Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Japan Global Leaders ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Index is reconstituted annually. Eligible securities are added into the Index as constituents during the next scheduled annual reconstitution. Similarly, securities that no longer meet the eligibility criteria of the Index may continue to remain in the Index until the next scheduled annual reconstitution, at which point they may be removed. There is no guarantee that the representativeness of the Index is optimised from time to time.

- The Fund’s investments are concentrated in securities in Japan. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Japanese market.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices. Further, the TSE or JASDAQ has the right to suspend trading in any security traded thereon. The Japanese government or the regulators in Japan may also implement policies that may affect the Japanese financial markets.

- The base currency of the Fund is JPY but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The Index Calculation Agent calculates and maintains the Index. If the Index Calculation Agent ceases to act as index calculation agent in respect of the Index, the Index Provider may not be able to immediately find a successor index calculation agent with the requisite expertise or resources and any new appointment may not be on equivalent terms or of similar quality. There is a risk that the operations of the Index may be disrupted which may adversely affect the operations and performance of the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the Stock Exchange of Hong Kong is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- The investment objective of Global X K-pop and Culture ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive K-pop and Culture Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (South Korea). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations in value of the Index resulting from adverse conditions in South Korea. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the South Korean market.

- The Fund’s investments are concentrated in companies in various industries and sectors including entertainment, communication services, internet, gaming, consumer staples, consumer discretionary as well as food. The business performance of these industries or sectors are subject to a wide range of risks. Fluctuations in the business for companies in these industries or sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is KRW but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

- Global X Innovative Bluechip Top 10 ETF (the “Fund’s”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset Global Innovative Bluechip Top 10 Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Index is an equal weighted index whereby the Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Index.

- The Fund’s investments are concentrated in companies with a technology theme. Many of the companies with a high business exposure to a technology theme have a relatively short operating history. Technology companies are often characterised by relatively higher volatility in price performance when compared to other economic sectors. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. Rapid changes could render obsolete the products and services offered by these companies. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in companies in the technology sector. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The number of constituents of the Index is fixed at 10. The Fund by tracking the Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is USD but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the SEHK is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X India Select Top 10 ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset India Select Top 10 Index (the “Underlying Index”).

- The Underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Underlying Index is an equal weighted index whereby the Underlying Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Underlying Index.

- The Fund is a FPI registered with the SEBI. The applicable laws, rules and guidelines on FPI impose limits on the ability of FPI to acquire shares in certain Indian issuers from time to time and are subject to change. This may also adversely affect the performance of the Fund. The FPI status of the Fund may be revoked by the SEBI under certain circumstances. In the event the Fund’s registration as a FPI is cancelled, revoked, terminated or not renewed, this would adversely impact the ability of the Fund to make further investments, or to hold and dispose of existing investment in Indian securities. The Fund may be required to liquidate all holdings in Indian securities acquired by the Fund as a FPI. Such liquidation may have to be undertaken at a substantial discount and the Fund may suffer significant/substantial losses.

- The Fund’s investments are concentrated in securities in India. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Indian market.

- The Fund’s investments are concentrated in companies in various sectors and themes including communication services, information technology, financials, health care, consumer staples and consumer discretionary, industrials and energy. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- The number of constituents of the Underlying Index is fixed at 10. The Fund by tracking the Underlying Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- High market volatility and potential settlement difficulties in the equity market in India may result in significant fluctuations in the prices of the securities traded on such market and thereby may adversely affect the value of the Fund. The BSE has the right to suspend trading in any security traded thereon. The Indian government or the regulators in India may also implement policies that may affect the Indian financial markets. There may also be difficulty in obtaining information on Indian companies as disclosure and regulatory standards in India are less stringent than those of developed countries.

