Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Little Giant ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies which may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies which are characterised by relatively higher volatility in price performance. The Sub-Fund may be exposed to risks associated with different sectors and themes including semiconductor, industrial, pharmaceutical, energy and technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Sub-Fund.

- Some of the companies classified as the Little Giants have a relatively short operating history. Such companies also face intense competition and rapid changes could render the products and services offered by these companies obsolete, which may have an adverse effect on profit margins.

- They may be more susceptible to risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences affecting those companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which

- may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

Monthly Commentary

China Thematic ETFs – Oct 2024

Global X China Electric Vehicle and Battery ETF (2845 HK)

Industry Update

- Strong September EV Sales; NEV penetration exceeded 50%: Major EV brands delivered record September Sales. BYD reported September NEV PV sales of 417k units, +46% YoY, with PHEV continuing to record strong growth. Overseas sales grew by 5% MoM to 33k.1 Li Auto delivered record 54k units in September, +49% YoY. Nio (+35% YoY) and Xpeng (+33% YoY) also recorded strong sales momentum in September. Xiaomi SU7 delivery exceeded 10k units in September. Xiaomi is continuously raising its effective capacity and aims to deliver 20k EV units in October. (for reference only, abovementioned stocks are not necessarily in the constituent list of the ETF). Based on insurance registration, new energy vehicle (NEV) penetration was 50% in the last week of September.2

- Over 1.1mn applications for Auto trade-in program: The trade-in stimulus has been doubled to Rmb20k (from Rmb10k) per NEV, and Rmb15k (from Rmb7k) per eligible ICEV,3 following central government’s indication that long-term government bonds could be used to fund consumer goods trade-in.4 As of 25 Sep, auto trade-in program received over 1.1mn applications.

- Retreat of foreign JVs: Different foreign JVs, including GAC-Honda, Dongfeng-Honda, SAIC-VW etc, are reportedly reducing capacity in China amid the slowdown in ICE demand.5 Domestic brands could further take share from JV brands.

- Tariff: European Commission announced a new draft decision on final countervailing duties on BEV imports from China, which are marginally lower than those disclosed in early July. Notably, tariff on China-made Tesla would be cut to 9% from previously planned 20.8% (on top of the 10% existing tariff). In addition, Canada says it will impose a 100% tariff on imports of China-made EVs.6

- Battery material costs could have bottomed: China’s spot lithium carbonate price declined by another 18% MoM to around RMB 73 k/t at early September.7 After CATL cut lithium production in Jiangxi, lithium price could have bottomed at Rmb70k/t (UBS estimates). Battery materials prices have decreased by over 80% from its peak in 2022, supporting the continued cost optimization for battery makers and EV manufacturers.

Stock Comments

- Li Auto recorded 30% share price gain in September, a key contributor to the ETF. On the back of a strong EV sales momentum in China, Li Auto delivered record high 53.7k vehicles in September, as driven by steady increase in order intake for Li L series and Li MEGA. Li Auto also launched new autonomous driving architecture, which integrates an end-to-end (E2E) model and a vision-language model (VLM), to ~10k test users during the month.8 As we enter into car sales peak season, outlook for Li Auto remains positive due to solid 3Q guidance, improving market pricing environment, and undemanding valuations.9

Preview

We remain positive on the long term growth potential for EV and battery value chain, along with the upward EV penetration trajectory. Domestic old car replacement demand, as stimulated by scaled-up auto trade-in program, together with export sales, should support China’s resilient auto momentum and benefit leading domestic brands. We expect the China auto market to stay competitive in 2024 with strong new product line-up and technology innovations from leading EV and battery brands, and new entrants such as Xiaomi. Geopolitical tensions remain the key risks, but China EV models will still remain competitive under new tariff landscape thanks to its cost advantages. Localized production will be the longer term solution for Chinese brands.

