Important Information

Investors should not base investment decisions on this website/material/video alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Little Giant ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies which may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies which are characterised by relatively higher volatility in price performance. The Sub-Fund may be exposed to risks associated with different sectors and themes including semiconductor, industrial, pharmaceutical, energy and technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Sub-Fund. Some of the companies classified as the Little Giants have a relatively short operating history. Such companies also face intense competition and rapid changes could render the products and services offered by these companies obsolete, which may have an adverse effect on profit margins. They may be more susceptible to risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences affecting those companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility. Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

Riding on High-quality “Little Giants”

China Little Giant ETF (2815 HK) presents investors with a unique opportunity to gain exposure to promising SMEs operating in strategic sectors, such as semiconductors, advanced manufacturing, pharmaceuticals, and clean energy. These specialized and sophisticated SMEs play a crucial role in China’s transition to high quality development. Moreover, under Trump’s reelection and resurgence of trade tensions, 2815 is likely to enjoy tailwinds from policy stimulus as top leadership emphasizes its commitment to achieving self-sufficiency. As a high quality, small-cap fund, 2815 is likely to benefit more than large-cap funds if the economy turns to strong recovery in 2025. In this article, we will provide an in-depth overview of the key holdings of 2815 HK.

IMEIK (300896 CH)

Imeik is a leading medical beauty product player in China, with a marketed portfolio of 8 proprietary-developed products registered as Class III medical device by the National Medical Products Administration (NMPA), including 5 hyaluronic acid (HA)-based dermal fillers (Hearty, I Fresh, Bonita, EME, and EME Plus), 1 PPDO facial implant thread, 2 PLLA-based dermal filler (CureWhite and Rusheng). As the largest provider of HA-based dermal fillers in China, Imeik benefits from the early registration of its innovative offerings.

Imeik has a strong pipeline of new products in development that could help the company sustain healthy growth with high margins while mitigating risks associated with reliance on a single product. Imeik has also demonstrated its ability to successfully commercialize medical aesthetics innovations. Bonita’s chin injection indication received approval in October 2024 and is set to launch in 1Q25. Additionally, the Phase III clinical trial application for Semaglutide Injection was approved by the NMPA in September 2024. According to the company, approvals for Minoxidil and Botulinum toxin are likely to occur in 2025. We also expect that stimulus from China government will support a gradual recovery in demand for high-end products going forward.

Suzhou TFC (300394 CH)

Established in 2005, TFC is an industry-leading optical component solution provider. Its products are widely used in telecom and datacom applications, and in recent year, the company has expanded its business into LiDAR market. The company’s core products include passive optical components, such as AWG, plastic lenses, fiber array products, as well as active optical components like optical engines. Over the past two decades, TFC has accumulated a number of core process technologies, becoming a one-stop solution provider for global optical communications customers. Initially focusing on niche items such as fiber adapters and optical receptacles, the company has successfully maintained its competitiveness in these high-margin segments.

