India Outlook 2024: The Secular Growth Story

In our view, India is the best structural growth opportunity in emerging markets (EMs), if not the world. As China’s growth ebbs and investors look for alternative growth markets, India has a generational opportunity to become the growth engine of EM and international markets, as we believe gross domestic product (GDP) can grow above 6% for years to come. Furthermore, the combination of the world’s largest general and youth populations, which provides a demographic dividend, coupled with a market friendly and democratically elected government, creates a powerful backdrop for stock selection and potential outperformance.1

Key Reasons for Optimism on India

- Risk Adjusted Returns: Since inception in 1995, India’s benchmark equity index, the Nifty, has a ratio of annualized returns over its volatility of 0.57, which compares to the Nasdaq 100 with a ratio of 0.54 and the S&P 500 at 0.46.2 The data show that, historically, the Indian market has offered robust returns with reduced volatility. We also note that India’s equity market has delivered seven consecutive years of gains (in rupee terms).3

- Market Depth: The Indian stock market is now larger than both Korea’s and Taiwan’s combined, with trading volumes that exceed those in Hong Kong.4 In 2023, there were more initial public offerings in India than in the U.S.5

- Declining Risk Premia: Starting June 28, 2024, India will be included in the JPMorgan Government Bond Index-Emerging Markets (GBI-EM), with a maximum weight of 10%.6 Inclusion in the EM bond index helps deepen the bond market, lowers risk premia, reduces the cost of capital, and improves debt sustainability, which in turn boost financing capacity at a time the country is undergoing a large capex growth cycle.

- Demographic Dividend: India recently surpassed China as the most populous nation in the world.7 The country now has the world’s largest general and youth populations, with 65% of people below 35 years old.8 Importantly, this young population is more educated than previous generations, with the youth literacy rate at roughly 90%.9 Furthermore, India should have the most university graduates in the world this year, as well as the third largest group of scientists and technicians in the world.10 India is young, educated, and starting to deliver across services, manufacturing, and consumption.

- Growing Consumer Economy: Per-capita GDP in India has crossed the US$2,000 mark, which historically has been the level consumer spending dramatically starts to pick up.11 Per-capita GDP is expected to double from less than US$2,500 in 2022 to nearly US$4,000 by 2028, with nearly two in three citizens likely to reach middle class status within the next 25 years.12,13 We expect consumer companies to receive most of the benefits from this trend.

- 2024 Elections: Prime Minister Narendra Modi has been in power since 2014, and his ruling Bharatiya Janata Party (BJP) recently won three out of four important state elections. Positive recent economic performance, increasing short-term social subsidies, and ongoing government reforms are likely to bolster support for the party ahead of April-May 2024 elections. In our view, the re-election of PM Modi would be an important driver of momentum in the economy, as the current government is likely to enact new initiatives that would support less affluent parts of the population, increase spending to support public sentiment, and stimulate consumption. This combination would likely bring political and economic continuity over the medium term.

