To Invest “Little Giant” ETFs, To Embrace the Power of Innovation

Listen

In a highly competitive market, investors need not only to look for stable growth opportunities, but also to tap into high-growth companies with huge potential and broad prospects. These companies usually have strong innovation capabilities and sustained growth performance. They are rising rapidly and finding their places in the industry. The specialized “Little Giant” companies make one good example. To effectively seize the growth opportunities of these “Little Giant” companies, more and more investors choose to access their growth potential by investing in ETFs.

Investors may wonder why specialized “Little Giant” companies have such huge growth potentials and vast room for development. Why should one invest? These questions can be answered by reviewing the following aspects.

Increased policy efforts, multi-dimensional support

As China’s economy changes its course from high-speed to high-quality development, the mode of economic development has also shifted from extensive growth to intensive growth. The focus of economic structure has shifted from growing the total volume and expanding production capacity to adjusting the existing volume, refining production and promoting new and old momentum conversion to shape the key path for economic transformation. In this process, technological innovation plays a vital role, and high-quality development of SMEs has also become an indispensable part of technological innovation. To this end, the Chinese government has provided multi-dimensional support to “Little Giant” companies including favorable policies and funds.

In April 2012, the State Council issued the “Opinions of the State Council on Further Supporting the Healthy Development of Small and Micro Enterprises”, which for the first time pointed out the direction for SMEs at state level, encouraging small and micro enterprises to follow the path of “specialization, sophistication, uniqueness and innovation” and to cooperate with large-sized companies via collaboration and on supporting products1. On January 23, 2021, China’s Ministry of Finance and the Ministry of Industry and Information Technology jointly issued the “Notice on Supporting the High-Quality Development of Specialized Small and Medium-sized Enterprises” to guide local governments to improve supporting policies and public service systems and to help the high-quality development of a total of over 1,000 national-level specialized SMEs in three batches2. In October 2022, the China National Intellectual Property Administration and the Ministry of Industry and Information Technology issued the “Several Measures on Intellectual Property to Support the Innovation and Development of Specialized Small and Medium-sized Enterprises” to help the innovative development of specialized SMEs by improving intellectual property creation, the efficient use of intellectual property, and intellectual property protection3.

