Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China MedTech ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China MedTech Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies in the medical technology industry. The value of the Fund may be more volatile than that of a fund having a more diverse portfolio of investments and may be more susceptible to adverse economic, political, policy, liquidity, tax, legal or regulatory event affecting the relevant industry.

- Many of the companies with a high business exposure to a medical technology theme have a relatively short operating history. Rapid changes could render obsolete the products and services offered by these companies and cause severe or complete declines in the prices of the securities of those companies. Additionally, companies with medical technology themes may face dramatic and often unpredictable changes in growth rates and competition for the services of qualified personnel. They may potentially subject to (i) substantial government intervention in the technology industry (including restrictions on investment in internet and technology companies if such companies are deemed sensitive to relevant national interests), (ii) complex laws and regulations including privacy, data protection, content regulation, intellectual property, competition, protection of minors, consumer protection and taxation, (iii) heavy and significant capital investment on research and development, (iv) risks of medical failure (including injury or death of patients), negligence or product liability claims, recall or withdrawal of products. These risks may result in adverse impact of the operating results of the companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility. Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Shares on the Stock Exchange of Hong Kong Limited is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

Introducing the Global X China MedTech ETF (2841)

Listen

Summary view

On August 4th, 2023, we listed the Global X China MedTech ETF (2841) on the Stock Exchange of Hong Kong. 2841 is the latest addition to Global X ETFs Hong Kong’s thematic suite, which is designed to offer investors targeted access to thematic growth potential. We see significant opportunities in China’s MedTech sector. According to UBS, it is expected to grow at 14% CAGR from 2022-2030e1. Key industry growth drivers include:

- Aging population drives the demand for medical devices and innovation

- Import substitution – to drive market share increase for domestic players

- New medical infrastructure projects to accelerate demand growth

- We have seen increase in Research &Development (R&D) efforts towards innovative medical devices

- Focus on premiumization to drive growth with less pricing pressure

- Funding environment remains healthy for China MedTech space

- Global exports remain long term growth opportunity

- Group purchasing organizations (GPO) risk is lower for medical devices

What is MedTech?

MedTech stands for “medical technology” – also known as health technology – it is a combination of technology and medical interventions. MedTech is an extensive discipline that includes all of the technologies, devices, services, products, and solutions that use medical technology2.

Examples of MedTech solutions include:

- Equipment, tools, and devices used to diagnose and treat patients

- Medical devices used for diagnostics, in-vitro diagnostics (IVD), labs, etc.

- Medical consumables and implants

Why China MedTech?

