Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Japan Global Leaders ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index (the “Index”).

- The Fund is subject to general investment risk, equity market risk, new index risk, annual reconstitution risk, differences in dealing arrangements between Listed Class of Units and Unlisted Classes of Units risk, differences in cost mechanisms between Listed Class of Units and Unlisted Classes of Units risk, currency risk, risk of reliance on the Index Calculation Agent, trading difference risk, passive investment risk, tracking error risk, trading risk, termination risk, reliance on market maker risks and distributions out of or effectively out of capital risk.

- The Fund’s investments are concentrated in securities in Japan. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Japanese market.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices. Further, the TSE or JASDAQ has the right to suspend trading in any security traded thereon. The Japanese government or the regulators in Japan may also implement policies that may affect the Japanese financial markets.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including product features and the risk factors. There is no guarantee of the repayment of the principal.

- Global X India Select Top 10 ETF’s (the “Fund”) underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Underlying Index is an equal weighted index whereby the Underlying Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Underlying Index.

- The Fund is a FPI registered with the SEBI. The applicable laws, rules and guidelines on FPI impose limits on the ability of FPI to acquire shares in certain Indian issuers from time to time and are subject to change. This may also adversely affect the performance of the Fund. The FPI status of the Fund may be revoked by the SEBI under certain circumstances. In the event the Fund’s registration as a FPI is cancelled, revoked, terminated or not renewed, this would adversely impact the ability of the Fund to make further investments, or to hold and dispose of existing investment in Indian securities. The Fund may be required to liquidate all holdings in Indian securities acquired by the Fund as a FPI. Such liquidation may have to be undertaken at a substantial discount and the Fund may suffer significant/substantial losses.

- The Fund’s investments are concentrated in securities in India. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Indian market.

- The Fund’s investments are concentrated in companies in various sectors and themes including communication services, information technology, financials, health care, consumer staples and consumer discretionary, industrials and energy. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Global X K-pop and Culture ETF’s (the “Fund”)The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (South Korea). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations in value of the Index resulting from adverse conditions in South Korea. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the South Korean market.

- The Fund’s investments are concentrated in companies in various industries and sectors including entertainment, communication services, internet, gaming, consumer staples, consumer discretionary as well as food. The business performance of these industries or sectors are subject to a wide range of risks. Fluctuations in the business for companies in these industries or sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- Global X Innovative Bluechip Top 10 ETF (the “Fund’s”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset Global Innovative Bluechip Top 10 Index (the “Index”).

- The Fund is subject to general investment risk, equity market risk, new index risk, equal weighted index risk, risks related to companies with technology themes, differences in dealing arrangements between Listed Class of Units and Unlisted Classes of Units risks, differences in cost mechanisms between Listed Class of Units and Unlisted Classes of Units risk, currency risk, trading difference risk, risks associated with ADRs, passive investment risk, tracking error risk, trading risk, termination risk, reliance on market maker risks, reliance of the same group risk and distributions out of or effectively out of capital risk.

- The Fund’s investments are concentrated in companies in the technology sector. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The number of constituents of the Index is fixed at 10. The Fund by tracking the Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including product features and the risk factors. There is no guarantee of the repayment of the principal.

- Global X AI & Innovative Technology Active ETF (the “Fund”)’s investment objective is to achieve long term capital growth by primarily investing in equities of exchange-listed companies globally, which fall within the investment theme of artificial intelligence (“AI”) and innovative technologies.

- The Fund will invest primarily (i.e. at least 70% of its net asset value (the “Net Asset Value”)) in equity securities and equity-related securities (such as common shares, preferred stock as well as American depositary receipts (“ADRs”), global depositary receipts (“GDRs”) and participation notes) of companies which (i) create, design and develop, or (ii) benefit from the advancement of, AI and Innovative Technologies Companies. Risk associated with AI and Innovative Technologies Companies include Operational and business risk, Changes in technology risk, Governmental intervention risk, Regulatory risk, Intellectual property risk, Significant capital investment risk, Cyberattack risk.

