Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Read on China New Consumer Policies

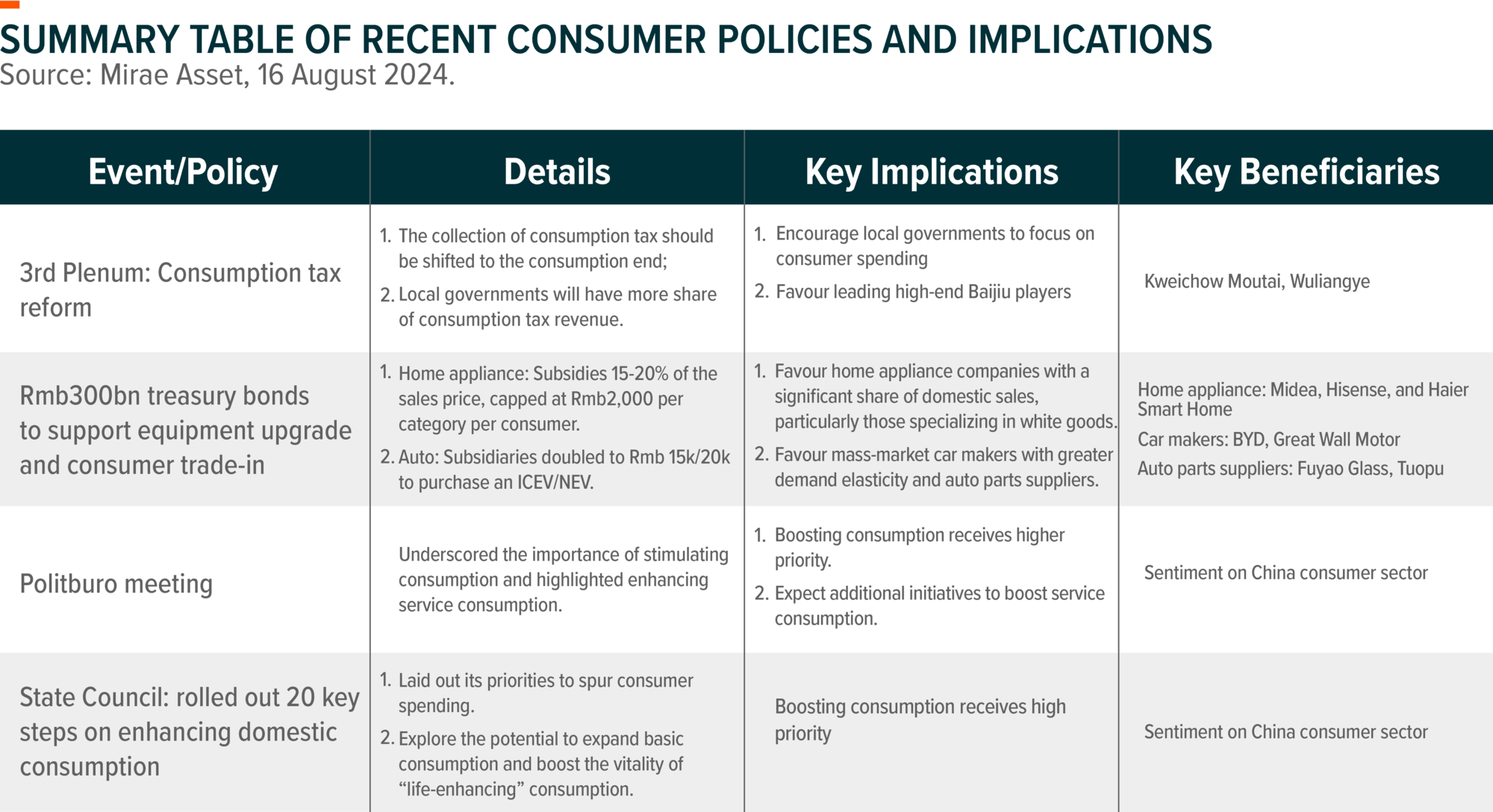

China consumer has recently received a series of policy stimuli. In July, 3rd Plenum mentioned consumption tax reform, while boosting consumption receives higher priority in Politburo meeting1. Additionally, NDRC and MoF allocated Rmb300bn long-term special bonds to support consumer trade-in and equipment upgrade2. In August, State Council rolled out 20 key steps on enhancing domestic consumption3. In this article, we will outline recent key policies and analyze their impact.