- The taxation of income and capital gains in India is subject to the fiscal law of India. The tax rate in respect of capital gains derived by a FPI on transfer of securities will vary depending upon various factors. Any increased tax liabilities on the Fund may adversely affect the Net Asset Value of the Fund. Any shortfall between the provision and the actual tax liabilities, which will be debited from the assets of the Fund, will adversely affect its Net Asset Value. For details, please refer to the section headed “Taxation in India” in the Prospectus.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is USD but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the SEHK is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

Monthly Commentary

Global Thematic ETFs – July 2025

Global X K-pop and Culture ETF (3158 HK)

Market Update

In July, KOSPI increased 13.9% MoM to 3,072 (Index dividend yield is not equivalent to yield/return of the fund. Positive index dividend yield does not mean positive return). Following Lee Jae-myung’s victory of president election on 3 June, Korea passed long-awaited commercial bill revision to tackle ‘Korea discount’. The amendment pushed by the new government is expected to accelerate improvement in Korean corporate governance and drive significant progress in a multi-year re-rating of Korea equities. Anticipation of this outcome, supported by sustained buying from both foreign and domestic institutional investors, has fueled the market’s upward momentum since late May.

We see K-pop sector as a key beneficiary of the thaw in Korea-China relations under the new government. The potential market reopen could facilitate the resumption of fan engagements and businesses in China. Additionally, the recovery is further bolstered by top artist comebacks, notably the completion of military service by all BTS members and Blackpink’s kickoff of their new world tour.

Stock Comments

- CJ Entertainment (035760 KS): CJ ENM recorded 22% return in June. The company stands as the primary beneficiary of the government’s policy promoting domestic OTT platforms. During his campaign, President Lee emphasized the strategical importance of leadership in cultural content and specifically advocated for fostering a globally competitive Korean OTT platform. Currently, CJ ENM’s profitability is dragged by Tving and the film/drama division. Government-led Korean OTT promotion policies fuel the market expectations for a turnaround and growth at Tving. Furthermore, the government may potentially facilitate consolidation between Tving and Wavve.

- HYBE (003230 KS): HYBE recorded 16% return in June. As of June end, all seven BTS members have completed their military service. With J-Hope and Jin’s solo concerts, it is likely that individual members will make solo activities throughout 2025. Contributions from core artists such as Seventeen, LE SSERAFIM, and TXT are expected to continue growing, driven by increasing global concert demand. The potential resumption of business activities in China presents significant earnings upside, which could further boost HYBE’s valuation.

- Nongshim (004370 KS): Nongshim experienced 7% loss in June. As Korea’s dominant noodle manufacturer commanding over 50% market share, the company faces limited growth opportunities domestically. Therefore, we view sustainable overseas expansion coupled with margin improvement as critical drivers for its future performance.

Preview

We maintain positive on the rise of K-Pop and cultural phenomenon in global market. Amid Trump tariff risk, we believe K-pop industry is less vulnerable thanks to its unique cultural and fandom characteristics, as well as the potential for price increases to mitigate the effects. Meanwhile, following Lee Jae-Myung’s victory in presidential election, we see K-pop sector as a key beneficiary of improving Korea-China relations under the new government, benefiting from the potential resumption of commercial activities and fan engagement in China. Top artists comebacks, such as Blackpink and BTS, further support the fundamental improvement. We expect this cultural wave to continuously provide a halo effect towards Korean goods such as cosmetics and packaged food.

Global X Innovative Bluechip Top 10 ETF (3422 HK)

- Microsoft to cut up to 9,000 more jobs as it invests in AI

Microsoft has confirmed that it will lay off as many as 9,000 workers, in the technology giant’s latest wave of job cuts this year.

The company said several divisions would be affected without specifying which ones but reports suggest that its Xbox video gaming unit will be hit. Microsoft has set out plans to invest heavily in artificial intelligence (AI), and is spending $80bn (£68.6bn) in huge data centres to train AI models. (BBC, 3 July 2025) - Amazon deploys its 1 millionth robot, releases generative AI model

The company also announced it’s releasing a new generative AI model called DeepFleet for its warehouse robots. This AI model, which can coordinate the robots’ routes within the company’s warehouses more efficiently, will help increase the speed of its robotic fleet by 10%, according to Amazon.