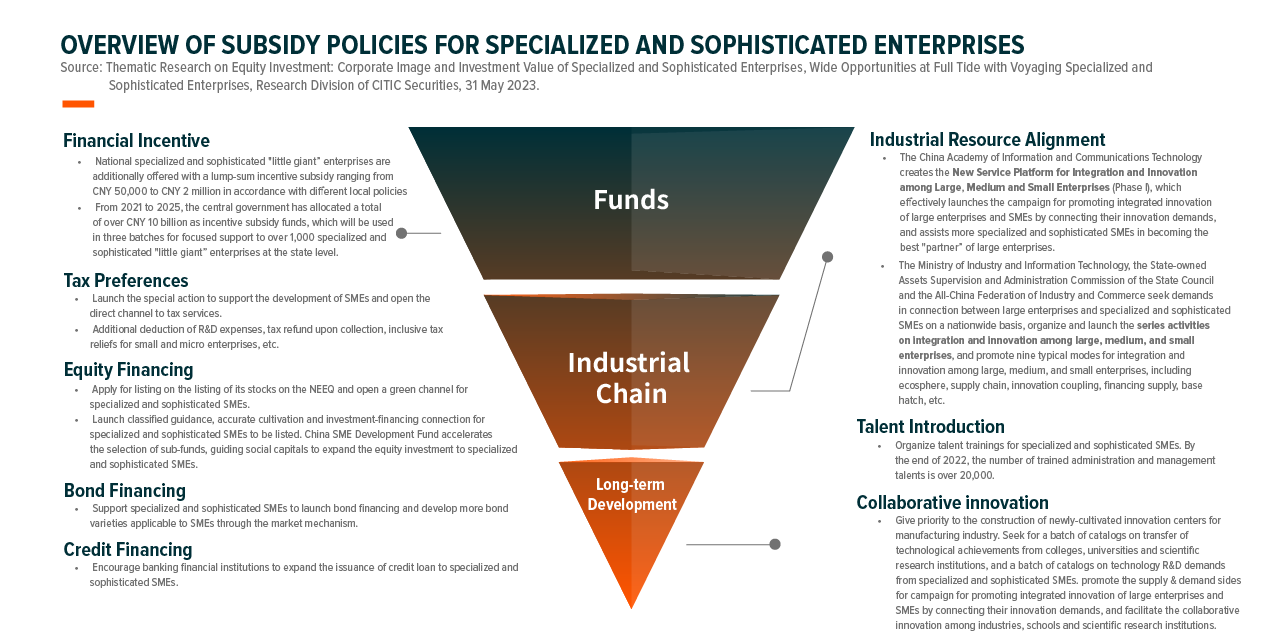

In addition to supporting “Little Giant” companies on a high level, a slew of down-to-earth favorable policies are enforced. For example, funding related policies include direct financial incentives, tax incentives, equity financing; industrial chain related policies include bridging the industrial chain resources; and supporting policies formulated from the long-term perspective, etc. The introduction of various supporting policies has laid a solid foundation for the future development of “Little Giant” companies.

Steady operation and innovation leadership

One should invest in specialized “Little Giant” companies for two reasons: strong policy support, and their stable operation and continuous innovation capabilities.

