Chinese Vaccine Industry Research Series I – Vaccines: Past, Present, and Future

The Oldest Biotech Drug in the World

Vaccines are probably the oldest biological drug in the world. In 1796 a British physician used matter from cowpox pustules to inoculate patients successfully against smallpox (caused by a related virus). By 1900, there were two human virus vaccines developed against smallpox and rabies and three bacterial vaccines against plague, typhoid, and cholera.

Immunization (or vaccination) is perhaps the most cost-effective public health intervention and is said to prevent 2-3 million deaths per year.

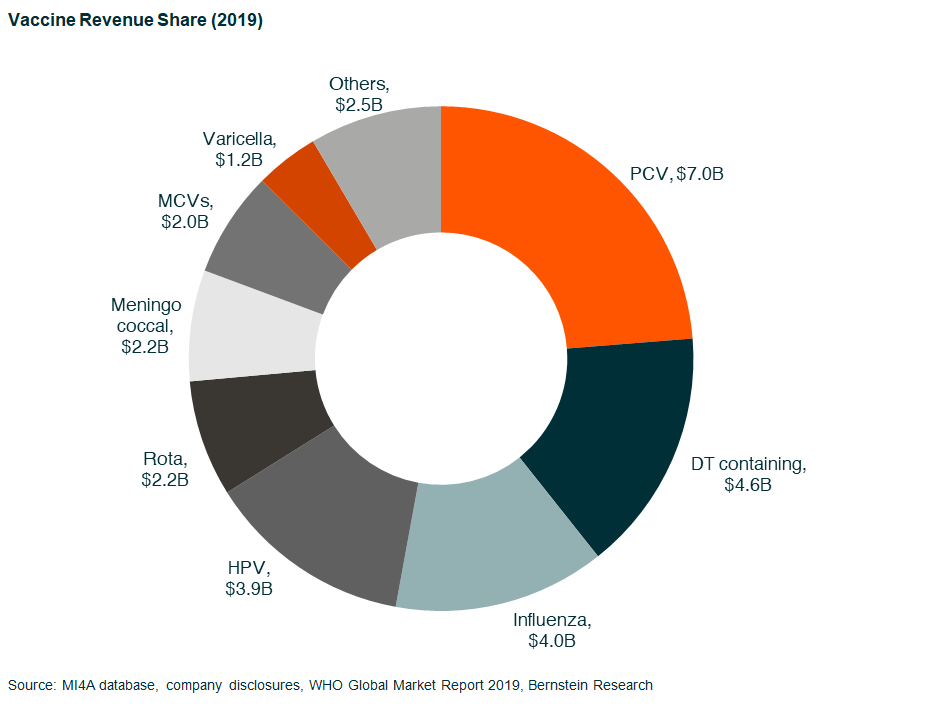

The vaccine market size is about US$35bn in 2020 (vs. around US$5bn in 2000) and has been growing at around 9% CAGR. The main growth driver has been the launch of key vaccines in the past two decades, including pentavalent DTP-HepB-Hib (2004), meningococcal ACYW (2005), pediatric pneumococcal (2000), HPV (2006), and rotavirus (2006) as well as increasing penetration.

