Important Information

Investors should not base investment decisions on this content alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Japan Global Leaders ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Index is reconstituted annually. Eligible securities are added into the Index as constituents during the next scheduled annual reconstitution. Similarly, securities that no longer meet the eligibility criteria of the Index may continue to remain in the Index until the next scheduled annual reconstitution, at which point they may be removed. There is no guarantee that the representativeness of the Index is optimised from time to time.

- The Fund’s investments are concentrated in securities in Japan. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Japanese market.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices. Further, the TSE or JASDAQ has the right to suspend trading in any security traded thereon. The Japanese government or the regulators in Japan may also implement policies that may affect the Japanese financial markets.

- The base currency of the Fund is JPY but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The Index Calculation Agent calculates and maintains the Index. If the Index Calculation Agent ceases to act as index calculation agent in respect of the Index, the Index Provider may not be able to immediately find a successor index calculation agent with the requisite expertise or resources and any new appointment may not be on equivalent terms or of similar quality. There is a risk that the operations of the Index may be disrupted which may adversely affect the operations and performance of the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the Stock Exchange of Hong Kong is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

Japan Market Fluctuates on Macro Uncertainty

Japan equity market recorded extreme volatility in past few days on BOJ rate hike and global macro uncertainty. On 31 July, BOJ decided to raise policy rate from 0-0.1% to 0.25%, the highest level since 2008.1 In addition, BOJ governor’s hawkish comments point to risk of the next hike to be brought earlier, depending on upcoming data. Hawkish BOJ move and accelerated US fed cut expectation drove Yen surge by over 10% to ¥145/$ from its lowest level in mid-July,2 leading to the unwinding of Carry Trade that resulted in a global risk asset sell-off in early August.

Implications

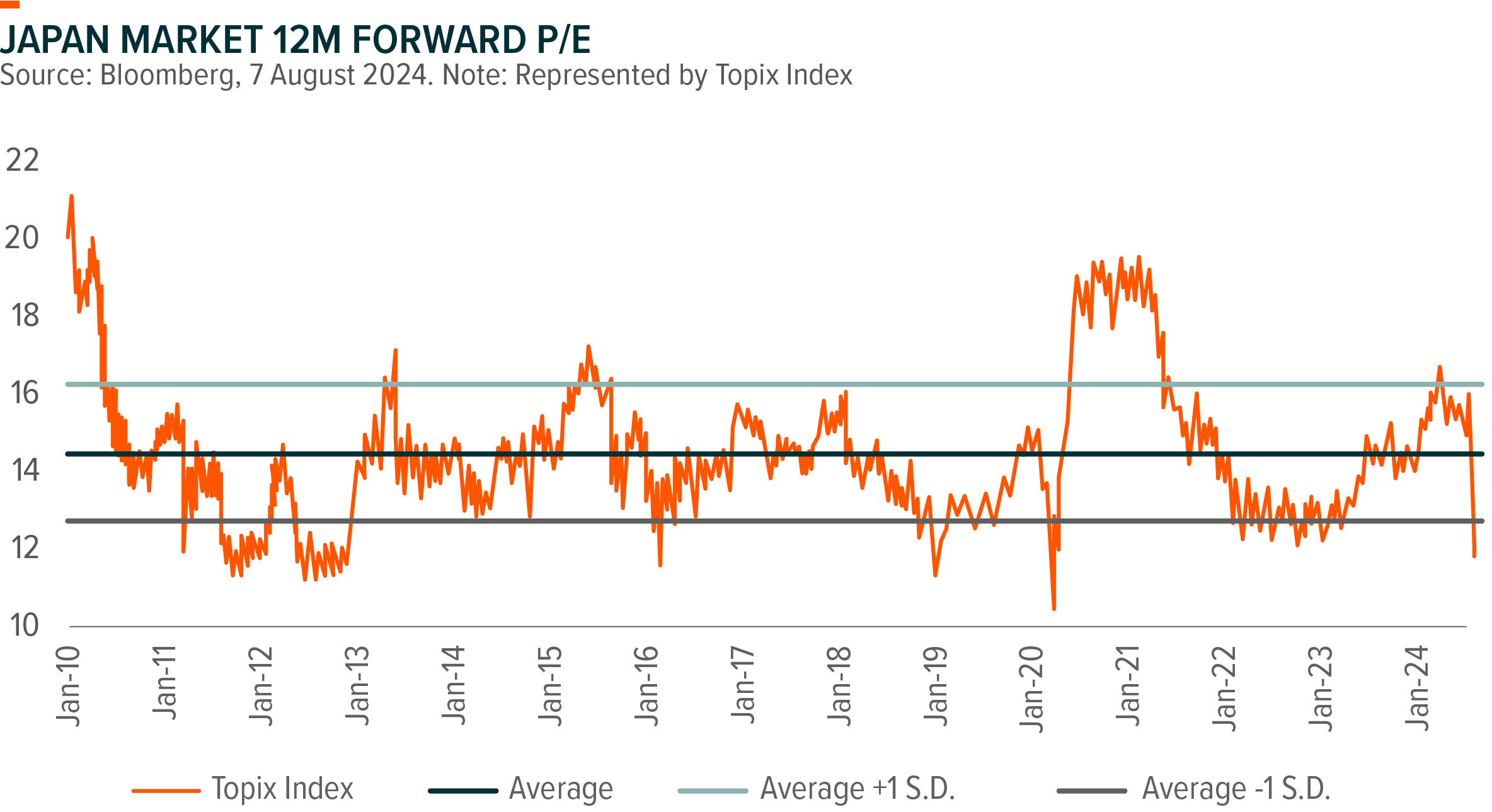

Japan equity market recorded 20% decline during 1 – 5 August, followed by rebound of over 10% in the next 2 days.3 After the volatility, Japan Market forward P/E has fallen to 13.0x, a level that is below historical average and where the fundamental looks attractive, though we note that downward earnings revisions from recent JPY appreciation might not have been reflected yet. The sell-off priced in JPY appreciation to ¥140/$, which would erode corporate EPS by 10%4. Near term uncertainty prevails, though a view that unwinding of JPY carry trades is almost over has also emerged. Both non-resident and individual investors have reset their YTD net buying. Potential downside risks come from further JPY appreciation and US economy falling into recession.

