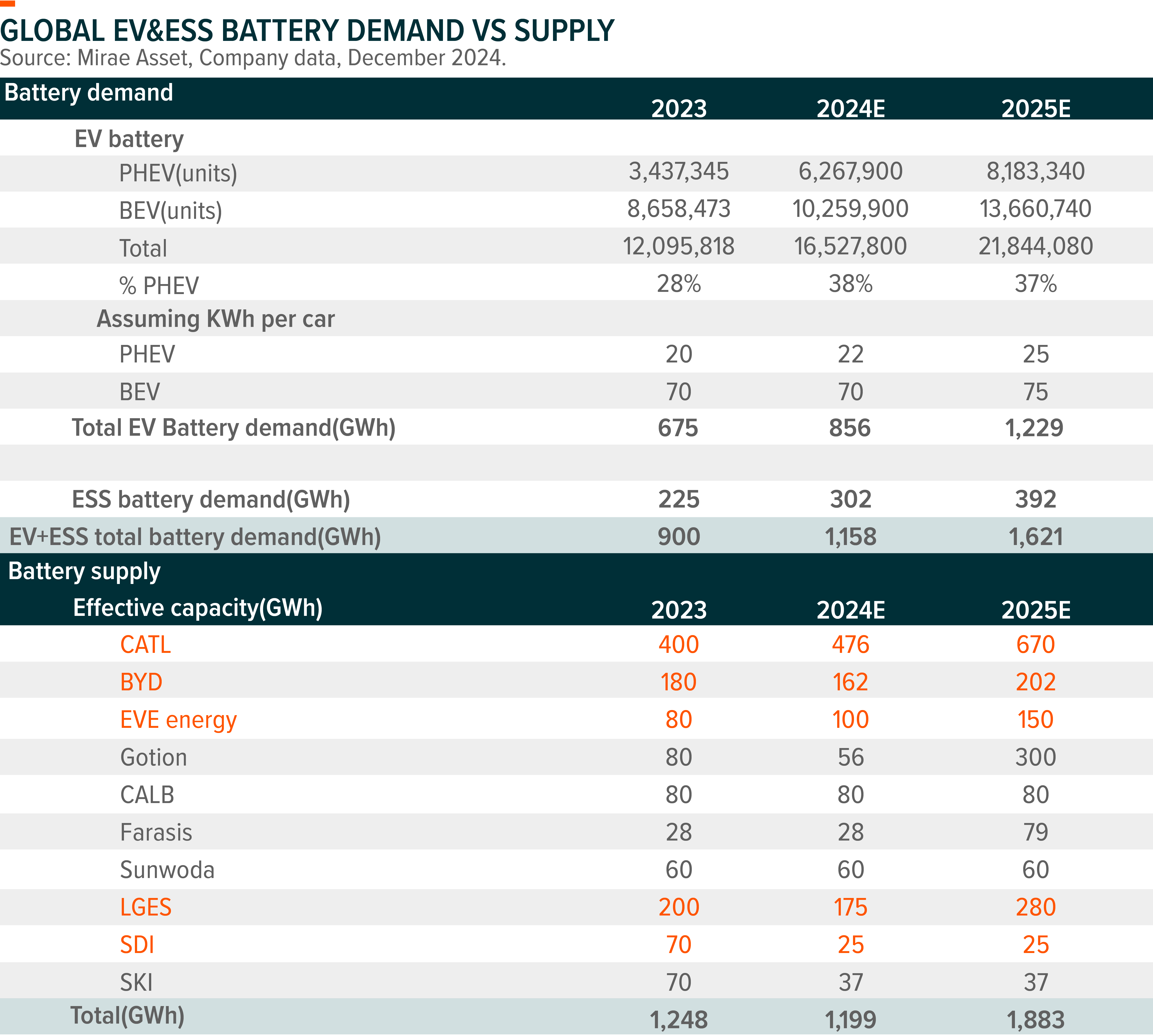

We are constructive on battery demand growth in 2025. However, we believe the business success of each battery maker highly relies on the partnership with electric car winners in the long run. CATL, BYD and LGES are relatively better positioning at the moment for a wide customer list as a third-party battery maker or in-house strong EV and battery integration. Competition amongst the second-tier Chinese battery makers (EVE, CALB, Gotion, Sunwoda) and SDI could be intensified to win orders from leading EV makers from a long-term strategic perspective. Additionally, we are also bullish on energy storage battery demand growth next year, +30%yoy or maybe higher, mainly driven by more ESS battery used per Wh in renewables projects and renewables installation growth in the emerging markets. We are currently expecting mild wind and solar installation growth next year due to a high base in 2024. Regarding the supply side, we have witnessed the industry lowering capex plan or delaying the new project construction in the last eighteen months. We expect global EV and ESS battery demand would be over 1,600GWh, vs total effective supply of 1,800+GWh. The battery overcapacity issue remains there, but the supply-demand gap is narrowed down significantly. Inventory in each segment along battery value chain are at the very low level. Battery players are restocking now, due to bullish demand outlook in 2025. Some battery materials, for example, anode, copper foil and LFP cathode, are under discussion on prices hike on the back of the long-time loss making. Overall, we believe the worst time is behind, and there could be surprise on upside if demand beat in 2025.

Global X Electric Vehicle and Battery Active ETF (3139) Strategy

We focus on global electric vehicle and battery supply chain who will be one of the fastest-growing industries in the coming decade in the world. We aim to capture the sub-sector leaders with remarkable growth potential, continuous technology innovation capability, sustainable and competitive business models and strong execution. We have unique value proposition of combining EV and battery knowledge with the understanding of traditional autos, industrials and materials sectors, to better understand the industry dynamics. Our research experience in traditional sectors provides insightful angles to learn the business cycle of each segment along EV and battery value chain. Additionally, we insist on a bottom-up fundamental perspective, looking for opportunities with the balance between cheap/reasonable valuation and solid earnings performance.

Industrywise, battery is our top pick, primarily because leading companies have proven their competitiveness in technology, cost control and supply chain coordination. Consequently, they are more likely to deliver long-term sustainable earnings growth even in this downcycle. We also increased the exposure to electric vehicle manufacturers. Automobile was a very rapid evolving business in terms of technology, design, pricing and fuel consumption. It was difficult to predict the competition landscape in the long term. Yet, we have seen some automakers showed early signs of comprehensive competitiveness in all these aspects and their sales volume soared globally in the last two years. Last but not the least, we slightly increased the weight on the upstream, mainly lithium, since materials prices are almost bottom. It still takes time to bottom out, but we think the risk-reward is good here, very limited downside from a long-term perspective.

Countrywise, we increased the weight on China recently for two reasons, despite the oversupply issues and people’s concerns on geopolitical risks: firstly, we remain constructive on China’s EV sales in 2025. We believe, China government will continuously take electric vehicles and battery manufacturing, exporting and consumption as an effective tool to boost economy. Secondly, we did witness some Chinese leading companies with proactive self-help measures to gain market share globally in 2024 on the back of increasing international trade frictions and ongoing import tariff headwinds. The current valuation has factored in most risks, and we would like to take any non-fundamental-driven correction as a buy opportunity. We reduced the weight on Japan thanks to rich valuation in the near term after stock rallied as well as concerns on their competitiveness in the EV-related components business in the long run