Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X India Select Top 10 ETF (the “Fund”) seeks to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Mirae Asset India Select Top 10 Index (the “Underlying Index”).

- The Underlying Index is a new index. The Underlying Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history. The Underlying Index is an equal weighted index whereby the Underlying Index constituents will have the same weighting at each rebalancing (but not between each rebalancing) regardless of its size or market capitalisation based on the methodology of the Underlying Index.

- The Fund is a FPI registered with the SEBI. The applicable laws, rules and guidelines on FPI impose limits on the ability of FPI to acquire shares in certain Indian issuers from time to time and are subject to change. This may also adversely affect the performance of the Fund. The FPI status of the Fund may be revoked by the SEBI under certain circumstances. In the event the Fund’s registration as a FPI is cancelled, revoked, terminated or not renewed, this would adversely impact the ability of the Fund to make further investments, or to hold and dispose of existing investment in Indian securities. The Fund may be required to liquidate all holdings in Indian securities acquired by the Fund as a FPI. Such liquidation may have to be undertaken at a substantial discount and the Fund may suffer significant/substantial losses.

- The Fund’s investments are concentrated in securities in India. The Fund’s value may be more volatile than that of a fund with a more diverse portfolio. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Indian market.

- The Fund’s investments are concentrated in companies in various sectors and themes including communication services, information technology, financials, health care, consumer staples and consumer discretionary, industrials and energy. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- The number of constituents of the Underlying Index is fixed at 10. The Fund by tracking the Underlying Index may have a more concentrated investment portfolio than it would have held if tracking an index with a higher number of constituents, leading to higher risks of volatility.

- High market volatility and potential settlement difficulties in the equity market in India may result in significant fluctuations in the prices of the securities traded on such market and thereby may adversely affect the value of the Fund. The BSE has the right to suspend trading in any security traded thereon. The Indian government or the regulators in India may also implement policies that may affect the Indian financial markets. There may also be difficulty in obtaining information on Indian companies as disclosure and regulatory standards in India are less stringent than those of developed countries.

- The taxation of income and capital gains in India is subject to the fiscal law of India. The tax rate in respect of capital gains derived by a FPI on transfer of securities will vary depending upon various factors. Any increased tax liabilities on the Fund may adversely affect the Net Asset Value of the Fund. Any shortfall between the provision and the actual tax liabilities, which will be debited from the assets of the Fund, will adversely affect its Net Asset Value. For details, please refer to the section headed “Taxation in India” in the Prospectus.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is USD but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The trading price of the Units on the SEHK is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

India Telecom: Leaders’ Play

India’s telecommunications industry has experienced significant consolidation over the years and is now primarily dominated by two players: Bharti Airtel and Reliance Jio. While Reliance Jio boasts a larger overall customer base, Bharti Airtel excels in affluent markets. Looking ahead, Bharti Airtel is positioned to lead growth in the sector, supported by its continuous market share gains, leadership in premium services and 5G expansion. Bharti Airtel is a key holding of Global X India Select Top 10 ETF (3184 HK) with a weighting of 10%.