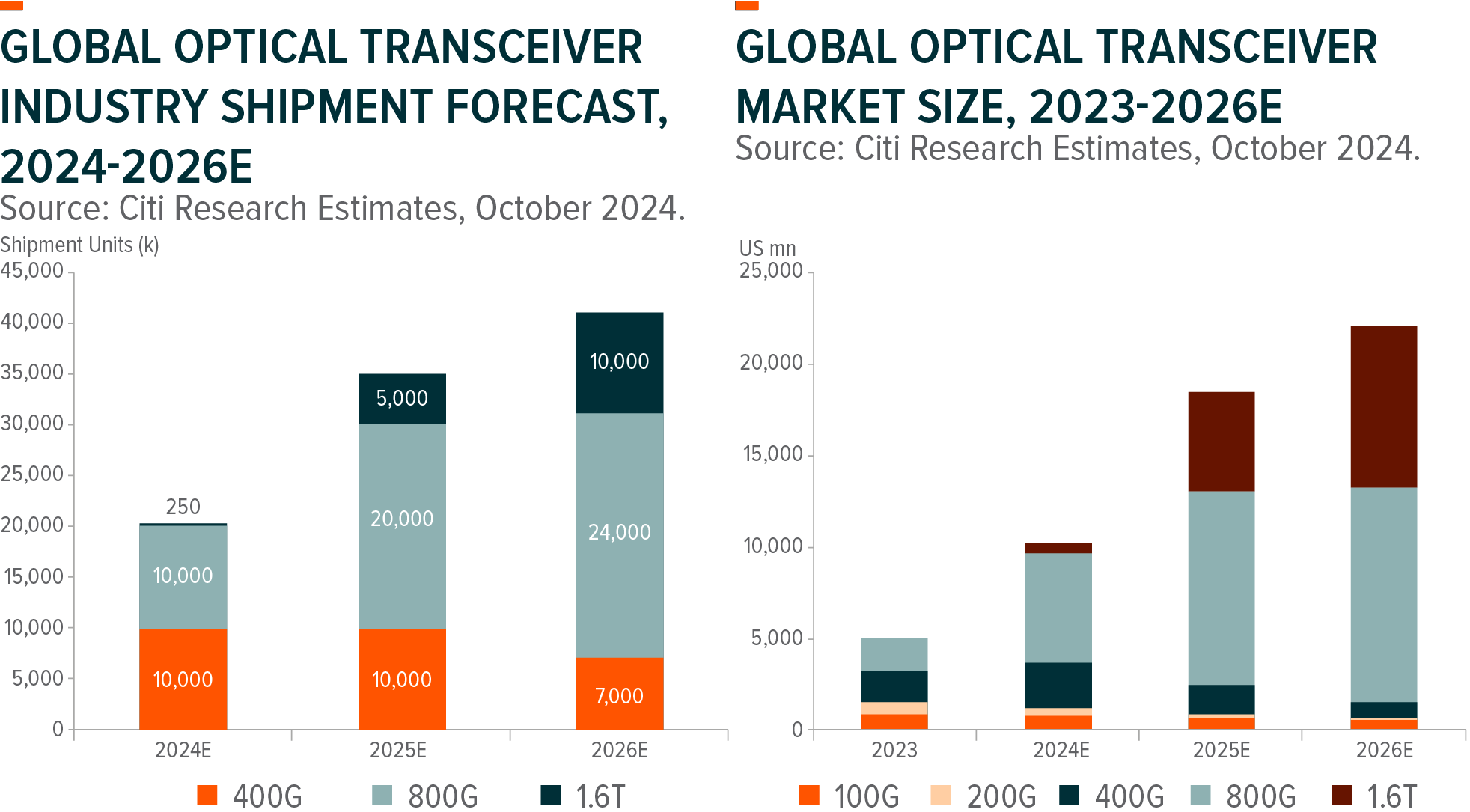

TFC is uniquely positioned within the global AI networking supply chain, supplying high-end optical engines (800G/1.6T) to Fabrinet, which manufactures NVIDIA Mellanox’s in-house designed optical transceivers. Additionally, TFC is expected to benefit from technology advancements in co-packaged optics (CPO), which have higher entry barriers. The company’s core products, such as fiber array units (FAUs), are expected to maintain strong demand and enjoy substantial entry barriers within the CPO value chain.

Shanghai Bochu (688188 CH)