- The performance of the Fund may be exposed to risks associated with different sectors including but not limited to industrial, consumer discretionary, financial services, information technology, semiconductor, communication services, entertainment and healthcare. Fluctuations in the business for companies in these sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund employs an actively managed investment strategy. The Fund does not seek to track any index or benchmark, and there is no replication or representative sampling conducted by the Manager. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- There is no industry sector requirement and the Fund may from time to time concentrate in a particular sector. The performance of the Fund may be exposed to risks associated with different sectors and themes, including but not limited to industrial, consumer discretionary, financial services including fintech, information technology, semiconductor, communication services, entertainment, and healthcare. The Fund may experience relatively higher volatility in price performance when compared to other economic sectors.

- Securities lending transactions may involve the risk that the borrower may fail to return the securities lent out in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- The trading price of the Listed Class of Units on the SEHK is driven by market factors such as the demand for and supply of the Listed Class of Units. Therefore, the Listed Class of Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- The Fund may invest in financial derivative instruments (“FDIs”) for non-hedging (i.e. investment) and/or hedging purposes, in order to achieve efficient portfolio management. Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- Global X Electric Vehicle and Battery Active ETF (the “Fund”) invests in equity to achieve long term capital growth by primarily investing in companies which are directly or indirectly involved in electric vehicle or electric vehicle-related battery businesses.

- The Fund employs an actively managed investment strategy and does not seek to track any index or benchmark. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investments are concentrated in companies involved in the EV/Battery Business, which may experience relatively higher volatility in price performance when compared to other economic sectors. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments and may be more susceptible to adverse economic, political, policy, liquidity, tax, legal or regulatory event affecting the relevant sector.

- Electric vehicle companies and electric vehicle-related battery companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of electric vehicle companies and electric vehicle-related battery companies may be significantly impacted by technological changes, changing government regulations and intense competition from competitors.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- The trading price of the Fund unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

Monthly Commentary on Global Thematic ETFs – Sep 2024

Global X India Select Top 10 ETF (3184 HK)

