Important Information

Investors should not base investment decisions on this website/material alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X Metaverse Theme Active ETF (the “Fund”) invests in equity to achieve long term capital growth by primarily investing in companies which engage in activities relating to or provide products, services or technologies that enable the development and operation of the Metaverse.

- The Fund employs an actively managed investment strategy and does not seek to track any index or benchmark. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investments are concentrated in companies involved in the Metaverse Business, which may experience relatively higher volatility in price performance when compared to other economic sectors.

- The Metaverse is a new theme. The values of the companies involved in the Metaverse Business may not be a direct reflection of their connection to the Metaverse, and may be based on other business operations. The Metaverse may not exist on a scale that provides identifiable economic benefit to many or all of the companies involved in the Metaverse Business.

- The performance of the Fund may be exposed to risks associated with different sectors and themes, including industrial, consumer discretionary, financial, information technology, robotics and artificial intelligence, semiconductor, video games and e-sports, communication services, entertainment as well as technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the Net Asset Value of the Fund.

- Investors should note that Unitholders will only receive distributions in USD and not HKD. In the event the relevant Unitholder has no USD account, the Unitholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Dividends may be paid from capital or effectively out of capital of the Fund, which may amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and result in an immediate reduction in the Net Asset Value per Unit of the Fund.

- The trading price of the Fund unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

Global X Metaverse Theme Active ETF (3006) Offers a Great Opportunity to Invest in AI and Metaverse

Listen

The Global X Metaverse Theme Active ETF (3006)1 is well positioned to capture the rapid technology innovation development in AI and Metaverse. Key underlying drivers behind the strong outperformance YTD include 1) acceleration of AI commercialization. 2) Semiconductor cycle bottom out. 3) Recovery of China technology names.

