Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X China Electric Vehicle and Battery ETF’s (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Electric Vehicle and Battery Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Listed companies on the ChiNext market and/or STAR Board are usually subject to higher fluctuation in stock prices and liquidity risks, over-valuation risk, differences in regulation, delisting risk, and concentration risk.

- There are risks and uncertainties associated with the current Mainland China tax laws, regulations and practice in respect of capital gains realized via Stock Connect on the Fund’s investments in Mainland China. Any increased tax liabilities on the Fund may adversely affect the Fund’s value.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy may invest up to 50% of its net asset value in financial derivative instruments (“FDIs”), which may expose the Fund to counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The Fund may suffer losses from its usage of FDIs.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Market Commentary

Global X China Electric Vehicle and Battery ETF (2845)

Sector Update

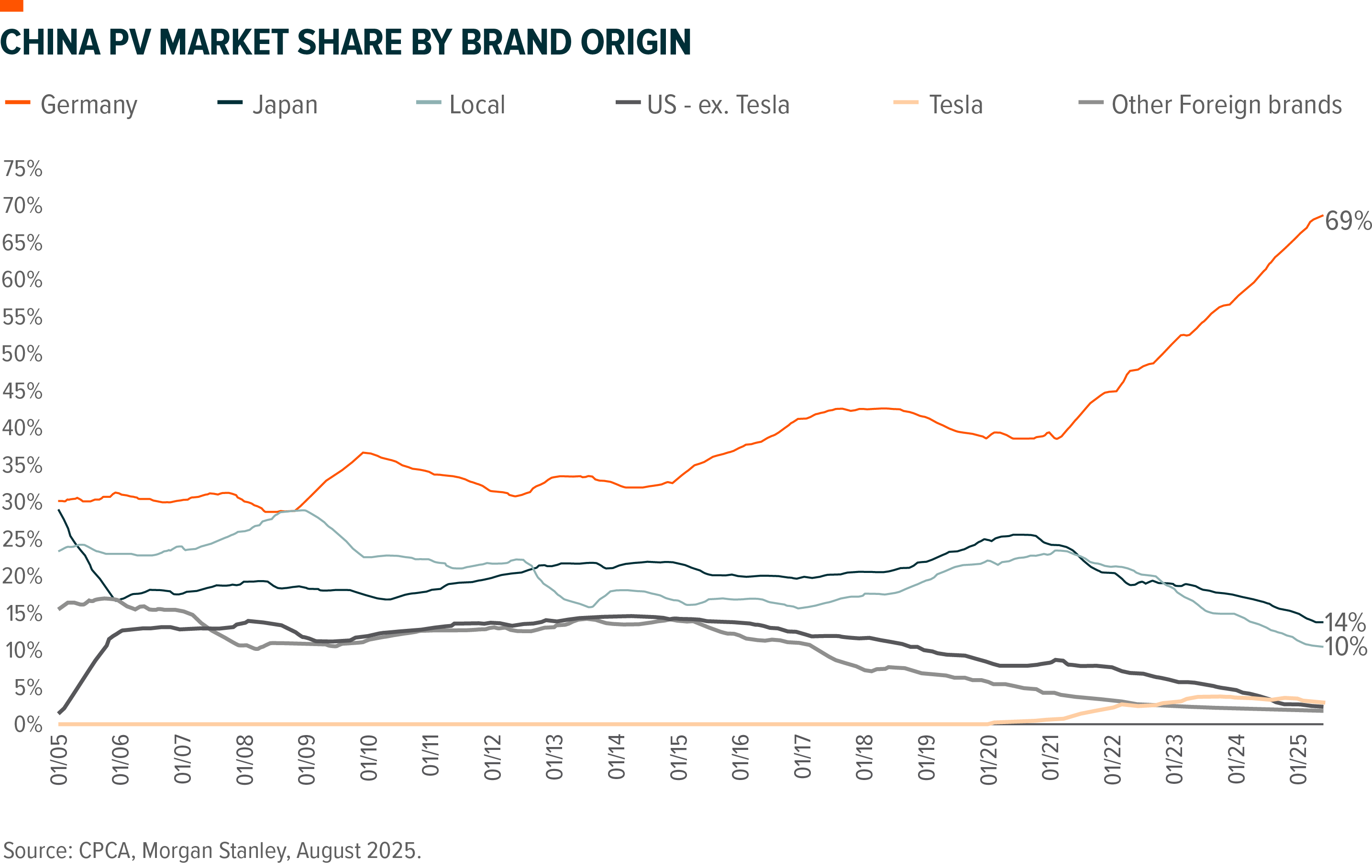