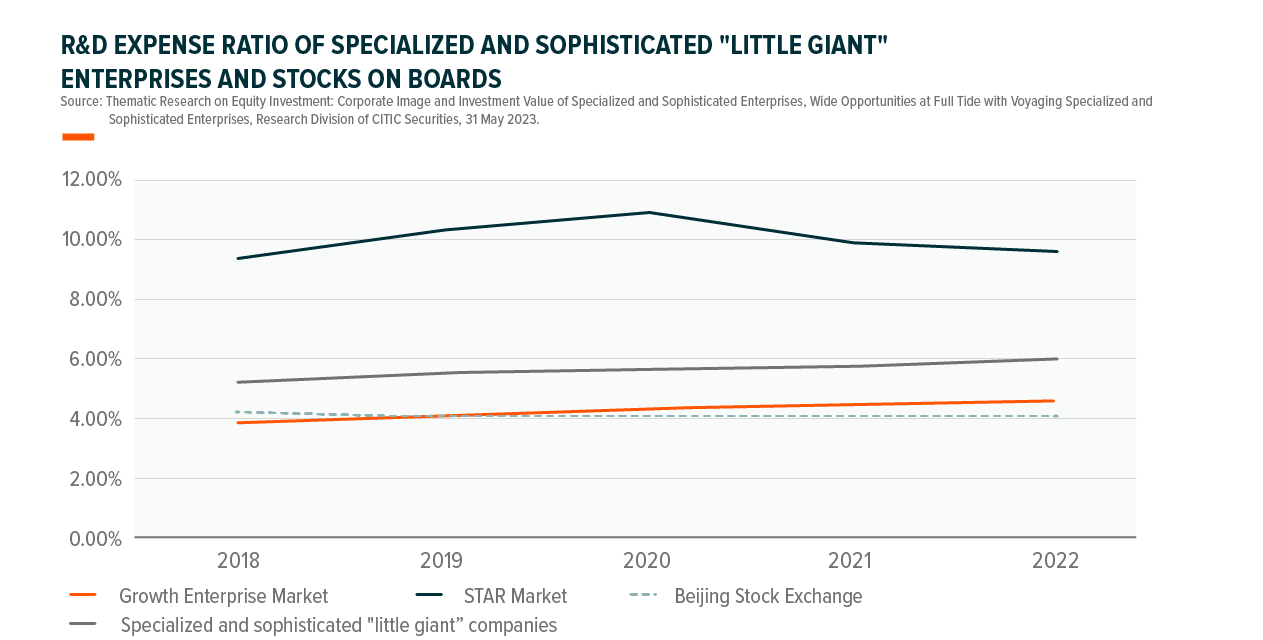

By industry distribution, over 10,000 out of the 12,000 “Little Giant” companies engage in the manufacturing business. Over 40% of the “Little Giant” companies are in the fields of new materials, new generation information technology, new energy and intelligent connected vehicles; over 60% are committed to fields related to basic industries; nearly 90% of the specialized SMEs have provided direct supporting service to at least one well-known large-sized company. Moreover, most “Little Giant” companies focus on their own segmented fields and are committed into their respective segmented market for over 16 years on average. Therefore, it has accumulated abundant innovation strengths. The R&D expense ratios of specialized “Little Giant” companies are significantly higher than those of comparable companies. In 2022, the R&D expense ratios of listed “Little Giant” companies was 6%, which was significantly higher than the 4.6% of those listed on GEM and the 4.08% of those listed on Beijing Stock Exchange4. Moreover, as a key force promoting the continuous innovation of “Little Giant” companies, the number of Chinese scientists and engineers continues to increase rapidly, and the growth rate has been rocketing since 2014, and the proportion of overseas graduates has also increased by the year. This provides a steady flow of talents to “Little Giant” companies in need for innovation.