Vaccines and its Lengthy Journey

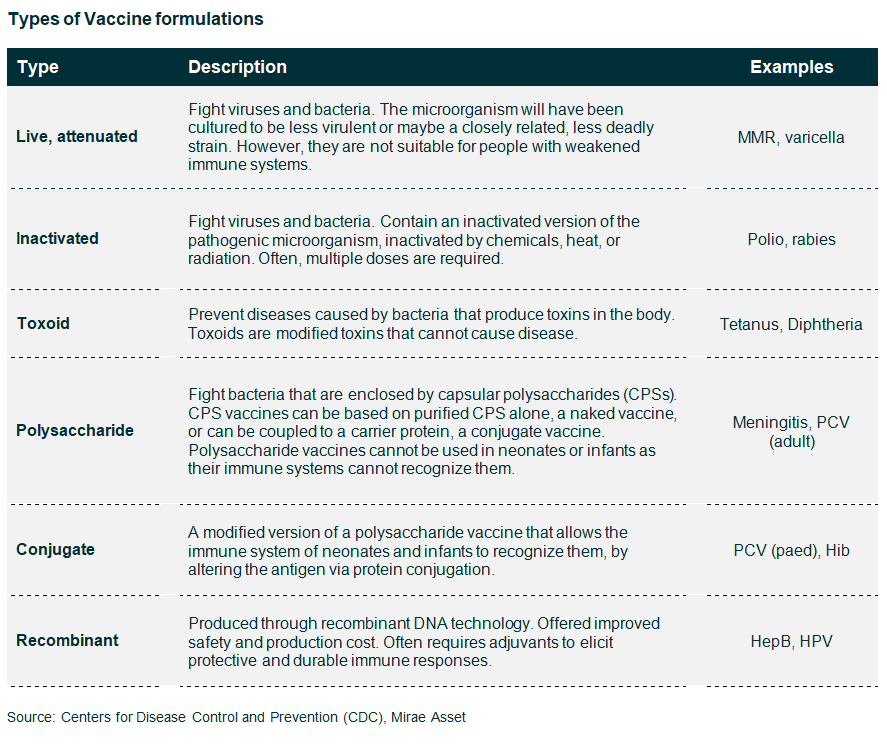

A vaccine is a biological agent that provides the recipient with immunity to a particular disease. Vaccines are made of agents based on the disease-causing microorganism (either weakened/disabled forms of the pathogen, or purified versions of its toxins/surface antigens). Vaccines stimulate the body’s primary immune response, causing antibodies to be produced.

Vaccines are complex biological products. The product is the process. They include an antigen, which is typically a large, complex molecule that is difficult to characterize as an inherently variable biological process produces it. This variability means that highly sophisticated manufacturing and testing techniques are required to produce vaccines of consistent quality. This ‘know-how’ and the associated costs create high barriers to entry for potential new players, even for non-patented vaccines.

Production of vaccines requires long lead times (8 to 36 months), with every step and variable in the process standardized, controlled, validated, and tested. Several sites may be involved in producing different vaccine components, and several hundred quality control tests are required. The requirement for highly sterile, temperature-controlled environments (standard “cold chain” is 2-8°C) adds further complexity. For example, in the US, the FDA requires new vaccine plants to operate for at least two years prior to releasing products to the market to demonstrate sterility, absence of foreign particulate matter, proper freeze-drying of vaccines for reconstitution, and consistency. This not only raises barriers to entry (because start-up costs and expertise required are high) but also increases pricing.

Oligopolistic Market

While the market for vaccines is attractive, new entrants in the global vaccine market have been limited. In our view, this is due to:

- Long lead times for development.

- Complex manufacturing. There are typically 20 to 25 site inspections per year for vaccine facilities from the Food and Drug Administration (FDA), the European Medicines Agency (EMA), the WHO, national regulatory authorities, and internal audits by quality assurance teams.

- Complex and different (vs. regular drugs) distribution channels

- Complex regulations. As an example, in the US, the FDA requires new vaccine plants to operate for at least two years prior to releasing products to the market to demonstrate sterility, absence of foreign particulate matter, and proper reconstitution and consistency following freeze-drying.

In terms of value, the top four companies contribute over 80% of the global vaccine market. And the top four diseases account for 60% of the revenues. While in terms of volume, MNCs account for ~30% of the volume because the leading companies focus more on selling newer, innovative drugs, while smaller domestic players focus older, less innovative vaccines as well as focus only on the local market.

A Promising Future for mRNA Technology

mRNA is a single-stranded molecule that carries genetic code from DNA in a cell’s nucleus to ribosomes, the cell’s protein-making machinery. mRNA medicines are simply sets of instructions that can be given to cells in the body to stimulate the production of a specific protein that can help prevent or fight disease. Various companies have developed or are trying to develop technologies and methods to create mRNA sequences that cells recognize as if they were produced in the body.

Several MNCs have already signed partnerships with companies developing mRNA technologies in vaccines. Pfizer, as an example, has partnered with BioNTech for its influenza candidate, Merck with Moderna on RSV, and Sanofi with Translate Bio. CureVac, partnering with Boehringer Ingelheim and Lilly, develops oncology products and Genmab for antibodies.

Global X China Biotech ETF, delivering access to dozens of companies with high exposure to the biotech theme in China, allows you access to the investment opportunities of the growing Chinese vaccine industry.