China passenger vehicle wholesales ended at 15.5mn units as of July 2025, +12.4%YoY, in which xEV wholesale was 7.63mn units, +35.2%YoY. xEV penetration was up by 8.32pp YoY to 49.2% in July. BEV and PHEV accounted for 61.5% and 29.4% of the total xEV sales. BEV has been gaining market share versus PHEV and EREV on the back of longer driving range and improved charging infrastructure. Local brands continued to gain shares owing to diversified EV models, competitive pricing and the benefits from trade-in programs. Leading companies such as BYD/Geely/Xiaomi witnessed sales volume growth 27.4%/48.8%/328.3%YoY as of July, while some traditional JV brands’ sales decline in China are worsening, e.g. Honda -30%YoY and BMW -19.6%YoY. (China Passenger Car Association, August 2025)

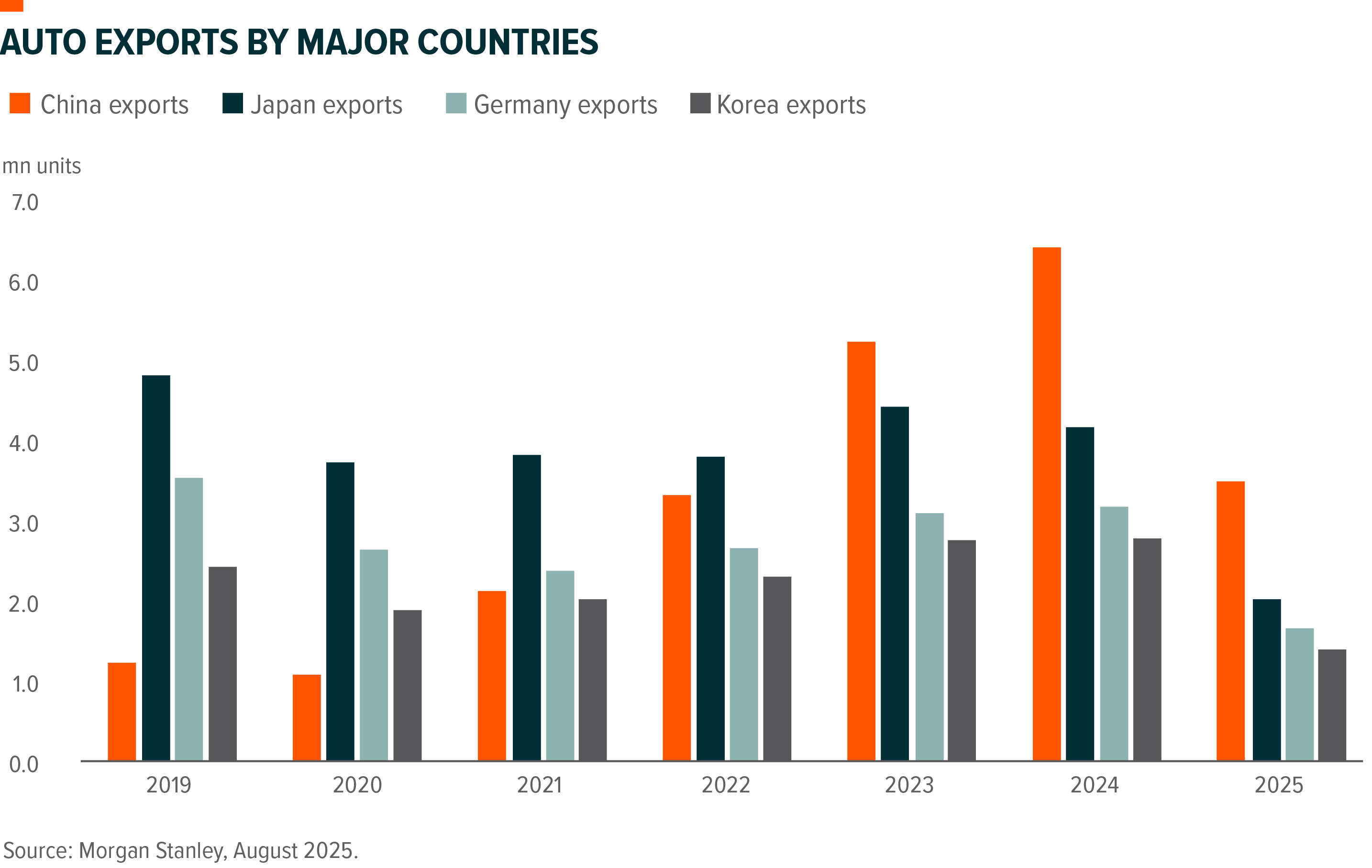

China auto exports are also fast growing, with 7M25 accumulated number (including CKD) to 4.17mn units, +19.7%YoY and export value US$65.1bn, +9.7%YoY. During the same reporting period, China xEV exports ended at 1.42mn units, +41%YoY, in which PHEV and HEV sales are catching up, especially new products of plug-in hybrid electric pickup that are well adopted in ASEAN and Latin America markets. The top destination countries of China EV are Belgium, Brazil, Mexico, Philippines, UK, Australia, Thailand, Turkey, UAE, India etc. (China Passenger Car Association, August 2025)