Industry Update

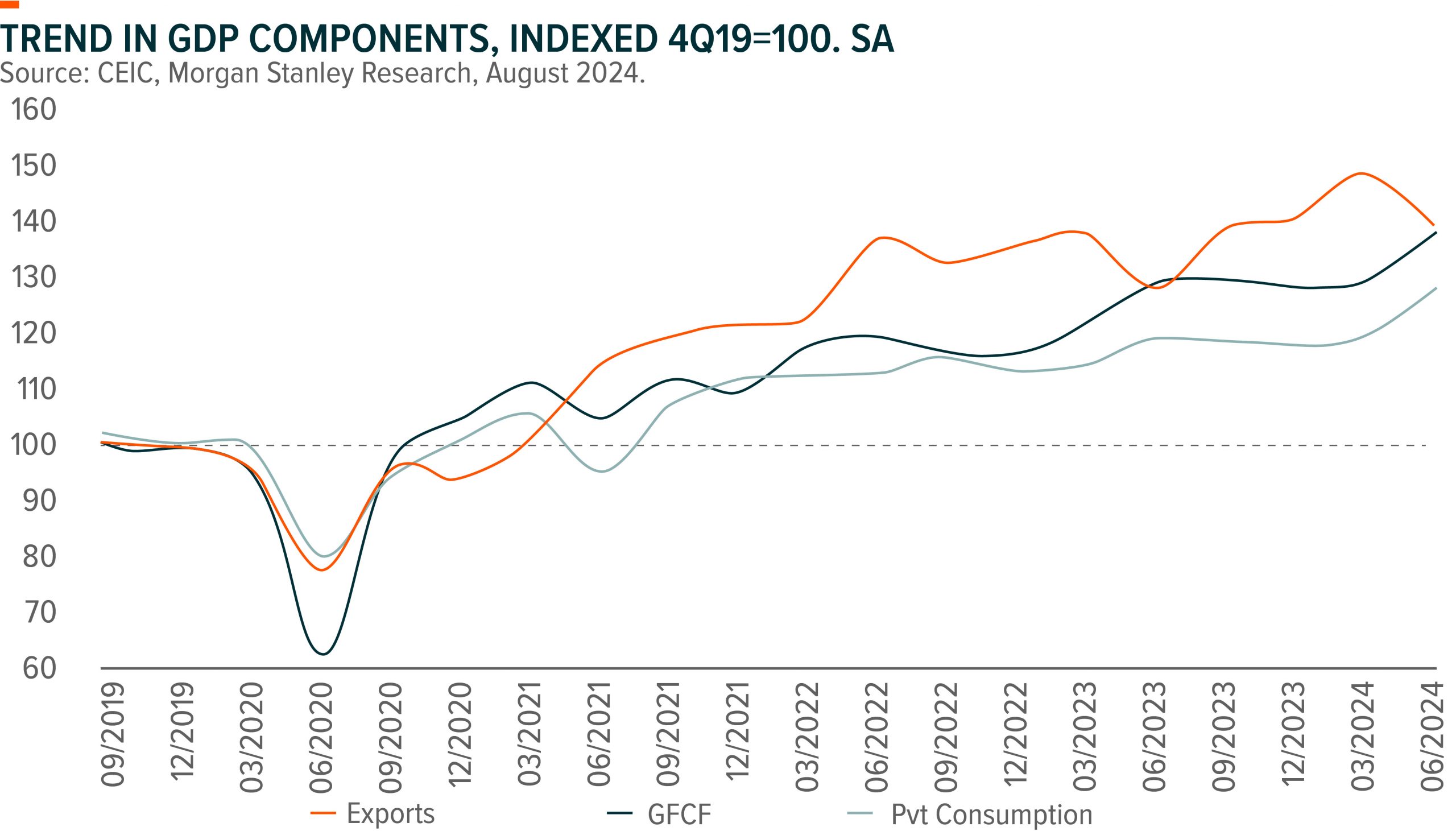

India’s market saw a drawdown of 5% (MSCI India in USD terms) during early August amid the global sell-off in July-August, but has recovered 6% from the bottom thanks to domestic-driven nature of economy as well as the market. Volatility picked up during the drawdown and defensive sectors like IT, Telco, and Pharma outperformed during the month. GDP growth moderated to 6.7% in 2QCY24 from 7.8% in 1QCY24 but was largely in-line with expectations. Private consumption grew a seven-quarter high of 7.4%yoy and gross fixed capital formation also further improved to 7.5%yoy growth during the quarter. India economy is showing more broad-based growth momentum with improving private consumption and robust capex.

Within consumption, we have witnessed mass consumption picking up in 1QFY25 with rural outpacing urban demand. The acceleration in growth across FMCG categories was largely driven by a pickup in rural demand. In addition, we have seen the strongest volume growth in high-penetration categories such as detergents, toothpaste, and biscuits. Within investment, we are seeing private capex showing green shoots with increasing order books and improving private sector investment intentions which would further support capex growth driven by government and household. Government expenditure softened in 2QCY24 due to general elections but we expect this to also improve in coming quarters.

Stock Comments

- Bharti Airtel (BHARTI IN) was the major contributor in August thanks to its strong growth outlook post tariff hike. The company reported steady 1QFY25 results with revenues up 3%yoy and EBITDA up 1%yoy. India revenues grew 10%yoy while international revenues were down 15%yoy. Strong net adds of subscribers (2.3mn) and ARPU of Rs 211 (+5%yoy) as well as strong additions in postpaid (+0.8mn) and data subs (6.3mn) supported strong growth in India. Moderating GAPEX with rising EBITDA will lead to strong FCF generation, and enable the company to deleverage its balance sheet and support shareholder returns in the next few years.

- Maruti Suzuki India (MSIL IN) was the major detractor in August due to concerns on subdued demand amid rising discounts and channel inventory. The company shared that they also raised discounts in June quarter in order to support end market demand to 3.5% of ASP. While the company expects SUV mix in the industry continue to move higher, they haven’t seen a small car demand recovery yet. First time buyers are still not coming back either, with this cohort contributing around 40% of the market. The market is still waiting to see whether overall private consumption improvement may also translate into improvement in demand for small car segment.

