The Rise of China AI Computer Vision Industry

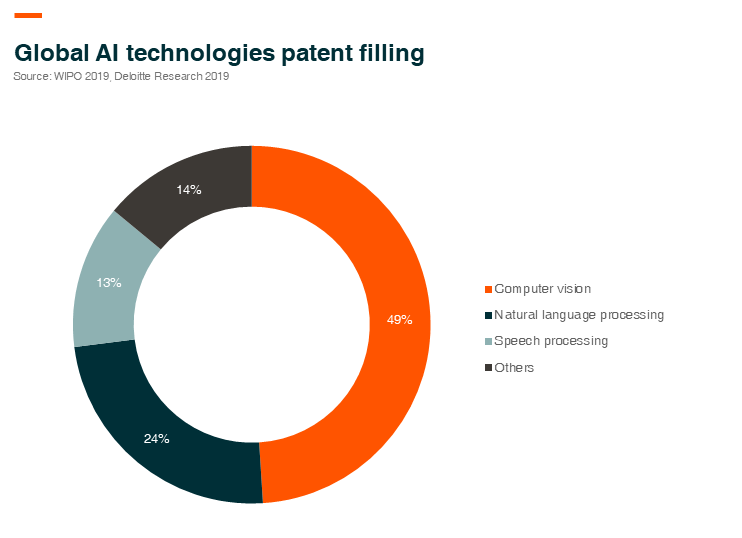

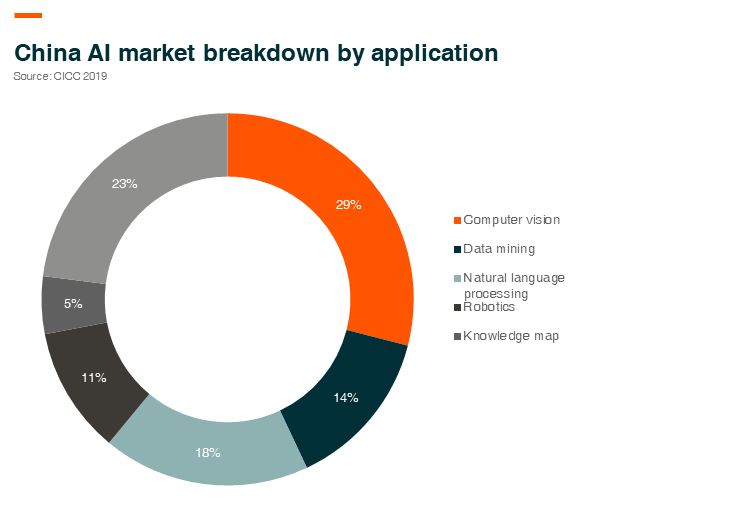

Computer vision is the largest Artificial Intelligence (AI) sub-segment globally in terms of patents filed and thus a key driver of China’s AI industry. Advancement in computing power both at the edge and on the cloud allows rapid improvement in the deployment of computer vision models. China has the second-largest AI industry globally, with a market size estimated to be over RMB100 billion in 2019, according to Deloitte. In this article, we will explore China’s AI computer vision industry by explaining what computer vision is as well as the ample application opportunities it has.

Understanding Computer Vision

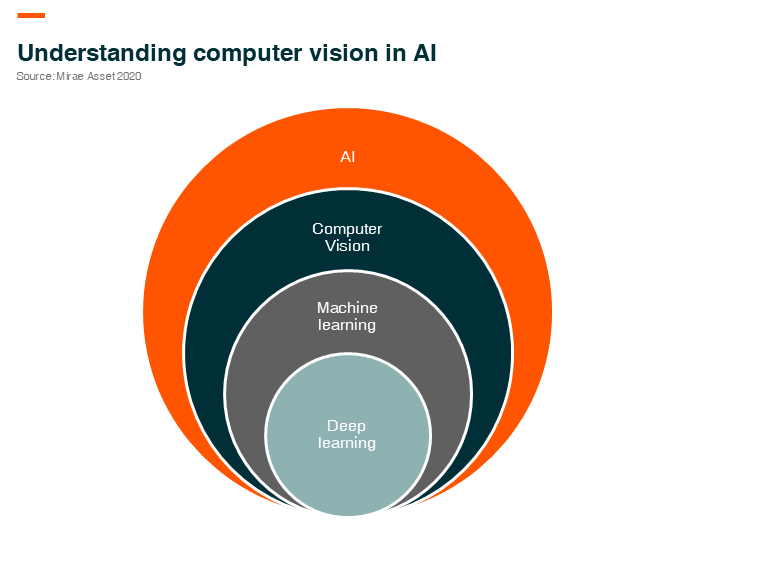

Computer vision is a field under AI, and its earliest development started with research in US colleges in the late 1960s. Fundamentally it works on the recovery of the three-dimensional structure of the world from images and uses this towards full scene understanding. Machine learning is one of the techniques used to develop algorithms for computer vision, and it is also widely used to construct models in other AI applications such as natural language processing.