1.Consumption Tax Reform: Possible Impact on Baijiu Players

Details

Document from Third Plenum mentioned that: 1) the collection of consumption tax should be shifted towards the consumption end instead of current collection at the production firm level. 2) Local governments will get a growing share of the consumption tax revenue, comparing with the current practice that 100% of consumption tax goes to the central government.

Implications

Overall, this adjustment could encourage local governments to focus on consumer spending rather than prioritizing boosting production.

Sector-wise, we believe this tax reform could favour leading high-end Baijiu players. These top-tier players are likely to sustain stable ex-factory price and transfer incremental tax burden to maintain profit margins thanks to 1) low consumer price sensitivity, 2) strong bargaining power along the supply chain, 3) local governments’ heavy reliance on their tax revenue. Meanwhile the shift may lead to increased market consolidation, as low-end Baijiu companies may be compelled to lower ex-factory price to maintain retail price stability due to higher consumer price sensitivity and weaker bargaining power, leading to profitability erosion. More details are expected to come out likely later in 2H or next year.

Key Beneficiaries

High-end Baijiu players like Kweichow Moutai and Wuliangye are expected to benefit.

China Consumer Brand ETF (2806 HKD) provides investors with the opportunity to capitalize on the policy trend, with Wuliangye and Kweichow Moutai being the primary and secondary largest holdings within the fund.