The company used Amazon SageMaker — the AWS cloud studio that helps build and deploy AI models — to create DeepFleet. Amazon trained the model on its own warehouse and inventory data. Amazon’s one millionth robot represents more than just a number. The company has improved its fleet of robots in recent years, adding new capabilities and models. (Techcrunch, 1 July 2025) - Nvidia announced solid result and guidance despite sizable impact from H20 ban.

First-quarter 2025 revenue of US$44.1 billion, a 69% year-over-year increase that exceeded guidance of US$43 billion, even as export restrictions on H20 chips forced the company to recognize over US$4 billion in inventory costs.

Global X Japan Global Leaders ETF (3150 HK)

Industry Update

In June 2025, the FactSet Japan Global Leaders Index recorded 0.5% returns in JPY terms (FactSet, January 2025) (Index dividend yield is not equivalent to yield/return of the fund. Positive index dividend yield does not mean positive return). Overseas investors were net buyers of both cash stocks and futures in the month, with sectors including semiconductors, capital goods, and IT&services recording solid performance. Uncertainty has been increasing as we approach July 9 US tariff deadline, and there are media reports that US tariffs could be raised to 30-35%. Updated share buyback plan exceeds market expectations, reflecting the favorable outcomes of capital market reforms and showcasing the resilience of companies. USDJPY ended June at 144, flat from end May.(Bloomberg, March 2025)

Stock Comments

- Nintendo recorded 17% return in the month. Nintendo Switch 2 had a global release on 5 June 2025, with solid number of initial shipment that is above expectation. Global sales topped 3.5mn units in the first 4 days, exceeding performance of Switch 1. Current buyers are mainly existing users and still need to monitor demand sustainability.

Preview

Japan stock market went through massive volatility over past few months under concern for JPY volatility, US tariff uncertainty, and US economy recession. While short term outlook remains uncertain given slowing global economy and political events uncertainty, we remain constructive over Japan stock market in the long term, as supported by a combination of robust export growth, recovering domestic demand, and ongoing corporate reform. JPY appreciation is a key market concern as it could weigh on Japanese corporate earnings, but gradual appreciation should be manageable for global investors as it is also positive for dollar-denominated returns (without currency hedging).(JP Morgan, August 2024)

Global X Asia Semiconductor ETF (3119 HK)

Industry Update

DDR4 memory prices surge 80% amid supply cuts

As major players like Samsung and Micron scale back DDR4 production, driving prices up in recent weeks, rumors that a leading Chinese DRAM maker plans to phase out DDR4 production have sent spot prices soaring even higher, according to Nikkei. (Nikkei, 28 June 2025)

UMC Reportedly Eyes Southern Taiwan Facility for Advanced Packaging Expansion Beyond Singapore

Taiwan’s second-largest foundry, UMC, is stepping up its efforts in advanced packaging. According to a report from Commercial Times, sources say the company is considering acquiring the facility of TFT-LCD panel maker HannStar in the Southern Taiwan Science Park, which could be used to develop future advanced packaging capacity. (Trendforce, 20 June 2025)

TSMC’s 2nd Arizona Fab Reportedly to Install 3nm Gear in 3Q26, U.S. Price Hikes Likely over 10% Next Year

As part of its fast-tracked U.S. expansion, TSMC’s second Arizona fab (P2) is set to begin equipment installation as early as Q3 2026, with mass production slated for 2027, according to Commercial Times

The report highlights TSMC’s push to compress construction into just two years, with the supply chain anticipating an even faster timeline to meet customer demand and navigate U.S. tariffs. Notably, analysts cited in the report also expect TSMC to raise wafer prices by another 3–5% in 2026 to offset rising construction costs, with price hikes at U.S. fabs potentially exceeding 10%. (Trendforce, 30 June 2025)

