Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X India Sector Leader Active ETF (the “Fund”)’s investment objective is to achieve long term capital growth by primarily investing in equities and equity-related securities of sector leading companies domiciled in or exercising a large portion of their economic activity in India.

- The Fund will invest primarily (i.e. at least 70% of its net asset value (the “Net Asset Value”) in equities and equity-related securities (such as common shares, preferred stock as well as American depositary receipts (“ADRs”), global depositary receipts (“GDRs”) and participation notes) of sector leading companies domiciled in or exercising a large portion of their economic activities (e.g., having investments, production activities, trading or other business interests) in India.

- The Fund employs an actively managed investment strategy. The Fund does not seek to track any index or benchmark, and there is no replication or representative sampling conducted by the Manager. It may fail to meet its objective as a result of the Manager’s selection of investments, and/or the implementation of processes which may cause the Fund to underperform as compared to other index tracking funds with a similar objective.

- The Fund’s investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- • The Fund is an FPI registered with the SEBI. The applicable laws, rules and guidelines on FPI impose limits on the ability of FPI to acquire shares in certain Indian issuers from time to time and are subject to change. This may also adversely affect the performance of the Fund.

- The FPI status of the Sub-Fund may be revoked by the SEBI under certain circumstances. In the event the Fund’s registration as an FPI is cancelled, revoked, terminated or not renewed, this would adversely impact the ability of the Fund to make further investments, or to hold and dispose of existing investment in Indian securities. The Fund may be required to liquidate all holdings in Indian securities acquired by the Fund as an FPI. Such liquidation may have to be undertaken at a substantial discount and the Fund may suffer significant/substantial losses.

- The Fund’s investments are concentrated in securities in India. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the Indian market.

- High market volatility and potential settlement difficulties in the equity market in India may result in significant fluctuations in the prices of the securities traded on such market and thereby may adversely affect the value of the Fund. The BSE has the right to suspend trading in any security traded thereon. The Indian government or the regulators in India may also implement policies that may affect the Indian financial markets. There can be no assurance that the Indian government will not impose restrictions on foreign exchange and the repatriation of capital.

- The taxation of income and capital gains in India is subject to the fiscal law of India. The tax rate in respect of capital gains derived by an FPI on transfer of securities will vary depending upon various factors. Any increased tax liabilities on the Fund may adversely affect the Net Asset Value of the Fund. For details, please refer to the section headed “Taxation in India” in the Prospectus. Any shortfall between the provision and the actual tax liabilities, which will be debited from the assets of the Fund, will adversely affect its Net Asset Value.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is USD but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Securities lending transactions may involve the risk that the borrower may fail to return the securities lent out in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

- The trading price of the Units on the SEHK is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Investors should note that where a unitholder holds Listed Class of Units traded under the USD counter, the relevant unitholder will only receive distributions in HKD and not USD.

- Payments of distributions out of capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions involving payment of dividends out of capital or effectively out of capital of the Fund may result in an immediate reduction in the Net Asset Value per Unit of the Fund and will reduce the capital available for future investment.