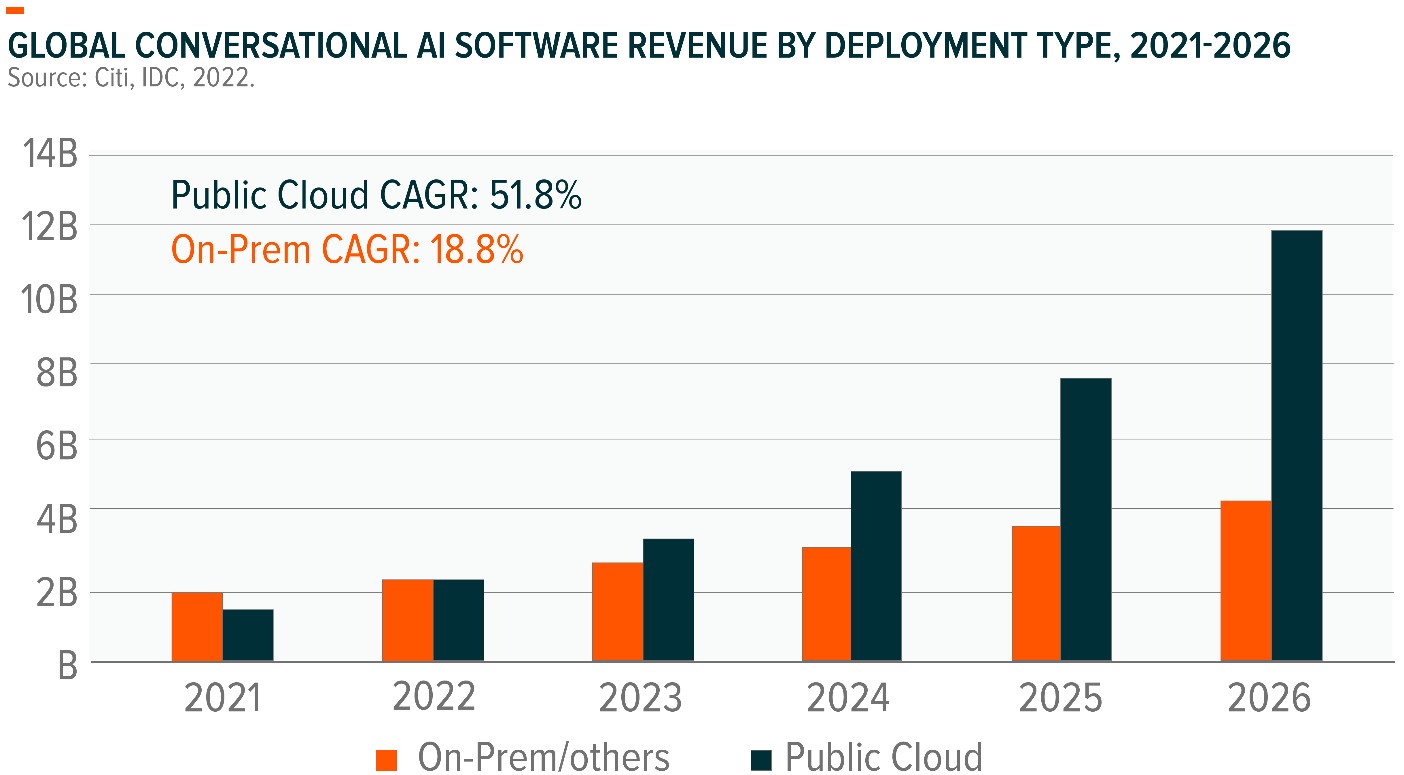

The AI market is expanding rapidly, with generative AI being a newer term for technology that creates novel insights from a dataset. The conversational AI market is a useful comparison for sizing generative AI, with IDC projected 37% CAGR growth from $3.3B in 2021 to $16B by 2026. The public cloud component is expected to grow at a higher CAGR than on-premise solutions, with the launch of ChatGPT on Microsoft Azure validating the scalability of the cloud market. This presents significant growth opportunities for cloud players such as Microsoft, Google, Amazon, and other data center supply chain players.

Top holdings well positioned for AI and Metaverse development

Microsoft

Microsoft is well-positioned to benefit from the generative AI opportunity in software, with potential gains in search market share, enhanced product competitiveness in the office offerings and opportunity to grow business in AI infrastructure leveraging Azure cloud clients and infrastructure.

On search there is ample opportunity to gain market share given Bing’s single digit market share position in the US at the moment. The momentum behind ChatGPT may help microsoft with MAUs and time spent on Bing, two crucial metrics that advertisers evaluate to increase spend on the platform.

Azure serves as the AI supercomputer that pretrains OpenAI’s foundational models, while its app marketplace distributes API access. Microsoft utilizes generative AI models internally to power its suite of products, including Power BI, Power Apps, and GitHub CoPilot. The Azure OpenAI Service enables customers to access generative AI models based on a per-unit price per model. Additionally, customers can feed their own data into the generative model and train AI needed for specific use cases.

Nvidia

Nvidia’s dominance in the training market for large AI models allow the company to capture incremental spending on AI infrastructure. The high capital intensity of these workloads, particularly on the training side, is now a major part of the investment for the largest companies in technology. Additionally, the company’s deal with Mercedes is expected to provide a subscription revenue stream for advanced ADAS, while new ADAS/autonomous wins with other automakers are expected to generate additional revenue.

Apple

Apple is expected to launch its MR (mixed reality) headset, called the Apple Reality Pro or Apple Reality One, at the WWDC 23 event this June. This presents a significant opportunity for Apple to expand its product category and enter the mixed reality market. We expect the headset to set the new benchmark for industry hardware and software design in mix reality, and drive the development of a new ecosystem.

Portfolio valuation and quality

The Global X Metaverse Theme Active ETF continues to focus on quality companies which will deliver high growth. As of 31 March 2023, the Global X Metaverse Theme Active ETF trades at 24X FY23 PE, vs EPS growth of 17% and 23% in 2023, 2024 respectively based on FactSet consensus estimates. Portfolio ROA and ROE are 12% and 24% respectively.