Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X Hang Seng TECH ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng TECH Index (the “Index”).

- The Fund’s investments are concentrated in companies with a technology theme. Technology companies are often characterised by relatively higher volatility in price performance. Companies in the technology sector also face intense competition, and there may also be substantial government intervention, which may have an adverse effect on profit margins. These companies are also subject to the risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences.

- The Fund’s investments are concentrated in securities listed on the Stock Exchange of Hong Kong (the “SEHK”) of companies that are active in technology sector may result in greater volatility in the value of the Fund than more diverse portfolios which comprise broad-based global investments. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the technology sector.

- The Index is subject to concentration risk as a result of tracking the performance of securities incorporated in, or with majority of revenue derived from, or with a principal place of business in, the Greater China region. The Fund’s NAV is therefore likely to be more volatile than a broad-based fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Fund unit (the “Unit”) on the SEHK is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- Global X China Clean Energy ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Many clean energy companies are involved in the development and commercialization of new technologies, which may be subject to delays resulting from budget constraints and technological difficulties. Obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions also significantly affect the clean energy sector.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Consumer Brand ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- The performance of companies in the consumer sector are correlated to the growth rate of the global market, individual income levels and their impact on levels of domestic consumer spending in the global markets, which in turn depend on the worldwide economic conditions, which have recently deteriorated significantly in many countries and regions and may remain depressed for the foreseeable future.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Robotics and AI ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Robotics and artificial intelligence sector is sensitive to risks including small or limited markets for such securities, changes in business cycles, world economic growth, technological progress, rapid obsolescence, and government regulation. These companies rely on significant spending on research and development and tend to be more volatile than securities of companies that do not rely heavily on technology.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- Global X China Little Giant ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies which may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies which are characterised by relatively higher volatility in price performance. The Sub-Fund may be exposed to risks associated with different sectors and themes including semiconductor, industrial, pharmaceutical, energy and technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Sub-Fund. Some of the companies classified as the Little Giants have a relatively short operating history. Such companies also face intense competition and rapid changes could render the products and services offered by these companies obsolete, which may have an adverse effect on profit margins. They may be more susceptible to risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences affecting those companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility. Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

Monthly Commentary

China Thematic ETFs – April 2025

Global X China Electric Vehicle and Battery ETF (2845 HK)

Industry Update

- Solid March EV Sales: According to CPCA estimates, March NEV wholesale sales volume was 1.14mn, +37% YoY. By individual brand, BYD reported February NEV PV sales of 371k units, +23% YoY and +17% MoM. Overseas sales remain the bright spot with record high 73k units (+9% MoM), and BYD announced Rmb10-16k discounts on 2024 Dynasty/Ocean models to bolster domestic sales. Xpeng recorded strong YoY sales growth of +268% YoY, and the company plans to unveil 4 new models in 2Q. Li Auto sold 36.7k units in the month, +27% YoY, as bolstered by recent discounts of L7/8/9. Xiaomi delivered over 29k units in March, and the company is confident to achieve its full year sales target of 350k units. (for reference only, abovementioned stocks are not necessarily in the constituent list of the ETF).

- Tariff updates: US announced 25% tariff on all imported vehicles to the US, but Chinese automakers should be relatively immune to this announcement due to minimum US exposure. However, other regions including EU and some emerging markets such as Brazil also announced additional tariffs on China EV imports over past few months, bringing tariff issues back to focus.

- Industry consolidation: Amid fierce competition, regulators urge for merges between SOE automakers. Further industry consolidation should bode well for profitability of leading Automakers.

- Battery material costs remained low: Battery grade lithium carbonate price was Rmb74.7k/ton, -1.1% wow, -27%/-30%/-8%/-3% vs. average of 1Q24/2Q24/3Q24/4Q24.1. Battery materials prices have decreased by over 80% from its peak in 2022, supporting the continued cost optimization for battery makers and EV manufacturers.