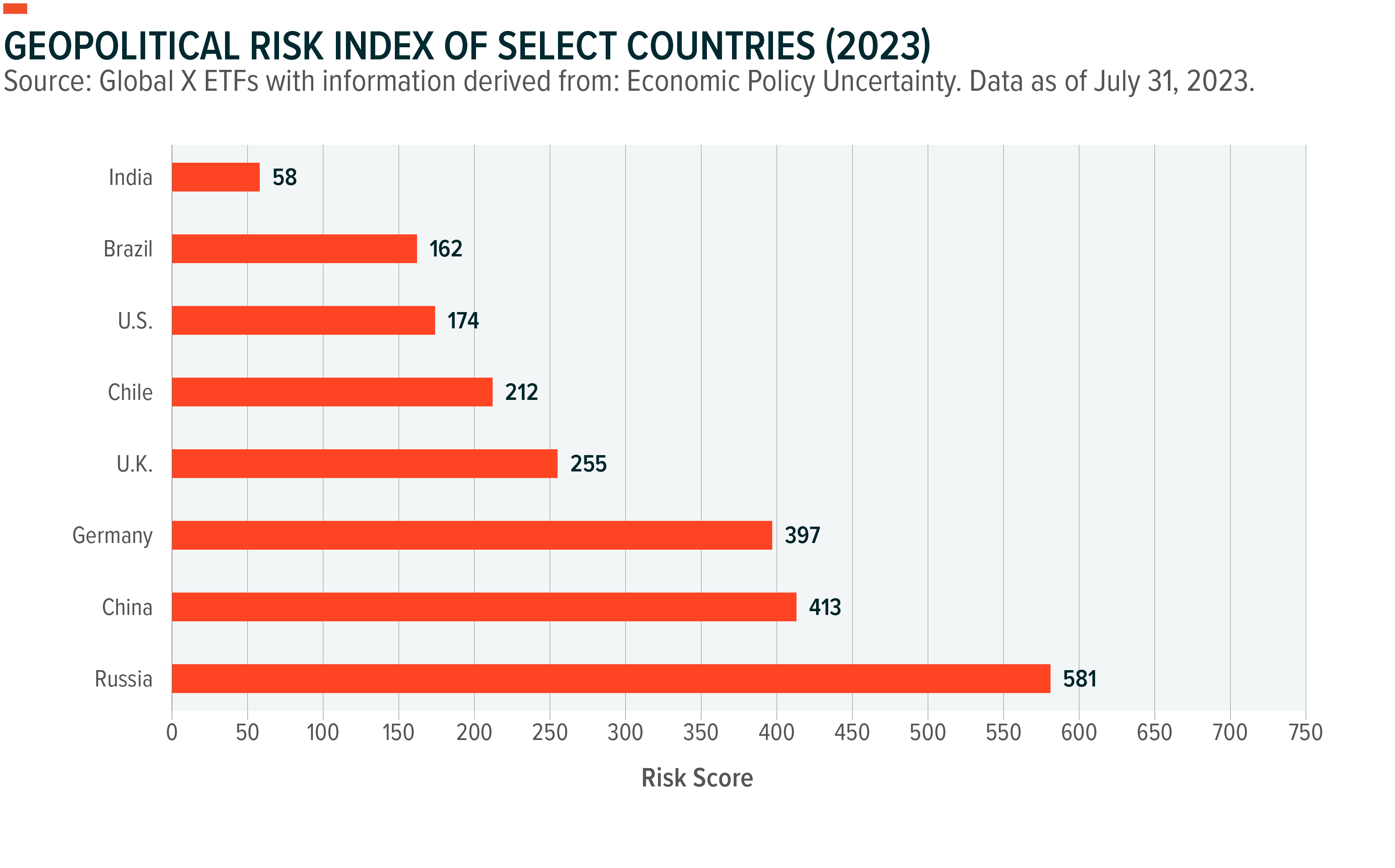

- Relatively Low External Risks: Indian equities have historically displayed a low correlation to global markets, and the MSCI India Index’s beta relative to the MSCI EM Index has declined to ~0.6, due to improved macro stability and a lower dependence on global capital market flows to fund India’s current account deficit.14 Also, as seen in the chart below, India has benefited from its status as a relatively low geopolitical risk EM country. Finally, as an oil importing country, oil prices have an impact on the country’s current account and inflation, so expectations for stable to lower oil prices could also be a benefit in 2024.

- Steady Currency: The Reserve Bank of India (RBI) actively uses its reserves to defend the rupee (INR) against external headwinds, which is why the INR was stable in 2023 despite a strengthening USD.15 A weaker dollar would probably be a tailwind, and we find Indian equities have historically rallied nearly 4% for every 1% weaker move in the dollar.16