Global X India Sector Leader Active ETF (3084/9084) Outlook 2025

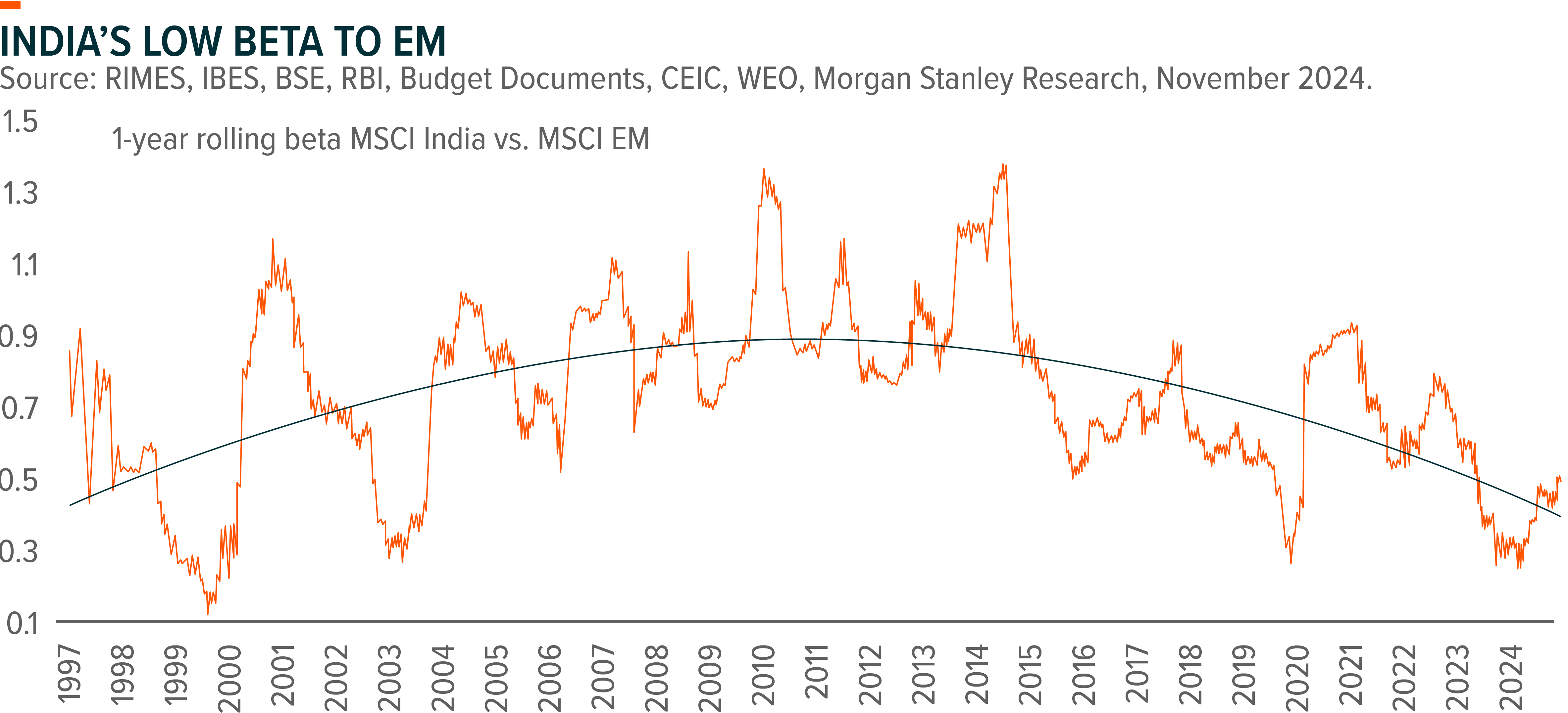

While the macro environment has become more challenging for emerging markets, including India post the US election, we believe Indian equities should remain relatively insulated from the macro headwinds of a stronger dollar and the US tariffs risks.