Stock Comments

SK Hynix +45.19%: Nvidia provided solid guidance which eased investors’ concerns on AI demand. SK hynix stands to benefit as the exclusive supplier of 12H HBM3E for the Blackwell Ultra. In addition, SK hynix could further strengthen its HBM lead, as the report suggests its HBM4 will power NVIDIA’s next-gen AI chip, Rubin, set for a Q3 launch. (Business Post)

TSMC +12.34%: Overall sentiment improvement on semiconductor cycle. Chairman and chief executive CC Wei said the artificial intelligence business would remain “very strong.””Our revenue and profit this year will set new historical highs,” he told the company’s annual shareholders meeting. With AI demand “very high,” the company was trying to “increase production capacity to satisfy our customers,” Wei said. But he denied reports that the company was planning to build factories in the Middle East.

Preview

Increasing AI adoption in the data centre and increasing penetration of AI at the edge and on-device will be the key enabler of next upcycle semiconductor as AI-enabled devices have much higher semi-content. We expect volume growth in end devices to drive broad-based semiconductor cycle recovery in 2025. (Mirae 2025)

Global X India Select Top 10 ETF (3184 HK)

Market Update

The MSCI India Index was up 3.22% in USD terms in June (Index dividend yield is not equivalent to yield/return of the fund. Positive index dividend yield does not mean positive return), driven by the outsized policy rate cut and liquidity injection by the Reserve Bank of India, a de-escalation of tensions in the Middle East, a cooling of oil prices and a modest appreciation in INR.

Domestic demand-based high-frequency data for June showed a similar picture to the previous month, with a mixed but gradual overall improvement. The Manufacturing PMI reached a 14-month high of 58.4, and the Services PMI climbed to a 10-month high of 60.4 in June. GST collections grew by 6.2%yoy, reaching INR 1.85 trillion, while central government capital spending softened to INR 616bn in May, growing at 38.7%yoy. Credit growth increased to 9.6%yoy in June, up from 9% in May. Vehicle registrations growth moderated, while air passenger traffic continued to grow at a healthy rate, reflecting resilient consumer sentiment.

