Important Information

Investors should not base investment decisions on this website/material alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Asia Pacific High Dividend Yield ETF (the “Fund”) aims to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Solactive Asia Pacific High Dividend Yield Index (the “Underlying Index”).

- There is no assurance that dividends will be declared and paid in respect of the securities comprising the Underlying Index. Dividend payment rates in respect of such securities will depend on the performance of the companies of the constituent securities of the Underlying Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Underlying Index.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- The Underlying Index is a new index. It has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Underlying Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- The trading price of the Fund unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

Governance Reform in Asia to Enhance Shareholders’ Return

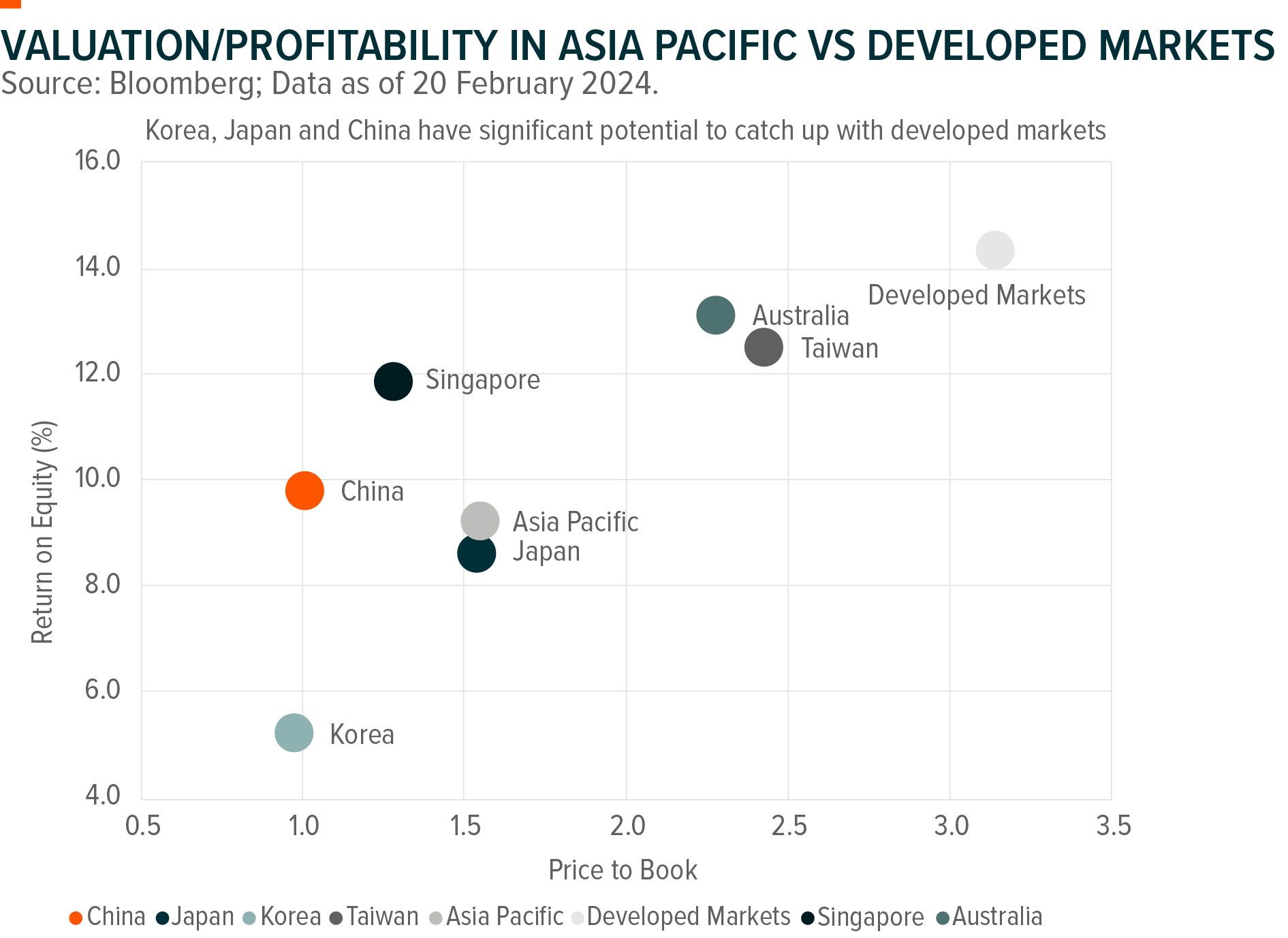

Historically, investors have long applied a valuation discount to Asia equity markets, partly due to perceived weaknesses in governance among corporations in the region. However the valuation gap between the Asia Pacific region and developed markets reached its peak in 2022 and since then, it has been narrowing as regulators continue to push for governance reform.

Governance improvements have played a crucial role in the recent valuation re-rating of Asian equities, with Japan serving as a prime example. Following the introduction of the Tokyo Stock Exchange’s Corporate Governance Code, listed companies have been revamping their practices to enhance decision-making and prioritise the needs of shareholders. As part of the Corporate Governance Code, Japan has implemented “comply or explain” rules to listed companies with low operating efficiency. Consequently, more Japanese companies are prioritising the improvement of profitability and expanding their valuation multiples. As this robust governance journey continues, Japan has maintained strong performance momentum from 2023 into 2024.

