Wind Energy Drives the Future of Sustainability

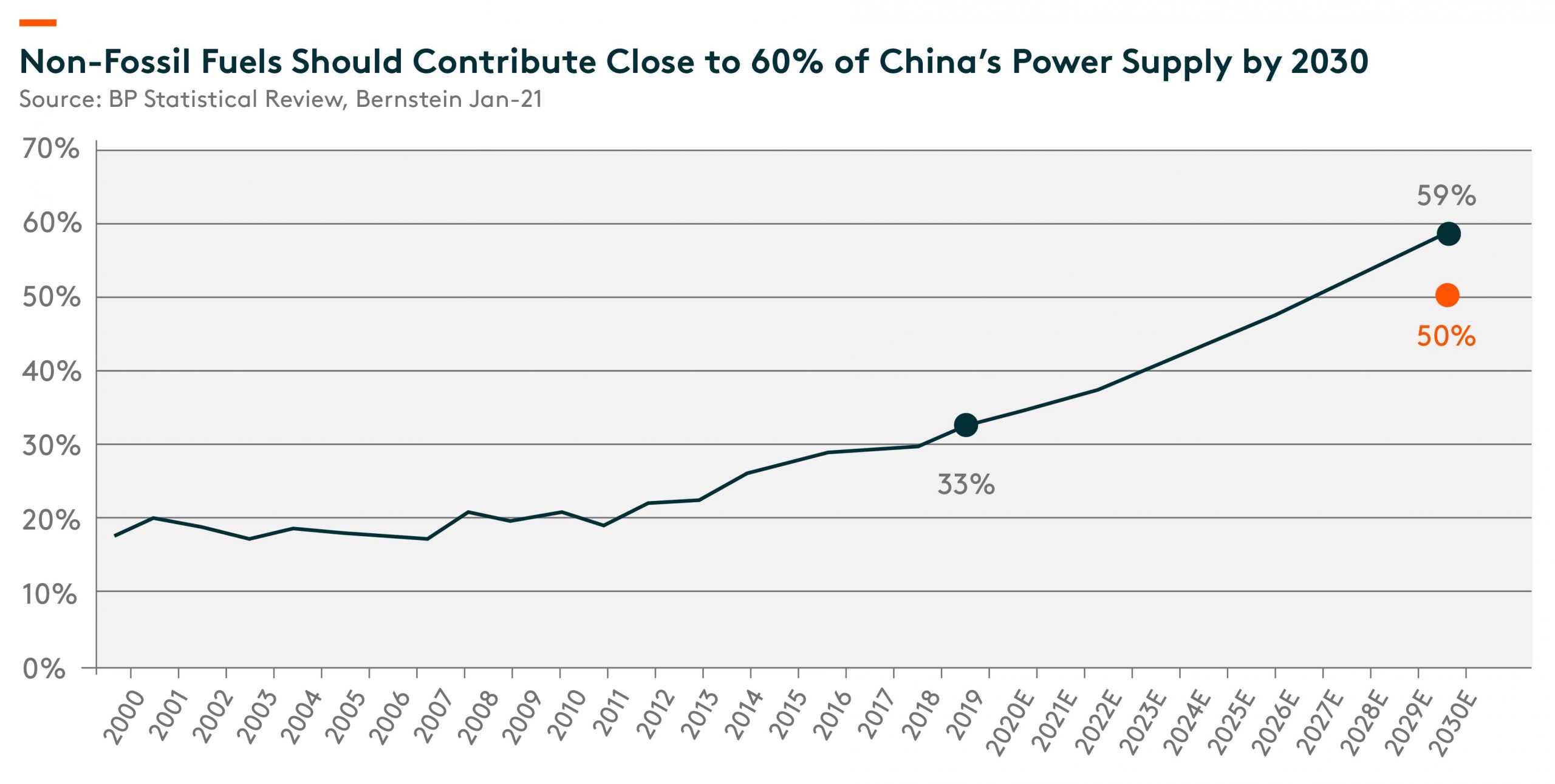

China’s decision to reach carbon neutrality by 2060 has thrust renewables into the spotlight as key pillars driving the energy revolution. Carbon neutrality is a function of reducing carbon emissions while improving carbon capture, utilization and storage. The Chinese government aims at increasing non-fossil fuel’s share in electricity generation to 50% by 2030, which also coincides with peak CO2 emission. Bernstein (Jan-21) predicts that over the next five years, 88% of China’s new energy capacity will come from renewable resources, with 49% deriving from solar and 23% from wind. By 2030, non-fossil fuel including solar, wind, nuclear and hydro should account for close to 60% of the country’s power supply.

