Important Information

Global X China Cloud Computing ETF

Global X China Clean Energy ETF

Global X China Consumer Brand ETF

Global X China Electric Vehicle and Battery ETF

Global X China Semiconductor ETF

Global X China Robotics and AI ETF

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Cloud Computing ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Companies in the internet sector may face unpredictable changes in growth rates and competition for the services of qualified personnel. The products and services offered by internet companies generally incorporate complex software, which may contain errors, bugs or vulnerabilities.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Monthly Commentary on Key Themes – June 2023

Listen

[2826/9826] Global X China Cloud Computing ETF

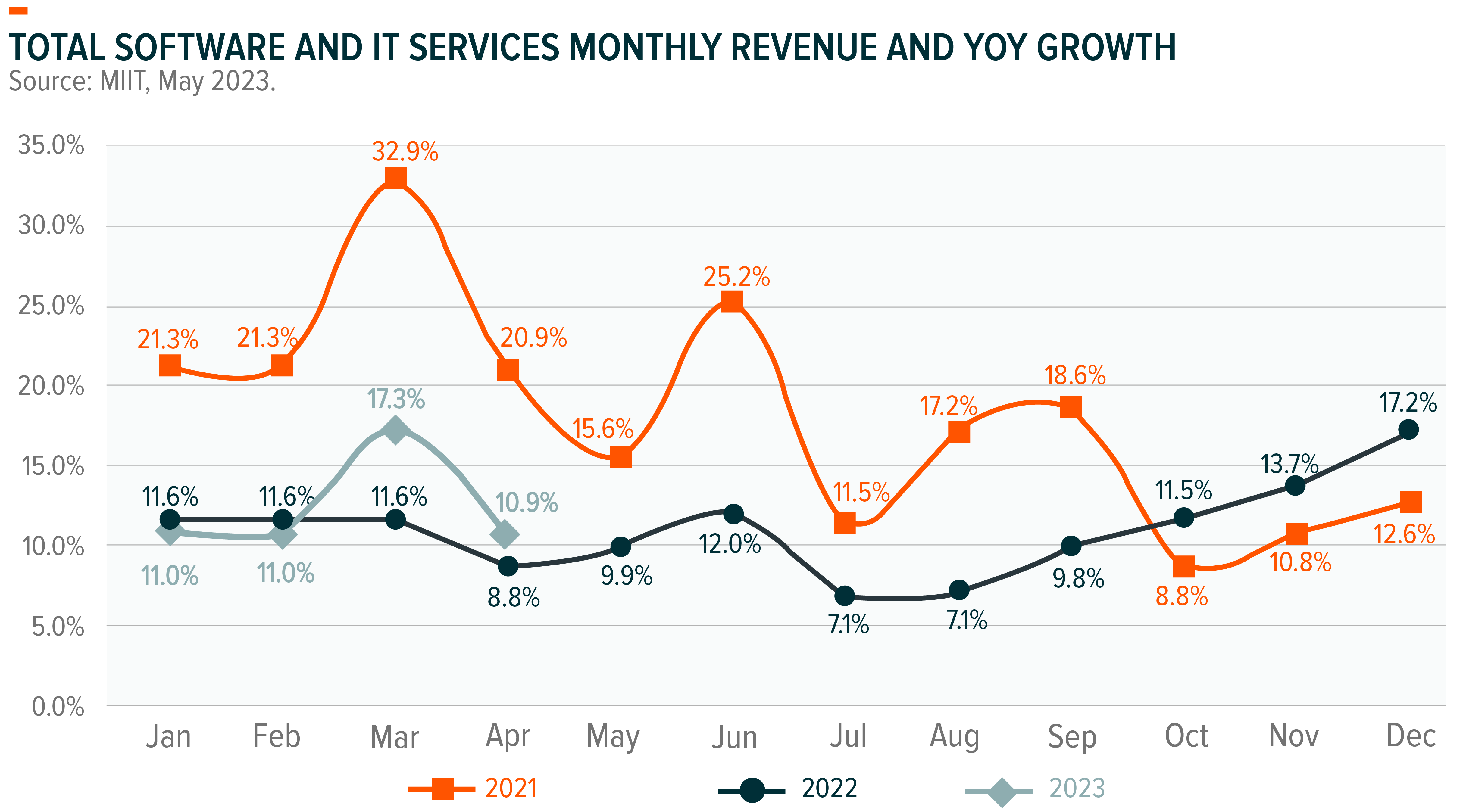

According to the Ministry of Industry and Information Technology, China’s software and IT service revenues were up 10.9% year-on-year (YoY) in April 2023, decelerating from 17% YoY growth in March. This drop-off likely reflects the slower macro recovery and lower-than-expected government spending on software localization initiatives due to budget constraints.