In January 2024, Korea launched its Corporate Value-up Program (CVP), which has garnered significant investor interest. The CVP targets companies with low valuations and encourage them to enhance profitability, aiming to narrow the “Korea Discount.” Also, Financial Services Commission has unveiled plans to reduce tax burdens on dividends and capital gains, incentivizing long term investment and improving shareholder returns. Although the specific details are yet to be released, the CVP is already positively impacting the market and bolstering investors’ sentiment in the recent weeks.

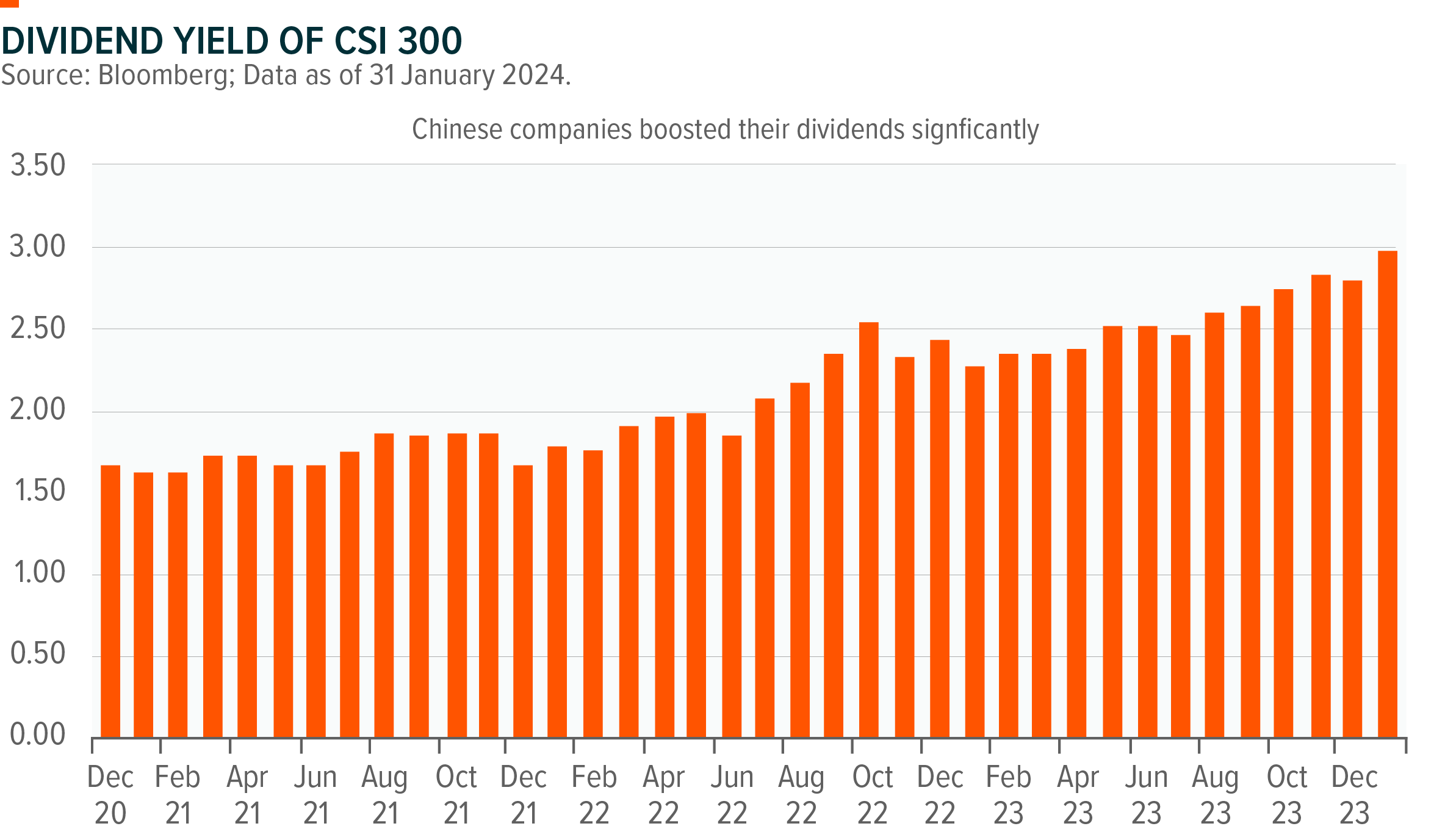

Over the recent weeks, Chinese regulators continued to promote the concept of “Valuation with Chinese Characteristics” (VCC), in efforts to enhance the quality and investment value of listed companies. One aspects of the VCC focus is dividend pay-out. By strengthening disclosure requirements for non-dividend paying companies, the China Securities Regulatory Commission urged listed firms to increase the frequency of dividend pay-outs and streamline interim distribution processes. Notably, Chinese companies are intensifying efforts to boost dividends. In the meantime, Hong Kong companies are frequently engaging in share repurchases, in an effort to improve shareholders’ return.