Global X Hang Seng TECH ETF (2837 HK)

Industry Update

Global X Hang Seng Tech ETF (2837 HK) has experienced a significant rebound following the announcement of the PBOC’s strong stimulus package, yielding 33% returns in September. Core internet platforms and technology companies rank among the top choices for global investors seeking opportunities in the Chinese market after the strong stimulus package. Sectors including ecommerce, advertising, EV, and 3C electronics are key beneficiaries of revived consumer sentiments under policy stimulus in China.

Stock Comments

- Bilibili recorded strong 69% growth in September. In addition to a broad China market rally, Bilibili’s outperformance should be attributable to 1) Strong performance of its newly launched Three Kingdom mobile game; 2) Faster than peers ad revenue growth on a lower base; 3) Better cost discipline and improving margin. With enhanced gaming and advertising revenue visibility, Bilibili could be turning to a profitable growth cycle starting 2025.

- Alibaba recorded return of 35% in September, a positive contributor to the ETF. Alibaba was included in Southbound Stock Connect Program starting 10 September, and Southbound ownership accounts for c.2.7% by end of September.10 Alibaba repurchased US$4.1bn worth of share in Sep-24 Quarter, and its share repurchase program has led to a 2.1% net reduction in share count as of 2QF25. LTM shareholder return implies 8% yield.11 Alibaba could benefit from the revived consumption sentiments under the stronger than expected government stimulus, and Taobao-Tmall have stabilized market share in recent months under a normalizing eCommerce landscape.12

Preview

Hang Seng Technology Index constituents are well positioned to benefit from the policy stimulus by central government. We see unique positioning of Hang Seng Tech thanks to its attractive valuation, ongoing margin expansion, and continued ramp up in shareholder returns. With well-established ecosystem containing large user base and leading technology in place, we see further upside potential for these leading technology companies coming from the rapid development of structural growth themes such as EV and AI in China.

Global X China Clean Energy ETF (2809 HK)

