Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X China Electric Vehicle and Battery ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Electric Vehicle and Battery Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Clean Energy ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Clean Energy Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Consumer Brand ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Consumer Brand Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Robotics and AI ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet China Robotics and Artificial Intelligence Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X Hang Seng TECH ETF (the “Fund”) is to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index.

- The Fund is exposed to concentration risk by tracking a specific regions or countries.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X China Little Giant ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index.

- The Fund is exposed to concentration risk by tracking a single regions or countries.

- The Fund may invest in small and/or mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Monthly Commentary

China Thematic ETFs – August 2025

Global X China Electric Vehicle and Battery ETF (2845)

Industry Update

– Divergent July EV Sales: According to CPCA, July NEV wholesale sales volume was 118mn, +24% YoY. By individual brand, BYD reported July NEV PV sales of 341k units, flat YoY and -10% MoM. Overseas sales fell 10% MoM to 81k, but YTD volume remain on track for 1mn target this year. Xpeng recorded YoY sales growth of +229% YoY to 36k, with MONA exceeding 15k. Upcoming new launches include new P7 Launch on 6 August and VLA smart driving. Li Auto sold 30.7k units in the month, -40% YoY. Xiaomi delivered over 30k units in July as the company starts to deliver the new YU7 BEV SUV. (for reference only, abovementioned stocks are not necessarily in the constituent list of the ETF).

– Anti-involution in EV sector: Since early July, a number of policies aiming to address involution in EV sector have been mentioned by regulators and industry associations, including the building of quality driven unified national market by Central Commission for Finance & Economic Affairs, and the calling for restrictions on “zero-mileage used car” by The China Passenger Car Association (CPCA). On central government level, MIIT, the State Council, the NDRC, and the State Administration for Market Regulation also conducted multiple meetings to address the involution issues in EV industry. Price competition remains a key concern in the sector and the anti-involution campaign

– Battery material costs remained low: Battery grade lithium carbonate price was Rmb73k/ton, flat wow, -10%/-5%/-4%/+11% vs. average of 3Q24/4Q24/1Q25/2Q25.(Goldman Sachs, July 2025) Battery materials prices have decreased by over 80% from its peak in 2022, supporting the continued cost optimization for battery makers and EV manufacturers.

Stock Comments

CATL recorded 5% return in the month, a key contributor to the ETF. CATL reported better than expected 2Q results, with record high net profit driven by overseas expansion with market share gains in Europe. CATL achieved battery sales volume of 150GWh in 25Q2, implying stable unit profit of Rmb110/kWh.1H25 capacity utilization increased to 90%, and management guided 2025E CAPEX to be 30% higher YoY.

Preview

We remain positive on the long term growth potential for EV and battery value chain, along with the upward EV penetration trajectory. Domestic old car replacement demand, as stimulated by scaled-up auto trade-in program (which has been extended in 2025), together with export sales, should support China’s resilient auto momentum and benefit leading domestic brands. Anti-involution campaign by the government could potentially improve the pricing environment. We expect the China auto market to stay competitive with strong new product line-up and technology innovations from leading EV and battery brands, and new entrants such as Xiaomi. BYD’s launch of God’s Eye ADAS in mass market model should accelerate smart driving adoption in China. Geopolitical tensions remain the key risks, but China EV models will still remain competitive under new tariff landscape thanks to its cost advantages. Localized production will be the longer term solution for Chinese brands.

Global X China Clean Energy ETF (2809)

Industry Update

– Renewables sectors play at the bellwether for the anti-involution reform in China in the last month, due to its substantial overcapacity, large overseas exports and significance in global energy transition. Chinese polysilicon makers are planning to set up a fund to retire production units of the key element used for solar panels. The fund size would be billion yuan to acquire and shut down a meaningful amount of polysilicon capacity. On August 1st, the Ministry of Industry and Information Technology also released the Notice on Issuing the 2025 Special Energy Conservation Supervision Task List for the Polysilicon Industry “关于印发2025年度多晶硅行业专项节能监察任务清单的通知” (“the “Notice”), which required local governmental authorities to promptly organize and implement the requirement in the Notice and submit the supervision results by the end of this September. The task list covers 41 polysilicon production entities in 12 provinces of China. We have witnessed polysilicon prices rebound significantly in the last one month as a result.

