Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Little Giant ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies which may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies which are characterised by relatively higher volatility in price performance. The Sub-Fund may be exposed to risks associated with different sectors and themes including semiconductor, industrial, pharmaceutical, energy and technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Sub-Fund. Some of the companies classified as the Little Giants have a relatively short operating history. Such companies also face intense competition and rapid changes could render the products and services offered by these companies obsolete, which may have an adverse effect on profit margins. They may be more susceptible to risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences affecting those companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility. Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

Monthly Commentary

China Thematic ETFs – June 2025

Global X China Electric Vehicle and Battery ETF (2845)

Industry Update

- Solid May EV Sales: According to CPCA estimates, May NEV wholesale sales volume was 1.24mn, +38% YoY. By individual brand, BYD reported April NEV PV sales of 382k units, +15% YoY and +1% MoM. Overseas sales remain the bright spot with record high 89k units (+13% MoM), with YTD overseas sales more than double YoY, while domestic sales growth was relatively lukewarm (Citi, Company data, June 2025). Xpeng recorded YoY sales growth of +270% YoY, XPeng’s MONA Max and upcoming new model launches could further expedite sales growth. Li Auto sold 40.9k units in the month, +17% YoY. Xiaomi delivered over 28k units in May, and is preparing for YU7 SUV mass production in July. (for reference only, abovementioned stocks are not necessarily in the constituent list of the ETF).

- BYD price cut sparks fears of intensified price competition: BYD announced price cuts of 10%-30% on 22 models on 23 May, leading to c.10% share price decline in the following 2 days. This move sparks market concerns on the prolonged price competition in the EV industry which affects profitability of OEMs. We note that the discount includes national trade-in subsidies and the impact could be less than the headline suggested, and impact on BYD profitability could be manageable. However, the potential following of peers could further dampen the profitability outlook for the EV industry.

- Battery material costs remained low: Battery grade lithium carbonate price was Rmb63.6k/ton, -2.9% wow, -41%/-22%/-17%/-16% vs. average of 2Q24/3Q24/4Q24/1Q25. (Goldman Sachs, June 2025) Battery materials prices have decreased by over 80% from its peak in 2022, supporting the continued cost optimization for battery makers and EV manufacturers.

Stock Comments

- BYD recorded loss of 0.2% in May, a detractor to the ETF. BYD announced price cut of Rmb12-40k on 22 models, to be financed by corporate and dealers. The decline of domestic market share for BYD over the past months could be the trigger of price cut, while its overseas sales are tracking ahead of its targets. Though the price cut impact on BYD could be manageable, the cut dampens sentiment across the sector as investors are concerned on the potential following of peers will further depress profitability of the sector.

- Li Auto recorded return of 15% in May, a contributor to the ETF. The company reported better than expected 1Q25 results with net profit of Rmb650mn, +10% YoY. Vehicle GPM of c.20% is also higher than market expectation thanks to cost reduction effort and pricing strategy changes. The company guided 2Q25 delivery of 123-128k units. The company will launch its first BEV SUV in July, which could support its sales growth in 2H.

Preview

We remain positive on the long term growth potential for EV and battery value chain, along with the upward EV penetration trajectory. Domestic old car replacement demand, as stimulated by scaled-up auto trade-in program (which has been extended in 2025), together with export sales, should support China’s resilient auto momentum and benefit leading domestic brands. We expect the China auto market to stay competitive with strong new product line-up and technology innovations from leading EV and battery brands, and new entrants such as Xiaomi. BYD’s launch of God’s Eye ADAS in mass market model should accelerate smart driving adoption in China. Geopolitical tensions remain the key risks, but China EV models will still remain competitive under new tariff landscape thanks to its cost advantages. Localized production will be the longer term solution for Chinese brands.

Global X Hang Seng TECH ETF (2837)

Industry Update

Global X Hang Seng TECH ETF (2837 HK) recorded positive return in May. US-China trade deal boosted the market in May, recovering the majority of losses since Liberation date tariff announcement. Additionally, the successful dual-listing of CATL in Hong Kong market also supported market sentiments. Several large cap technology companies reported generally upbeat 1Q results, but were showing concerns over domestic consumption recovery. A new round of price cut initiated by BYD sparked concerns over prolonged EV price competition, leading to sell off in the sector. But we continue to expect leading domestic EV brands to gain share, and could maintain a relatively stable margin thanks to vertical integration and economics of scales. With a clear change in policymaker stance, the gradual rollout of stimulus policies could support a revived consumer sentiments that will benefit sectors including ecommerce, advertising, EV, and 3C electronics. Online gaming sector remains less macro-dependent and continued to record solid revenue supported by high quality games.