On the other hand, Chinese telco companies’ cloud revenue continued to grow strongly. It is an industry consensus that government policies are currently a tailwind for telcos’ cloud businesses since state-owned enterprises (SOEs) would favor telcos as a “safe” choice, especially when considering data security risk and the need to support localization initiatives. As SOEs and industrial digitization will be the main driver of cloud growth in China, telco companies will likely continue to see a sustainable advantage and, thus, more market share gain. As such, we expect private cloud demand growth will continue to outgrow that of public cloud in the near term.

However, with the fast development of artificial intelligence-generated content (AIGC), there should be a meaningful uplift in terms of public cloud resource demands driven by AI model training. We expect public cloud providers such as AliCloud, Tencent Cloud, and Baidu Cloud to be well-positioned to capture such demands in the medium to longer term.

[2809/9809] Global X China Clean Energy ETF

Regarding solar, feedback from the 2023 SNEC PV Power Expo in Shanghai, which attracted surprisingly huge traffic, showed N-type solar cells (mainly TOPCON) are replacing PERC as the new mainstream. TOPCON cell became a clear winner for 2023, while HJT cell will likely emerge as the mainstream cell technology from 2024 onward.

Polysilicon prices are falling sharply, breaking below RMB 100 per kg, which is close to the price level before 2021. The dramatic price change was due to the massive capacity build-up in polysilicon production. The China Clean Energy ETF has little exposure to polysilicon stocks (less than 2%), so the ETF has been relatively safer from the polysilicon oversupply issue.

As of April 2023, solar installations in China reached 48.31GW year-to-date (YTD), vs 16.88GW YTD as of April 2022 (+186% YoY). Over the first quarter of 2023, solar module exports ended at 51GW (+37% YoY), while solar cell exports ended at 8.6GW (+66% YoY). The whole year installation number has been guided up to over 450GW globally amid the SNEC event.

Regarding the wind industry, the latest monthly data points indicate that wind tendering procurement pricing has stabilized around RMB 2000/kW, similar to April but higher than the 1Q average of RMB 1844/kW. The wind turbine installation in March and April has picked up after several months of logistics and installation disruptions. Year-to-April wind installations grew by 48% and reached 14.2GW, still much below the record-high full-year tendering volume we saw last year at 91GW. With that, we believe the strong new order growth in 2022 will continue to translate into actual installations in the remainder of 2023. Many component suppliers will be beneficiaries as they can enjoy strong operating leverage when actual installations pick up.

According to Windmango’s news on 31 May 2023, the Guangdong Provincial Development and Reform Commission recently announced the 2023 offshore wind competitive bidding work plan, with a remarkable capacity of 7GW (or 15 projects) offshore wind farms located in provincial-jurisdiction areas and 16GW (or 15 projects) in national-jurisdiction areas. The competitive bidding will start in early June, with the final bidding results to be announced by the end of August. This is a positive update to support a growing offshore wind capacity in China.

[2806/9806] Global X China Consumer Brand ETF

China’s consumption recovery continues, but the pace remains somewhat slower than anticipated. April retail sales growth came in at +18.4% YoY, higher than +10.6% YoY in March but lower than the market expectation of +21.9% YoY. China’s consumer confidence remains low, around 95 levels, i.e. still 15% below the pre-lockdown level in March 2022. We need to see a job market and wage growth recovery before we see improvements in consumer confidence, which by then should translate Chinese consumers’ current high savings into consumption and lead to a more broad-based recovery.

If the recovery pace continues to remain sluggish, we expect to see more government stimulus announcements to support growth. In fact, the government just extended the tax exemption for new energy vehicle (NEV) purchases beyond 2023 and also relaxed property purchase restrictions in some cities. We think such property-related measures may possibly extend to other cities as well. Also, monetary policy remains accommodative to support infrastructure and other investments to drive growth.