Preview

This confluence of strong GDP growth, moderate inflation, and recovery in consumption suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. We remain constructive on India market.

Global X K-pop and Culture ETF (3158 HK)

Industry Update

In August, KOSPI declined 3.5% MoM to 2,674. The initial part of the month saw heightened concerns over a potential US recession, prompting a sell-off across various asset classes. This led to the KOSPI dropping below 2,450 for the first time since mid-January. As worries about a recession eased as the month progressed, the KOSPI recovered from its early dip in line with global equities. However, sector-specific challenges, particularly affecting memory stocks, continued to exert downward pressure on Korean equities. By sector, investors accumulated financials names ahead of the Korea government’s Value-Up index launch in September. Internet and Healthcare names rallied on Fed rate cut expectations.

Overall growth environment remains resilient with continued strength in export growth. Exports in August recorded 11.4% YoY growth, and the momentum is expected to persist throughout the remainder of the year. Exports to China (+7.9% YoY in August) exhibited a consistent recovery pattern, outpacing the US in July and August. CPI inflation slowed down to 2.0% YoY in August (vs. 2.6% in July) on high base.

Stock Comments

- Krafton (259960 KS): Company posted a record quarter with revenue/NP up 83/166% YoY, 20/88% above consensus. The significant beat was primarily fueled by mobile, indicating some change in payment terms from publisher Tencent. Despite that, the underlying performance is strong across all platforms and regions. As a traditionally weak season, 2Q witnessed a solid market share QoQ for PUBG PC and mobile. Management highlighted a strong start for 3Q24, with July recording 50% YoY growth in MAU for PC and console, along with improvement in monetization. By region, mobile saw strong growth in various regions like China, Southeast Asia and India. Dark and Darker Mobile global launch now is scheduled for 4Q24.

- HYBE (352820 KS): Following the appointment of new CEO, Jae-sang Lee, HYBE unveiled its 2.0 Strategy in August. Key points include: 1) Restructuring its core business into Music, Platform, and Tech-driven Future Growth Initiatives; 2) Introducing HYBE MUSIC GROUP APAC to oversee the multi-label operations in Korea and Japan; 3) Launching a label service under HYBE AMERICA to provide local artists with HYBE’s 360 integrated management system; 4) Launching Weverse subscription-based membership service in 4Q24. HYPE also reinforces its existing global expansion strategies and will continue to develop local talents.

2Q revenue was up 3% YoY to Won640bn, slightly below consensus of Won657bn. OP of Won51bn missed consensus mainly due to larger-than-expected marketing costs from new game publishing. On 27 August, HYBE announced the resignation of Min Hee-jin as CEO of ADOR, while Min will retain her position as director at ADOR and her role of producing NewJeans. ADOR overhang is likely to linger with the possibility of Min’s endeavoring to reclaim CEO position.

- Amorepacific (090430 KS): 2Q24 results were disappointing with sales -4% YoY and OP missed consensus by 30% at Won54bn. China-related earnings exhibited a significant weakness with a notable sales decline, while earnings contribution from COSRX was smaller on low seasonality. Company maintained a 50% growth target for COSRX sales in 2024, but cautioned about escalating losses in China for 3Q24 with more inventory refund and downsizing. Other regions delivered in-line sales performance and better operating margin in 2Q24, with organic operating profit at Won14bn in 2Q24 vs. Won6bn in 2Q23. The prolonged delay in China’s turnaround, coupled with persistent disappointments and subdued consumer demand in China (also impacting TR sales), as well as the absence of short-term catalysts, could exert pressure on the company’s near-term share price

Preview

Although facing short term fluctuations, we maintain positive on the rise of K-Pop and cultural phenomenon in global market and expect it to continuously provide a halo effect towards Korean goods such as cosmetics and packaged food. Beyond that, price competitiveness and compelling value propositions stand out as key factors driving the strong export of Korean consumer goods in the global market, especially under current economic uncertainties and consumer downtrading trend. Yet, we remain cautious on the impact from China market especially for some companies with meaningful China exposure.