Stock Comments

- NetEase recorded 15% return in May, a positive contributor to the ETF. NetEase reported solid 1Q25 results, with game revenue up 15% YoY and OP up 34% YoY. Its legacy games are showing signs of bottoming out, newly launched titles are recording strong grossings, and PC game revenue further accelerated. Gaming revenue growth outlook is good from 2Q onwards due to easier comps last year.

- BABA reported loss of 3% in May, a detractor to the ETF. The company reported solid 4Q FY3/25 results, with 18% YoY cloud revenue growth and 12% YoY CMR revenue growth. CAPEX of Rmb24.6bn fell short of market expectation, leading to negative share price reaction after the results

Preview

Hang Seng Technology Index constituents are well positioned to benefit from the policy stimulus by central government. We see unique positioning of Hang Seng Tech thanks to its attractive valuation, ongoing margin expansion, and continued ramp up in shareholder returns. With well-established ecosystem containing large user base and leading technology in place, we see further upside potential for these leading technology companies coming from the rapid development of structural growth themes such as EV, Semiconductor and AI in China

Global X China Clean Energy ETF (2809)

Industry Update

In the first four months of 2025, China added 140.5GW of power capacity, up 58.2% yoy, including 104.9GW and 20.0GW of solar and wind power. Newly installed solar was 45.2GW in April (including 32GW distributed) driven by the rush installation ahead of the policy node on April 30. Investment in power generation capacity and power grid was Rmb193bn and Rmb141bn during the same reporting period, up 1.6%yoy and 14.6%yoy, respectively. National power consumption was up 3.1%yoy in January-April2025, vs. 9.0%yoy growth recorded in January-April 2024, owing to a leap day in 2024 and weaker residential demand amid warmer temperatures in 1Q25.(Morgan Stanley, June 2025)

China Electricity Council (CEC) maintains its full-year forecast of 6% YoY growth, 1% higher than GDP growth target. The new addition power generation capacity will exceed 450GW, in which 300GW are renewables.

Stock Comments

- Goldwind Science & Technology Co. Ltd. Class A: China offshore wind installation is accelerating. The company also benefits from wind exports to ASEAN and European countries.

- China Yangtze Power Co., Ltd. Class A: Sector rotation to play defensive amid the uncertainties of US tariff.