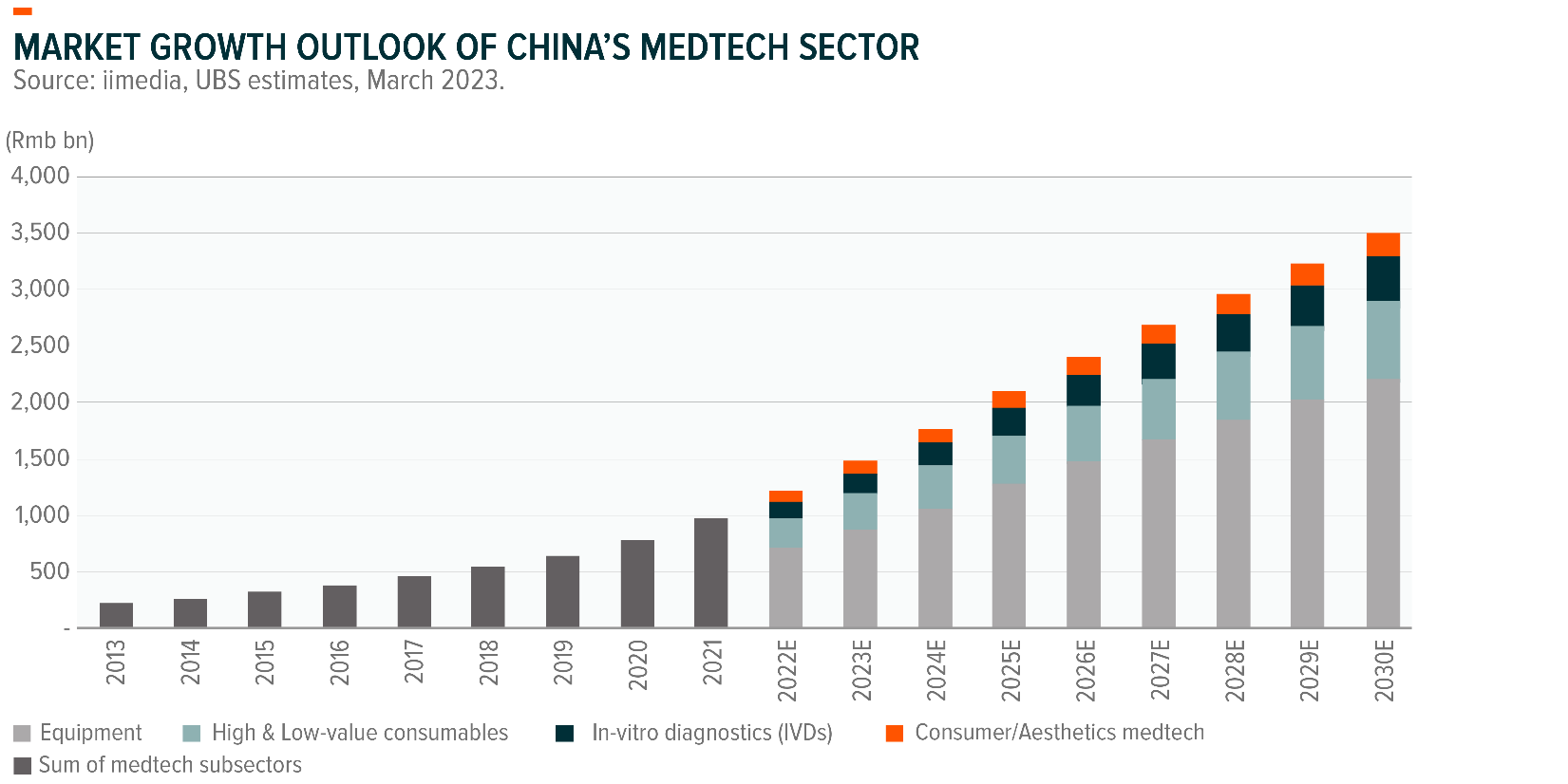

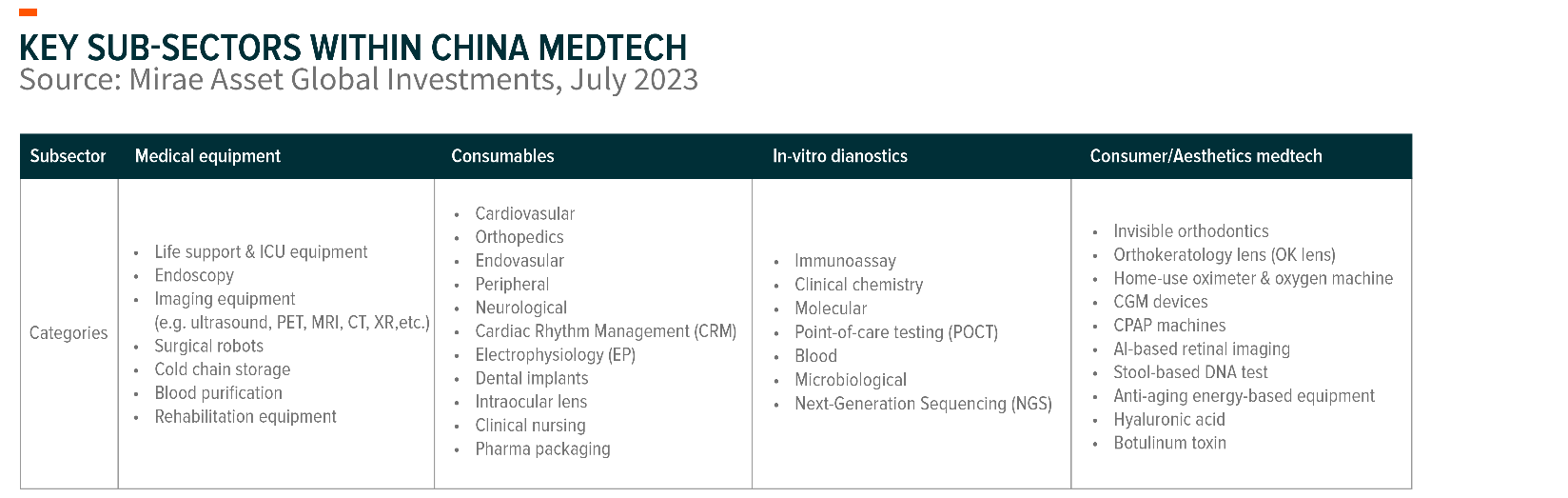

We see significant opportunities in China’s MedTech sector. Key sub-sectors that continue delivering growth include medical equipment, high-and low-value consumables, in-vitro diagnostics, as well as aesthetic MedTech.