Global X Innovative Bluechip Top 10 ETF (3422 HK)

Stock Comments

NVIDIA see no change in demand outlook for 2025 despite delay in Blackwell

FY3Q (October) revenue guidance of $32.5bn (+8% qoq, +79% yoy) at the mid-point came in 2% above BBG consensus, but at the low end of buy side expectation at 32-36bn. Non-GAAP gross margin (excl. SBC) was guided to 75%, non-GAAP opex to $3bn (+12% qoq), other income and expenses to ~$350mn, and non-GAAP tax rate to 17%. This guidance implies a FY3Q non-GAAP EPS (excl. SBC) of ~$0.73 slightly ahead of BBG.

iPhone orders reported to rise over 10% this year amid AI demand

According to a report from Nikkei on August 29, Apple is said to be betting that its first iPhone with Apple Intelligence will be a hit. Thus, the tech giant has requested suppliers to provide components for approximately 88 to 90 million iPhones, over 10% more than the initial component orders of 80 million units for new iPhones in 2023. (Nikkei)

BYD reported in-line results

BYD reported in-line 2Q24 and 1H24 results on 28 August. 24Q2 net profit came in at Rmb9.1bn, up 98% q/q and 33% y/y with 63% q/q and 45% y/y volume growth.1 Management believed 4mn units of sales target is achievable this year, and looked for 5mn unit target in 2025, with upside coming from overseas and high-end sales.2 BYD launched the Song L DM-i and Song Plus DM-i in July, followed by the launch of the new Seal EV and Seal 07 DM-i in early August, adopting LiDAR for the first time

Global X Japan Global Leaders 10 ETF (3150 HK)

Industry Update

In August 2024, the FactSet Japan Global Leaders Index recorded loss of 1% in JPY terms3 . Japan stock market started August with an over 20% corruption on the back of a series of events including BOJ rate hike, JPY appreciation and carry trade unwind, mounting fears of US Recessions, and lower than expected quarterly earnings of some US Big Techs. After initial rout, Japan market subsequently recovered its losses throughout the month, as Japan market’s investment opportunities remain appealing with improving GDP and real wage indicators, as well as the accelerating corporate governance reform. USDJPY ended August at 146, from 151 as of end July.4

Stock Comments

Seven & i recorded total return of 17% in August, a key contributor to index performance. Nikkei reported that Seven & i received an M&A proposal from Alimentation Couche-Tard (ATD) on 19 August 2024. Seven and i confirmed the same day after the market close that the company received a confidential, non-binding and preliminary proposal.5 A merger would combine the two largest convenience store operators in the US, and bring potential synergies for ATD’s operations. Though no bidding offer has been disclosed, Seven & i’s current valuation looks attractive compared to Seven & i’s previous acquisition of Speedway, or ATD’s current valuation.6

Preview

Japan stock market went through massive volatility under concern for JPY appreciation and US economy recession. While short term outlook remains uncertain given potential for further Carry Trade unwinding and slowing global economy, we remain constructive over Japan stock market in the long term, as supported by a combination of robust export growth, recovering domestic demand, and ongoing corporate reform. JPY appreciation is a key market concern as it could weigh on Japanese corporate earnings, but gradual appreciation should be manageable for global investors as it is also positive for dollar-denominated returns (without currency hedging).7

Global X AI & Innovative Technology Active ETF (3006 HK)

Industry Update

NVIDIA see no change in demand outlook for 2025 despite delay in Blackwell

FY3Q (October) revenue guidance of $32.5bn (+8% qoq, +79% yoy) at the mid-point came in 2% above BBG consensus, but at the low end of buy side expectation at 32-36bn. Non-GAAP gross margin (excl. SBC) was guided to 75%, non-GAAP opex to $3bn (+12% qoq), other income and expenses to ~$350mn, and non-GAAP tax rate to 17%. This guidance implies a FY3Q non-GAAP EPS (excl. SBC) of ~$0.73 slightly ahead of BBG.

