The Latest on COVID in China

Listen

Swift Change From Zero-COVID Policy

In this article, we access recent updates on COVID infection in China, recent evidence on caseload, bordering opening timelines as well as our expectations on the path to economic normalization.

Key Takeaways

- We believe China can open up earlier than what the market expects. It is possible that the economy can achieve the path to normalization from February 2023 onwards, much ahead of expectations of the middle of 2023.

- Early evidence suggests that COVID-19 cases in larger cities have peaked. Rural areas might peak around Lunar New Year, in our view.

- While we don’t have fatality data, given the shorter recovery period as well as milder than before symptoms for newer Omicron variants, we believe actually fatality could be lower than before.

Pivot Away From Zero COVID Policy – May Have Led to a Huge Increase in COVID Cases in December 2022

China pivoted from its stringent zero-COVID policy in early December 2022, with easing controls on lockdowns and frequent mass testing. In addition, COVID-19 infection is now downgraded to Class B infectious disease. December saw a very high case count load. Scrapping lockdowns as well as mass testing while cases still going up would have led to a huge increase in COVID cases in December, in our view. With local governments no longer conducting mass testing, according to Bloomberg news – there might be 37 million infections in one day (20 December 2022), and as many as 248 million people, or 18% of the population likely contracted COVID in the first 20 days of December. (Source: Bloomberg News, as of 23 December 2022).