The Evolving Landscape of India’s Telecom Industry: Two Leaders Wining Shares

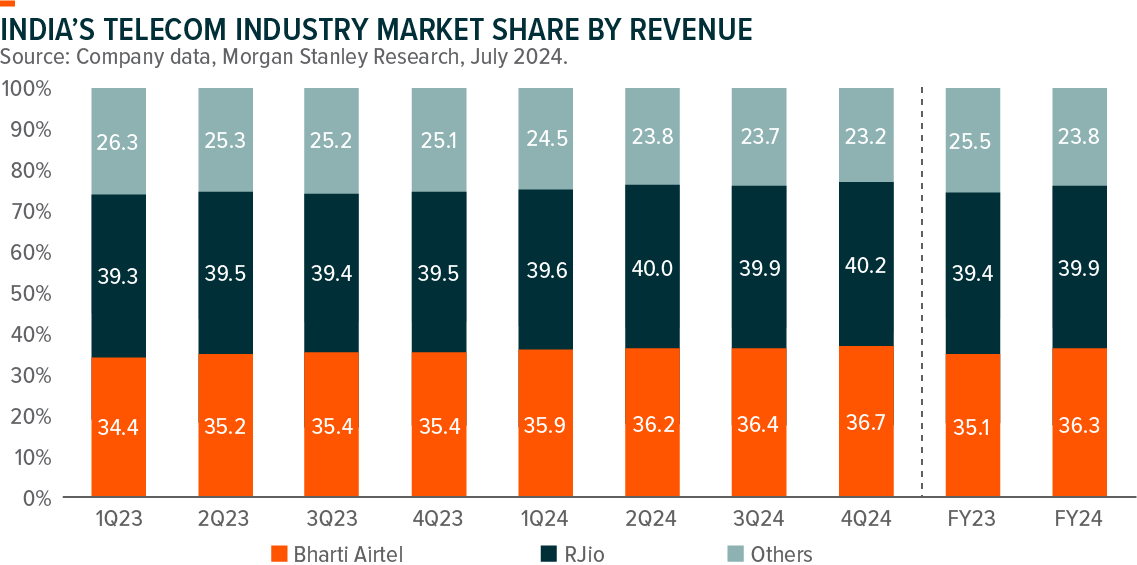

India’s telecommunications industry has undergone significant consolidation over the years, with the number of players decreasing from 14 in 2010 to just 4 in 2024 (comprising 3 key private players and 1 government-owned entity). Among these players, Bharti Airtel and Reliance Jio have emerged as the dominant forces, collectively commanding 76% of the total market share as of FY24. While we anticipate that Bharti and Reliance Jio will maintain their upward trajectory, we expect this growth to occur at a slightly slower pace moving forward. Notably, Bharti Airtel has been the only company to consistently gain market share since the entry of Reliance Jio, reaching 36% market share in FY24.

We view the current competitive environment as healthy for India’s telecom market, with high levels of consolidation leading to a reduction in aggressive tactics among key players. This shift is reflected in their focus on reducing customer churn and improving pricing strategies—topics we will analyze further in the latter sections of this report. Additionally, the presence of a limited number of major players is not unique to India; similar trends can be observed in other significant markets like the United States and China.

From FY22 to FY24, Bharti Airtel’s subscriber base has experienced a CAGR of 3.9%, outpacing the industry active subscriber growth of c.2% during the same period, mainly at the expense of Vodafone Idea. India’s mobile subscriber penetration stands at 73% as of CY23 (vs 115%/128% in US/China), suggesting there remains substantial room for growth.

Enhancing ARPU: Bharti Airtel at the Forefront of Growth

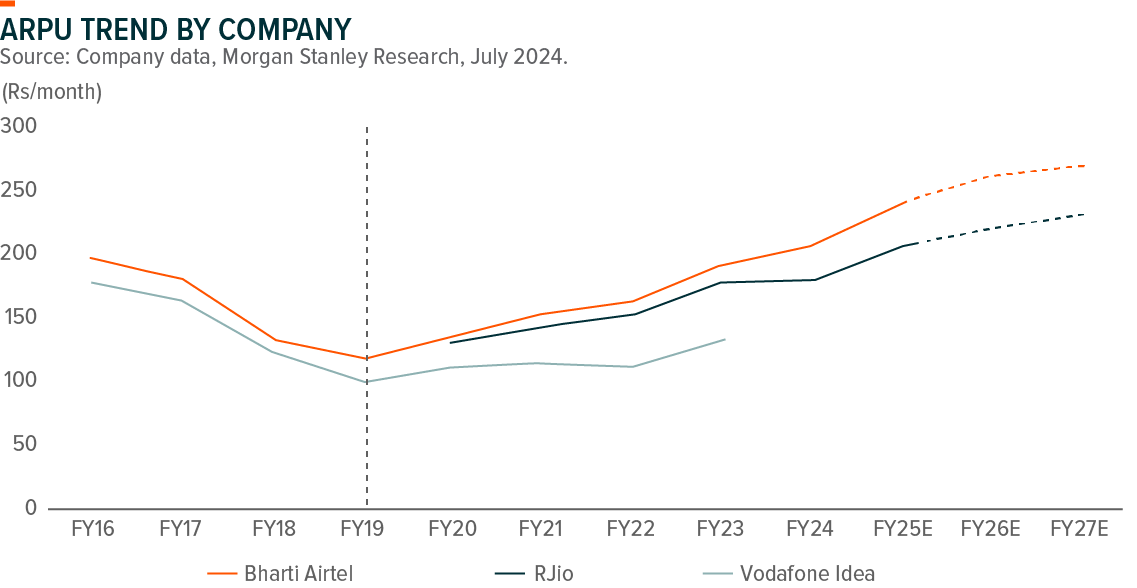

India’s telecom industry has faced significant competitive pressures on pricing/average revenue per user (ARPU) since the entry of Reliance Jio in FY16, continuing until FY19. However, beginning in FY19, ARPUs have shown signs of recovery, with a total of three major tariff hikes implemented since that time.

Despite these improvements, India’s telecom ARPU remains one of the lowest in the world, accounting for 1.4% of consumption expenditure, compared to a median of 1.7% in key markets and 2.5% in China. This suggests that there is substantial room for ARPU growth. We anticipate that the industry’s recovery phase will persist, driven by a favorable market structure and regulations. Increased data consumption and improved monetization of 5G services are key factors that could further boost ARPU, in addition to any future tariff hikes.