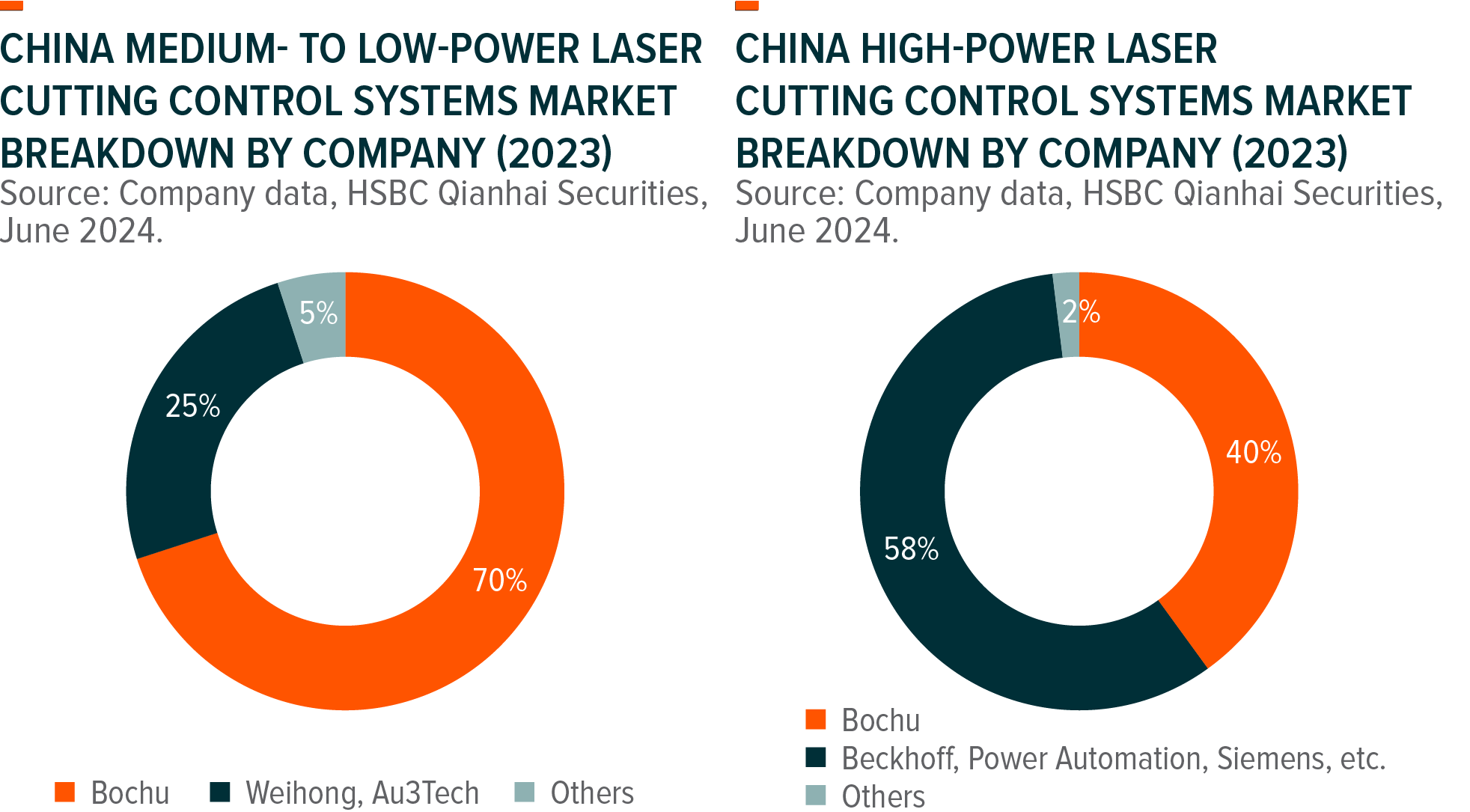

Shanghai Bochu is a leader in laser motion control, holding the largest market share among Chinese players in laser cutting control systems. Bochu commands over 70% of the market in the low- to mid-power range and is increasingly replacing foreign brands in the high-power segment, where it accounts for approximately 40% of the market share.

We expect the increasing adoption of high-power laser cutting technologies within the domestic market to continuously drive the demand for high-power control systems. Furthermore, with domestic manufacturers offering comprehensive solutions at competitive prices—ranging from 30-70% lower than those of overseas products—we expect that domestic control systems will steadily capture market share from foreign competitors. As the leading supplier of high-power laser cutting control systems in China, Bochu is poised to be a significant beneficiary of these trends.

In addition to laser cutting systems, Bochu began manufacturing laser cutting heads and offering bundled sales with its software in 2018. This vertical expansion has further solidified Bochu’s leading position in the laser supply chain. In 2021, the company capitalized on the growing demand for welding robots by expanding into welding control software, creating a significant revenue driver for the mid-term and helping to mitigate the cyclical nature of the laser industry.

The complexity and diversity of technologies involved in laser cutting control systems present substantial barriers to entry, allowing manufacturers in this space to enjoy higher gross margins. For instance, Bochu achieved an average GPM of 81% from 2018 to 2023, well above the margins of approximate 33% seen by leading laser equipment manufacturers and laser source suppliers.1 Given these high entry barriers and Bochu’s prominent market position, Bochu has consistently maintained its margin level and stable product prices despite the price competition that has affected the broader laser supply chain in recent years. This advantage, combined with robust R&D capabilities, expertise in software development, and seamless hardware integration, has enabled Bochu to maintain a solid foothold in the market.

| Global X China Little Giant ETF (2815 HKD) |

|

|---|---|

| Inception Date | 17 Nov 2023 |

| Reference Index | Solactive China Little Giant Index |

| Primary Exchange | Hong Kong Stock Exchange |

| Total Expense Ratio | 0.68% p.a. |

| Product page | Link |

Source: Mirae Asset; Data as of November 2024.