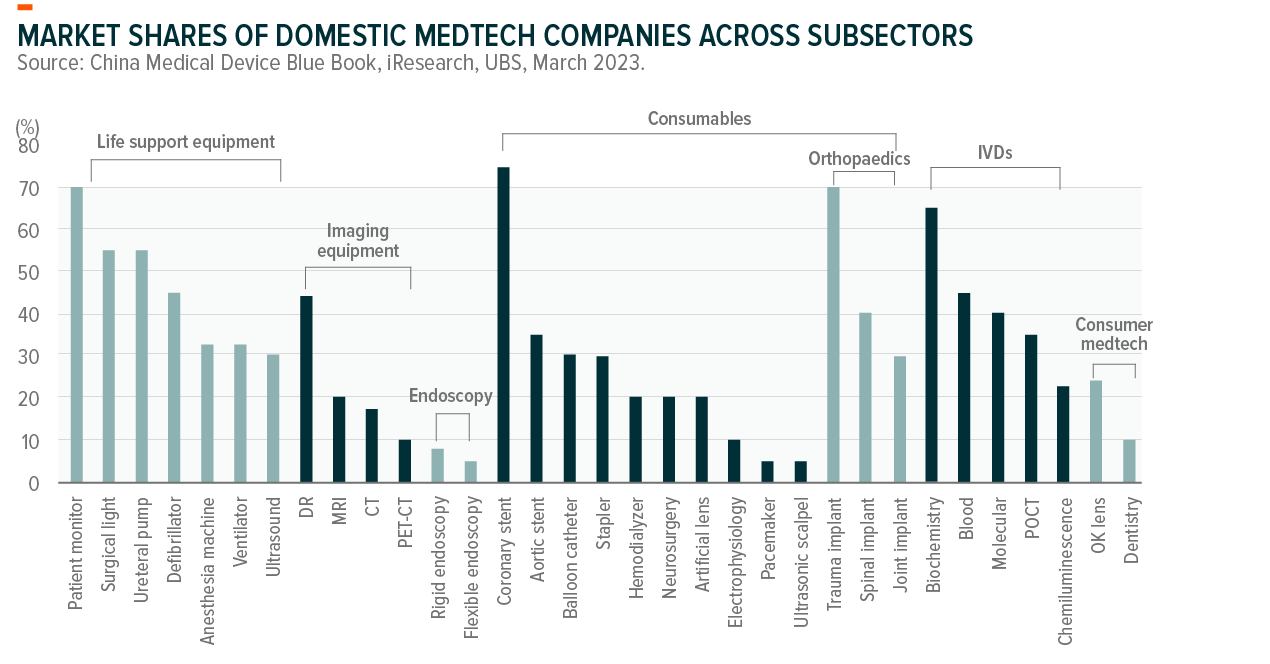

We also see meaningful opportunities in import substitution, especially where domestic manufacturers’ market share is low. Even though the technological gap between domestic and foreign firms still exists for more complex and high-end products, the difference is narrowing over time with continued R&D investment.

Accordingly, to UBS the total market size of China’s MedTech sector will rise from RMB1.2 trillion in 2022 to RMB3.5 trillion in 2030, a 14% CAGR over 2022-30E.3

The implementation of new medical infrastructure projects in China that emerged as a result of the pandemic will continue to accelerate the growth in the MedTech sector.

What are the Industry Growth Drivers?

Import Substitution

In terms of the import substitution opportunities in China, we expect there will be more upside in areas with low domestic market share. Some examples include:

- Equipment: Ultrasound, Ventilator, PET-CT, CT, MRI, Endoscopy

- Consumables: Ultrasonic scalpel, Electrophysiology, Joint and spinal implants

- In-vitro diagnostics: Chemiluminescence reagents, POCT

- Consumer/aesthetics: Dentistry, OK lens

Key drivers for import substitution include the continued implementation of new medical infrastructure projects supported by low interest government loans and recent guidelines on the build-out of more ICU beds.