Blackwell: Production ramp is scheduled to begin in FY4Q (start to ship) and continue into FY26. Change of Blackwell mask is completed, with no functional change. Management expect several billion dollars of Blackwell revenue in 4Q, demand continue to be well above supply. Nvidia expect next gen AI model requires 10-20x more compute to train with significantly more data, which translates to significant growth in data center business next year. (Company data, Mirae )

OpenAI in talks to raise funding that would value it at more than $100 billion

OpenAI, the company behind ChatGPT, is seeking a valuation of over $100 billion in a new funding round. Thrive Capital would lead the round and would invest $1 billion. Earlier this year, OpenAI was valued at a reported $80 billion from $29 billion the prior year. Annualized revenue reportedly surpassed $2 billion earlier this year. (CNBC)

Stock Comments

Apple + 3.8%

According to a report from Nikkei on August 29, Apple expect its first iPhone with Apple Intelligence will be a hit. Thus, the company has requested suppliers to provide components for approximately 88 to 90 million iPhones, over 10% more than the initial component orders of 80 million units for new iPhones in 2023. (Nikkei)

Tencent + 2.38%

The company delivered solid 2Q24 results. Domestic games revenue was Rmb34.6bn (+9% YoY vs -2% YoY in 1Q); international game revenue was Rmb13.9bn (+9% YoY vs +3% YoY in 1Q). Non-IFRS NP Rmb57.3bn (+53% YoY), NPM 35.6% (+11.3ppt) was a solid beat vs Rmb47-48bn consensus driven by share of profits from JV and Associates.

Global X Electric Vehicle and Battery Active ETF (3139 HK)

