Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X Hang Seng High Dividend Yield ETF (the “Fund”) is to provide investment results that, before deduction of fees and expenses, closely correspond to the performance of the Hang Seng High Dividend Yield Index.

- Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. There can be no assurance that the distribution yield of the Fund is the same as that of the Index.

- The Fund may invest in mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The Fund invests in the emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Global X Hang Seng High Dividend Yield ETF (3110) Updates

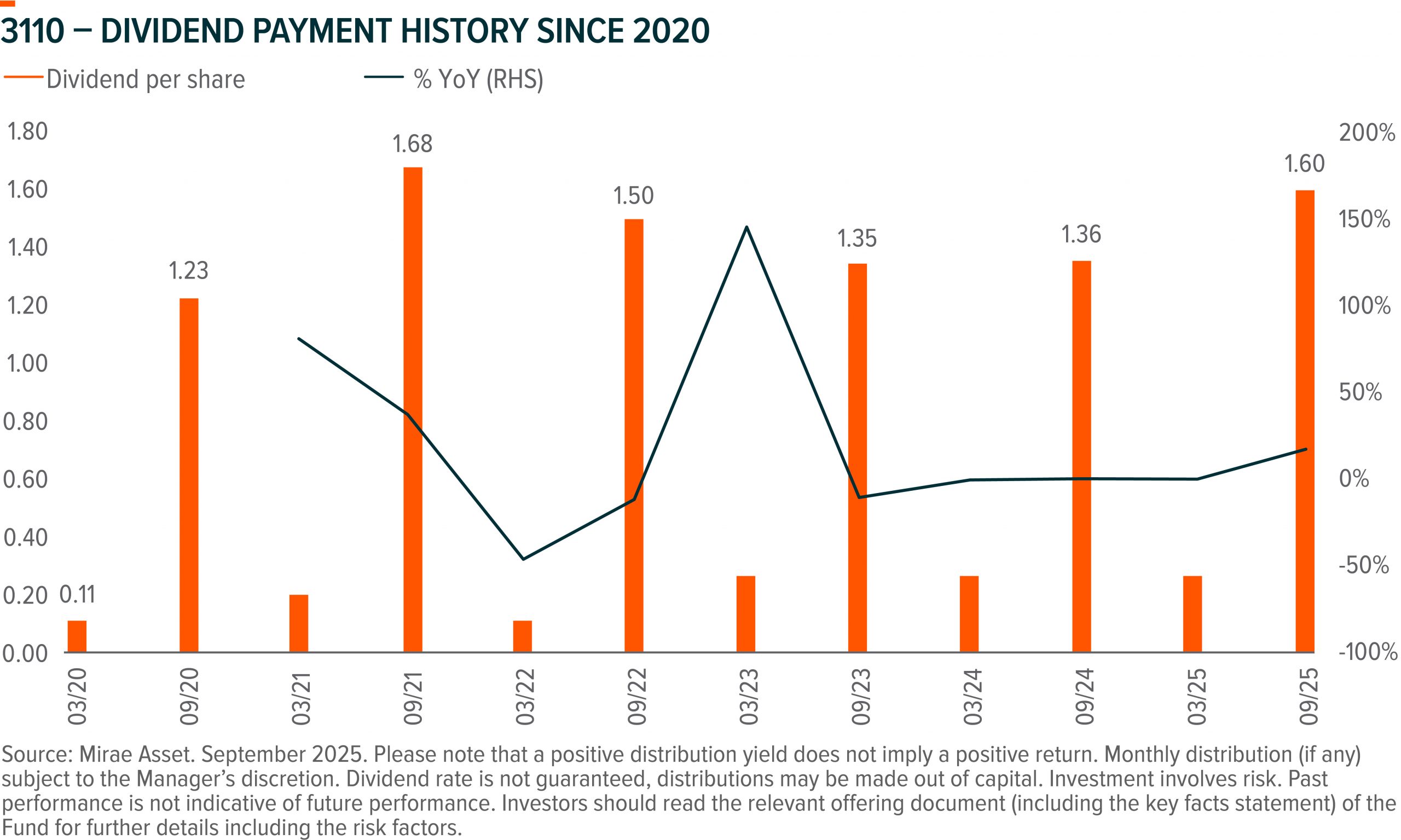

Global X Hang Seng High Dividend Yield ETF (3110) announced dividend payment of HK$1.6/share on 9 September 2025. The ex-dividend date is 24 September, and dividends are scheduled to be paid on 30 September. Based on 29 August fund NAV, Last 12 month dividend yield is 6.25%1. Dividend payment has grown steadily over the past three years.