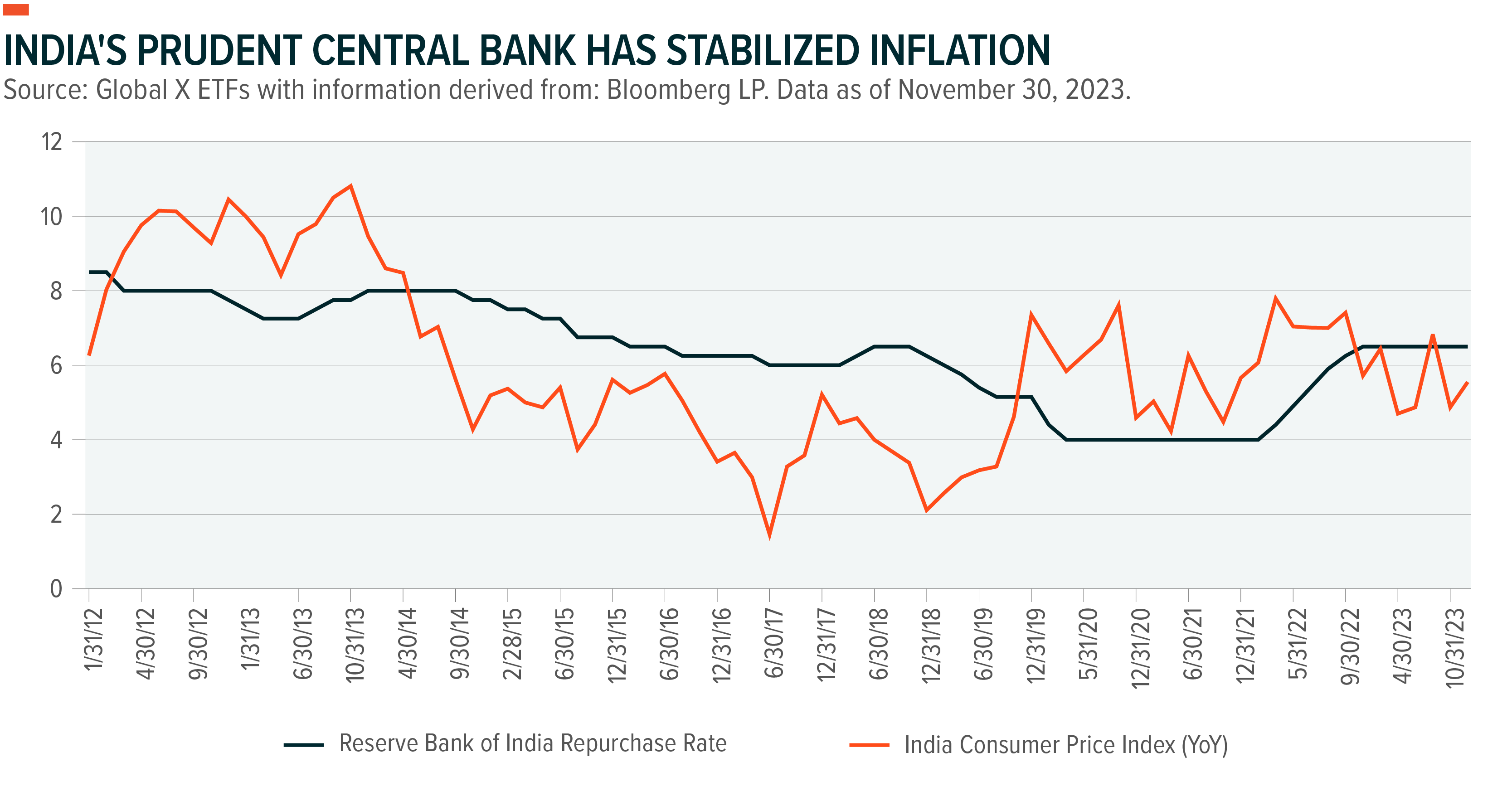

- Sound Economic Policies: India continues to prudently manage both its monetary and fiscal policies. Inflation is starting to decline, the rupee remains stable, and both the current account and fiscal account are forecast to improve in 2024 and 2025, according to consensus expectations.17

- Key Structural Reforms: India’s government continues to focus on efficient structural reforms. Recent improvements include: the United Payments Interface (UPI), the national digital payment system that has facilitated digital transactions; Adhaar, which has allowed for unique customer identification; and the Goods and Services Tax (GST), which has helped companies build credit profiles, lend to customers, and simplify cross-state shipping – allowing e-commerce competition to flourish across all income groups. In addition to growing the digital economy, lower corporate tax rates, production linked incentive programs, and the Make in India Program have all helped improve the ease of doing business in India.

- An Alternative to China: We expect India to gradually close the income gap versus China, as GDP expectations continue to move higher for India for longer. In turn, we believe India can become an investment alternative to China. India still has the capacity to replicate China’s manufacturing driven growth model and is gaining relevance due to its status as a China+1 country benefitting from re-shoring trends, international corporate support, and growing manufacturing clusters and hubs. Government driven production-linked incentive schemes and lower manufacturing labor costs (~40% those of China) further support growth of manufacturing, as seen in the ongoing domestic capex cycle.18 India’s young population is also growing increasingly educated, with around 1.5mn engineering graduates every year and climbing.19 India’s demographic dividend is likely still ahead, while China needs to find a way to support an aging and declining population. India is also a democratic country, with dispute resolution mechanisms and natural safeguards against unfair practices.

Conclusion

With expectations for political and economic continuity coupled with increasing flows, we see 2024 shaping up as another year for strong potential positive risk adjusted returns, especially compared to other EMs and developed markets. Capital markets are deepening, investment is continuing, wages are growing, supply chain diversification and manufacturing are improving, and consumption is increasing. This appears to be driving a positive virtuous cycle, and demographic tailwinds could provide longer legs to the theme. Therefore, we see corporate earnings strength as durable, while capital markets and funding are improving and the country’s prudent central bank acts as a check on inflation and other external risks. Given the above, we believe India looks like one of, if not the best, structural investment opportunities in the world and believe this combination could lead to consistent +6% GDP growth over the next several years. Finally, while the MSCI India Index is trading at a ~22x price-to-earnings ratio, we see the consensus +16% 2024 earnings-per-share growth, 15%+ sustainable returns on equity, and declining cost of capital more than justifying the multiple.20