Stock Comments

- BYD recorded 4% return in March, a key contributor to the ETF. BYD reported in-line 4Q24 results during the month, with 4Q24 net profit of Rmb 15bn, +73% YoY. NP per car improved by 10% YoY to Rmb9.3k, suggesting relatively stable profitability despite industry competition thanks to BYD’s economies of scale. Overseas margins in 2H24 came in at 27%, 7ppts higher than domestic parts.

- Fuyao Glass recorded 4% return in March, a key contributor to the ETF. Fuyao Glass reported in-line 4Q24 results. 4Q24 revenue of Rmb11bn was +17% YoY, significantly outpacing global auto market, highlighting the global auto glass leader’s abundant order backlog. Fuyao Glass is benefiting from global auto electrification trend as its high value-added products could see accelerating adoption.

Preview

We remain positive on the long term growth potential for EV and battery value chain, along with the upward EV penetration trajectory. Domestic old car replacement demand, as stimulated by scaled-up auto trade-in program (which has been extended in 2025), together with export sales, should support China’s resilient auto momentum and benefit leading domestic brands. We expect the China auto market to stay competitive with strong new product line-up and technology innovations from leading EV and battery brands, and new entrants such as Xiaomi. BYD’s launch of God’s Eye ADAS in mass market model should accelerate smart driving adoption in China. Geopolitical tensions remain the key risks, but China EV models will still remain competitive under new tariff landscape thanks to its cost advantages. Localized production will be the longer term solution for Chinese brands.

Global X Hang Seng TECH ETF (2837 HK)

Industry Update

Global X Hang Seng Tech ETF (2837 HK) recorded positive return in March. Hang Seng TECH Index saw massive decline in early April after higher-than-expected US tariff announcement, but subsequently partially recovered losses as driven by hopes for supports from China regulators. AI theme continues to gain traction in Hong Kong market, with key players like Alibaba continue updating its AI initiatives. Major cloud providers are benefiting from increasing AI related demand, with Alibaba and Baidu both recorded accelerated cloud revenue growth, further supporting positive sentiments. We see more AI models emphasising cost efficiency, which should accelerate AI adoption and benefit software and internet companies. US tariff and escalating US-China geopolitical tensions under Trump presidency and policy supports for domestic chip development continue to drive the elevated sentiments on China semiconductor sector, leading to outperformance of leading domestic players like SMIC. With a clear change in policymaker stance, the gradual rollout of stimulus policies could support a revived consumer sentiments that will benefit sectors including ecommerce, advertising, EV, and 3C electronics. Online gaming sector remains less macro-dependent and continued to record solid revenue supported by high quality games.

Stock Comments

- Tencent recorded +4% return in March, a positive contributor to the ETF. Tencent reported solid 4Q24 results in the month. Revenue growth was +11% YoY as driven by solid games and advertising revenue. Adj. net profit grew by +30% YoY, higher than market expectation. Tencent also expects a significant step-up in AI-related Capex, and the company should be a key AI beneficiary in China through integration of AI with its Weixin ecosystem and core business such as gaming and advertising.

Preview

Hang Seng Tech Index constituents are well positioned to benefit from the policy stimulus by central government. We see unique positioning of Hang Seng Tech thanks to its attractive valuation, ongoing margin expansion, and continued ramp up in shareholder returns. With well-established ecosystem containing large user base and leading technology in place, we see further upside potential for these leading technology companies coming from the rapid development of structural growth themes such as EV, Semiconductor and AI in China.

Global X China Clean Energy ETF (2809 HK)

