Inside the Auto Semiconductor Industry

In this article, we will provide an overview of the auto semiconductor industry and explore the opportunity arising from the electric vehicle (EV) and automation trends.

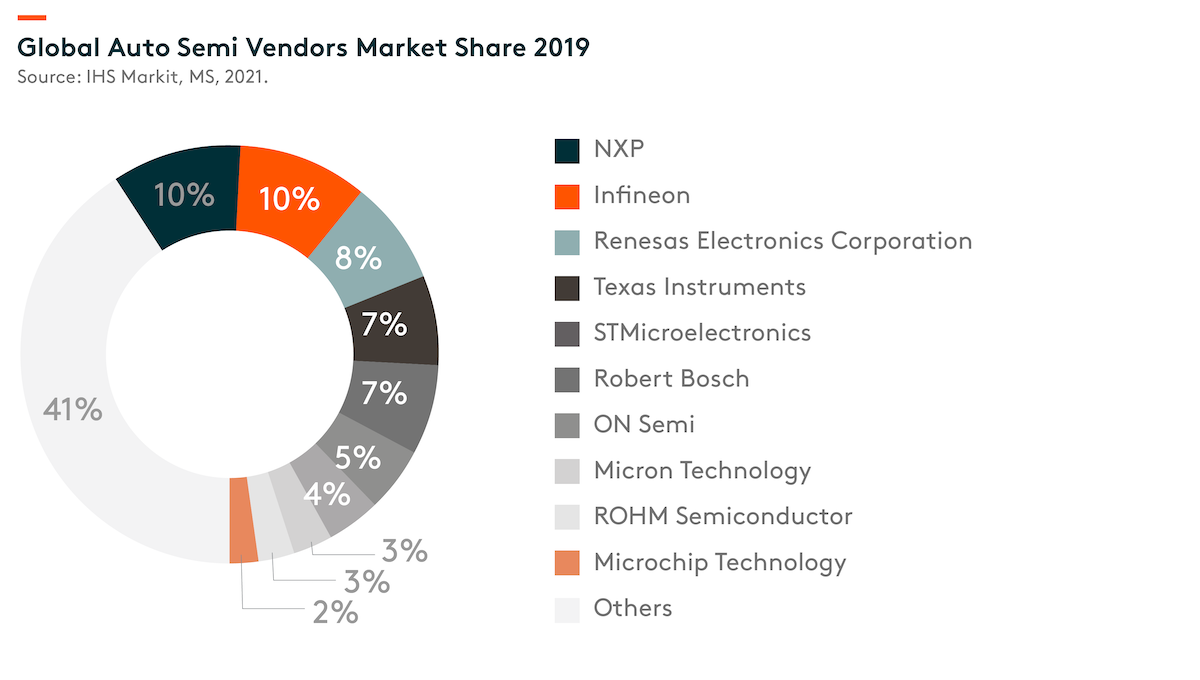

Auto semiconductor is estimated to be a US$38bn market in 2020 (Credit Suisse 2021). MPU (microprocessor unit)/MCU(microcontroller unit) is the largest sub-segment (18% of the total market) followed by discrete, non-optoelectronic sensors and PMIC (power management integrated circuit). (Credit Suisse 2021). Global leaders in auto semi include NXP, Infineon, Renesas, Texas Instrument, ST Micro, Bosch and On Semi. NXP and Infineon had the largest market share in 2019, both at around 10%. Although industry leaders are mostly IDMs (integrated device manufacturers), they also outsource part of the production especially in MCU where more advanced manufacturing process is required. IHS Markit estimates that around 70% of all automotive microcontrollers are manufactured by TSMC. The top six microcontroller suppliers (Renesas, NXP, Infineon, Texas Instruments, Microchip Technology, and STMicro combined to be around 98% of the auto microcontroller market) (MS 2021) all outsource to foundries.

![]()

EV and Automation to Increase Auto Semiconductor Value per Car

We are positive on the long-term outlook of auto semiconductors, as the increasing EV penetration and autonomous driving will drive demand for auto semi content. EV penetration (including pure EV and hybrid) is projected to rise from 11% in 2020 to 62% by 2030. (CS 2021) Infineon estimates semi BOM (Bill of materials) of full EV today to be US$834, compared to around US$500 in an ordinary car. Around 75% of the incremental content comes from power semiconductors. We estimate the BOM for a full self-driving car can be US$1,200 – US$2,000+ depending on the design of the full self-driving computer. This will drive the auto semiconductor market to reach US$110bn by 2030, representing a 11% CAGR. (CS 2021)

![]()

![]()

Backbone to Self-Driving-Chip

Semiconductor plays an important role in autonomous driving, and the performance improvement in auto SoC (system on chip) will be key to the deployment of complex machine learning models in L4/L5 self-driving vehicles. We see strong product line-up from companies like Nvidia, Tesla, Mobile eye, and Horizon Robotics in the race to provide autonomous driving chips. Current products can do around 30 TOPS (trillion operations per second) per chip designed for L2-L3 applications, and companies are expected to launch products with 100-200+ TOPS by 2022. (Mirae asset 2021) We expect to see 1,000+ TOPS chips by 2024 for L5 full autonomous vehicles.

![]()

China’s Auto Semiconductor Supply Chain

Although domestic power semiconductor players are relatively small compared to global leaders, China has formed a local supply chain in auto semiconductors. Wingtech acquired Nexperia which is a key supplier in discrete auto semiconductors, especially in low-voltage products. Hua Hong works with domestic fabless to produce automotive chips. In IGBT, Starpower has around 2% (CICC 2020) market share globally and is gaining market share in industrial and auto applications. CRRC Times operates an IDM model supplying high voltage IGBT for railway and industrial applications, and the company is now working to enter the auto segment.