The wind sector has been capturing increasing investor attention thanks to a coordinated global push towards renewable energy. In particular, wind energy has become more important as an alternative source of energy for China in order to meet President Xi’s target of becoming carbon neutral by 2060. This report will touch on issues and updates within the sector such as onshore and offshore projects, cost trends, government policies and the competitive landscape.

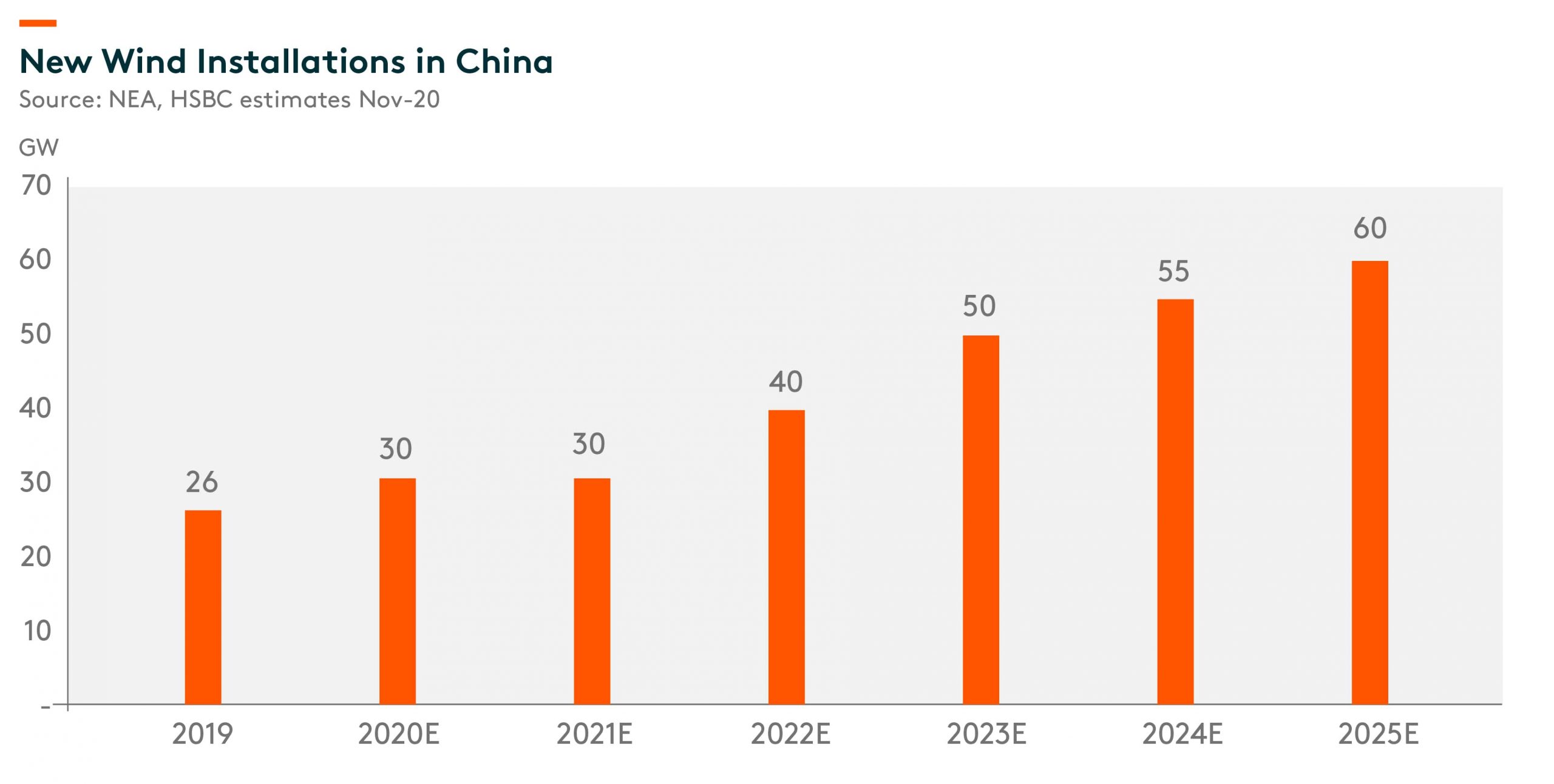

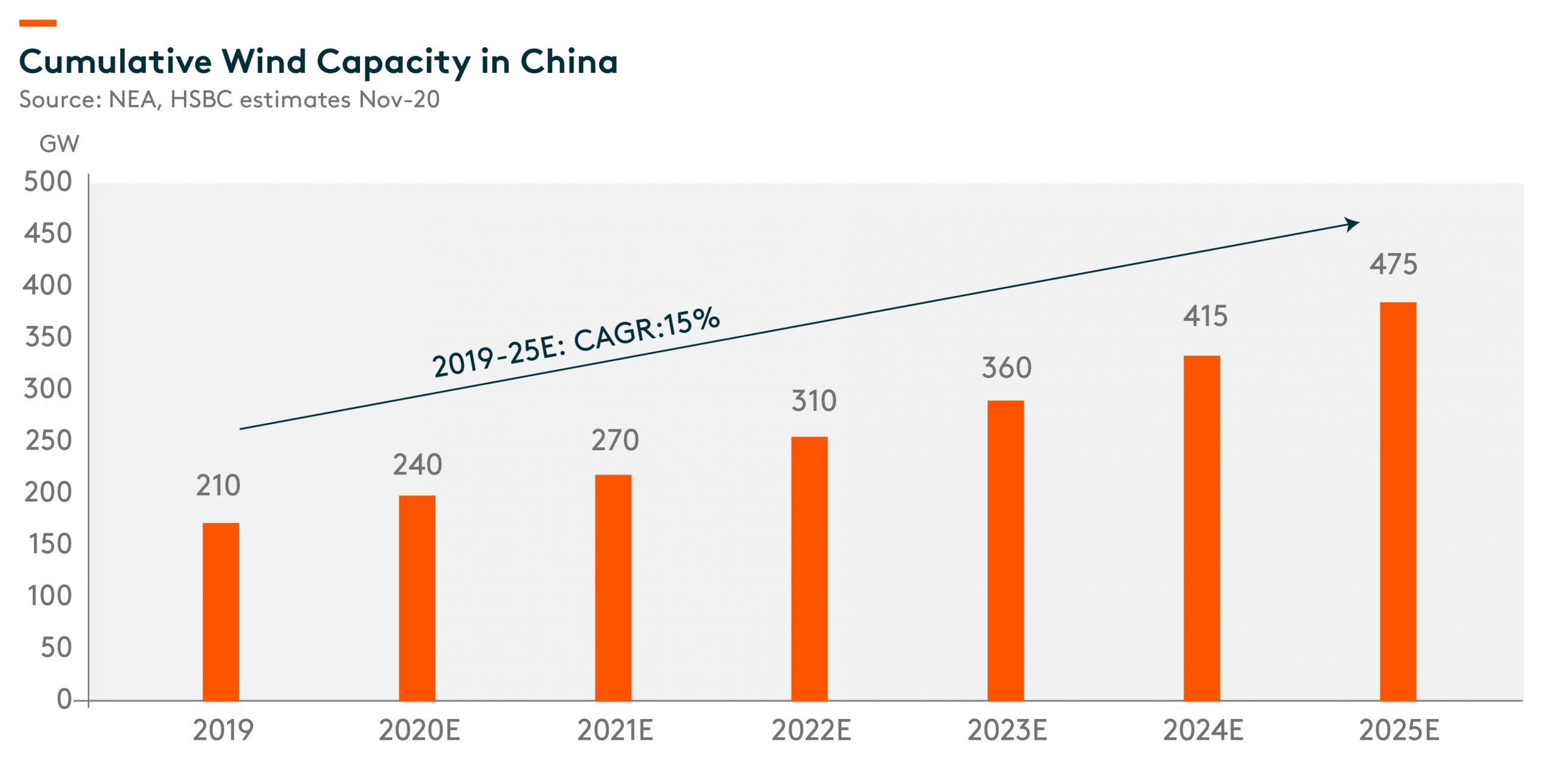

Based on China’s 14th five-year plan, HSBC (Nov-20) expects China to add a total of 235GW of wind capacity driven by its green ambition and falling wind turbine prices. According to Shanghai Daily (14 Oct 2020), representatives of wind energy enterprises issued the “Wind Energy Beijing Declaration” during the China Wind Power Conference 2020, whereby it is necessary to ensure an average annual wind installation of more than 50GW p.a. during the 14th FYP, post which new installations should be at least 60GW p.a. in order to achieve carbon neutrality. HSBC expects China’s cumulative wind power installed capacity to reach 475GW as of end-2025E (2019: 210GW), implying a CAGR of 15% over 2019-25E.