1 Source: Mirae Asset, 29 August 2025. Dividend rate is not guaranteed, distributions may be made out of capital or income at the Manager’s discretion. The Manager may at its absolute discretion declare distributions semi-annually to unitholders in each financial year and details of the distribution declaration dates, distribution amounts and ex-dividend payment dates will be published on the Manager’s website https://www.globalxetfs.com.hk/. Distributions may be made out of capital or income at the Manager’s discretion. There can be no assurance that a distribution will be paid and dividend rate is not guaranteed. Please refer to the prospectus of the fund to understand the distribution policy and other details. The annualized yield is calculated as follows: (dividends per share distributed in Mar 2025 and Sep 2025) / net asset value per unit of the fund on 29 Aug 2025. Investors should note that yield figures are estimated and for reference only and do not represent the performance of the Fund, and that there is no guarantee as to the actual frequency and/or amount of dividend payments. Please note that a positive distribution yield does not imply a positive return on the total investment. Investors should not base investment decisions on the above information alone. Please refer to the Prospectus(including Product Key Facts Statement) for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance.

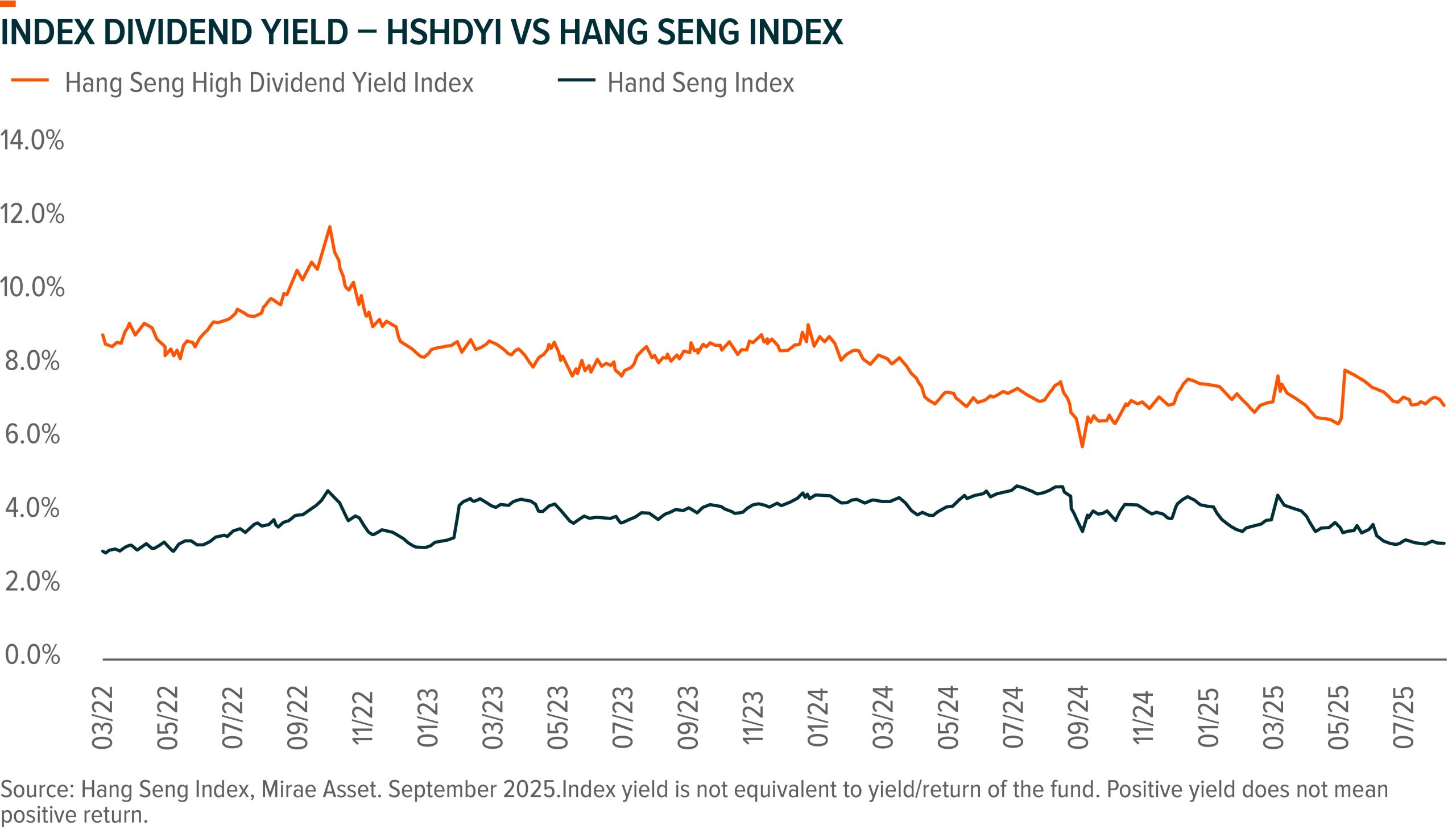

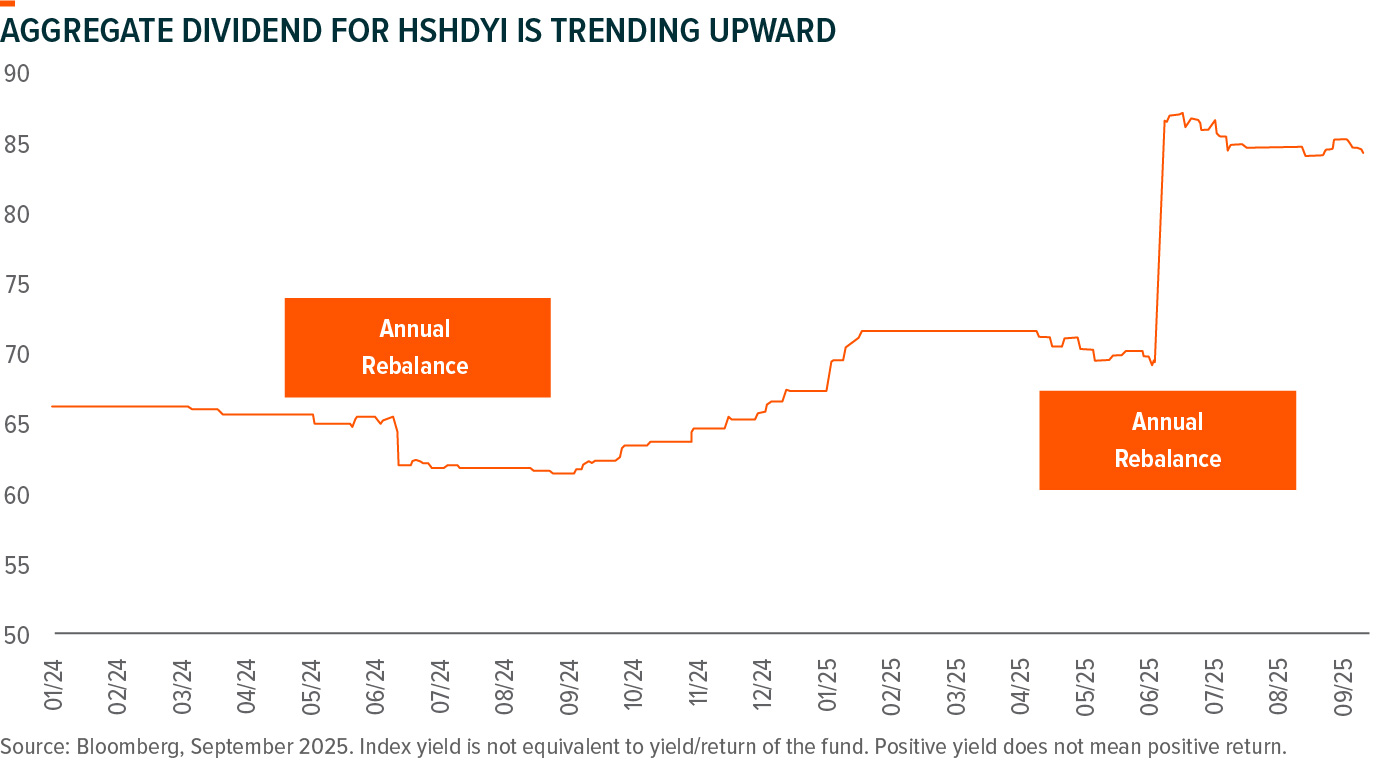