Bharti Airtel enjoys a sector-leading ARPU of Rs 211 in 1QFY25, which is 16% and 45% higher than Reliance Jio and Vodafone Idea’s ARPUs of Rs 182 and Rs 146, respectively. This indicates that Bharti has a more premium subscriber mix. Bharti Airtel’s strategy focus on quality consumers, which contrasts with Reliance Jio’s approaching of expanding its subscriber base through rock-bottom pricing. In alignment with its premium positioning, Bharti Airtel has recently reaffirmed its target of achieving an ARPU of Rs 300 and expects to reach this goal in the foreseeable future. The gap in ARPU between Bharti and its competitors has been widening in recent periods. We believe that Bharti is likely to see a greater transmission of tariff hikes compared to its peers, driven by its more valuable subscriber mix, which will further enhance this ARPU gap.

Invest for Future: Bharti Airtel’s Leadership in 5G Expansion

Bharti Airtel was the first operator in India to launch 5G services, quickly deploying a wide network of 5G sites. As of 4QFY24, both Bharti Airtel and Reliance Jio have seen a gradual increase in their number of 5G subscribers, with Bharti reporting 72 million and Jio reporting 108 million. These figures account for 40% and 29% of their respective 4G subscriber bases.

Despite this growth, India’s overall 5G penetration remains low at just 10% in CY23, compared to 45% and 59% in China and North America, respectively. This highlights substantial growth potential for 5G services in India. Currently, Reliance Jio and Bharti Airtel are the only two companies making significant investments in 5G infrastructure in India, positioning themselves for future market share gains.

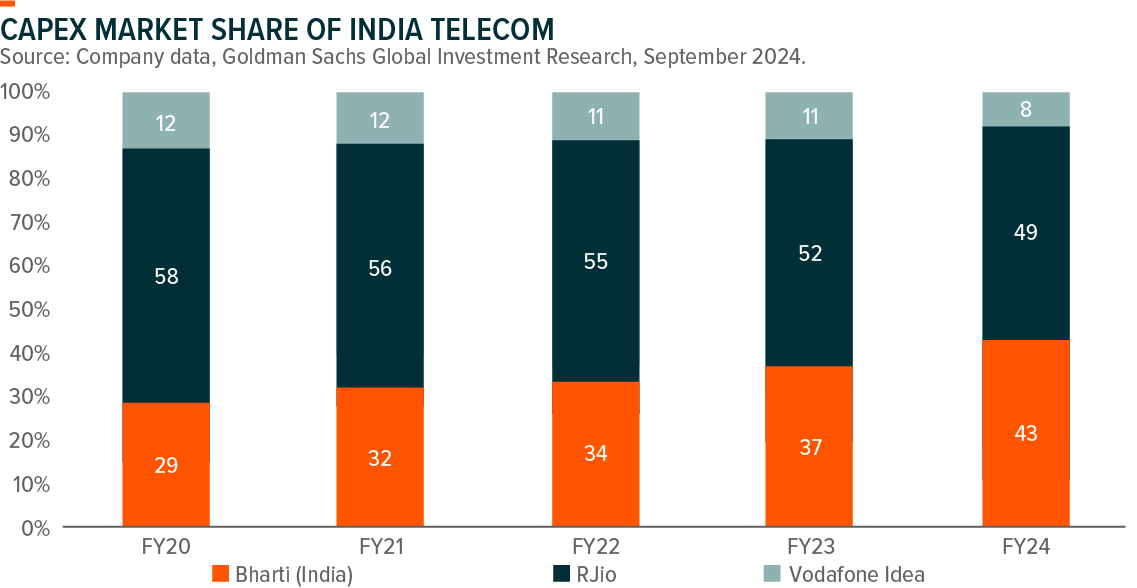

In FY23 and FY24, Bharti Airtel experienced a rise in capex intensity, driven primarily by 5G spectrum rollouts. Bharti FY25 capex is expected to come down as the company completes a substantial portion of its 5G rollout. Bharti Airtel remains committed to investing in advanced technologies to improve its services and strengthen its network infrastructure

Related Global X ETFs’ Product1

| Global X India Select Top 10 ETF (3184 HK) |

|

|---|---|

| Listing Date | 19 Mar 2024 |

| Reference Index2 | Mirae Asset India Select Top 10 Index |

| Primary Exchange | Hong Kong Stock Exchange |

| Ongoing Charges Over A Year | 0.68% p.a. |

| Product Page | Link |

The Fund adopts a single management fee structure, whereby a single flat fee will be paid out of the assets of the Fund to cover all of the costs, fees and expenses of the Fund. As the Fund is newly set up, this figure is an estimate only and represents the sum of the estimated ongoing charges over a 12-month period, expressed as a percentage of the estimated average Net Asset Value of the Listed Class of Units of the Fund over the same period. It may be different upon actual operation of the Fund and may vary from year to year. As the Fund adopts a single management fee structure, the estimated ongoing charges of the Fund will be equal to the amount of the single management fee, which is capped at 0.68% of the average Net Asset Value of the Listed Class of Units of the Fund. Any ongoing expenses exceeding 0.68% of the average Net Asset Value of the Listed Class of Units of the Fund will be borne by the Manager and will not be charged to the Fund. Please refer to the Key Facts Statement and the Prospectus for further details.