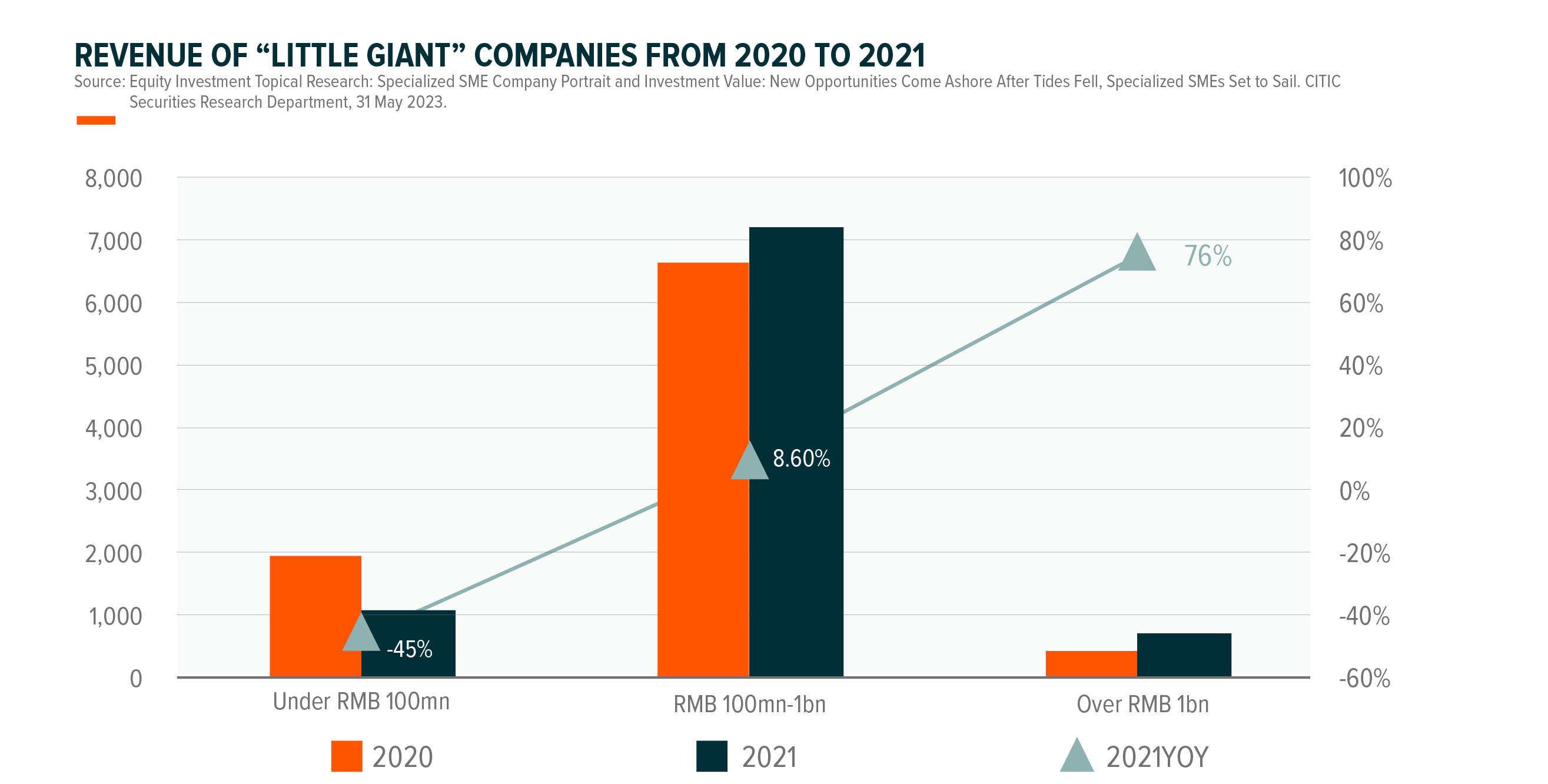

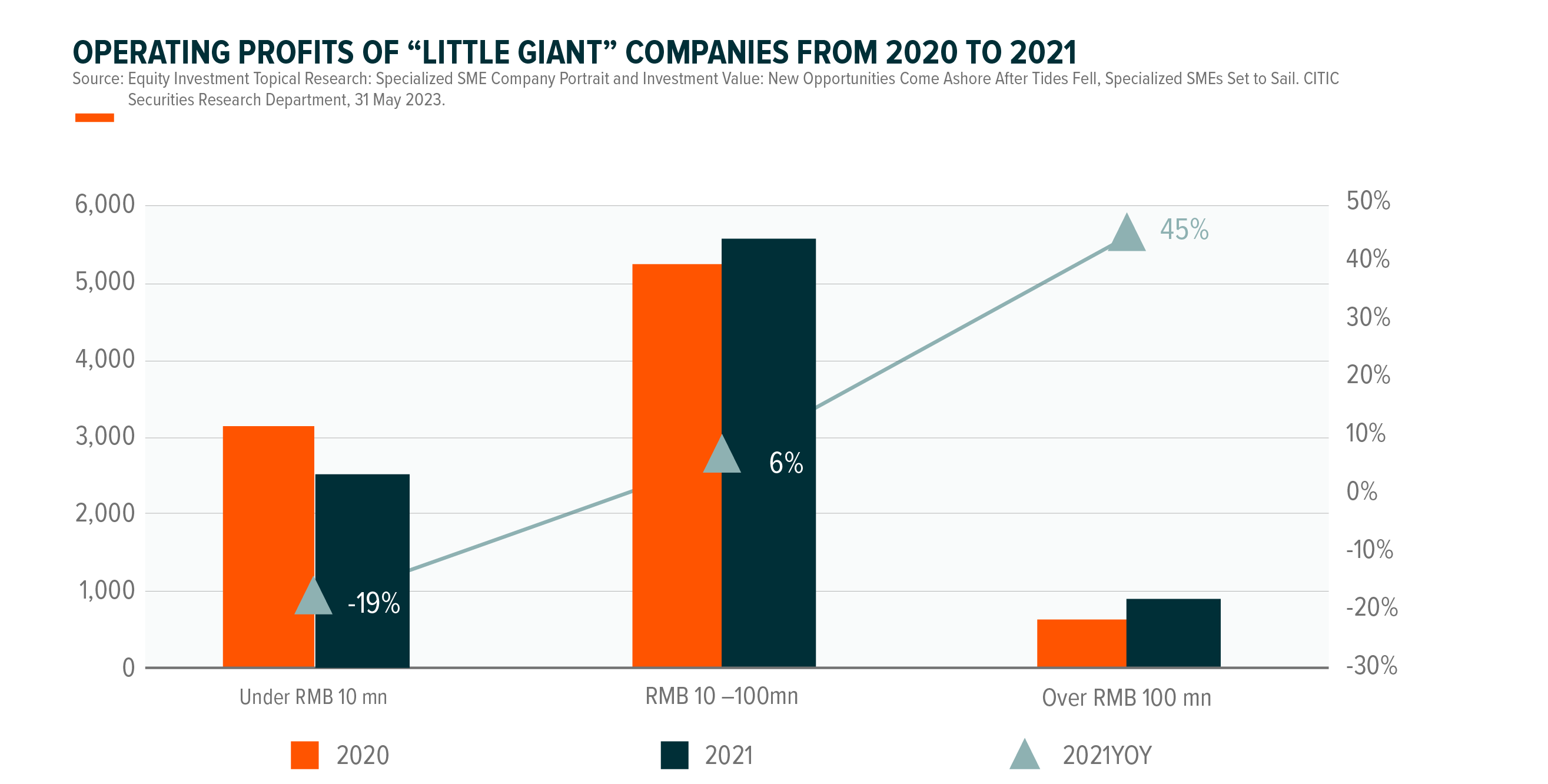

The continuous investment in R&D has created thick profits for “Little Giant” companies and also delivered satisfactory performance to the market. In 2021, “Little Giant” companies achieved annual revenue of RMB 3.7 trillion, with 30% yoy growth, annual profits of over RMB 380 billion, and operating profit margins of more than 10%5.

Institutional investors’ attention and inflow of funds