China’s battery installation was also much better than people’s initial expectation in the beginning of the year. China’s EV, ESS and other battery shipment hit a new high 787GWh as of July 2025, +58%YoY, in which EV battery shipment 577GWh, +48%YoY and ESS battery 210GWh, +93%YoY. LFP batteries are widely accepted by automakers with an installation rate of 80%. (China Automotive Battery Innovation Alliance, August 2025)

China battery exports reached 150.5GWh in 7M25, +53.1%YoY, in which EV battery exports were 96.4GWh, +29.4%YoY, accounting for 64% of the total exports. The exporting business, including local production outside China, has become another growth driver for Chinese battery makers despite the tariff headwinds. According to SNE research, the leading Chinese battery makers, not limited to CATL, BYD, Gotion, EVE energy and Svolt, have been continuously expanding their footprint outside China in the last two years. CATL remained top1 in the global battery usage ranking with a worldwide customer list both in EV and ESS applications. Compared to Korean and Japanese peers, BYD and EVE Energy are rapidly catching up in volume growth in non-China markets. (China Automotive Battery Innovation Alliance, August 2025)

The Latest Key Update

- Price War And Anti-involution In China

Stock prices in China auto sector have been volatile since May, when leading EV makers launched an aggressive pricing campaign on account of intensified competition and accumulated inventory pressure in dealer end. Later, government kicked in with soft guidance on anti-involution. Consequently, industrywise auto sales are generally a bit slowing down sequentially, despite EV sales growth remaining faster on a year-over-year basis. In July, inventory decline in dealer end is observed. Dealer discounts are also narrowing down. Heading to the second half of the year, we are cautiously optimistic on the price war. Most of the automakers have a challenging 2H25 sales target on the high base of last year. Yet, none of them would like to give up profitability for volume just simply by incentives spending on the back of broad anti-involution in China, although competition remains there. (Mirae Asset, August 2025)

- Automakers’ Payable/supply Chain Issues

Local media reported BYD’s financial distress early this year, pointing out its harsh treatment of suppliers including longer-than-normal account payables period and low-margin procurement. It also raised people’s wide concerns about the sustainability of China’s EV industry, as the OEMs are being forced to squeeze suppliers to maintain working capital and fund their fight for market share amid heavy discounting. (Bloomberg, Mirae Asset, August 2025)

Chinese local automakers generally asked for tough payment conditions from the component companies, for which BYD is not the sole case. JV brands are moderate possibly because they are global business and applying global standard. Hence, we believe the criticism of BYD is a good reminder to the key participants in China’s auto supply chain to benchmark to their global peers, bearing more social responsibility and leading the ecosystem more sustainable. Indeed, the central government promptly reacted to ease stresses of a damaging price war with carmakers pressed to settle invoices within 60 days. A handful of leading carmakers committed to 60-day or less bill payment soon later in response to ensure supply chain stability. Given they currently have sufficient net cash to cover the cash reserve decline due to the implementation of a shorter payment cycle, we don’t think the payable issue will have meaningful impact, especially on the top players. (Mirae Asset, August 2025)

- Lithium Supply-side Disruption

CATL suspended its Jiangxi lithium project in early August with annual production up to 70kt due to the mining license issues. The company got the production license in the name of non-lithium mine with lithium as by-product, dating back to 2021-2022 when lithium prices were elevated, because non-lithium mine license could be rapidly approved by local government, while for lithium mine, as a strategy metal reserve, the approval process must be done by central government. Now, CATL has to renew the license as a lithium project. There are additional 80kt capacities faced with the same issue. The suspension led to people’s concerns on short supply in the upcoming peak season. As a result, lithium carbonate prices shoot up to nearly Rmb90k/t from the bottom of less than Rmb60k/t. (Company data, August 2025)

We think lithium oversupply will be unchanged till early 2026. However, the inflection point is around the corner. Should global EV and ESS market continue moderately growing, we may see the rebalance of lithium S/D in the next twelve to eighteen months. We can also expect more surprise on upside if CATL cannot resume production soon and the extra ~80kt capacities are stopped production.