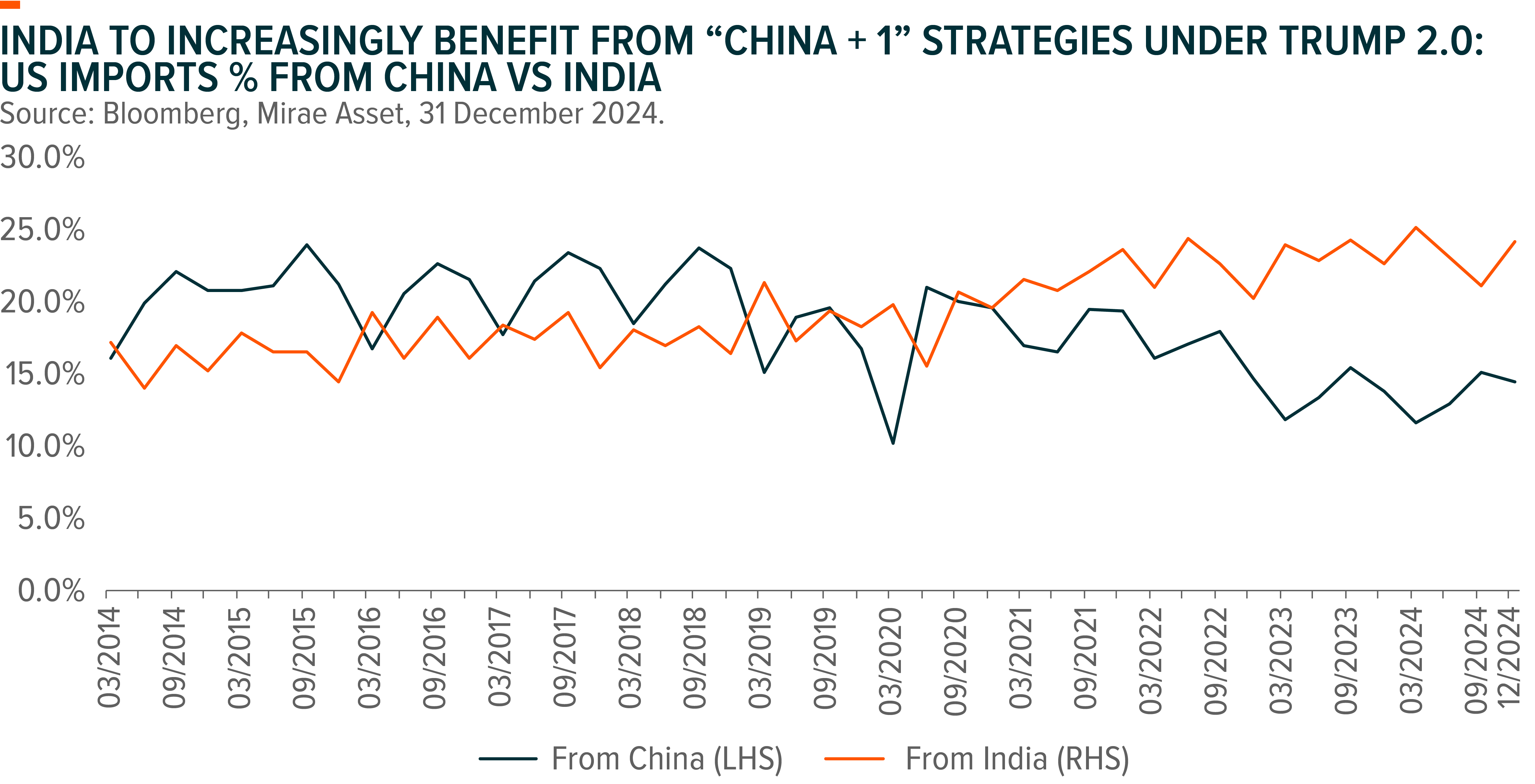

India is still largely domestic demand driven economy with consumption contributing nearly two-thirds of GDP, and an investment upcycle is expected to continue over the next several years. The US contributes only 10-15% of India’s exports, primarily in IT services and Pharmaceuticals, which may have a limited impact from the tariff risks. On the other hand, we believe India may benefit from the current geopolitical situation as well as from multinationals’ “China + 1” strategies as India is now in a much better position than in previous years to attract more investments and thus gain more shares in global manufacturing industries. We believe investing in sector leaders will be a good strategy to navigate macro uncertainties while capitalising on India’s structural growth story.

We believe “Trump 2.0” administration may bring more opportunities than risks to India, as the country is now much better prepared to attract more investments from multinational companies’ reshuffling their supply chain. This preparedness is supported by better infrastructure, supportive government policies, and a growing base of affordable consumers, which creates a large consumption market. Companies like L’Oreal and Schneider Electric have already held their global analyst meetings in India in 2024, and we expect more companies to follow in coming years. Despite India was not a primary beneficiary of the previous US trade tensions, much has changed since then. We expect India to receive more foreign direct investment (FDI) not only in high-tech sectors but also in mid-tech sectors like textiles and small electrical goods, which tend to be more labour-intensive by nature and are crucial for job creation. The “Make in India” initiative has been one of the key priorities for the Modi government over the past decade, and after the government regained strong leadership post the Maharashtra state elections, we expect the Central government may continue to undertake various reforms to achieve its “Make in India” goal.