2.Rmb300bn Treasury Bonds to Support Equipment Upgrade & Consumer Trade-in

Details

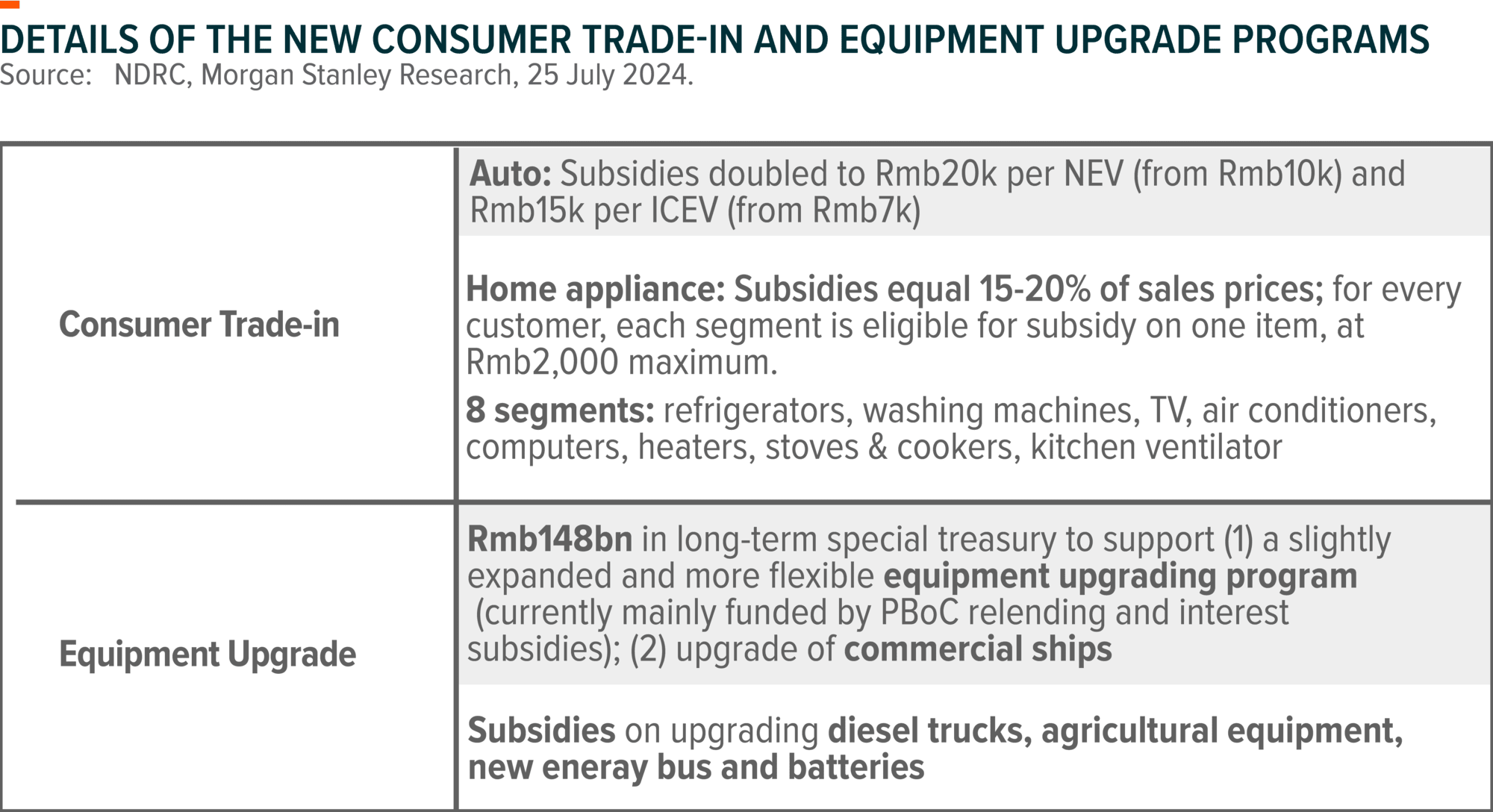

On 25 July, the NDRC specified arrangements for Rmb300bn in ultra-long-term special treasury bonds to support equipment replacement and trade-ins for consumer goods like autos and home appliances. Details are shown in table below.

Implications

Compared to previous policies, this measure is expected to deliver more significant impact as: 1) The scale and scope of this initiative have exceeded market expectations, in contrast to the previous plan which lacked a specified fund amount, resulting in restrained market anticipations. 2) Increased central government support. For previous subsidy program of passenger vehicles, the allocation to finance the subsidies between central/local governments was 6:44, while it increased to 9:1 this time5. This is also higher than nationwide home appliance “To the Countryside” program from 2008 to 2012, which primarily relied on 80% funding from the central government’s fiscal support6. This heightened contribution from the central government is poised to ignite greater enthusiasm among local authorities.

- Home Appliance: Expect Meaningful Sales Up sideThe subsidies are easily accessible as there is no requirement to replace existing appliances, and they are also substantial, amounting to 15-20% of the product’s retail price. Assuming a subsidy allocation of Rmb15bn for home appliances, this initiative has the potential to stimulate a significant retail demand of around Rmb100bn.Key Beneficiaries

We expect that home appliance companies with a significant share of domestic sales, particularly those specializing in white goods, will be the primary beneficiaries of the trade-in policy. Key name includes Midea, Hisense, and Haier Smart Home.China Consumer Brand ETF (2806 HKD) provides investors with the opportunity to benefit from this stimulus, with home appliance (incl. Midea, Hisense, and Haier Smart Home) ranking as the second largest subsector within the fund.

- Autos: The Subsidy Amount for Passenger Vehicles DoublingThe upgraded auto trade-in stimulus reaffirms the government’s commitment to bolstering auto demand. We expect that the doubling of subsidies will drive an increase in sales volume this year. According to CPCA data, the total number of passenger vehicles currently meeting the scrappage criteria amounted to 16 million units in 20237. UBS projected that the recent stimulus could potentially generate an additional demand of 2 million units, given that the subsidies of Rmb15-20k represent a significant 10-20% of the price of a mass-market vehicle.8Key Beneficiaries

We believe this will favour mass-market car makers including BYD and Great Wall Motor as well as auto parts suppliers like Fuyao Glass and Toupu.China Electric Vehicle and Battery ETF (2845 HKD): BYD and Fuyao Glass stand as the second and fifth largest holdings, while the fund also has position in Tuopu.China Consumer Brand ETF (2806 HKD) holds positions in Fuyao Glass and Great Wall Motor.

3.Politburo Meeting: Boosting Consumption Receives Higher Priority

Details

Comparing the 2H policy guidance from July Politburo meeting with those of the April politburo meeting, there is a clear emphasis on boosting consumption. The recent statement underscored the importance of stimulating consumption to bolster domestic demand, shifting the focus of economic policy towards enhancing social welfare and consumption. It outlined strategies to raise household incomes through various means, improve the consumption potential and inclination of low- and middle-income segments of the population.

Implications

The meeting specifically highlighted the significance of advancing and enhancing service consumption, such as cultural tourism, elderly care, childcare, and housekeeping. This led to expectations that following the recent introduction of trade-in subsidies for consumer goods, the government might introduce additional initiatives to bolster service consumption.

Key Beneficiaries

China Consumer Brand ETF (2806 HKD) could help investors capture investment opportunities in China consumer sector.