Industry Update

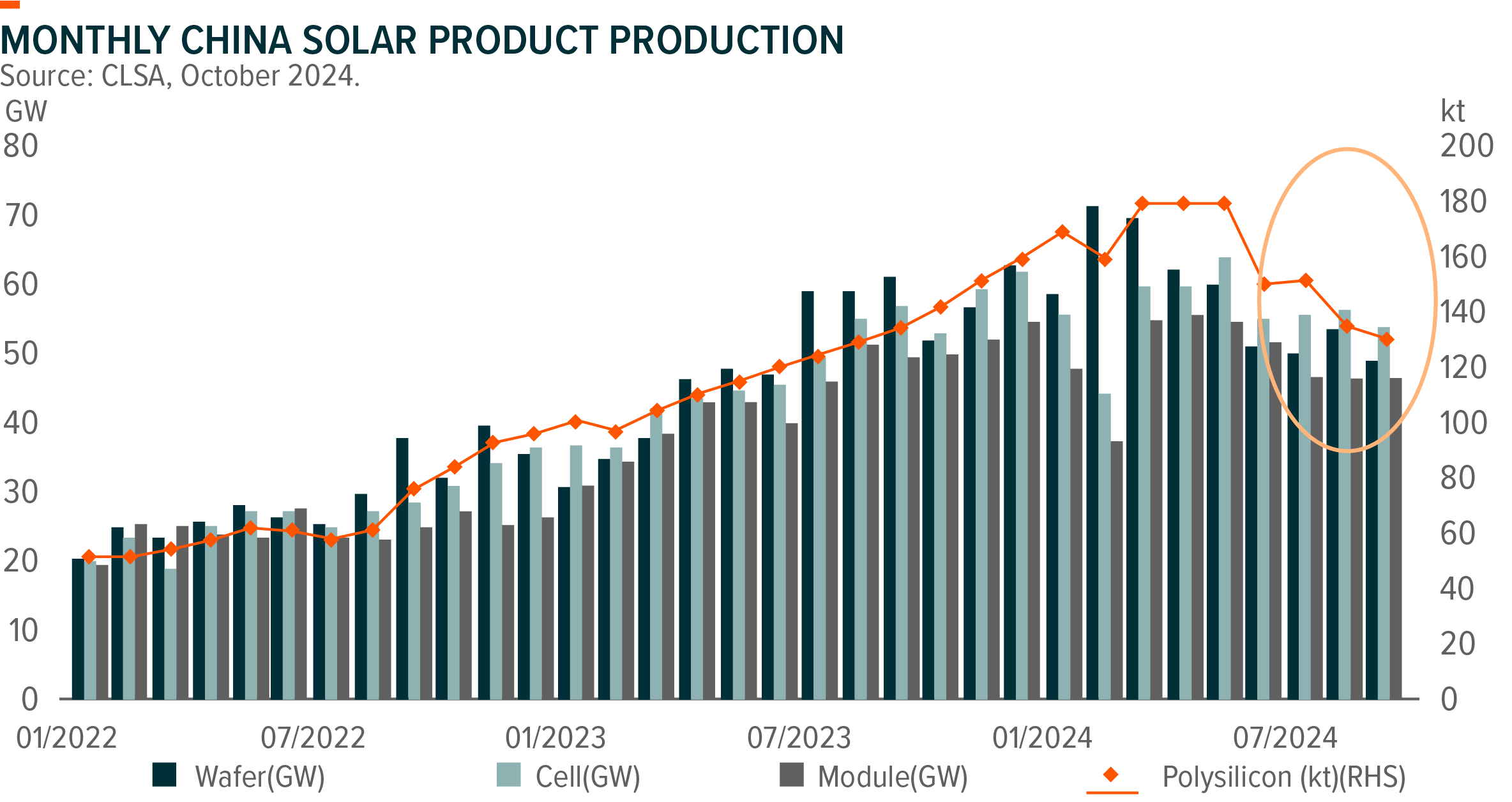

China solar installation ended at -22%MoM and +3%YoY to 16.5GW in August, decelerating mainly due to power grid digestion constraint. 2024 demand are now expected at 450GW globally and 230-250GW in China. On the supply side, it remains on the way of more supply exits and consolidation. The Commerce Department of the USA released its preliminary determination in the CVD investigation for cells imported from four SEA countries (Cambodia, Malaysia, Thailand and Vietnam) on October 1st. The results of tariff are generally lower than expected, while AD is the next that may come more punitive vs CVD.

China wind installation ended at 3.7GW in August, -9.8%MoM and +42%YoY. China’s grid infrastructure investment in 8M24 was 140GW, +23.7%YoY. Power grid capex is strong as expected to better utilize the renewables generation in the near future.

Stock Comments

- Sungrow Power Supply: The company delivered strong Q2 results with energy storage sales much better than feared. Sungrow is a global leader in solar inverter and ESS integration business with great exposure to exporting.

- LONGi Green Energy: The leading solar wafer makers slightly increased wafer selling prices recently, implying positive signals on wafer S/D balance. Additionally, China’s recent stimulus policies on stock market also helps with high beta play like Longi.

Preview

We remain constructive on the global clean energy growth and the trend of energy transition. However, we also must admit the near-term broad mismatch between supply and demand along solar/wind supply chains, which led to poor earnings for a couple of months or maybe even longer. It takes more time than expected for the small players to exit and demand to catch up, especially when China solar value chain are faced with geopolitical pushback from the United States. On the bright side, we have seen strong demand from some emerging markets like ASEAN, Middle East regions, Africa and South America, but it still needs more time.