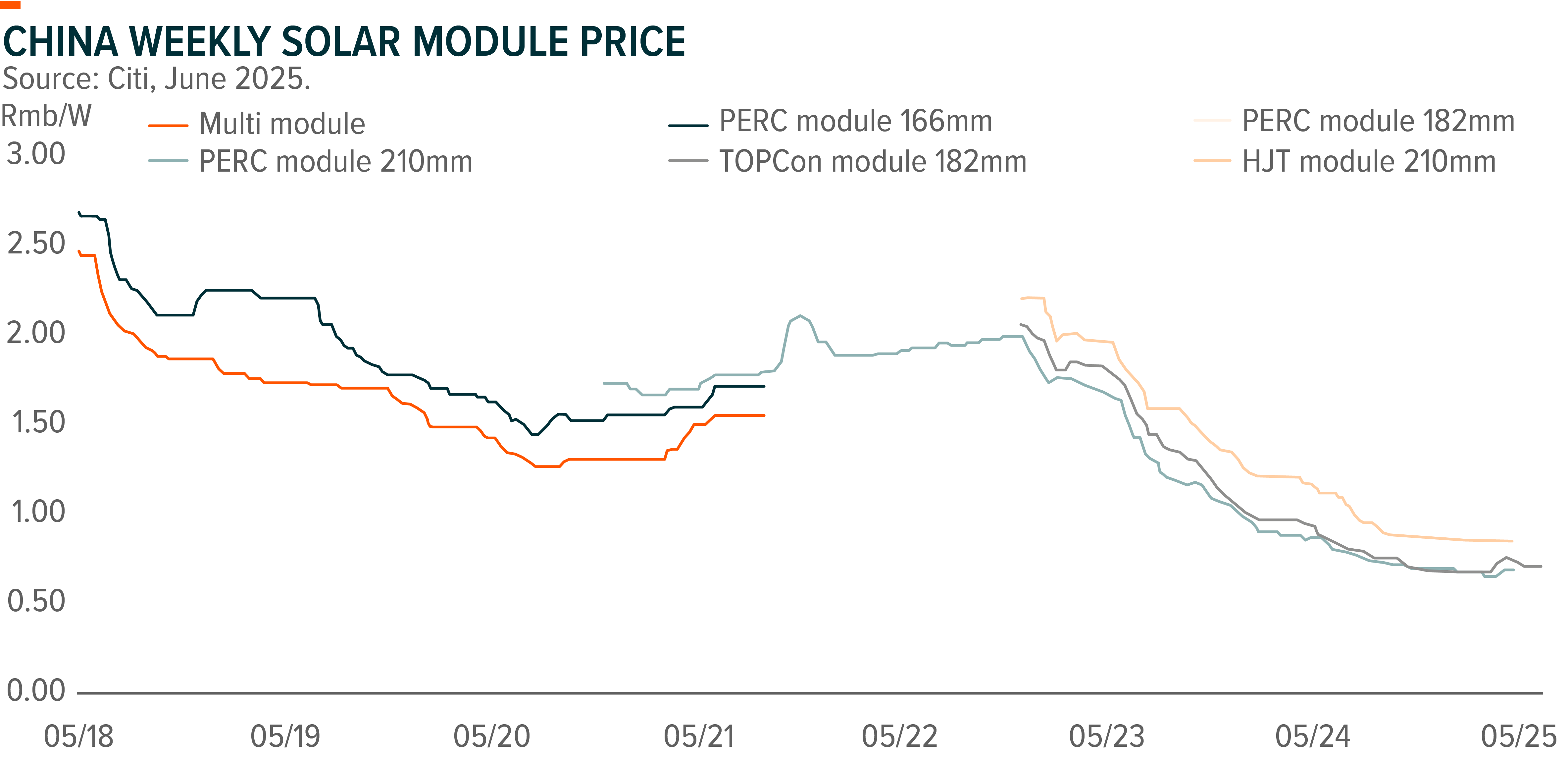

- LONGi Green Energy Technology Co., Ltd. Class A: Supply side reform are not yet to work given soft prices along solar value chain. We didn’t see the inflection point in the near term, though demand remains strong

Preview

China solar power installation is stronger than expectation, partially owing to front loading before June 2025. We expect a modest growth rate for the European solar power market, mainly because the residential solar demand slowed down for the decreasing ROI as electricity prices normalized and the impacts of the energy crisis faded. China’s supply-side policies on solar may take more time to play out, despite the worst time behind. We are constructive on China’s wind equipment exporting for better profitability from exporting. We remain constructive on the global clean energy growth and the trend of energy transition, just staying cautious about the near-term broad mismatch between supply and demand.

Global X China Consumer Brand ETF (2806)

Industry Update

The Dragon Boat Festival holiday data came in line. During the three-day holiday, data from the Ministry of Culture and Tourism showed a 5.7% increase in total domestic tourists and a 5.9% rise in domestic tourism receipts YoY, indicating a flat spending per person. This growth trend is similar to the tourism performance during the May 2025 Labor Day holiday, which saw a 6.4% increase in tourist numbers and an 8.0% rise in tourism receipts.

While investor sentiment toward China’s consumer sector remains cautious, interest in new economy stocks continues to be strong. Pop Mart remains the top favourite among these names, consistently attracting investor attention.

Stock Comments

- Li Auto (LI US): Li Auto recorded 15% return in May. Li Auto reported 1Q25 results with GAAP net profit beating consensus mainly on stronger vehicle sales. The company guided 2Q25 delivery of 123-128k units, with stable vehicle prices. Li Auto’s premium vehicle lineup allows it to avoid intense price competition faced by mass-market brands. Additionally, the company aims for overseas sales to constitute approximately 30% of total volume in the long term.

- Galaxy Entertainment (9992 HK): Galaxy achieved 18% return in May. The company reported a consolidated EBITDA of HK$3.3bn in 1Q25, up 1.8%/16% QoQ/YoY. This is supported by better VIP hold but partially offset by weaker mass hold rate. Despite macroeconomic uncertainties stemming from US-China geopolitical tensions, company’s GGR market share remained robust at ~20% QTD, compared to 19.7% in 1Q25. Looking ahead, management expects the newly-opened Capella Hotel, with its larger suites, personalized services and new gaming areas, to help expand market share.