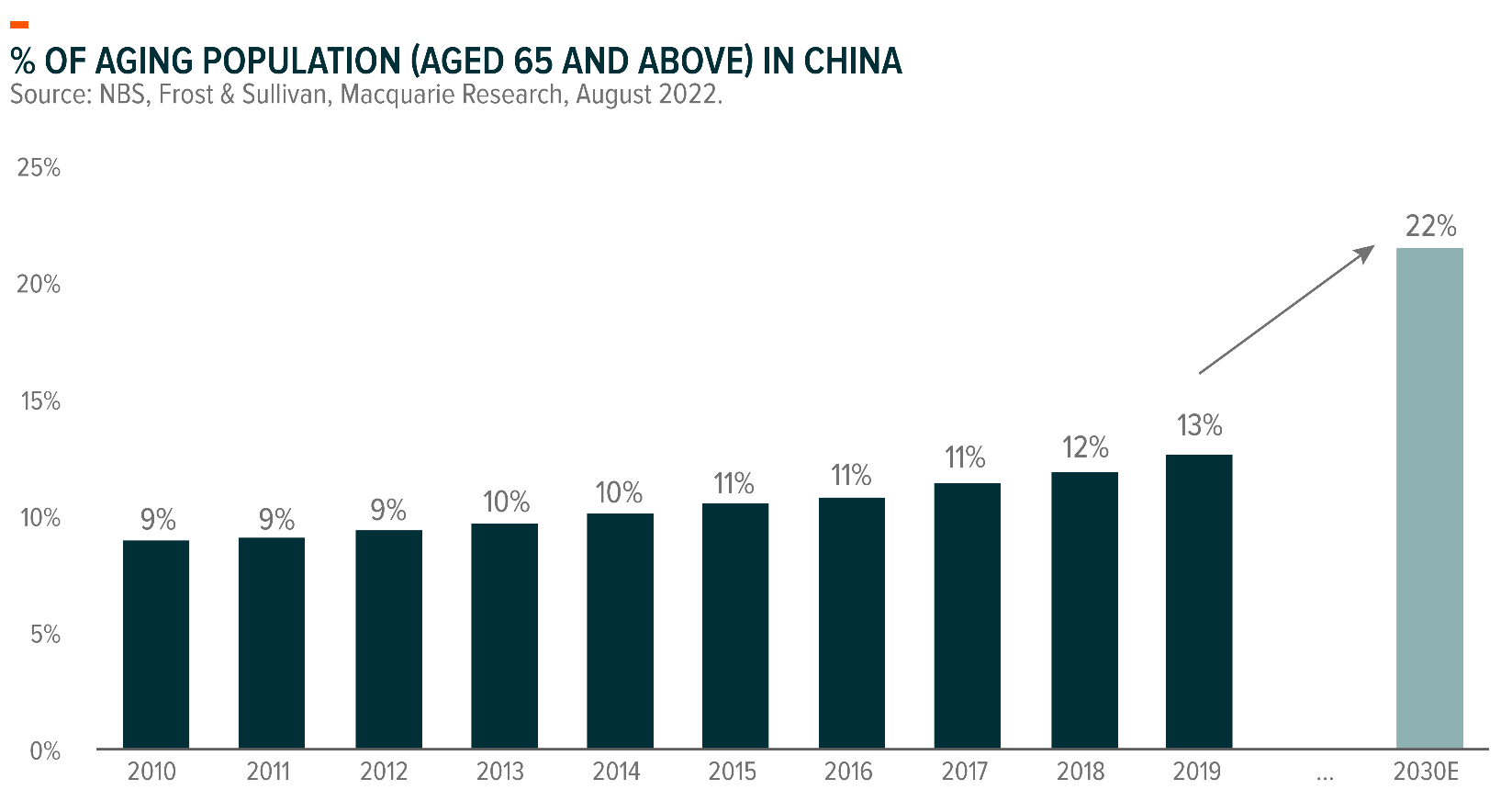

Aging Population

Aging population drives demand for better healthcare services, healthcare diagnosis as well as hospital infrastructure. Tremendous success has been achieved by China’s healthcare system to increase life expectancy, from 64 years in 1980 to 78 years in 2021, according to the World Bank4. However, China’s demographic shift towards an aged population is expected to create demand for healthcare products, services, healthcare diagnosis as well as hospital infrastructure.

Diagnosis Related Group (DRG) / Diagnosis-Intervention Packet (DIP) Payment Leads to Increased Cost Control among Hospitals

With the continued rollout of DRG/DIP payment reform by the National Healthcare Security Administration to cover all eligible medical institutions by 20255, hospitals may have to bear the extra costs that are not included in the national medical insurance coverage. To better control the costs of hospital operations, there could be an incentive for them to change the products from imported to domestic brands. The rising demand for domestic MedTech products will help drive up supply of higher-quality local options.

Hospital Expansion Supported by New Medical Infrastructure Projects

The implementation of new medical infrastructure projects that emerged as a result of the pandemic will continue to accelerate the growth in the MedTech sector. We believe rising demand for low-to high-end MedTech products from various tiers of hospitals provides more potential revenue upside for domestic firms. Together with favourable government policies such as low-interest government loans and guidelines on the build-out of more ICU beds to support hospital expansion, we expect the revenue growth of China’s MedTech sector will be well supported in the coming years.

New Product Launches

MedTech firms with strong pipelines of new products might have better visibility on higher revenue growth. Examples still in the early stages of the product cycle with less competition include degradable stents, wireless pacemakers, stem cell artificial organs, etc.

New MedTech products usually have strong pricing power for a certain period before encountering any price cuts.