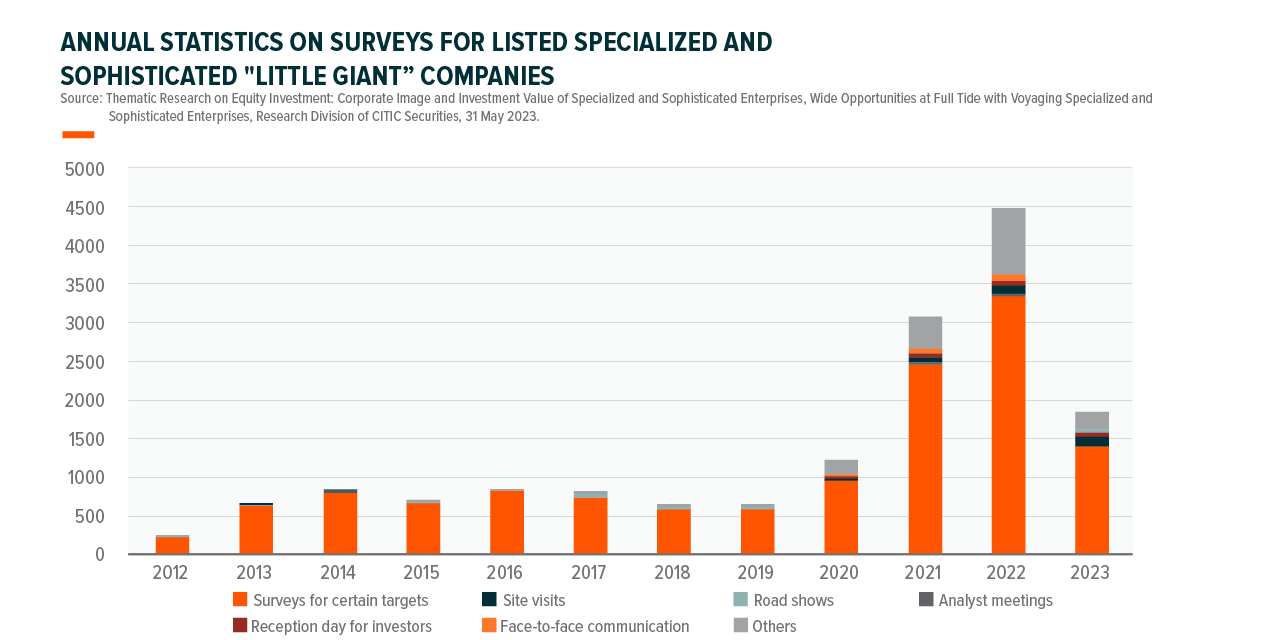

The booming of “Little Giant” companies in recent years have drawn the attention of more institutional investors into this blue ocean of investment. In 2022, 4,535 new institutional investors conducted research on “Little Giant” companies, with 46% yoy growth. Since 2023, institutional investor research mainly focused on themes such as robotics and high-precision medical equipment6.