Global X China Consumer Brand ETF (2806 HKD)

Industry Update

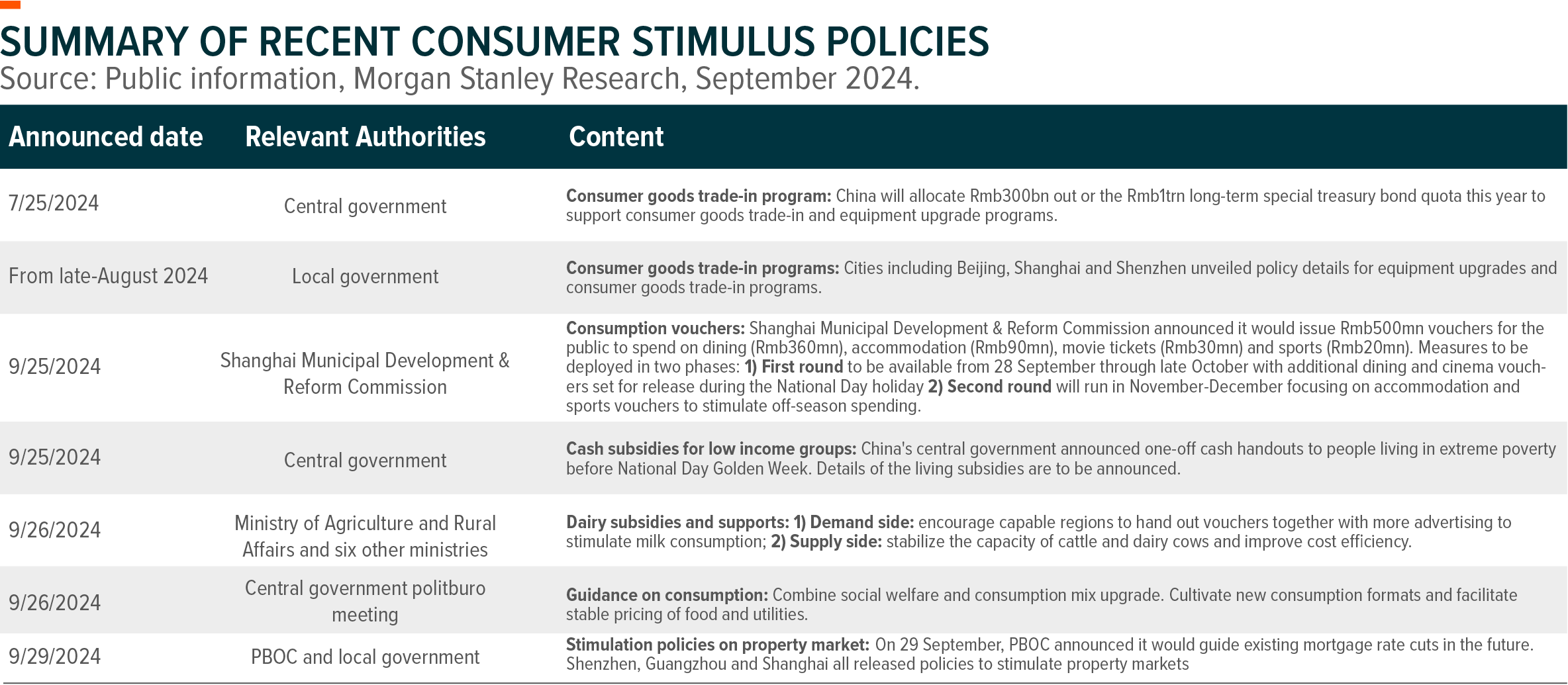

China consumer along with overall China market has been significantly strengthened by recent policy stimulus. On September 24, PBOC announced a comprehensive monetary stimulus package that surpassed market expectations. On September 26, the first ever Politburo meeting pledged more stimulus measures focused on fiscal and monetary easing, stabilizing the property market, underpinning the equity market, and boosting consumption and employment.