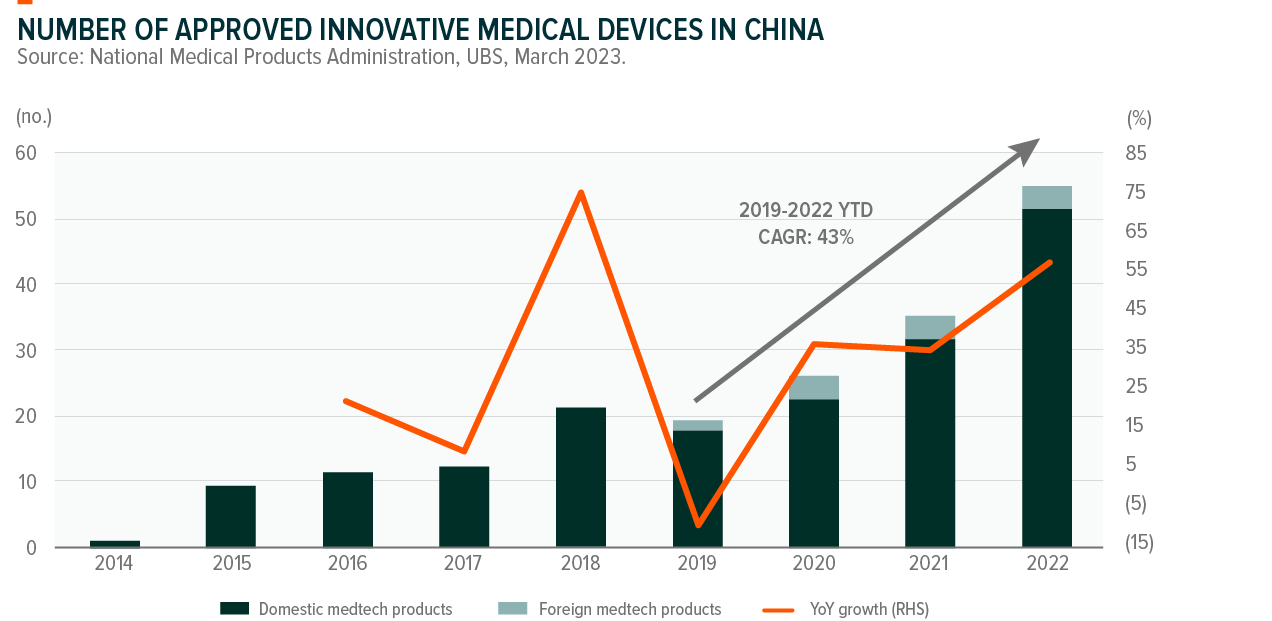

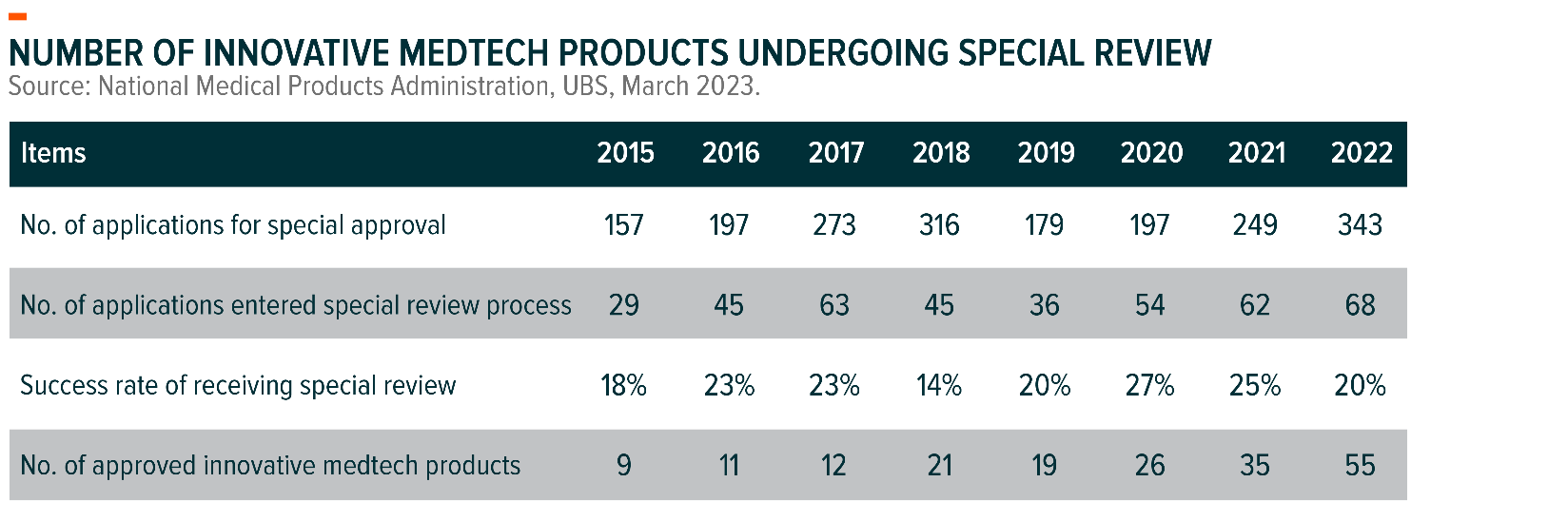

The number of innovative medical devices approved by the National Medical Products Administration in China increased from 19 to 55 products in 2019-22 at a 43% CAGR with most being local brands.6 Key areas of the newly approved MedTech products include endoscopy, medical imaging, surgical robots, high-value consumables and in-vitro diagnostics.

The pipeline of innovative MedTech products undergoing special review remains strong. In 2022, 343 applications were received but only 68 entered the special review process and 55 innovative products were finally approved.7 We expect more applications currently in the queue may be selected for special review and be approved in the future.

From Low-to-mid-end Focus to Premiumization

We believe product premiumisation is critical to drive import substitution as domestic players mainly capture opportunities in the low-to-mid-end market at this stage. To compete with foreign companies, more efforts are needed into R&D to launch more innovative MedTech products in the higher-end segments. The selected A-share companies spent 0.7-27.9% R&D cost as a percentage of total sales in the first 9 months of 2022.8