The levelized cost of energy (LCOE) for wind has been on a downtrend with cost declines largely coming from technological advances that enable higher electricity generation at a lower cost. China’s National Energy Commission (NEA) has reduced the value of feed in tariffs (FITs) for onshore wind for three consecutive years from 2014 to 2016, with the final announcement giving guidance to FIT levels in 2018. In mid-2018, the NEA launched the auction mechanism whereby developers will need to bid in provincial-level auctions to receive wind power tariffs above the regulated coal-fired tariff level. Strike prices for onshore wind auctions during the transition period are capped based on existing wind feed-in tariffs (FITs) as ceiling prices. Projects approved before end-2018 need to connect to the grid by end-2020 to enjoy the old tariff. Projects approved between Jan 2019 and end-2020 through the auction mechanism need to connect to the grid by end-2021. Any new projects approved after Jan 2021 will be considered a grid parity project.

We expect China’s offshore wind market to become the largest globally driven by carbon neutrality targets, the maturity of the offshore wind value chain, and solid support from central and provincial SPEs in offshore wind development. During 2022-24, we expect the provincial governments of some coastal provinces, such as Guangdong, to subsidize the local offshore wind segment, given goals to improve non-fossil fuel consumption and reduce carbon emissions, as well as to foster the local offshore wind manufacturing value chain.