Beyond the two key events boosting on China stock market, China consumer has been continuously receiving policy supports over the recent few months from both central and local government, helping on consumer sentiment. We observed that the effects of earlier policy initiatives are becoming increasingly evident, particularly with the consumer trade-in programs (incl. autos and home appliance) launched by NDRC in July. In August, passenger car sales increased by 10.8% MoM, with NEV sales growing by 17%. As of September 24, China has approved nearly Rmb11bn subsidies through the national automobile trade-in platform, while over 5.2m home appliance units have benefited from subsidies, amounting to Rmb4.67bn. On September 25, Shanghai announced Rmb500mn consumption vouchers for the public — Rmb360/90/30/20mn for dining/accommodation/movie tickets/sports. This initiative represents the first major action by a local government following the PBOC stimulus package and showcases positive attitude from local authorities

Stock Comments

- Wuliangye Yibin (000858 CH): Wuliangye achieved a 32% return in September. We attribute this mainly to the upward revision of valuations in the Baijiu sector, driven by an oversold position and improved sentiment from policy support. We continue to observe that high-end spirits, such as Wuliangye, exhibit stronger channel power and a robust prepayment pace. Wuliangye has maintained relatively resilient retail sales momentum in major markets, with SD% YoY increase for the overall Mid-Autumn Festival demand. Additionally, Common Wuliangye’s wholesale price per bottle remained stable, with a slight increase of Rmb5, rising from Rmb920 to Rmb925 in September.

- Trip.com Group (TCOM US): Trip.com achieved a 24% return in September. TCOM saw resilient travel demand, particularly in the leisure-related segment (~70% of TCOM’s revenue) with steady ARPU YoY suggesting travellers are taking advantage of lower hotel ADRs and airfares to upgrade and pursue better quality product offerings. TCOM reiterated its revenue growth guidance of 11-16% YoY (vs. +14% YoY in 2Q24), supported by robust momentum in outbound travel (+50% YoY) and from its Trip.com platform (+60% YoY). TCOM is well-positioned to provide better certainty with its dominant position in the Chinese outbound travel market and increasing exposure to the overseas OTA sector through its Trip.com platform..

Preview

We believe policy stimulus could enhance consumer sentiment and bolster stock performance in the near term. As a late cycle play, consumer sector valuation has been compressed over the past year under an uncertain macroeconomic environment. Despite a recent rebound, the sector is currently trading at 16x PE as of September end, which remains well below the long-term average.

In our view, a fundamental turnaround and sustained improvement will take time. Large-cap sectors such as liquor, dining, and home appliances exhibit higher beta characteristics in a bullish macro scenario. Notably, home appliances and dining are also direct beneficiaries of consumer stimulus policies, including trade-in programs and consumption vouchers. For many consumer companies, especially staple names, we expect stabilization and recovery of earnings entering 4Q24 given easing comps.

The market is expecting additional stimulus measures in the near future. To track sector sentiment and performance, we recommend to follow forthcoming policy announcements, the impact of key initiatives such as trade-in program progress, and data points relating to consumer income outlook, including property price trends,

Global X China Robotics and AI ETF (2807 HK)