Industry Update

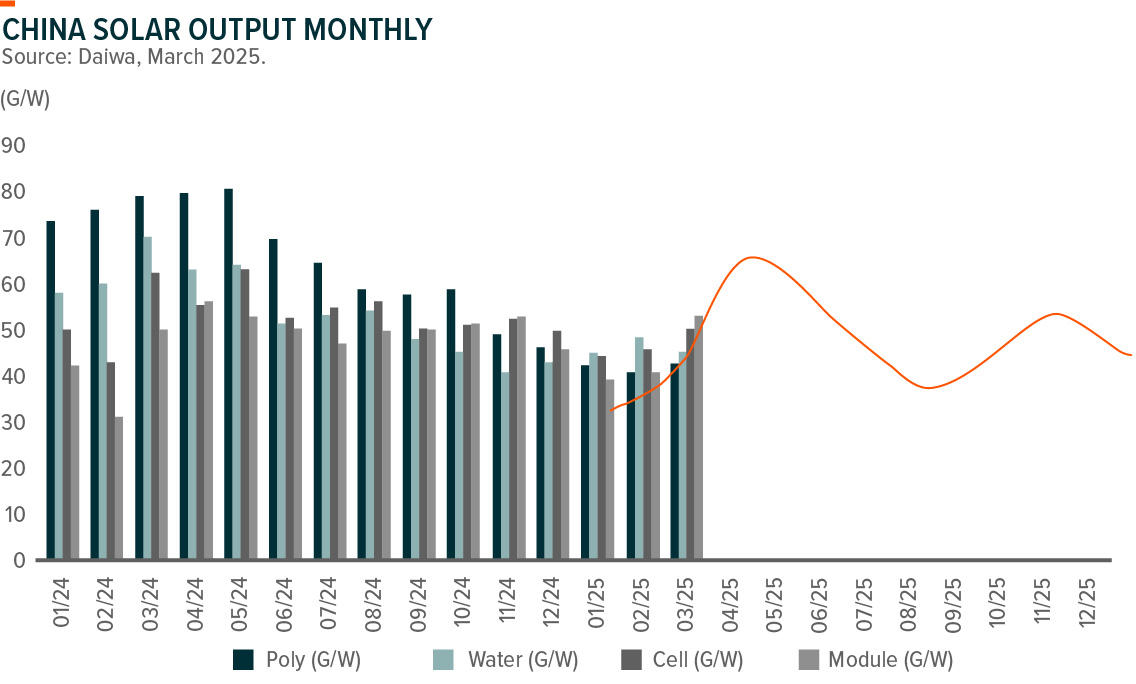

In 2M25, China solar installation remained strong of 39.5GW capacity addition, +7.5%yoy, while wind installation was 9.3GW, -6.2%yoy. Investors’ estimation for the whole year are now solar capacity up by 4%yoy growth to 290GW and wind up by 13%yoy to 90GW, respectively. Investment in power generation capacity/power grid was further accelerating to Rmb118.9bn/Rmb43.6bn in 2M25, +10.3%yoy/+33.5%yoy, respectively. China power demand increased by 1.3%yoy in the same reporting period, which was split as follows: 62% by industrial sector (+0.9%yoy), 19% by servicing sector (+3.6%yoy), 18% by residential sector (+0.1%yoy), and 1% by farming and fishing (+8.2%yoy). The weak demand was partially attributed to CNY festival impact.

The US imposed high tariff on China and ASEAN imports on April 2nd 2025, which would be limited impact on solar manufacturing considering the previous AD/CVD tariff rate on the ASEAN countries for solar capacity was already high and China module exports to the US was very limited.

Stock Comments

- Sieyuan Electric Co., Ltd. Class A: The company is the key beneficiary from power equipment exporting in 2024. Sales outside China would remain solid heading into 2025.

- China Yangtze Power Co., Ltd. Class A: Sector rotation to play defensive.

- LONGi Green Energy Technology Co., Ltd. Class A: Supply side reform are not yet to work given soft prices along solar value chain. We didn’t see the inflection point in the near term, though demand remains strong

Preview

China solar power installation is stronger than expectation, partially owing to front loading before June 2025. We expect a modest growth rate for the European solar power market, mainly because the residential solar demand slowed down for the decreasing ROI as electricity prices normalized and the impacts of the energy crisis faded. China’s supply-side policies on solar may take more time to play out, despite the worst time behind. We are constructive on China’s wind equipment exporting for better profitability from exporting. We remain constructive on the global clean energy growth and the trend of energy transition, just staying cautious about the near-term broad mismatch between supply and demand.