![]()

Stock Comments

LONGi Green Energy Technology : China is pushing anti-involution in solar sector to reduce overcapacity and loss-making. People expect Longi would be one of the key beneficiaries despite weak fundamentals right now.

Sungrow Power Supply : Similar as Longi for anti-involution. Additionally, the European market destocking of solar inverter is close to the end.

China Yangtze Power: Sector rotation when investors are taking profits.

Preview

China has added a record-high solar installation in May, which suggests the demand slowdown in the next few months and the oversupply issue further worsening without any intervention. Thus, the top-down anti-involution reform is critical right now to assist industry self-discipline and sustainable growth. 2026 is the first year of the fifteenth five-year plan. We expect renewable installation may not decelerate on the back of China’s power consumption growth in the long term, driven by electrical vehicles, residential demand, data center and industrial/manufacturing demand.

Global X China Consumer Brand ETF (2806)

Industry Update

According to National Bureau of Statistics of China, China Retail sales growth in June 2025 moderated at 4.8% YoY growth (vs. +6.4% YoY in May), below market expectations; this slowdown was broad-based across most categories. While CPI returned to positive territory during the month, primarily driven by a rebound in industrial consumer goods prices, the overall consumer spending momentum appears to be softening.

Market dynamics have shifted in July, with sector rotation from China consumer and new economy stocks towards higher-beta themes like AI and anti-involution. Within the consumer sector itself, new consumption heat cooled down during the month, while investors focus has pivoted to 2Q earnings, politburo policy on birth subsidies and broad consumption data.

Stock Comments

– Nongfu Spring (9633 HK): Nongfu Spring achieved 14% return in July. Management reaffirms confidence in achieving double-digit YoY sales growth for 2025. In packaged water, market share has risen sequentially MoM YTD, though it remains below 2023 levels. Given Wahaha’s recent negative publicity—including inheritance disputes and governance scrutiny—Nongfu is poised to accelerate its water business recovery in 2H25. Its robust growth in tea and functional beverages is expected to persist through 2H.

– Galaxy Entertainment (9992 HK): Galaxy Entertainment recorded 11% return in July. Macau GGR grew 8% YoY in 2Q25 (vs 1Q25 at 1% YoY) and accelerated to 19% YoY in June/July, beat market consensus. The is mainly driven by easier visa issuance with mainland visitation +25% YoY in 2Q25, a packed schedule of concerts featuring top Asian artists, and resurgent junket activity. Galaxy gained market share during the quarter, benefiting from newly operational capacity at Capella and its hosting of major events like the Jacky Cheung concert series at Galaxy Arena.

– New Oriental Education & Technology (EDU US): New Oriental experienced 18% loss in July. 4QFY25 results beat, but its revenue guidance of +2–5%/5-10% YoY in 1QFY26/FY26 missed market expectations. The decline in overseas business demand is expected to negatively affect both revenue and margins in FY26, and it remains uncertain whether management’s cost-control efforts will be sufficient to mitigate this adverse impact.

Preview

We believe policy stimulus remains key to enhancing consumer sentiment and bolstering stock performance for China consumer in 2025. During the Two Sessions, consumption was reaffirmed as a primary policy focus, and the introduction of the Special Action Plan to boost consumption underscores this commitment. Amid escalating trade tensions, China government may accelerate the pace and scale of these policies. We expect that macroeconomic recovery, supported by policies and the stabilization of the property market, presents the largest upside potential for China consumer sector in 2025. Among subsector, we favour those that are directly targeted by stimulus policies, such as home appliance and EV under extended consumer goods trade-in programs, as well as sectors sensitive to macroeconomic changes, such as Baijiu, catering and beverage.