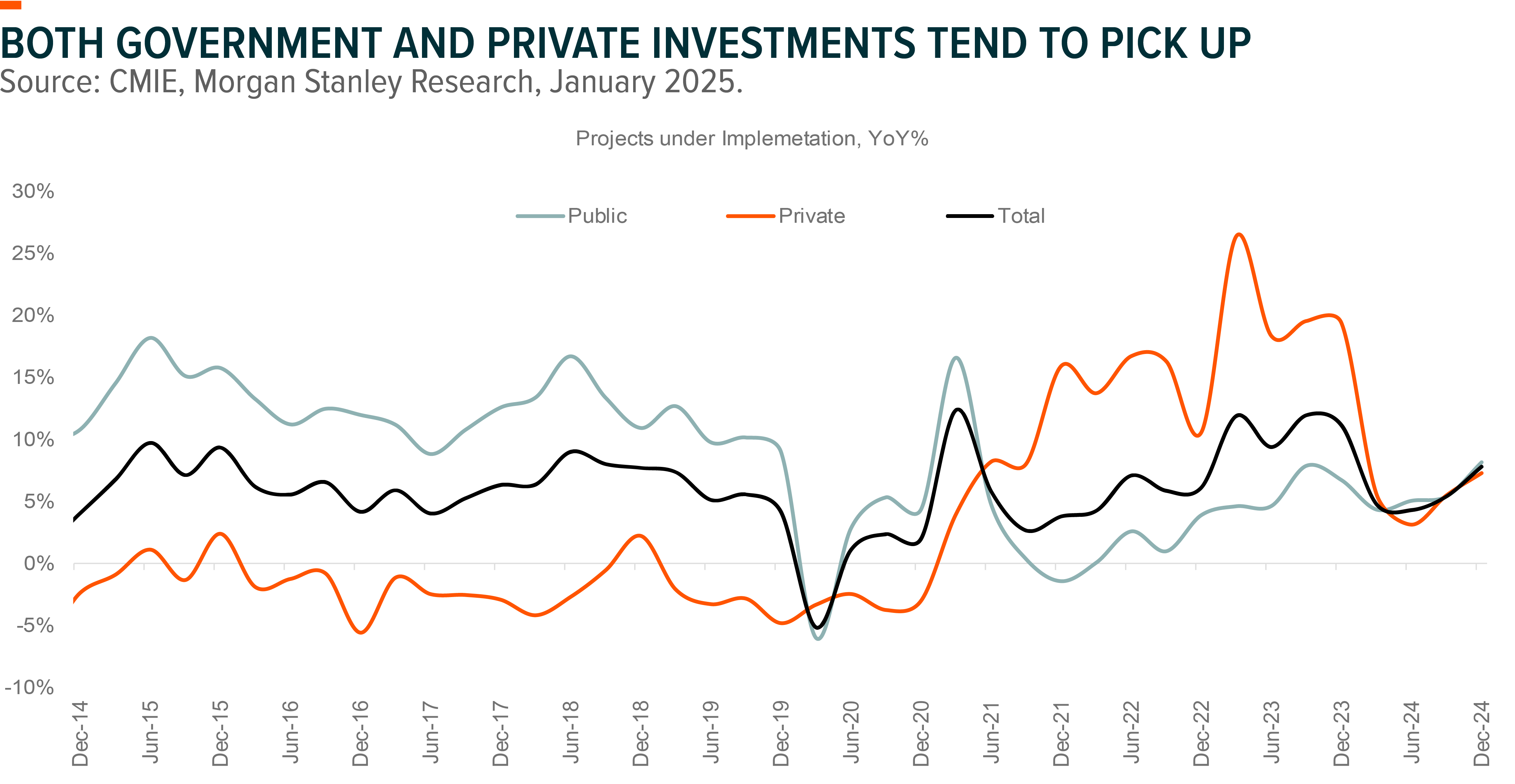

We see the current economic slowdown as transitory and expect growth to rebound in 2025. Government capex has slowed in 1HFY25, largely due to national elections, disruptive weather, and seasonal factors. However, we have witnessed government spending picking up in 3QFY25, which will continue in coming quarters. In addition, the housing cycle remains strong with a low level of inventories.

More importantly, private capex is expected to take the baton from the government moving forward. Private corporate capex is expected to increase considering strong balance sheets and opportunities in various sectors including power, electrification, Production Linked Incentive (PLI) schemes etc. We have also seen an increase in bank-approved projects, which should soon translate into private corporate investments, leading to a better earnings cycle.