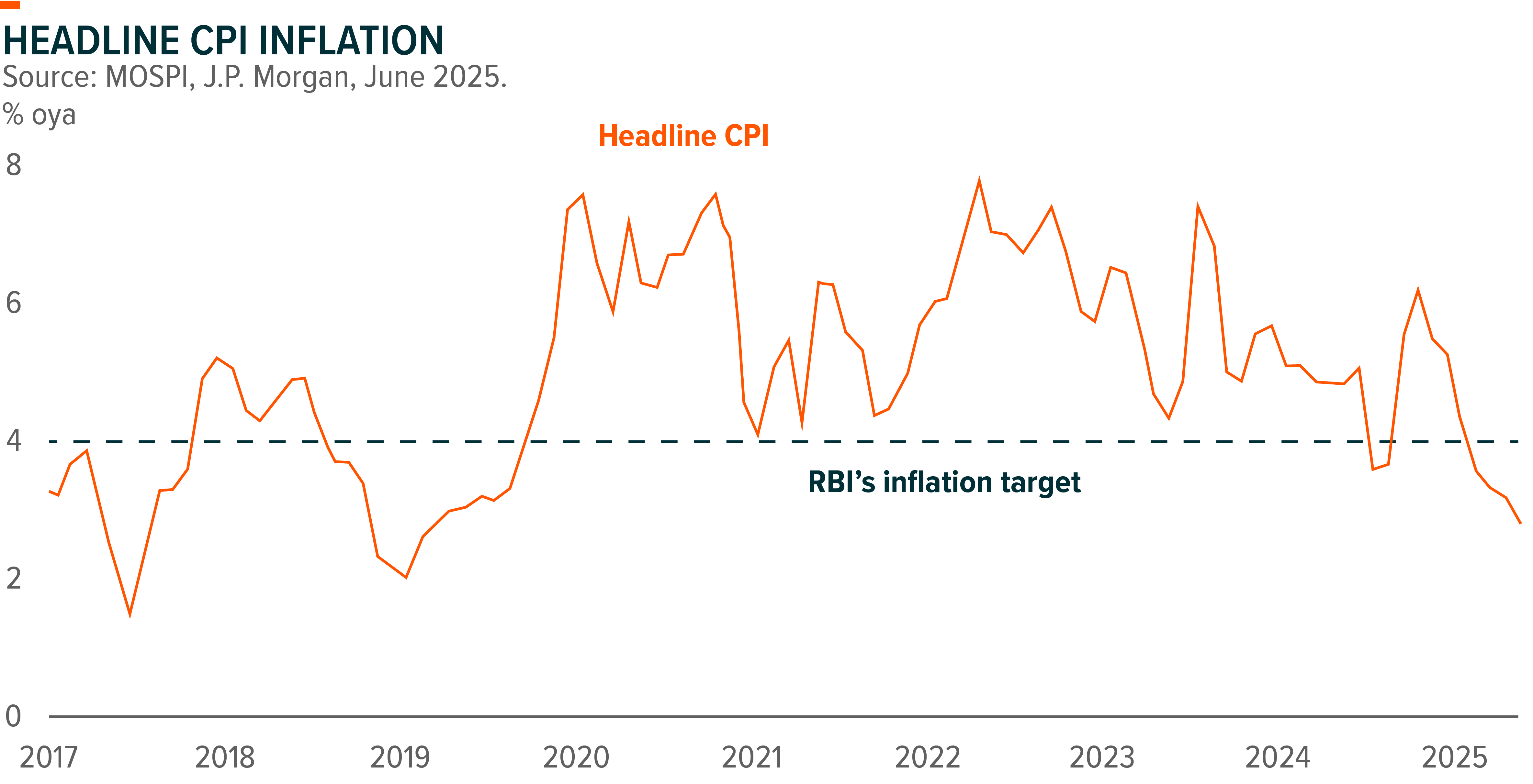

May CPI came in below expectations, at 2.8%yoy down from 3.2%yoy in April. This unexpected drop was mainly driven by food prices, which fell for the fifth consecutive month, particularly in vegetable prices. Food inflation eased to 1.5%yoy in May, marking the lowest rate in six years, down from 5.7%yoy in January. June CPI is also following a similar trend, suggesting potential downside risks to the RBI’s CPI forecast of 3.7%yoy for FY26.

Indian equity flows from foreign institutional investors continued buying this month and bought USD 2.3 billion in June (vs. USD +1.7 billion in May), and domestic institutional investors remained their buying trend for the 23rd consecutive month by net buying USD 8.1 billion during the same period (vs. USD + 7.9 billion in May).

Stock Comments

Bharti Airtel (BHARTIIN) was the major contributor in June as Bharti Airtel along with Reliance Jio are expected to gain further market shares and sustain their robust growth in 1QFY26. The street expects India revenue growth of +16%yoy and consolidated revenue growth of +17%yoy with Africa business growing +18%yoy and EBITDA growth of over 20%yoy. Bharti Airtel is expected to show another year of steady growth while offering defensiveness due to the nature of its business..

Hindustan Unilever (HUVR IN) was the major detractor in June due to its ongoing lack of growth. The overall demand for FMCG products has remained weak, leading to expectations of subdued volume growth in the near term. In addition, price hikes appear challenging in the current environment of lower input costs. Furthermore, competition has intensified across various categories, particularly with the rise of e-commerce and quick commerce, which have provided consumers with easy access to new and emerging brands.

Preview

While global macro uncertainties remain, we expect India’s domestic growth to recover over the coming quarters, supported by easing monetary policy and improved fiscal spending, moderate inflation, and recovery in consumption. This suggests a buoyant outlook for the Indian equity markets, and we believe these conditions will be conducive to capitalizing on potential growth opportunities during this fiscal year in India. We remain constructive on India market.