The 618 online shopping festival just kicked off, and we are currently monitoring whether this can boost consumption. We maintain our view that private consumption will be China’s major economic growth driver and remain positive on the consumption outlook this year.

[2845/9845] Global X China EV & Battery ETF

Battery material costs have stabilized: Lithium prices declined sharply year-to-date, consistent with our view that the overall lithium supply tightness will ease into 2023. Prices began stabilizing in May after battery and battery material destocking was almost complete. The prices have also hit levels around RMB 150,000/ton, which is considered a balanced price point – leaving enough profit to lithium resources players while allowing battery cell makers to lower the product cost meaningfully. Of late, battery makers have become more willing to produce and start restocking to meet the potential demand in the second half. For other battery materials, there were modest levels of annual price cuts. The sharp correction in lithium price may be negative for short-term sector sentiment but positive for long-term EV and battery competitiveness.

China EV sales and competition landscape are still challenging: Post the Shanghai Auto show, we saw various new and competitive EV and plug-in hybrid EV (PHEV) car models to be launched this year. According to news media, more than 60% of new car models launched in China year-to-date are NEVs.

Risk of further price competition remains: In late 2022 and early 2023, Tesla announced an EV price cut, which initiated a price war in China amid seasonally weak industry-level sales volume. Huawei, Xpeng, Nio, Aion, and BYD have also announced price cuts. Tesla sales in China have rebounded after the price cut, but the magnitude was not as high as expected as their car models are relatively outdated. In May, Tesla raised some model prices modestly, reversing the price cut trend year-to-date and sending stabilizing signals to car buyers. With still a short order lead time and high inventory, we can’t rule out the possibility of Tesla’s further price adjustment in the rest of 2023.

US Inflation Reduction Act (IRA) yet to have clarity: The IRA detail announced this March was similar to the December version. There were limited new implications for Chinese battery suppliers. The Ford-CATL collaboration is yet to be finalized. Any progress will provide clarity to Chinese players on whether to enter the US battery market.

[2807/9807] Global X China Robotics & AI ETF

The growing attention to AI: After the booming use of ChatGPT, there has been a growing interest in AI. The potential of AI to transform various industries has led to increased investment in AI-based technologies. As a result, the share prices of many companies have rebounded as investors flocked to take advantage of this trend.

China robotics and automation cycle: We believe China’s prompt reopening process will drive a higher capital investment appetite for Chinese companies in 2023. However, this anticipated trend may be partially postponed by the growing concerns about the global economic slowdown. Such concerns could cause uncertainty around the investment plans of some export-oriented Chinese companies. Based on the latest PMI data points, we see signs of US and Europe industrial activities slowing down.

Quality automation solution might gain global market share: As China quickly passes the reopening disruptions, we see a growing interest for Chinese companies to resume global expansion plans. Many industrial products and solutions have been well developed in the past few years, and this could accelerate their global penetration with corporates’ focus and improved sales support.

[3191/9191] Global X China Semiconductor ETF

Japan restricts chip-making equipment exports to China: On 23 May, the Japanese government unveiled details of its updated export control on China, under which local companies must have a license to sell 23 types of chip-making equipment to China. The curbs are set to take effect on 23 July. Japanese companies will need licenses to ship a broad range of semiconductor equipment spanning cleaning, deposition, annealing, lithography, etching, and testing. The scope of the ban is largely in-line with US export restrictions published in 4Q 2022. There are concerns about Japan’s restriction on the immersion lithography tool, which could become a reference for the Netherlands to draft its upcoming export control rule.