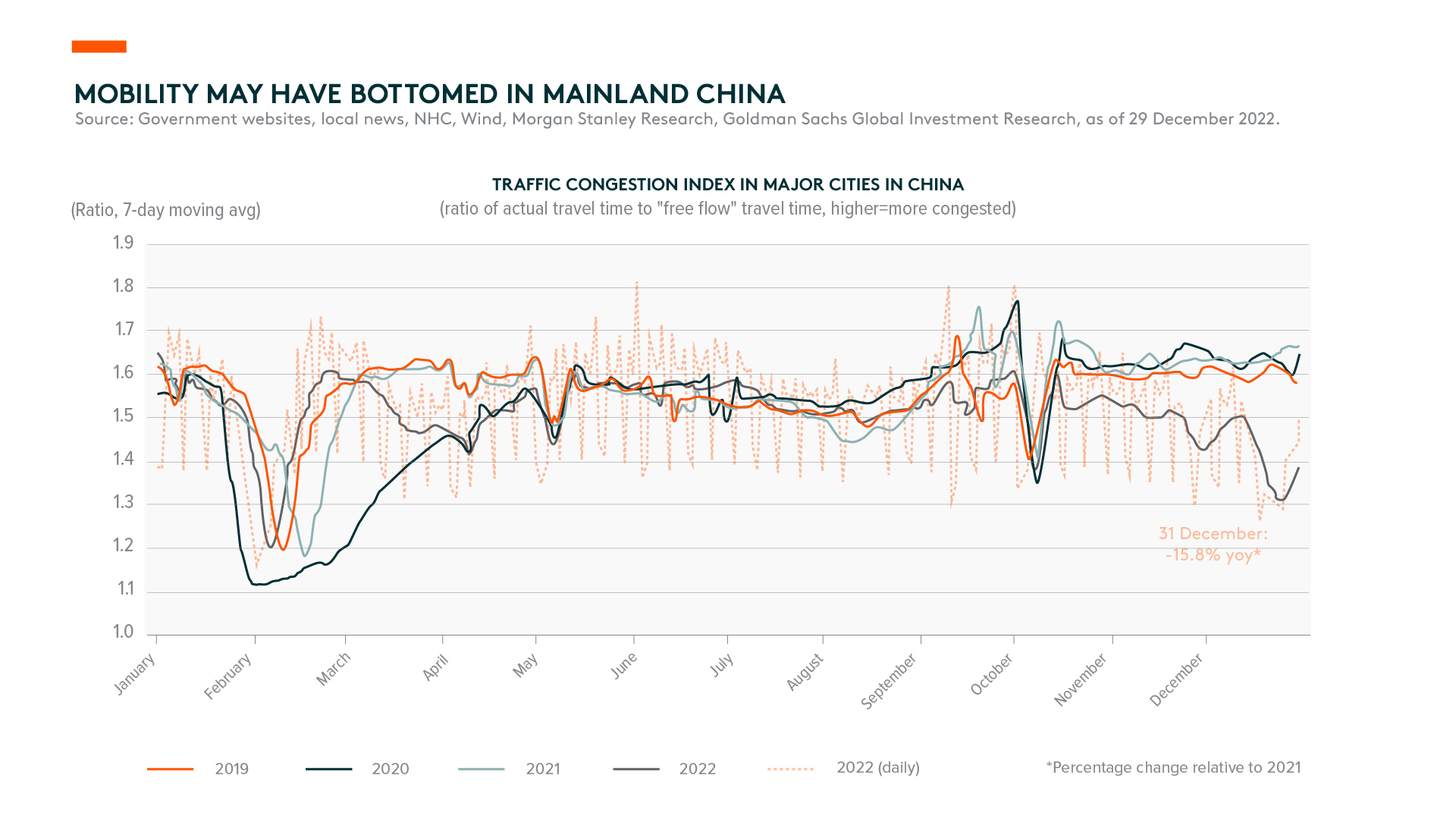

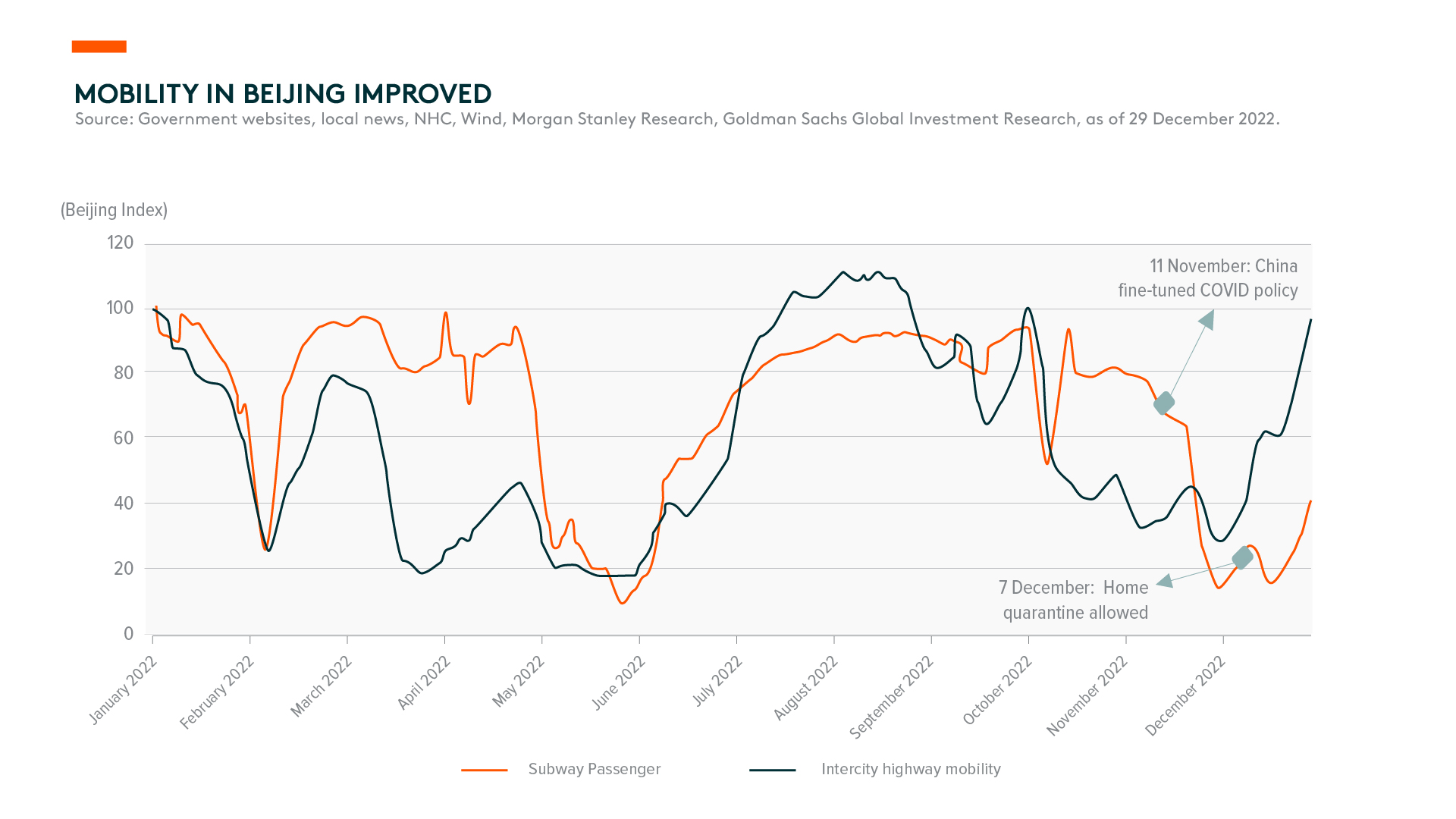

When will COVID peak – While the jury is still out, we try and evaluate this from early evidence. Government official commentary so far suggests that larger cities have peaked. As an example, according to Wu Zunyou, an epidemiologist with the Chinese Centre for Disease Control and Prevention, COVID-19 cases in Beijing, Tianjin, Hebei province, Chengdu and Chongqing were estimated to have passed their peak. Similarly, according to The Guangzhou Health Commission – the number of patients visiting fever clinics had started to decrease from December 23, going down from 60,000 a day at the height of the wave to 19,000. Rural cases might not have peaked yet. While the peak in rural areas might have not reached yet. The lunar New Year travel rush might bring forward the same. Mobility data (as of 27 December 2022) at the National level is improving at the margin. We are seeing a rebound of mobility in areas like Beijing, Guangdong, and Chongqing. Shanghai mobility was still subdued until 26 December 2022.

Medical Capacity Ramping Up Rapidly: As of 25 December 2022, the total ICU bed count in China was 185,000, per NHC (vs. 138,000 as of 9 December 2022). Overall on a countryside basis, the ICU occupation rate has been hovering at around only 50% and the bed occupation rate in Class II and above hospitals was ~60%, although medical resources of some provinces hit hardest by COVID are still nearing capacity. Key unknowns and risks include 1) how often the reinfection occurs, 2) how severe they are compared with initial infections and 3) what their long-term health effects are. In a study led by Peking University, researchers examined 6.6 million cases from around the world and found the average reinfection rate of all pre-Omicron variants was around 2 percent.

Border Opening Up from 8 January – this will be the last hurdle for full reopening since COVID controls were first relaxed in mid-November. With COVID being downgraded to a “Class B” infectious disease, inbound travelers will only need to present a negative pre-departure COVID test, with neither tests nor quarantine on arrival. Issuance of visas for foreigners and business/tourism travel permits to Hong Kong will also resume, while international flights and outbound tourism will be gradually revived.