Industry Update

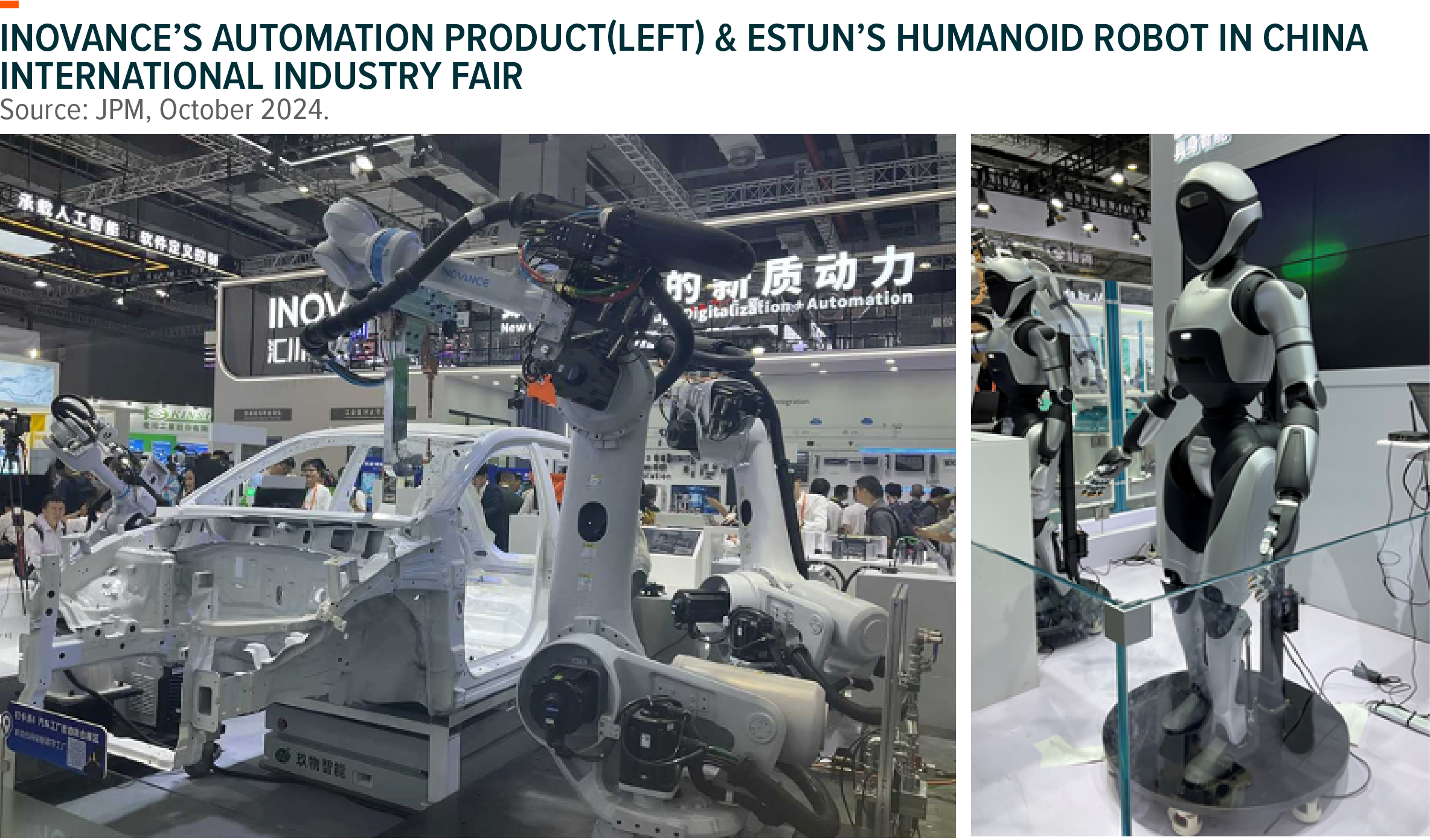

China factory automation demand remained soft, attributed to consumer electronics’ seasonally slow demand, rising uncertainties from trade policy changes that impact negatively on investment in export sectors, and weakening capex for the new energy sector, particularly solar industry. Channel feedback suggests pricing competition has eased off though pricing dropped sequentially in 3Q24. Domestic players are keen with market share gains, trying to expand into new fields and resulting in overlaps of addressable markets. Destocking by international players including Yaskawa, Fanuc, ABB and Siemens are close to the end. Key players implied limited appetite for further price cuts, helped by resilient auto vertical demand for industrial robot and normalized FA parts inventory. Given Q4 in the last year is a low base, we expect sector bottom soon later from here, coupled with China’s recent stimulus policies.

Stock Comments

- Zhongji Innolight : The company delivered solid Q2 results actually, with revenue up by 175%yoy and net profits up by 271%yoy. Management reiterated a strong demand outlook for 2H24, as they will continue to expand capacity to meet the downstream demand.