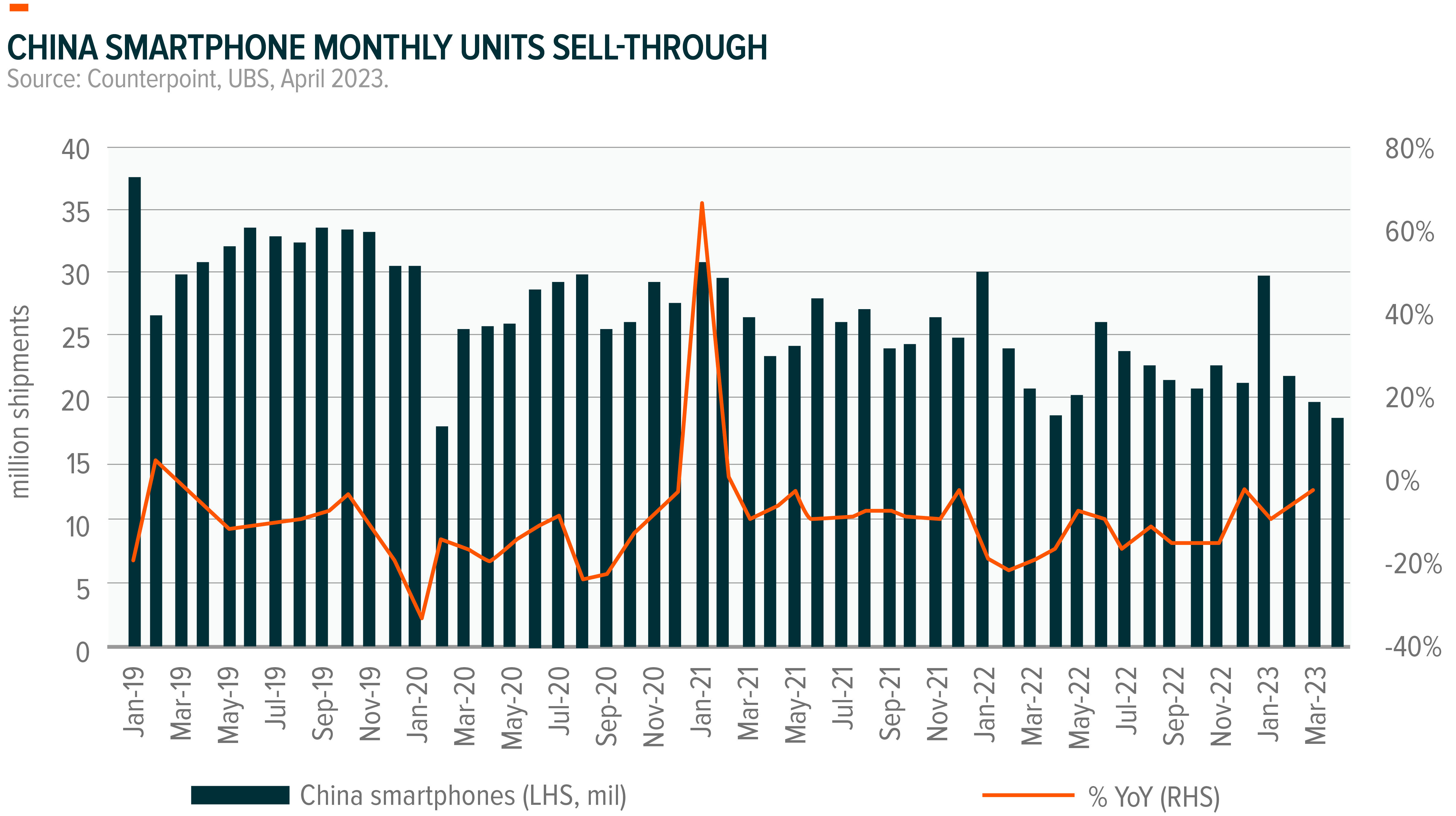

Smartphone shipments see monthly improvement in China: Global smartphone units sell-through for the month of April 2023 came in at 88.7 million units (-10.5% YoY), continuing from last month’s recovery in YoY growth, where February and March sell-through was -14.4% and -13.6% YoY, respectively.1 Similar to last month, the incremental improvement was most notably driven by YoY sell-through in China, improving to -1.9% YoY or 18.1 million units (was -9.9%/-5.7% in February/March). From an original equipment manufacturer (OEM) perspective, the month-on-month (MoM) improvement in YoY smartphone sell-through was primarily led by Android smartphones. Oppo, Vivo, and Xiaomi all showed incremental improvement in YoY sell-through for April to -11.1%/-18.5%/-8.0% YoY (was -17.2%/-29.5%/-14.4% YoY in March). The recovery was, for the large part, centered on both China (Xiaomi and Vivo) and the rest of the world (Oppo and Vivo).