Our View

We remain constructive on China electric vehicle and battery sector growth despite the high base in 2H24 and tariff policy risks. It is an important vehicle for China government to boost economy in the near term and part of the long-term strategy to reduce the dependency on oil imports. We are positive on the leading companies who are continuously working on technology innovation, making strategic self-help efforts and gaining market share globally in spite of protectionism. Some of them have proven their competitiveness in technology and cost control in the last three to five years. We have seen the signals that increasingly more non-Chinese automakers are open to adopt Chinese LFP battery to boost their EV sales locally, which was controversial regarding the quality or technology. For example, Volkswagen succeed in iD3 sales in Europe since last year by using CATL’s LFP battery and largely cutting the cost/price. We have also seen Chinese OEMs’ growing presence in the major economies like Europe, ASEAN, Australia, Latin America, etc., driven by better products at competitive prices. Notably, the Chinese brands are not materially undercutting the incumbent OEMs on price as consumers’ first image of Chinese “cheap goods”, because they have learnt “cheap” is not necessarily a good starting point for brand building and they prefer competing on product rather than pricing, taking it as opportunity to avoid the criticism on dumping and improve the group level profitability in the meanwhile.

Top Holdings Update

- CATL

The company delivered solid 1H25 results of revenue up by 7%YoY and bottom line up by 33%YoY. Total battery shipment amount to more than 270GWh, in which 80% are EV battery and 20% ESS battery. Utilization has been significantly improved in the last twelve months to quite full now amid broad oversupply concerns. Overseas demand, especially in Europe, turned out stronger than feared in spite of tariff uncertainties. The company shared battery prices are stabilized in 2025 as lithium prices bottoming. Known for its consistent innovation in battery technology, CATL have continuously pushed boundaries with advancements in charging speed, energy density, driving range and safety features, solidifying their position as a major player in global fast-growing battery market. We are quite bullish on CATL to maintain its high growth trajectory in the medium term, driven by rising battery capacity per car, accelerating electrification in transportation sector, longer-duration ESS deployment and share gains in Europe. (Company data, Mirae Asset, August 2025)

- BYD

BYD’s share price has moved up by nearly 80% at its peak in May and then pulling back by 27% after the company announced a double-digit price discount across major models that led to concerns about its inventory and profitability. Subsequently, the company revised down its full-year sales target due to competition, aimed at improving dealers’ cash flow. People now expect 4.8~5mn units sales in 2025, in which exports account for 0.9~1mn units and domestic sales 3.8~4mn units. Sales in non-China markets have significantly increased, with a notable surge in more than 70 countries across the world, which brings much better profitability to offset the volume growth slowdown in domestic market. Looking ahead, BYD will add three to four overseas plants into production: Brazil plant has started the production recently; Indonesia plant will complete and ramp up production in 2H25, followed by Turkey and Hungary plants in 2026. The company is able to deliver probably 1.5mn units exports in 2026, coupled with a fleet of eight car-carrying vessels fully deployed this year. We stay positive on BYD’s long-term growth despite the near-term headwinds. (Company data, Mirae Asset, August 2025)

- Seres

Seres AITO wholesales ended at 193.7k units as of July 2025, -13%YoY, mainly due to competition and potential customers postpone purchase caused by new models launches in 2025. As one of the leading premium electric vehicle producers in China, Seres AITO stands out since the first launch in 2021, particularly in smart driving features, thanks to its partnership with Huawei who are providing the HarmonyOS intelligent cockpit operating system, ADS autonomous driving solutions and more importantly, the nationwide sales channel. The company expect to launch a new-generation ultra-large-size SUV AITO M7 in September 2025, a new-generation M5 in 2026 and maybe one more large-size SUV in 2027, to fully capture the growing opportunities in the premium electric SUV market. (Company data, Mirae Asset, August 2025)

- Inovance

China industrial automation demand was up by 2.4%YoY in 1Q25 and declined by 1.5%YoY in 2Q25 due to soft demand from EU market. People expect a prolonged modest recovery with low-single digit degrowth or flattish in 2025-2027E. Inovance’s order growth and revenue growth remains on track through market-share gain across segments. The company addressed four strategic directions for long-term growth: domestic market share gain, exports to Europe, new products, AI and embodied AI. Management guided for 20%YoY revenue growth for automation business and 30%YoY for NEV powertrain, as well as 5~25%YoY net profits growth in 2025. In the latest update, the company shared they were seeing limited impact on China IA demand from Trump’s tariff in April and May, and 15%YoY/20%YoY new order growth in June/July, led by strong demand in logistics, crane, lithium battery, packaging, machine tools, textiles, etc. (Company data, Mirae Asset, August 2025)