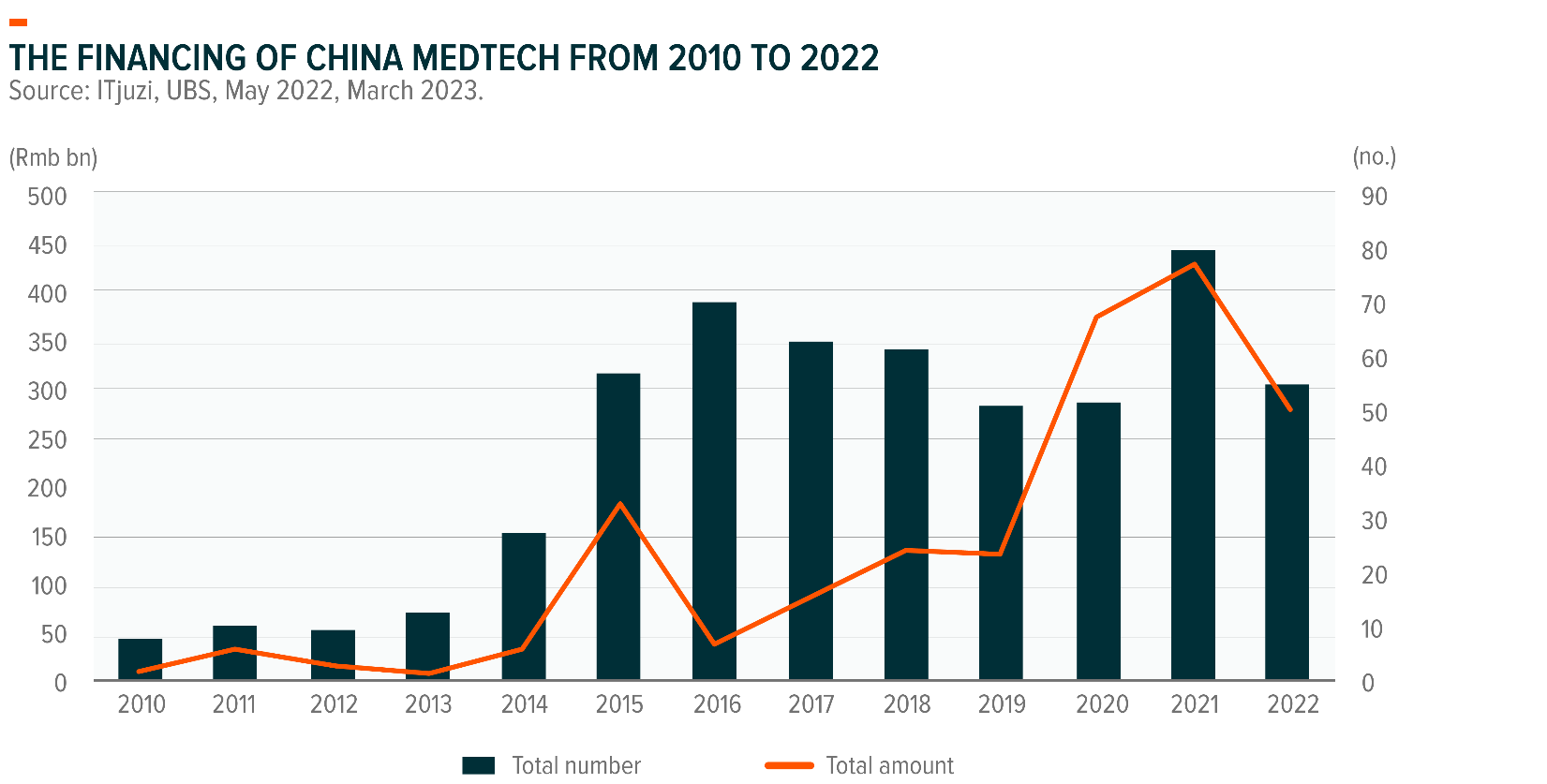

Financing Support For Domestic MedTech Remains Active

Apart from the ongoing R&D investment by listed firms, funding in both the primary and secondary markets to support domestic MedTech innovation also remains healthy. Total fundraising for China MedTech firms peaked at RMB 78 billion in 2021.9 Even though there was a gradual slowdown of funding to RMB 51 billion in 2022, the overall amount was still higher than in 2019 (RMB 24 billion) and hence seems reasonable. In 2022, total financing reached a peak in August, mainly due to the initial public offering of United Imaging, and maintained an upward trend from October to December.10