Ample Application Opportunities for Computer Vision

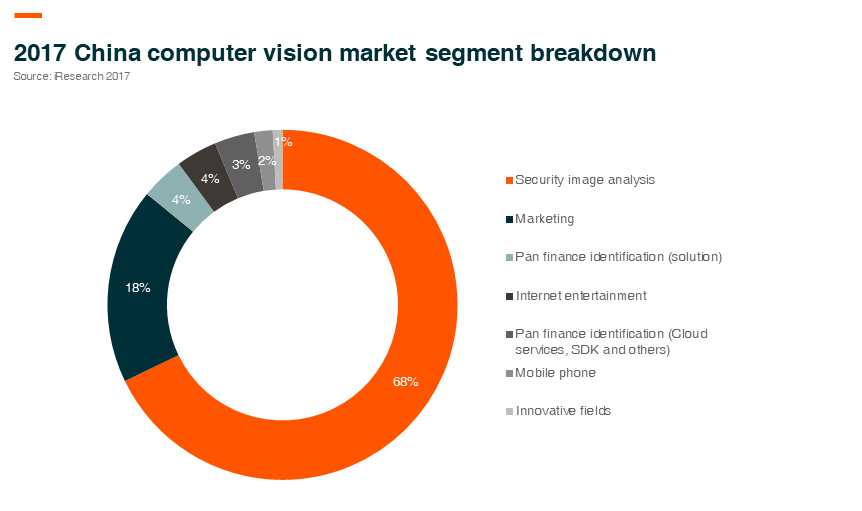

Surveillance is the earliest adopter of computer vision, as firms have been focusing on providing integrated hardware and software surveillance solutions to local governments in the past few years. Computer vision accounted for about 68% of the total vision industry in China in 2017. There are plenty of opportunities for computer vision technologies to penetrate multiple industries in China. Companies are exploring applications in areas such as healthcare, autonomous driving, and smart retails. We will take a closer look at some key areas to apply computer vision below.

Surveillance – Computer Vision to Drive More Application Scenarios

In surveillance, we have end-to-end solution providers such as Hikvision, Dahua, and Huawei, which supply everything from front to back end hardware and software. Several startups focus on the development of vision algorithms such as SenseTime, Megvii (Face++), and YITU. Tech giants, such as Alibaba, focuses more on back-end software services to support the entire architecture. Companies are able to add new functionalities to surveillance as both hardware (AI chips, edge computing) and software (algorithms, architecture) continue to improve rapidly. This will unlock a new world of more intelligent surveillance in property management, smart city, and smart home.

Mobile Internet – AI enabling Multiple Functions behind Smartphones

Computer vision technology enables key functions on smartphones, such as improving the image quality of smartphone cameras, facial recognition for payment and phone security, AR applications, and space recognition. Startups like SenseTime and Megvii license their algorithms to smartphone manufacturers and application developers. Tech giants like Huawei and Bytedance also develop in-house algorithms for various smartphone vision applications.

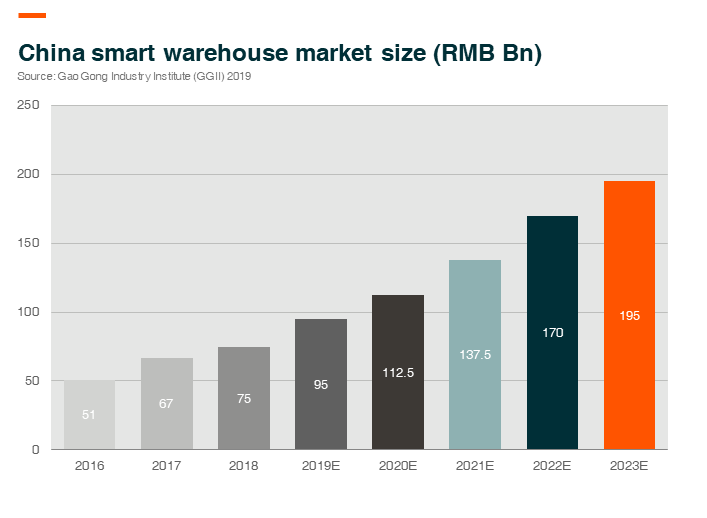

Logistics – Start from Smart Warehouse

The smart warehouse is an entry point for the industry as computer vision technology is relatively more mature to build a complete solution. The ultimate goal is full autonomy in logistics which depends on progress in autonomous driving. Gao Gong Industry Institute (GGII) estimates China’ smart warehouse industry to be a RMB195 Bn market by 2023. The next generation smart warehouse can leverage on computer vision technology in multiple areas:

- Automated guided vehicles (AGV) are used to maneuver items in the warehouse, and startups like Geek+ and Quicktron have launched competitive solutions.

- Dimensioning weighting scanning (DWS) system is used to sort parcels by collecting a range of data points through cameras and sensors. Companies like Hikvision and Megvii have this as part of their integrated solutions.

- Intelligent surveillance cameras can be used to monitor real-time resource allocation and detect security breaches.

Chinese companies have established a solid ecosystem around computer vision in surveillance. We think computer vision technologies will be applied in more areas such as healthcare, autonomous driving, and smart retail, etc. We believe it is still early days for commercialization and monetization of the technology and remain confident about the outlook of the industry.

Global X China Robotics and AI Brand ETF (2807 HKD / 9807 USD), seeks to deliver the performance of the FactSet China Robotics and artificial Intelligence Index, enabling investors to access to high growth potential through companies critical to the development of robotics and artificial intelligence in China.

Other Key Features of Global X China Robotics and AI ETF:

- Unconstrained Approach: The fund’s composition transcends classic sector and industry classifications by tracking an emerging theme.

- ETF Efficiency: In a single trade, the fund delivers access to dozens of companies with high exposure to the robotics and artificial intelligence theme in China.

Please click here for more information on the Global X China Robotics and AI ETF.