Mobility Data

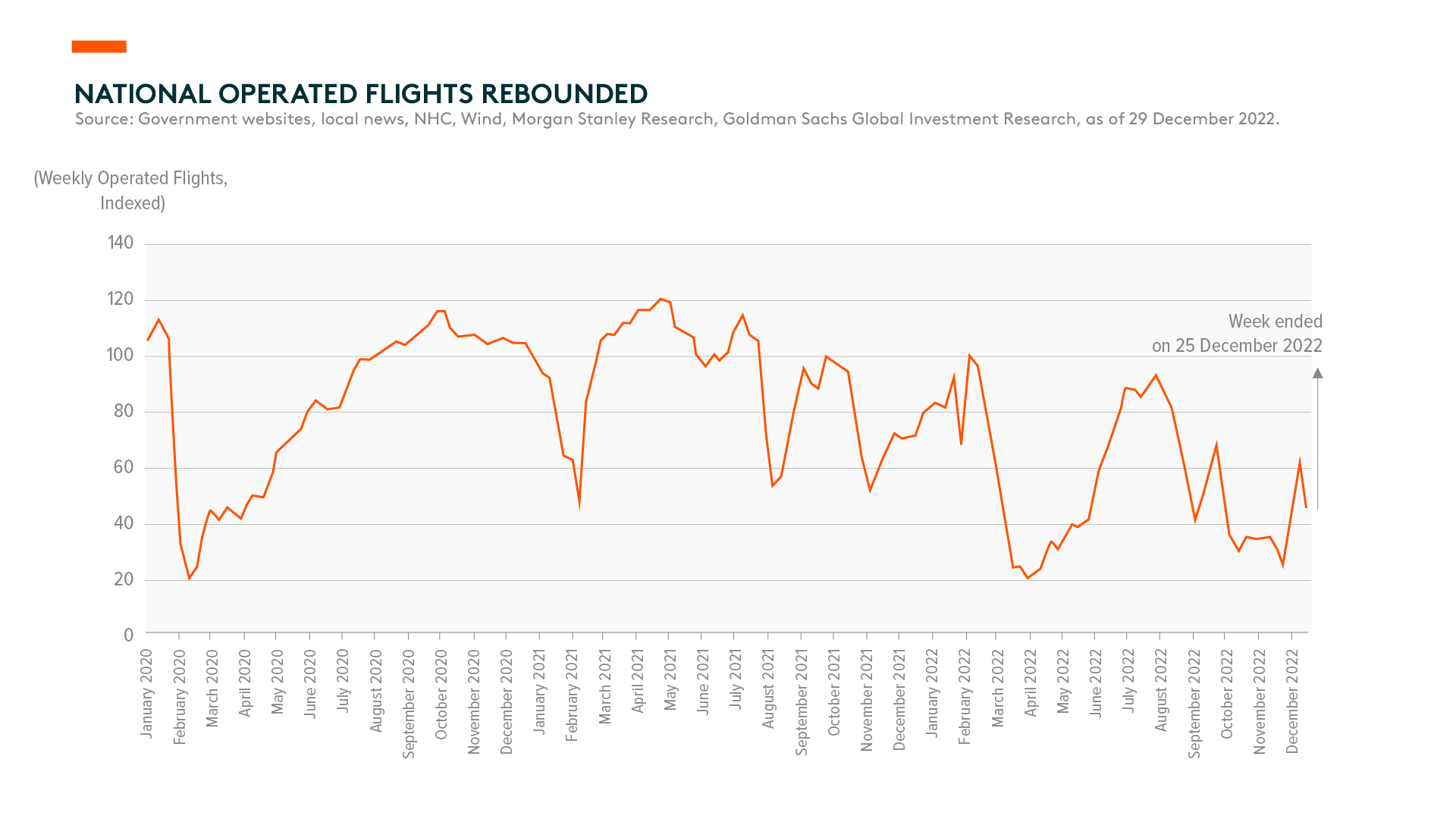

How Would this Impact Consumption – For cities that are estimated to have passed COVID infection peak, we see consumption recovery across different categories. For example, table turn of restaurants in tier 1 cities started to rebound quickly driven by pent-up dine-out demands by those who have recovered from COVID infections. Apparel and discretionary category sales remained subdued potentially more a result of low consumption confidence amid a weak macro situation. Travel-related spending also experienced encouraging signs of improvement. According to Tongcheng e-Long, overall domestic flight booking increased by 2% compared to the same period in 2020 (pre-COVID), and hotel booking +32% compared to the same period in 2020. Domestic duty-free consumption recovered sequentially. The average hotel occupancy rate in Sanya reached 76.2% on 1-Jan with some popular high-end hotels seeing nearly full occupancy, according to Citi Research. We expect strong consumption rebounds for the upcoming Chinese New Year holiday as the majority of the large cities in China have passed the COVID infection peak and mobility resumes.

Market Impact: The drop of “Zero COVID” since December has clearly signaled that the government will prioritize economic recovery over other agenda. Drop of “Zero COVID” policy is the single most effective policy stimulus to China’s economy. The shorter the disruption impact, the bigger the stimulus effect we will see on GDP this year. Considering the current infection rate, we could see most regions’ cases peak off after Chinese New Year (while it is even earlier for high-tier cities which have more impact on GDP). This will have a much milder impact on overall economic activities as it’s a low season for most manufacturing/economic activities during the festive period.