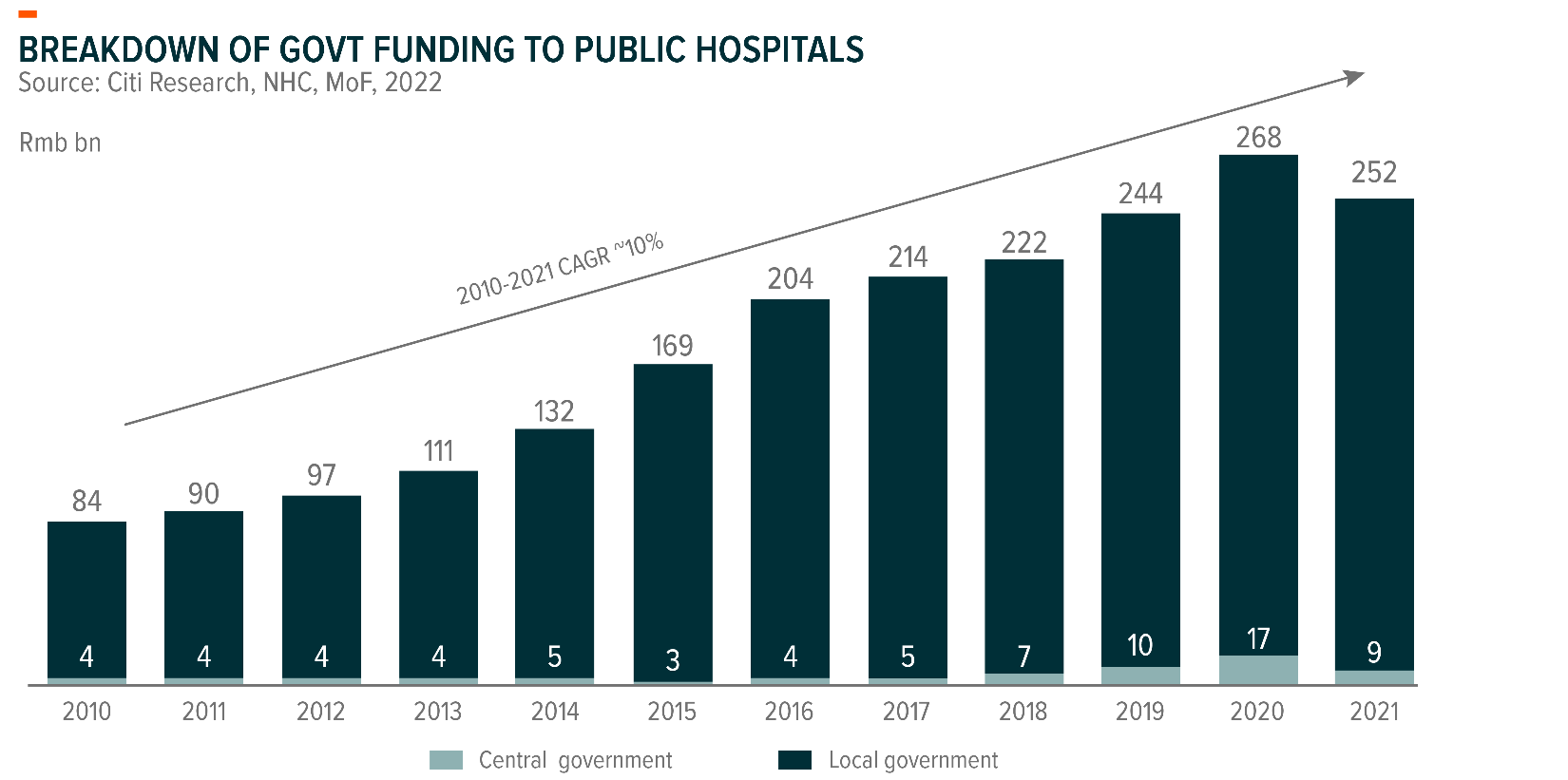

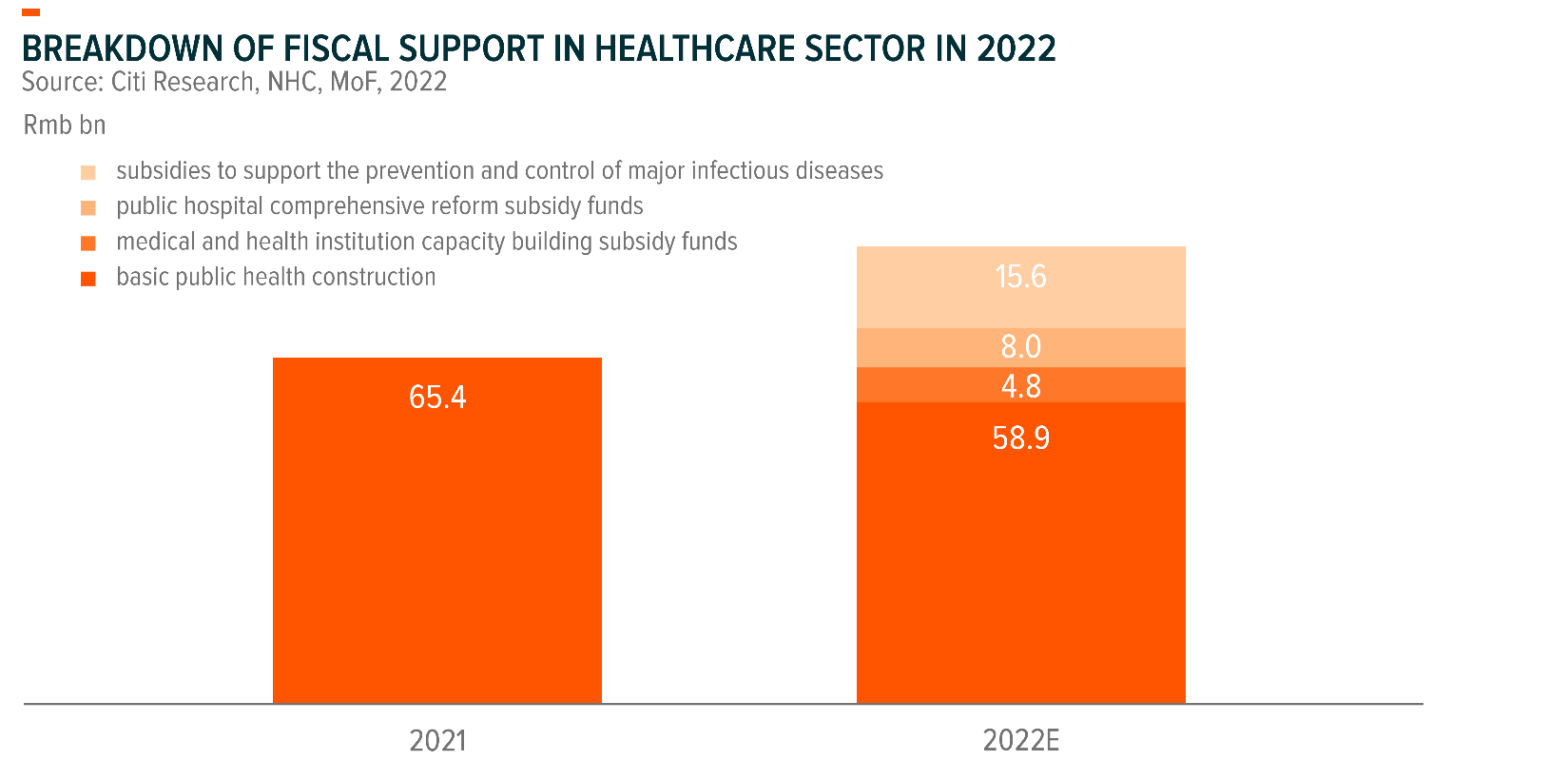

New Infrastructure Construction and Subsidized Loan to Boost Growth

Generally, the procurement of regular medical devices is funded by 1) fiscal allotments from local/central governments and 2) hospitals’ own operating cashflows.