- Giant Biogene (2367 HK): Giant Biogene experienced 13% loss in May as the company was criticized by the well-known beauty influencer “Dr. Big Mouth”(大嘴博士). The influencer accused the company’s flagship product, Kefumei’s recombinant collagen one-time essence, of containing less recombinant collagen than advertised and questioned the absence of glycine, an essential component of collagen protein. This triggered a sharp selloff in the stock. The ongoing debate between Giant Biogene and Dr. Big Mouth continues to intensify, adversely affecting the company’s sales during the 618 shopping festival.

Preview

We believe policy stimulus remains key to enhancing consumer sentiment and bolstering stock performance for China consumer in 2025. During the Two Sessions, consumption was reaffirmed as a primary policy focus, and the introduction of the Special Action Plan to boost consumption underscores this commitment. Amid escalating trade tensions, China government may accelerate the pace and scale of these policies. We expect that macroeconomic recovery, supported by policies and the stabilization of the property market, presents the largest upside potential for China consumer sector in 2025. Among subsector, we favour those that are directly targeted by stimulus policies, such as home appliance and EV under extended consumer goods trade-in programs, as well as sectors sensitive to macroeconomic changes, such as Baijiu, catering and beverage.

Global X China Robotics and AI ETF (2807)

Industry Update

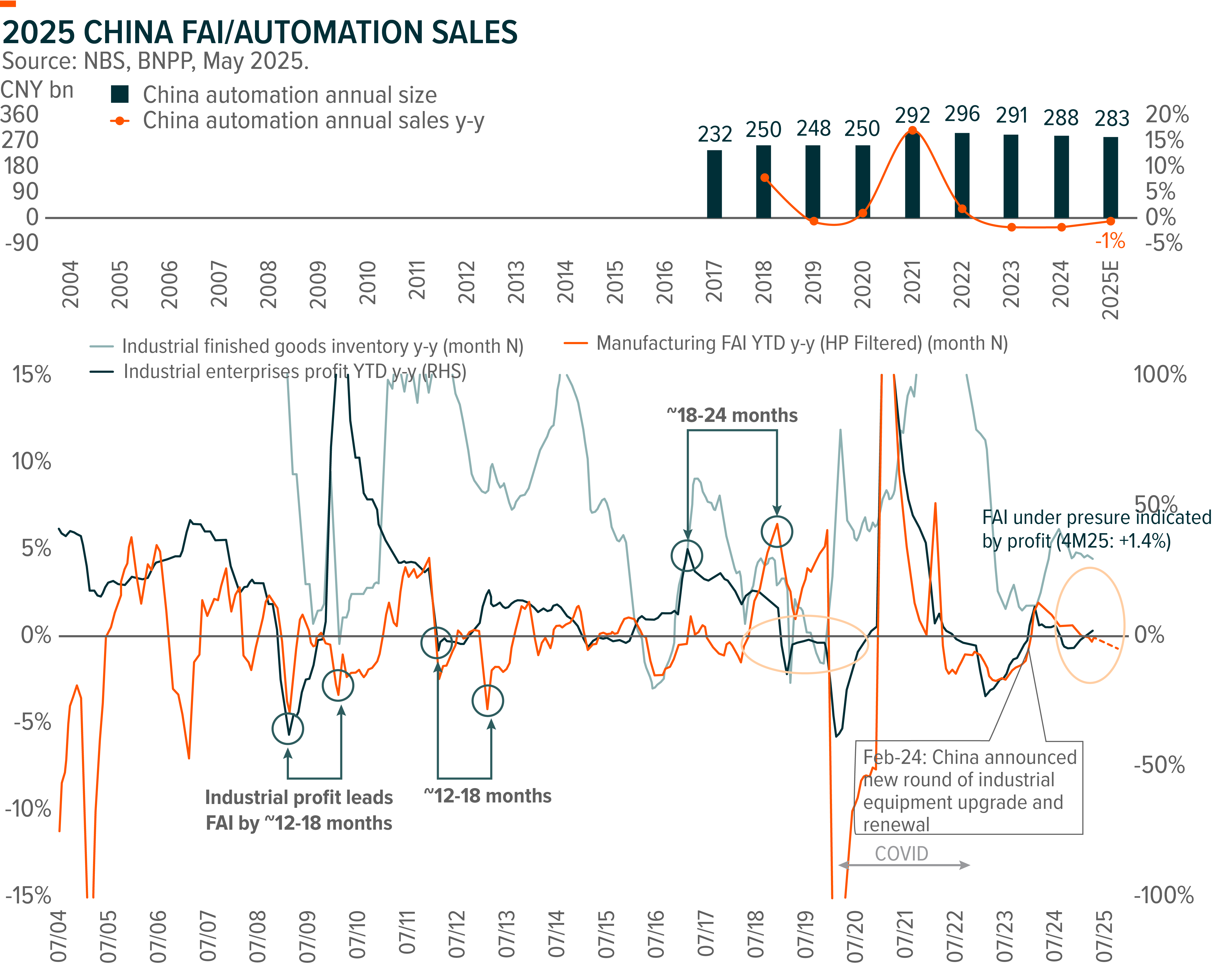

The strong momentum of China automation continued in April, with new orders up by 27.9%yoy, further accelerating after 12 consecutive months of year-over-year growth since April 2024. Japan machine tool manufacturers also confirmed benefits from China government’s subsidy policies on equipment renewal /upgrade since 2Q24. Chinese machine tool manufacturers’ new orders and order backlog caught up with Japan peers in 1Q25 (+22.7%yoy and 20.2%yoy respectively, accelerated from +5.5%yoy and +8.7%yoy in 2024). In the meanwhile, China’s industrial enterprise profit increased by 1.4%yoy in the first four months of 2025 vs -3.3%yoy in 2024. Industrial finished goods inventory growth also slowed to 4.4%yoy during the same reporting period vs 4.8%yoy in 2024, which together seemed to show signs of China automation sector bottoming out. (JPM, NBS, June 2025)

Chinese robotics companies are focusing on commercialization at the existing phase of development, as China’s sophisticated manufacturing supply chain offers a rich landscape for manufacturing user-case scenarios, and data quality for robot training. The future of robotics, particularly in warehousing and humanoid applications, is poised for significant growth. The industry is moving towards developing lightweight, flexible and easily deployable robots that can enhance operational efficiency and reduce costs.