Global X China Robotics and AI ETF (2807)

Industry Update

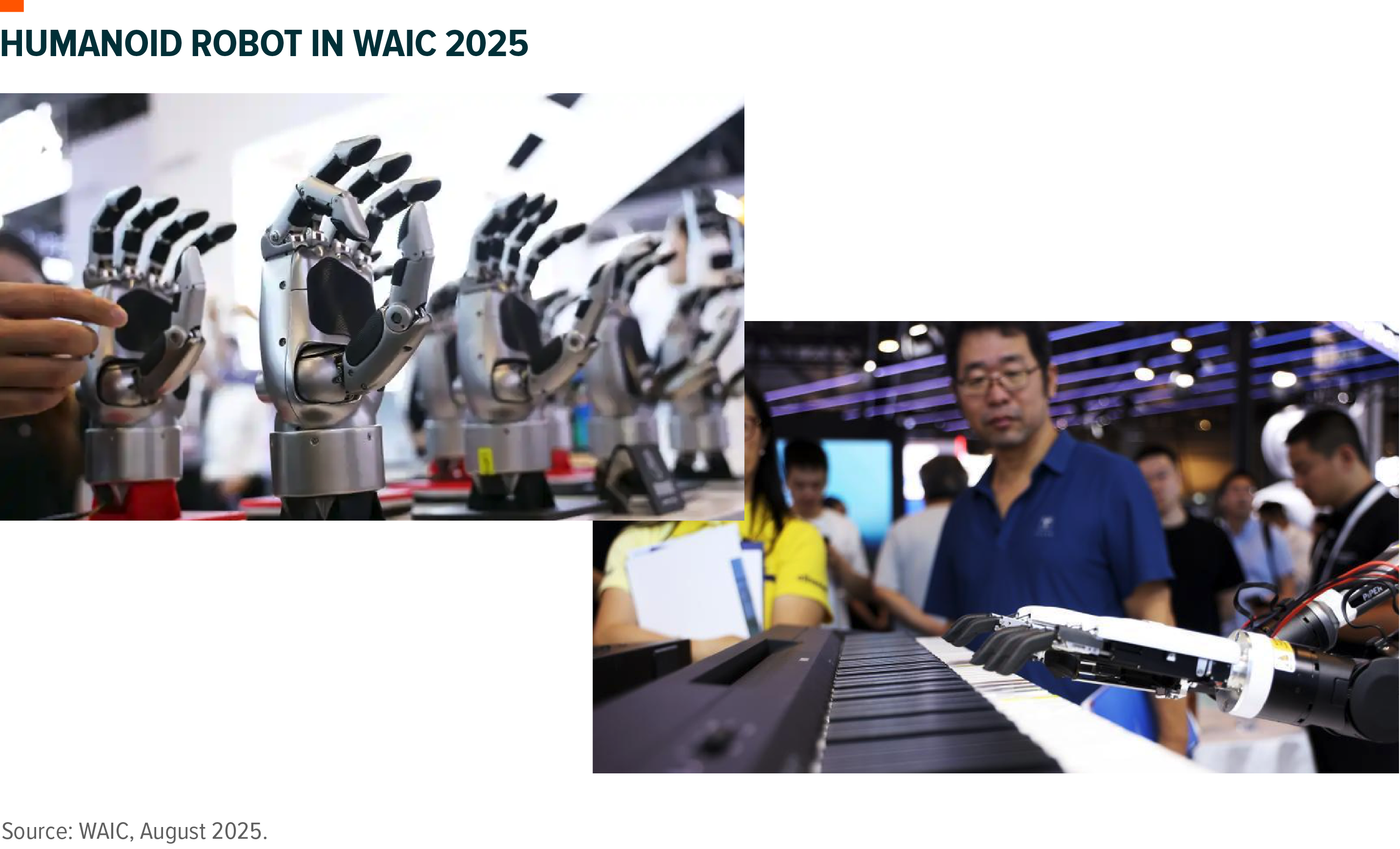

– Shanghai World Artificial Intelligence Conference (WAIC) 2025 presented AI in physical forms, including autonomous driving, smart cockpit, humanoid robot and their supply chains. There were 150+ humanoid robots on show, a historical high level, suggesting rapidly growing opportunities along the supply chain. We saw a number of new players, many of whom are start-ups and will compete with auto suppliers on actuator assembly, dexterous hands and limb structure, etc. We also witnessed more targeted and active exploration of application scenarios, spreading across manufacturing, warehouse and logistics, consumer and retail, family and elderly care, etc. Based on the talks with many companies in the humanoid supply chain, competition in some key components including reducer, motor, screw, sensor, sounded also intensified, which implies cost cutting faster than expected and monetization more visible.