- Shenzhen Inovance Technology: New order inflow for Inovance remains soft recently. Yet, the company benefits from China’s recent stimulus policies as a high beta play, given the valuation is very low

Preview

Sector rallied a lot after China’s stimulus policies. We are cautious about the key drag of solar industry despite low base in 4Q23, and how much the new policies on demand recovery has been priced in in a short period of time. We remain positive on the long-term trend of China industrial automation market growth. Domestic manufacturers continue gaining market share on the back of customized products across emerging industries, fast delivery and advanced post-sale services, while foreign brands keep losing market share in China.

Global X China Semiconductor ETF (3191 HK)

Industry Update

XMC, Sister Company of YMTC, Has STAR Market IPO Application Accepted

Wuhan Xinxin Semiconductor Manufacturing Co. (XMC) has had its IPO application for the STAR Market officially accepted, marking the official start of its listing process. The company currently offers 12-inch NOR Flash, CIS, and Logic wafer foundry services, with process nodes of 40nm and above. (Trendforce)

TSMC’s 2nm Wafers Reportedly Set to Double in Price

As TSMC has reportedly begun trial production of 2nm chips in its Baoshan Plant in Hsinchu, northern Taiwan, the schedule of mass producing 2nm in 2025 remains on track. A report by Commercial Times reveals that the price of 2nm wafers is expected to double compared to 4/5nm, which may exceed USD 30,000 per wafer. (Trendforce)

Stock Comments

- SMIC recorded +24.36% return. Domestic foundry utilization continues to recover on restocking orders. Market turn more positive on China semiconductor demand after the government announced stimulus package. SMIC has projected a 13-15% Q/Q revenue growth for 3Q24. 3Q gross margin guidance of 18-20% exceeds expectations, due to rising ASP, given a higher 12-inch wafer shipment mix.

- Montage recorded +27.08% return. Montage is the proxy for DDR5 chips in Greater China, and now leads the interface for DDR5 Gen 3. Inventory digestion completed and the traditional server market is expected to grow in 2H24.

Preview

Increasing AI adoption in the data centre and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI-enabled devices have much higher semi-content. Currently we are still in the process of cycle recovery as both stocks and earnings are below previous peak. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2024. (Mirae 2024)

Global X China Little Giant ETF (2815 HK)

Industry Update

September 24th’s press conference announced a broad package of monetary stimulus measures, including 50bps/20bps cut in RRR/7-day repo rate respectively, lowering mortgage rates by around 50bps, lowering down payment ratio for 2nd home from 25% to 15%, and most to investors’ surprise, the creation of a swap facility up to RMB500bn to allow eligible financial institutions to obtain additional liquidity accessing the stock market. This is viewed as a coordinated effort approved by higher authorities. Investors turned more bullish and further lifted their policy expectation after the announcements in Sep Politburo meeting regarding boosting fiscal spending. It’s unusual for officials to address economy-related issues in September meetings and therefore investors take it as a positive sign of government re-prioritizing economy.

The unusual timing likely pointed to a strong sense of urgency to arrest the worsening growth slowdown and sent out a strong signal that they have shifted away from piecemeal style to a coordinated approach with bazooka style. Underneath, I believe there is a shift of policy objective/approach. Policy objective is now to revert deflationary narrative and bring back animal spirit.

Preview

We expect more fiscal policies to roll out in coming weeks/months (ie. more infrastructure spending, consumption package, CGSB to replenish capital of state banks, potential more special government bond at party congress, extended appliance subsidy for trade-ins and equipment replacement, etc). And Sept NDRC press conference, we might be able to expect more on industrial and technology policies. Market tends to focus on size of fiscal spending, which is important for near term. But I think near term fiscal headlines we see are likely only for achieve this year’s growth target, hence headline number might be below already elevated expectation. But to me what’s more important, and whether the recovery/rally is sustainable, is still whether and how will they address the structural issues (ie. property, local government fiscal condition, and confidence).

When NDRC starts to roll out industrial and technology policies, and when animal spirit comes back, market might shift towards more growth and technology related names which Little Giant are positioned at. We shall expect strong rebound of Little Giant index post A share opening.