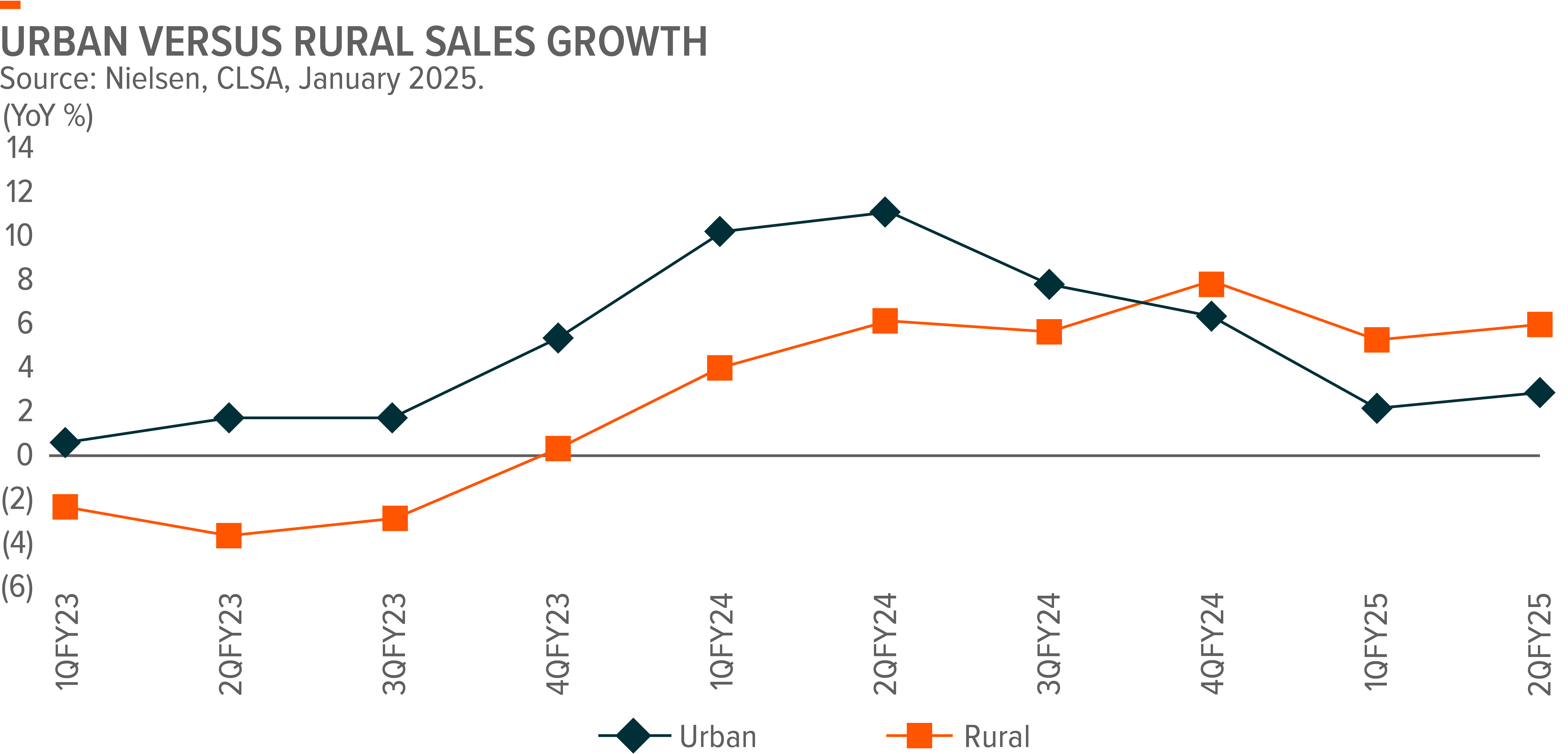

Consumption growth has also slowed in recent quarters, particularly in urban mass consumption, which has experienced a cyclical downturn due to high food inflation and a slowdown in unsecured consumer credit after Reserve Bank of India (RBI) pre-emptively tightened credit growth, especially on unsecured consumer loans since late 2023. We expect credit growth to stabilise from here as it has now come down to similar level of deposit growth. Furthermore, RBI is shifting to an easing monetary cycle, with interest rates likely to be cut in 1QCY25.

While we are closely watching out for food inflation, we expect a generally stable inflation environment for 2025 on the back of benign oil prices. Meanwhile, rural consumption has remained resilient and continues to show gradual improvement. In addition, premium consumption among affluent Indians – such as travel, luxury hotels, private hospitals and premium properties – has shown solid demand. Thus, we prefer to stick with consumer services where demand remains strong for the time being, as we navigate the cyclical slowdown in mass consumption.

While we expect some headwinds from the global macro environment, we believe India’s structural growth story remains intact and is expected to be one of the fastest-growing economies in 2025. Thus, we believe investing in sector leaders with strong management teams will be the best way to navigate tough times amid increased uncertainties while capitalizing on potential growth opportunities. Furthermore, we prefer to focus on sectors with strong demand, such as travel, internet/quick commerce, power, and hospitals, which offer high earnings visibility.