Stock Comments

Horizon Robotics: The company’s shipment and margins are expected to improve in 2H25, thanks to more sales from key customers and increasing penetration to new automakers.

WeRide: WeRide is partnering with Uber to offer robotaxi services beyond China and the United States.

Shenzhen Inovance Technology: The company’s order intake was a little slowing down in June but accelerating in July again. Indeed, the company shared demand from logistics and heavy machines, lithium battery and autos, F&B and some traditional industries are solid in July.

Preview

China’s FAI in advanced manufacturing and technology have been stronger than expectation in early 2025. Robotics, AI and automation are one of the key beneficiaries from both the government’s stimulus measures in the near term and the economy transition goal in the long run. We expect the monetization of humanoid robots in industrial and residential scenarios may be accelerating from here. However, due to fierce competition and fast-innovating technology, it is yet to determine who will be the ultimate winners.

Global X Hang Seng TECH ETF (2837)

Industry Update:

Global X Hang Seng TECH ETF (2837 HK) recorded positive return in July. The proposed resumption of Nvidia H20 sales could sustain internet platform’s AI capex plan and supported share price for major internet cloud services providers. On food delivery side, while major platforms continue to invest in subsidy to gain share, central and local government are trying to step in and prevent the price competition from further escalating, as part of China’s anti-involution campaign. With a clear change in policymaker stance, the gradual rollout of stimulus policies could support a revived consumer sentiment that will benefit sectors including ecommerce, advertising, EV, and 3C electronics. Online gaming sector remains less macro-dependent and continued to record solid revenue supported by high quality games.

Stock Comments

Kuaishou recorded 22% return in the month, a key contributor to the ETF. Kuaishou’s Kling AI emerge as one of the best generative AI application in video space and continues to ramp up commercialization. Furthermore, Kuaishou’s advertising revenue growth could further accelerate starting from 2Q25 as driven by solid demand from sectors such as ecommerce and local services.

Tencent recorded 9% return in the month, a key contributor to the ETF. Nvidia announced resumption of H20 sales to China in mid-July, which boosted China AI sector sentiments. The resumption of H20 sales is positive for large cap internet cloud service providers as it sustains their CAPEX plan and revives market narratives around AI. Major internet platforms including Tencent rallied on the news. Furthermore, Tencent will launch Valorant Mobile on 19 August, which could be another major mobile title for the company.

Preview

Hang Seng Technology Index constituents are well positioned to benefit from the policy stimulus by central government. We see unique positioning of Hang Seng Tech thanks to its undemanding valuation, ongoing margin expansion, and continued ramp up in shareholder returns. With well-established ecosystem containing large user base and leading technology in place, we see further upside potential for these leading technology companies coming from the rapid development of structural growth themes such as EV, Semiconductor and AI in China.

Global X China Little Giant ETF (2815)

Industry Update

China A share market is supported by continuously improving liquidity, solid 2Q25 real GDP growth, and expanded policy support, both on the supply side (anti-involution) and the demand side. We still expect promoting emerging industries to climb up technology tree and supporting domestic substitution remain policies priorities in 2025. Therefore, these specialized and sophisticated SMEs play a crucial role in China’s transition to high quality development.

As a high-quality, small-cap fund, Global X China Little Giant ETF is likely to benefit from government’s supportive policies on tech innovation and may outperform large-cap funds if the economy turns to strong recovery in 2025.

Stock Comments

Zhejiang Changsheng Sliding Bearings Co., Ltd. (300718.SZ), a leading manufacturer of self-lubricating bearings. Share price rallied in July, driven primarily by spillover enthusiasm from developments in China’s humanoid robotics sector.

The key catalyst was the announcement that Unitree Robotics, a prominent maker of humanoid robots, had filed for IPO counseling with China’s securities regulator, signaling preparations for a potential public listing as early as later in 2025. As a core supplier to Unitree, Changsheng provides specialized self-lubricating bearings that are essential for the smooth operation and durability of robot joints, including in hip joint tests where its products demonstrated superior performance with minimal wear.