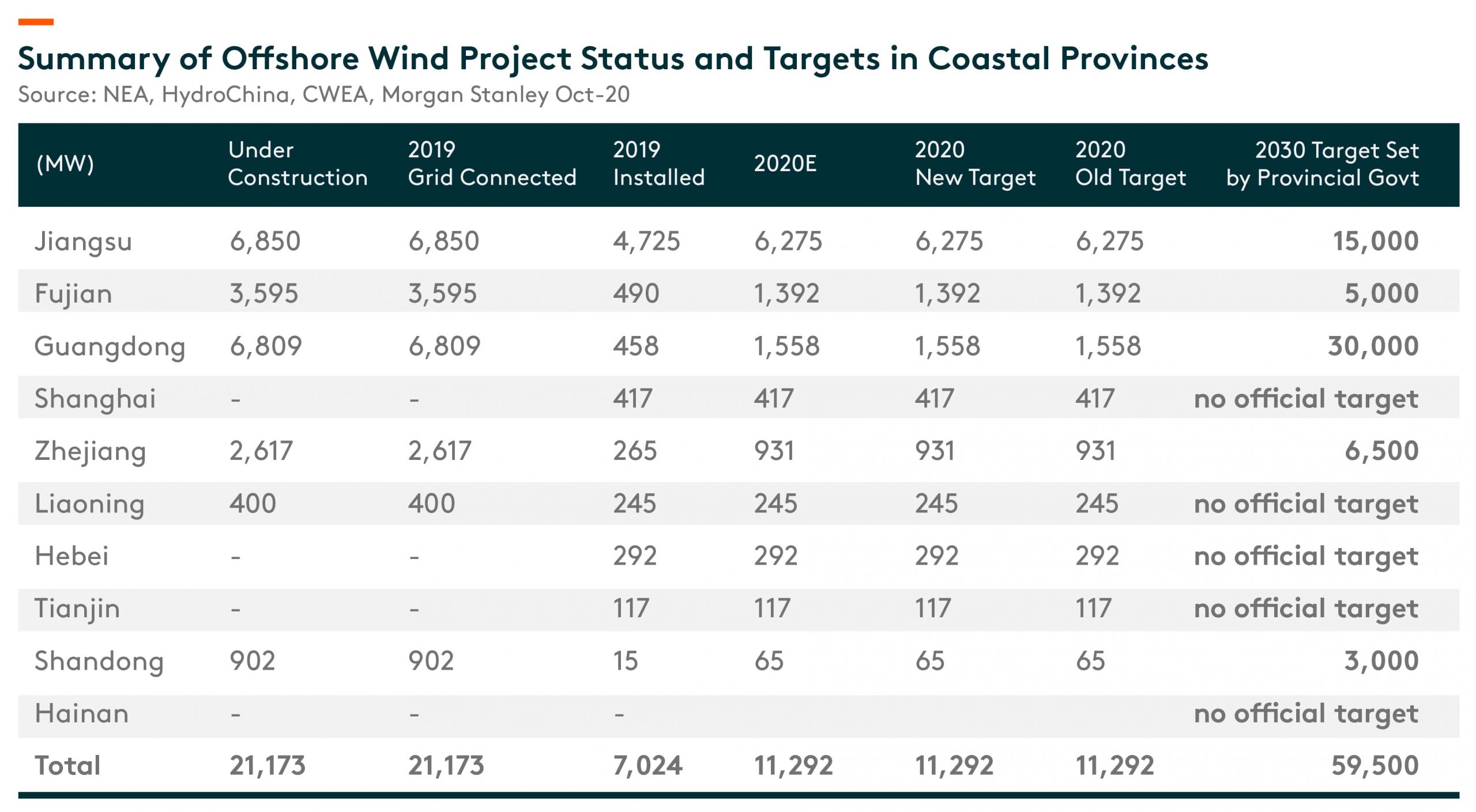

China has a total of 7.0GW1 offshore wind capacity now installed, making it the third-largest offshore wind market globally after the UK’s 9.6GW and Germany’s 7.6GW, as of end-2019. In 2019 alone, China installed the most offshore wind capacity, at 2.5GW, ahead of the UK’s 1.8GW and Germany’s 1.1GW that year. Eight provinces/municipalities (i.e., Jiangsu, Fujian, Guangdong, Shanghai, Zhejiang, Liaoning, Hebei, and Shandong) have offshore wind projects in operation. Jiangsu has the largest offshore wind cluster in China, with an installed 4.7GW and connected 4.2GW, as of end-2019, accounting for 67% and 71% of China’s total installed and total grid-connected offshore wind respectively.