Overall, governance improvements in Asia, particularly in Japan, Korea, and China, are playing a significant role in enhancing shareholders’ return. As these countries continue to prioritize governance enhancements, it is likely that the valuation gaps between Asia Pacific and Developed Markets will gradually narrow further, presenting potential investment opportunities for discerning investors.

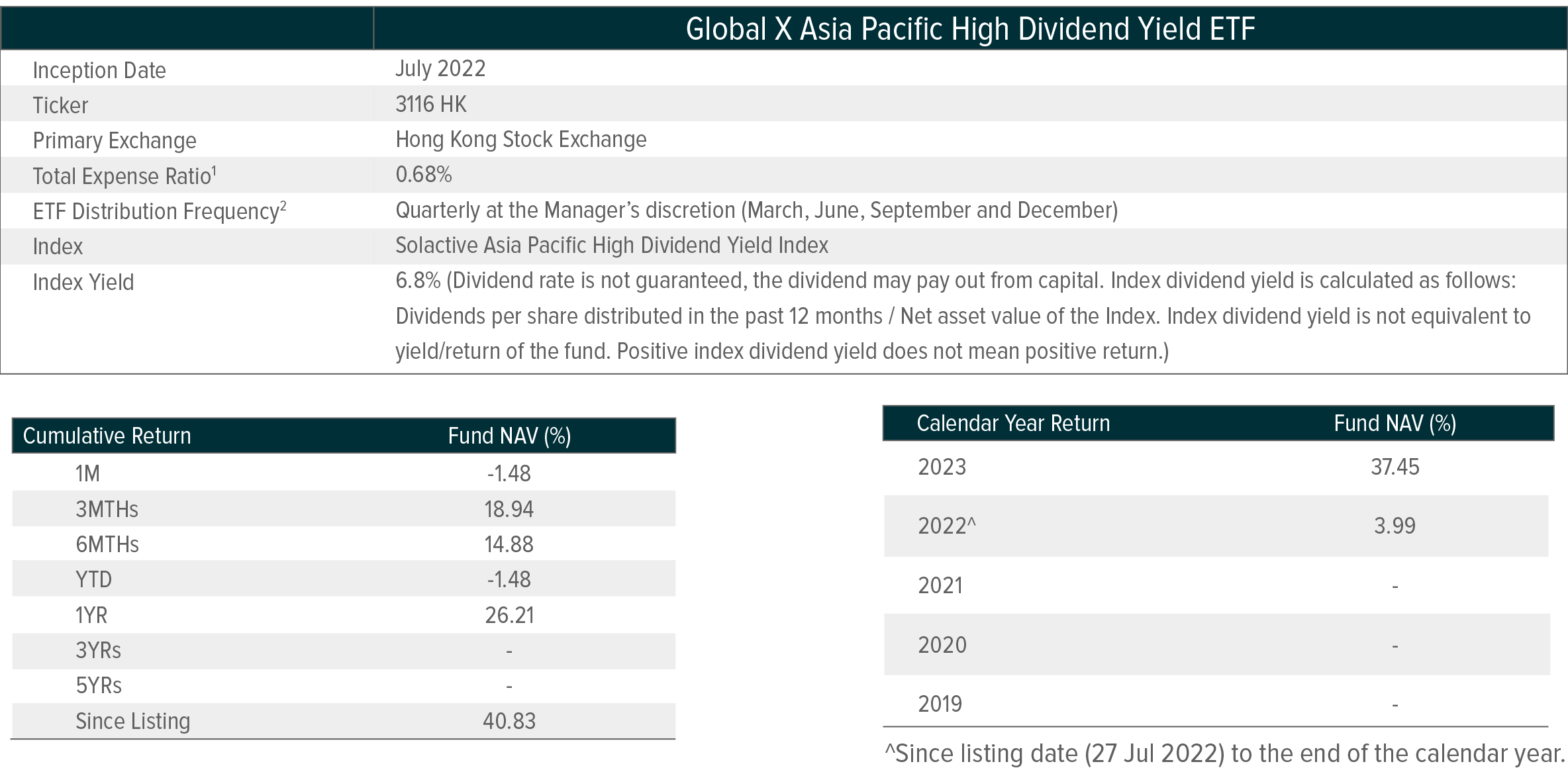

To seize the potential opportunity, investors may consider investing in the Global X Asia Pacific High Dividend ETF (3116 HK). This ETF comprises high dividend-paying securities listed in the Asia Pacific region including Korea, Japan, China, Hong Kong and Taiwan. As of January 31, 2024, the index’s dividend yield stands at 6.8%. (Dividend rate is not guaranteed; the dividend may pay out from capital. Index dividend yield is calculated as follows: Dividends per share distributed in the past 12 months / Net asset value of the Index. Index dividend yield is not equivalent to yield/return of the fund. Positive index dividend yield does not mean positive return.) The ETF aims to distribute dividends on a quarterly basis subject to the Manager’s discretion. In each of the quarter since launch, the Manager has decided to distribute dividends.