Global X China Consumer Brand ETF (2806 HKD)

Industry Update

On March 16, China government unveiled a Special Action Plan to boost consumption. The plan outlines key strategies to support consumer spending, addressing various aspects from demand—such as enhancing income and social security—to supply and creating a favorable consumption environment, including policies to promote specific categories and remove consumption restrictions. Notable areas of focus include home appliances (with a trade-in policy), products for infants and children, particularly dairy and infant formula (supported by childcare subsidies), sportswear (to encourage ice and snow-related activities), IP (promoting Chinese brands and consumption upgrades), and services such as travel and specialty catering. While market still awaits more details and further implementation of those policies, this marks an upgrade and innovation of China’s consumption policies.

Stock Comments

- Pop Mart (9992 HK): Pop Mart achieved 50% return in March thanks to its strong earnings. 2024 revenue beat, up 107% YoY, implying 4Q sales growth of 80%+ in China and 400%+ in overseas market, respectively. Looking ahead, the company uplifted its guidance and now expects revenue growth of 50%+ in 2025, with overseas growth expected to exceed 100%, reaching up to Rmb10bn (vs. Rmb1bn in 2023).

- Trip.com (TCOM US): Trip.com recorded 12% return in March, recovering from 21% loss in February. Recent travel data also showed positive trends: 1) OTAs are showing a solid recovery in business travel demand in China, outpacing the overall growth of the domestic travel market; 2) China’s outbound air pax (handled by Chinese airlines) increased by 33% YoY, reaching 102% of 2019 levels in 2M25; 3) during the Qingming Festival, domestic tourist numbers rose by 6.3% YoY, while tourism revenue improved by 6.7% YoY.

- Li Auto (Li US): Li Auto experienced 18% loss in March. 4Q24 results were in line with NP up 25% QoQ (-38% YoY). 4Q revenue rose by 3% QoQ, driven by 4% QoQ volume growth, which suggests a slight 1% dip in ASP. Company guided 1Q25 volume of 88-93k units, down 41-45% QoQ. Li Auto expects total revenue to decrease 44-47% QoQ in 1Q25, indicating another c.5% decline in ASP.

Preview

We believe policy stimulus remains key to enhancing consumer sentiment and bolstering stock performance for China consumer in 2025. During the Two Sessions, consumption was reaffirmed as a primary policy focus, and the introduction of the Special Action Plan to boost consumption underscores this commitment. Amid escalating trade tensions, China government may accelerate the pace and scale of these policies. We expect that macroeconomic recovery, supported by policies and the stabilization of the property market, presents the largest upside potential for China consumer sector in 2025. Among subsector, we favour those that are directly targeted by stimulus policies, such as home appliance and EV under extended consumer goods trade-in programs, as well as sectors sensitive to macroeconomic changes, such as Baijiu, catering and beverage.

Global X China Robotics and AI ETF (2807 HK)