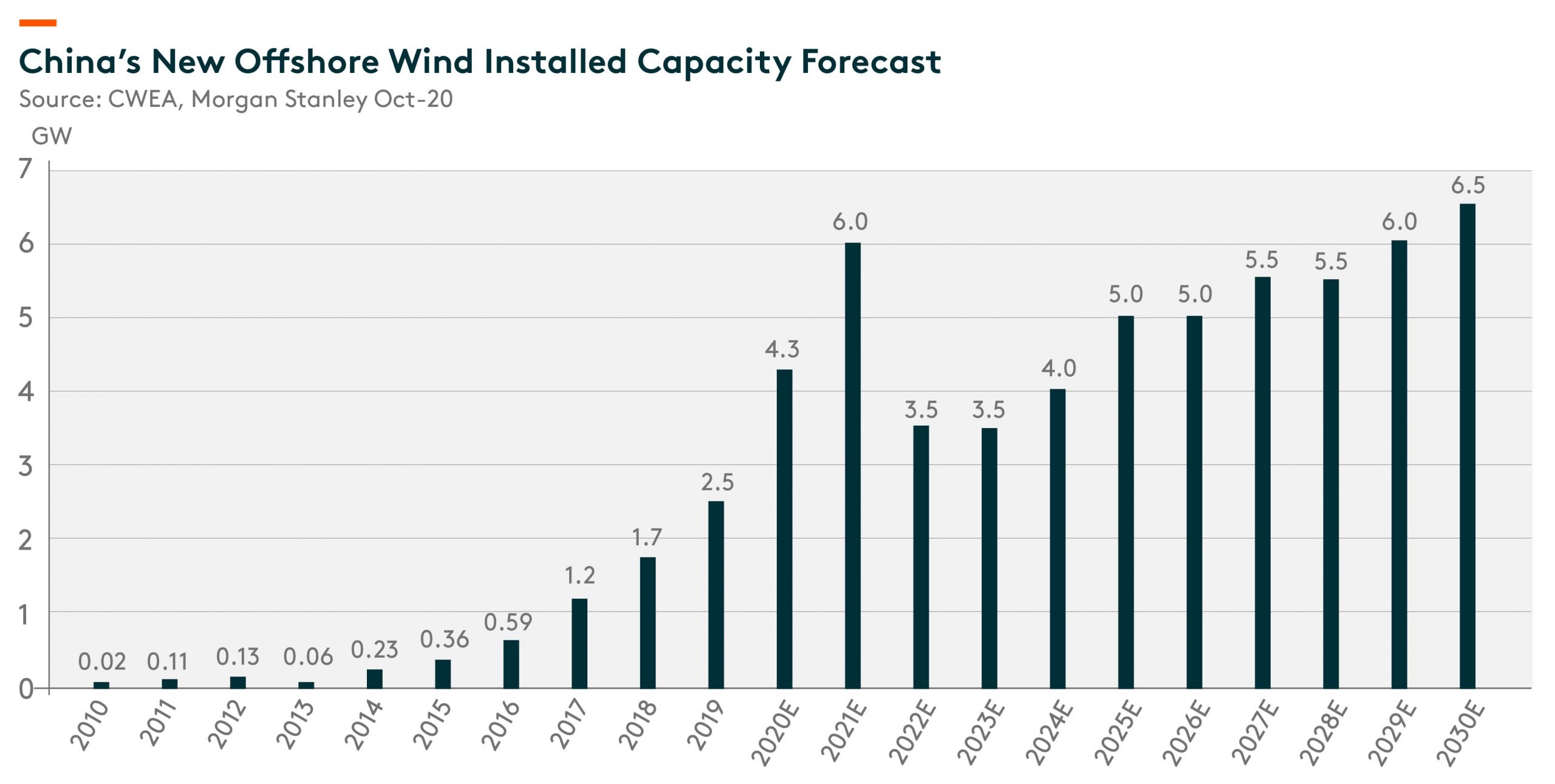

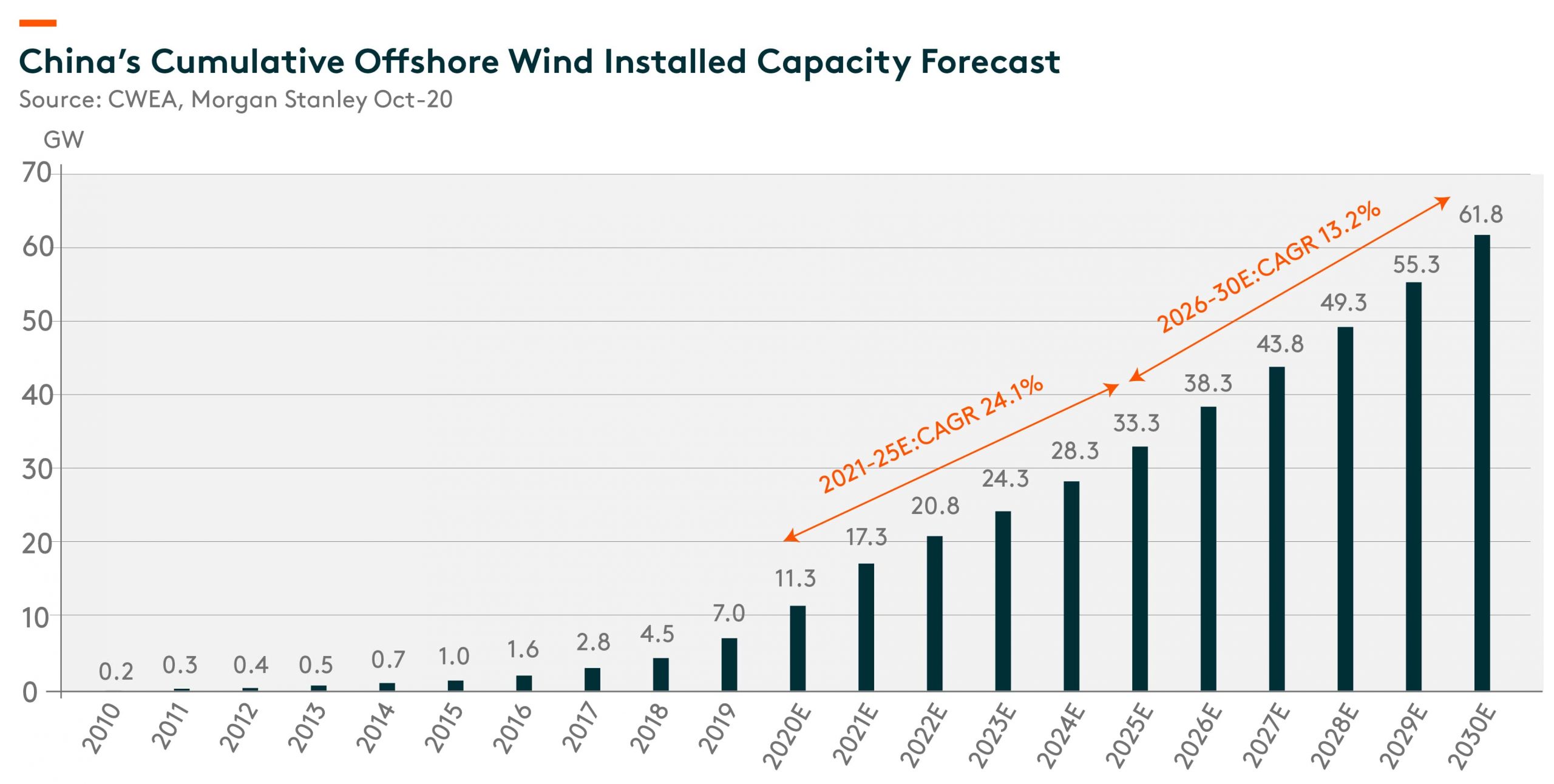

During 2022-24, we expect the termination of central government subsidy support will lead to a decline in annual new offshore wind installation from the short-term pickup in 2021, to 3.5-4.0GW per annum. China had 21.2GW2 in offshore wind projects under construction as of end-August 2020, with around 10.9GW worth of projects that started construction that will be left over for future development, beyond end-2021. We note some offshore provinces have set very ambitious targets for 2030, and we believe these regions are likely to provide some subsidy to support the offshore wind market, including the manufacturing value chain. Moreover, we believe central and provincial State-Owned Enterprises (SOEs) will continue to expand offshore wind capacity, despite a lower tariff and return, by shifting investment from coal-fired power to renewable energy, and also to improve the power generation capacity mix.

We expect China’s offshore wind industry to reach grid-parity in 2025, driven by maturing technology and experience accumulated in offshore wind turbines and key components, marine engineering, and offshore wind farm operation and maintenance. Morgan Stanley (Oct-20) forecasts that new offshore capacity will pick up to 5GW p.a. over 2025-26, stepping up to 5.5GW p.a. over 2027-28, and further increasing to 6.0GW in 2029 and 6.5GW in 2030. The termination of central government subsidy support is likely to force the Chinese offshore wind industry to reach grid parity sooner rather than later.

Moreover, most coastal provinces have established offshore wind targets for 2030, aiming to adjust the energy consumption mix, replacing coal-fired power with renewable energy and boost the wind equipment value chain. Guangdong has the most ambitious plan to build 30GW of offshore wind capacity by 2030, followed by Jiangsu’s 15GW, Zhejiang’s 6.5GW, Fujian’s 5GW, and Shandong’s 3GW. Other coastal provinces, namely Liaoning, Hebei, Guangxi, Hainan and Shanghai, also have offshore wind development plans. The country’s offshore wind targets, close to 60GW by 2030, provide long-term visibility and scale for local industry, despite no provincial government yet committing to a post-2021 support scheme.