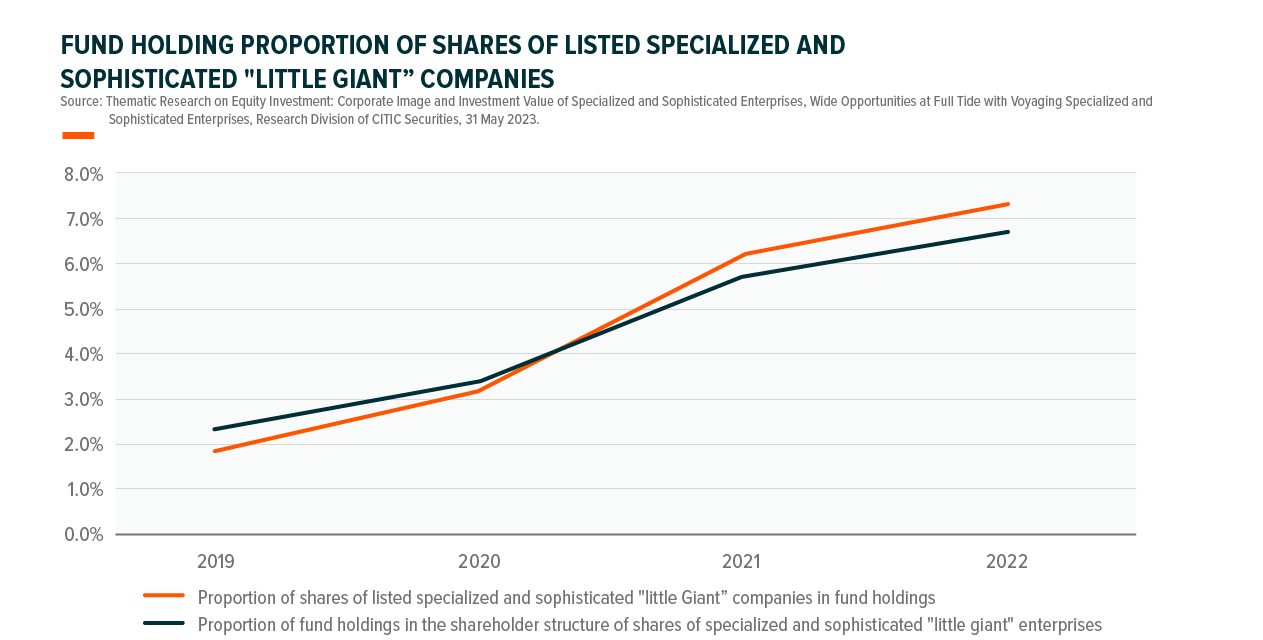

Institutional investors’ attention brought inflows of funds. The holdings of specialized “Little Giant” stocks by mutual funds has increased significantly from 1.9% in 2019 to 7.4% in 2022; the shareholding ratios of mutual funds in specialized companies has also grown, and institutional investors’ recognition of specialized company stocks has increased significantly7.

Why choose ETFs to access “Little Giant” companies

In the past, “Little Giant” companies were often regarded as a high-risk and high-return investment due to their high volatility and liquidity. However, as ETFs coming into the picture, investors can access the growth of these companies with lower risks, and benefit from their growth. There are many advantages to access “Little Giant” companies via ETF.

First, the ETF investment research team has richer professional knowledge and experiences than individuals. By investing in ETFs and allowing a professional investment research team to help with stock selection and management, investors can not only save a lot of time, but also have better chances in higher returns.

Second, the holdings of ETF are diversified. ETFs invest in a number of “Little Giant” companies by tracking indexes. Such method of investment allows investors to benefit from a variety of companies with one portfolio, thereby diversifying risks and reducing the impacts from specific companies. Compared with direct investment in “Little Giant” companies, ETFs have lower risks and higher liquidity, allowing investors to have a better grip on investment opportunities.

Finally, ETFs also offer flexibility. Compared with ordinary equity funds, ETFs can be purchased on a per-unit basis, or traded in the secondary market like common stocks, making them more liquid. Investors can buy and sell ETF units at any time and flexibly adjust their investment portfolio.

The above advantages combined make ETFs the best choice for investing in specialized “Little Giant” companies.

Conclusion

Many “Little Giant” companies are active in emerging fields and technological innovations. These areas often have exceptional growth potential and contain the ability to shape an industry. Therefore, investing in “Little Giant” companies via ETFs not only help you grasp the potential returns in the future, but also embracing the power of innovation!