Industry Update

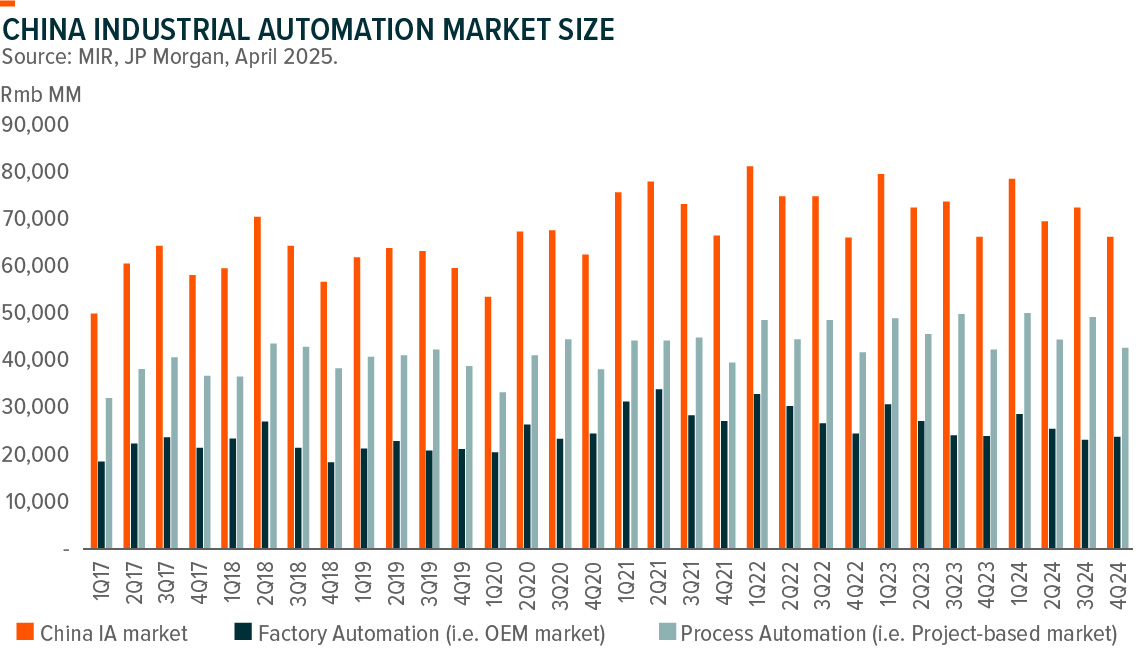

China’s industrial robot production and Japan’s machine tool orders in March suggest the recovery of China automation sector much better than expected. Broad-based traditional manufacturing sectors, such as machine tools, packaging, autos, etc., provide a solid foundation for the factory automation cycle inflection, while the recovery of lithium battery capex led by the first-tier players are also supportive for the end-demand growth. Globally, the humanoid robotics sector is experiencing rapid advancements YTD, which also helps with automation capex accelerating from the OEMs side. Shenzhen Inovance released March automation orders grew by 30%yoy vs 10-20%yoy in Jan-Feb-25, driven by strong demand in machine tools, metal processing, printing and packaging, plastic injection, etc. Airtac also indicated a 16%yoy sales increase in March, driven by sectors like lithium battery, autos, machine tools, aligning with Invoance’s trends.

Thu US tariff may negatively hurt people’s confidence in general investment and global trades, indirectly affecting automation demand in a longer period of time. In the near term, China FA cycle is largely immune from the direct impact of US tariff hikes as most of the business are domestic play with limited exposure to the US. It takes time to see the comprehensive results

Stock Comments

- Baidu, Inc. Sponsored ADR Class A: The company expects solid progress in AI across core business lines such as Search, AI Cloud and Robotaxi.

- Hangzhou Hikvision Digital Technology Co., Ltd Class A: The company is seen as the beneficiary from transforming into a provider of AI-powered comprehensive sensing solutions.

- Beijing Kingsoft Office Software. Inc. Class A: The company was seen as one of the key beneficiaries from AI adoption in China if DeepSeek is widely used in software development. Investors may take profits after stock rally

Preview

China’s FAI in advanced manufacturing and technology have been strong despite the overall economy slowdown. Robotics, AI and automation are one of the key beneficiaries from both the government’s stimulus measures in the near term and the economy transition goal in the long run. China automation companies are largely immune from the direct impact of US tariff hikes as most of the business are domestic play with limited exposure to the US. However, we remain cautious on the indirect impact on people’s confidence in manufacturing investment and demand outlook in the long term.

Global X China Little Giant ETF (2815 HK)

Market Update

During March, investor attention was mainly on the Two Sessions during the first half, and then shift to US tariffs after Trump announced unexpectedly high tariffs hike, with tariffs on China reaching 145% as of April 11. We expect rising tariff tensions between US and China may strengthen policy support to enhancing supply chain upgrades and achieving self-sufficiency. We still expect promoting emerging industries to climb up technology tree and supporting domestic substitution remain policies priorities in 2025. Therefore, these specialized and sophisticated SMEs play a crucial role in China’s transition to high quality development. As a high-quality, small-cap fund, Global X China Little Giant ETF is likely to benefit from government’s supportive policies on tech innovation and may outperform large-cap funds if the economy turns to strong recovery in 2025.

Stock Comments

Fujian Torch: 2024 results were inline with market expectation. Among them, active components (such as power semi) and capacitors saw strong growth. Margin was also improved.

Stock price was also responding to defense spending recovery as well as employee incentive plan (with ambitious targets) and new business initiative as well as acquisitions of Fujian Millimeter.