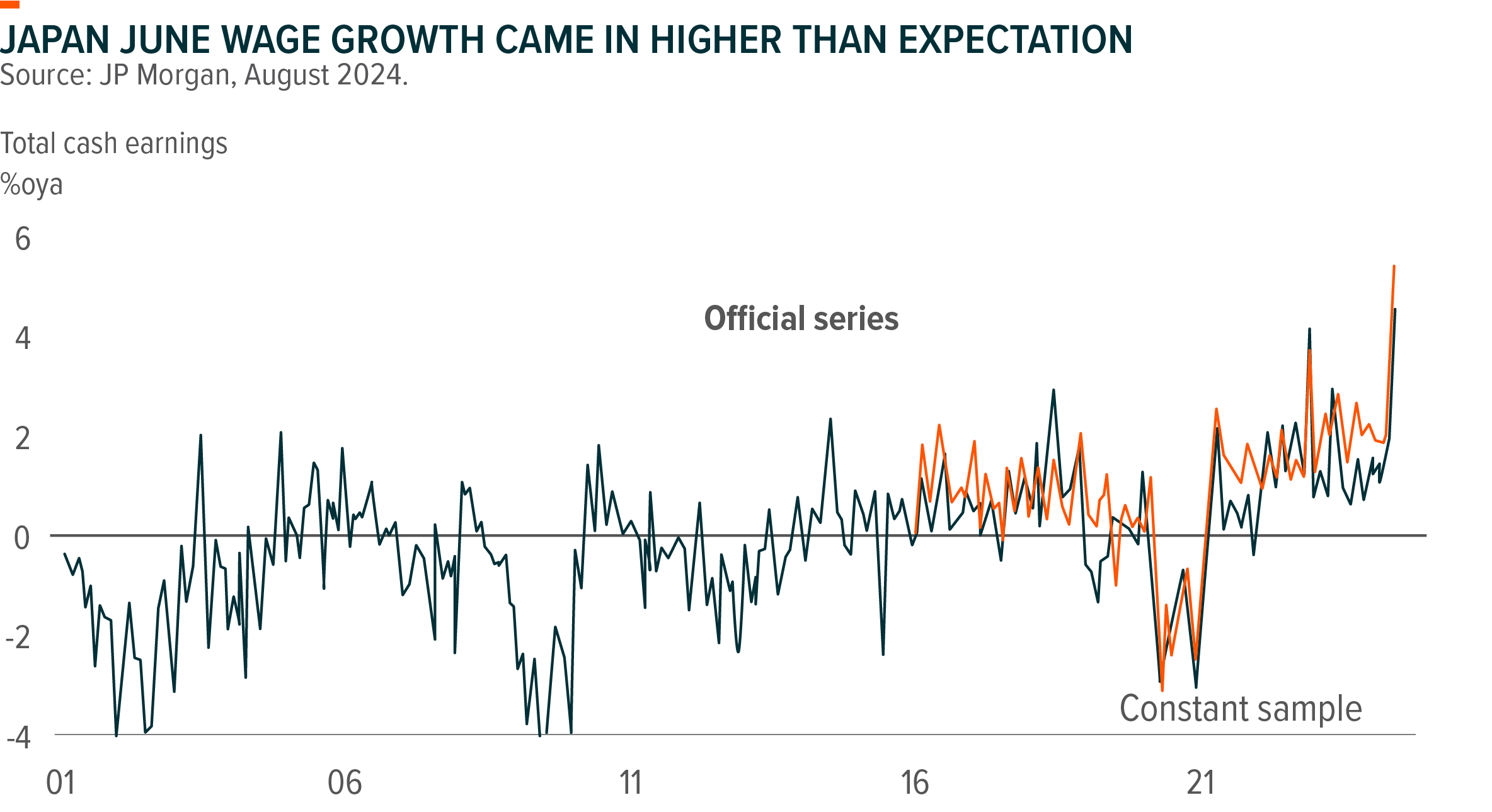

While we continue to monitor near term development, we remain constructive on Japan equity market with positive structural changes occurring in Japan. June headline wage growth came in at 4.5% (vs consensus of 2.4%), with real wage turning positive for the first time since April 2022,5 further supporting the reflationary thesis for Japan economy. A meeting of the MOF, FSA, and BOJ following the market sell-off and resulting expectations of changes in BOJ hawkish stance also supported the market in the near term. Continued progress on corporate reform and enterprise share buyback, coupled with increase in Japanese household investment under new NISA scheme, should drive a revitalized Japan equity market despite near term uncertainty.

Global X Japan Global Leaders ETF (3150 HKD) invests in 20 leading Japan export companies. The index delivered continued outperformance compared to broad-based indexes thanks to export strength for Japan on Yen weakness and strong product competitiveness.