Stock Comments

- Pony AI Inc. Sponsored ADR: The company is teaming up with Uber to provide driverless taxis in the Middle East regions.

- WeRide Inc. Sponsored ADR: Similarly as Pony AI, WeRide is also partnering with Uber to offer robotaxi services beyond China and the United States.

- Shenzhen Zhaowei Machinery & Electronic Co., Ltd. Class A: Investors take profits before seeing meaningful delivery of humanoid robots in the near term.

Preview

China’s FAI in advanced manufacturing and technology have been strong despite the overall economy slowdown. Robotics, AI and automation are one of the key beneficiaries from both the government’s stimulus measures in the near term and the economy transition goal in the long run. We are waiting to see some meaningful delivery from the current robotics companies in the coming twelve months,

Global X China Little Giant ETF (2815)

Market Update

Global X China Little Giant ETF experienced a loss in May. China A-Share market benefited from the abundant domestic liquidity with PBoC cutting policy rates and RRR on 8 May, and eased concerns over geopolitical tensions following the better-than-expected US-China trade deal, which could continue to support the market in June. We expect the continued US-China trade tension uncertainty might strengthen policy support to enhancing supply chain upgrades and achieving self-sufficiency. We still expect promoting emerging industries to climb up technology tree and supporting domestic substitution remain policies priorities in 2025. Therefore, these specialized and sophisticated SMEs play a crucial role in China’s transition to high quality development.

As a high-quality, small-cap fund, Global X China Little Giant ETF is likely to benefit from government’s supportive policies on tech innovation and may outperform large-cap funds if the economy turns to strong recovery in 2025.

Stock Comments

TFC‘s sequential revenue growth has flattened over the past few quarters as customers’ 800G demand stabilized while 1.6T ramp has not reached meaningful scale yet.

With increasing ASIC GPU expectation recently from Computex, demand for 800G transceiver next year will be uplifted, along with increase of revenue contribution of 1.6T starting from 2H25.

Moreover, with upgrade of overseas cloud infrastructure from 100G/200G/400G to 800G, this replacement cycle will likely sustain until 2027, which could be better than market expected.