Industry Update

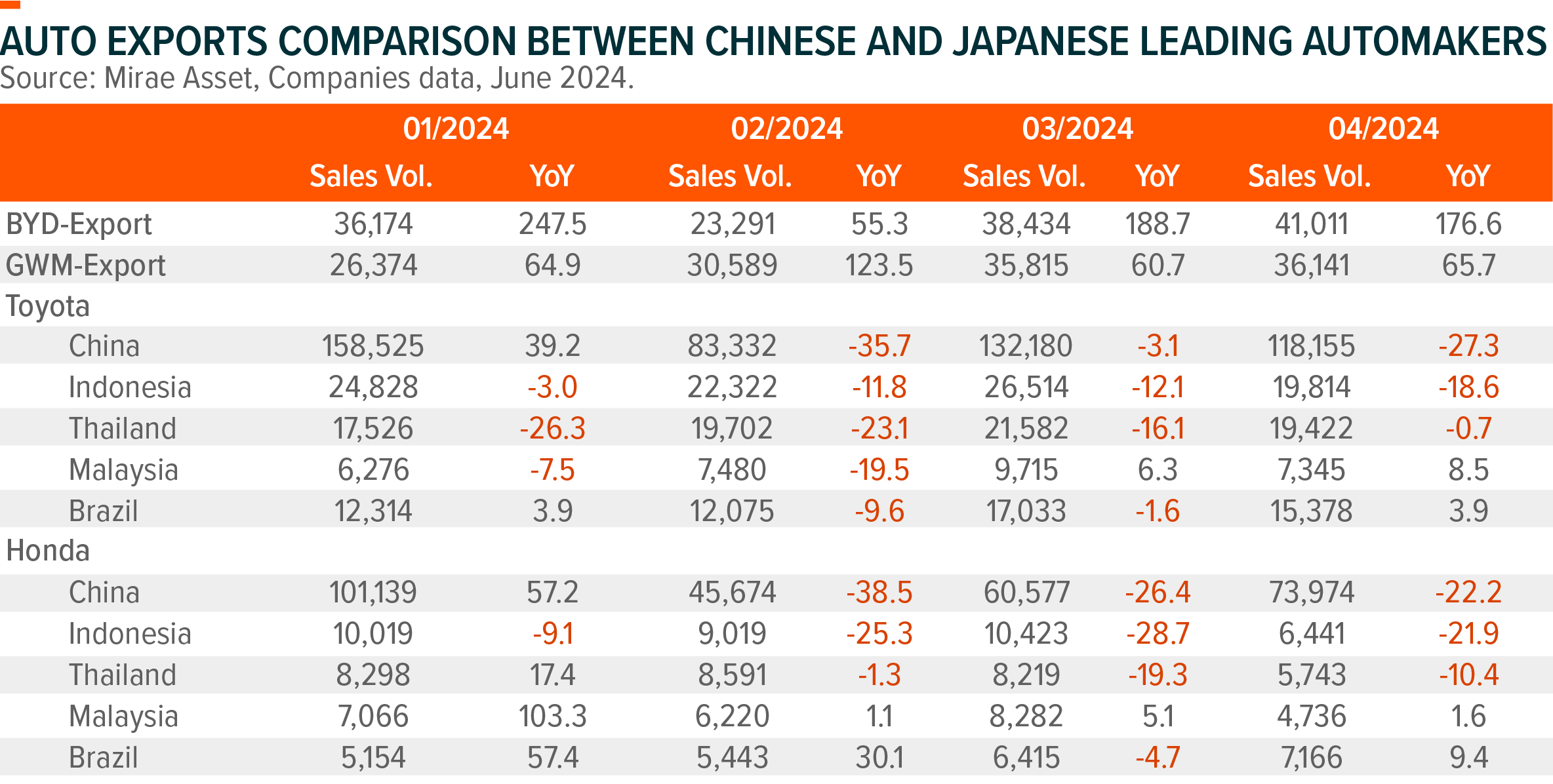

7M24 global EV sales ended at 8 million units, in which non-China markets accounts for nearly 3 million units. 7M24 global EV penetration arrived at 19%, +4.7ppt YoY. In July 2024, global EV penetration hit 20%, up by 4.1ppt YoY, largely driven by China EV sales surge to 53%, up by 18.1ppt YoY. Chinese brands’ EV sales dominated more than half of global market share. In non-China markets, Chinese EV makers are continuously gaining market share in ASEAN, Oceania, the Middle East regions, Central and Eastern Europe, and Central and South America, while a little lost market share in Western Europe and North America this year.

7M24 global EV battery installations reached 434GWh, +22%yoy. CATL led with 163GWh, +30%yoy, expanding its market share to 38%, +2ppt YoY. BYD and LG Energy Solution are No.2 and No.3 battery producers, with 70GWh and 54GWh sales, and market share stable at 16% and declining to 12%, respectively. Lithium carbonate prices have come down to below Rmb80,000 per ton, which is much close to most lithium producers’ production cost.

Renesas’ 3Q sales guidance was weak, which showed the slowdown of auto semiconductor and initiated people’s concerns on valuation correction of AI-related stocks, coupled with great volatility of the US tech sector recently. Demand for automotive chips may weaken because of slower-than-expected inventory adjustment at customers in the near term.

Stock Comments

Fuyao Glass Industry Group Co., Ltd. Class H: The company delivered solid Q2 results recently. As the global leading auto glass producer, company is gaining market share globally by product mix upgrading and cost cutting.

BYD Company Limited Class H: The company delivered strong Q2 results with double-digits growth in top line and bottom line. BYD is gaining market share in and outside China, with price-competitive xEV models. They also guided up their auto sales to 5 million units in 2025.

EVE Energy Co. Ltd. Class A: The company’ 2Q results is a miss on margins due to battery oversupply and price war, though they are the few players who are still making money. Company expects margin improvement going forward, driven by product mix upgrading and utilization improvement.

Preview

Global electric vehicle sales remain in the uptrend despite price war in the near term due to weak global macro. We are positive on global EV penetration which is a visible decade growth story in most of the major economies such as Europe, China, ASEAN, South America and the Middle East regions. Some of Chinese leading EV makers have

shown the early signs of competitiveness in global competition and continuously gained market share from legacy automakers in China and outside China. As one of the key beneficiaries, the worst time is behind for battery sector, though it takes time for bottom-out. We expect more M&As and capacities exit in battery and battery materials industries. Auto semiconductor industry would be another key beneficiary in spite of slowdown in the near term. Leading companies’ technology competitiveness remain solid in the foreseeable future. Yet, we have also seen some early signals of new entrants’ catch-up.