Fourteen developers had new offshore wind capacity commence operations in 2019; the top five developers are China Huaneng Group 605MW (24.3%), China Energy Investment Corporation (CHN Energy, offshore wind mainly under Longyuan) 530MW (21.3%), China Three Gorges Corporate (CTGC) 352MW (14.1%), China Datang Corporation 254MW (10.2%), and Guangdong Energy Group (Yudean) 187MW (7.5%)3. As of end-2019, China had 21 offshore wind developers; the top five, combined, had capacity close to 5GW ( 70.9% of total capacity), and they are all central SOEs. The 21.2GW offshore wind projects under construction belong to more than 20 developers, and the majority of these developers are either traditional power investment central SOEs or provincial energy investment bodies (e.g., Yudean, Fujiang Funeng, Zhejiang Energy, Fujian Investment) with provincial government backgrounds, long histories of energy-related investment, and a high portion of local energy resource (including coal-fired power plants) ownership. We think central or local SOEs developers will accept the lower tariff and return, and continue to complete investment in unfinished projects, beyond 2021.

Related ETF

Global X China Clean Energy ETF is designed to offer investors efficient access to growth potential through companies critical to further advances and increased adoption of clean energy in China.

Other Key Features:

- Unconstrained Approach: The fund’s composition transcends the classic sector and industry classifications by tracking an emerging theme.

- ETF Efficiency: In a single trade, the fund delivers access to dozens of companies with high exposure to the clean energy theme in China.

Please click here for more information on the Global X China Clean Energy ETF.