Dividend yield for Hang Seng High Dividend Yield Index (HSHDYI) is 6.9%2 as of 29 August 2025. Index dividend yield increased to 7.8% (Hang Seng, September 2025) after June annual rebalancing, the subsequent decline is due to strong price growth momentum. Both DPS and price have been on a steady upward trend since 2024.

2Source: Mirae Asset, Hang Seng, 29 August 2025. Index yield is not equivalent to yield/return of the fund. Positive yield does not mean positive return. Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

Recently softened US labor data, coupled with a more dovish stance from the US Federal Reserve, is fueling an expedited US rate cut cycle that is expected to commence as early as September. High Dividend Strategy continues to stand out amid market uncertainty for its combination of elevated dividend yields and reduced volatility, and we are seeing more investor interests in the product lately. For onshore China, the low bank deposit rate and bond yield could potentially prompt more household savings into equity market, and equity income products could be among the first to benefit. High dividend strategy is also a key beneficiary for China’s forceful stimulus package and policy supports. PBOC’s Relending facility should boost corporate buyback, and Capital Market ‘Nine Measures’ issued by Central Government last year also promotes more stable and frequent corporate dividend payout. (Mirae Asset, September 2025)

Constituents Updates

At the latest earnings season, 42 out of the 50 constituents announced 1H25 interim dividend*. Among the 42 companies that announced 1H25 interim dividend, 30 companies (71%) will increase or maintain payout amount as compared to same period last year. On LTM basis (1H25 Interim dividend + FY24 Annual dividend), weighted average DPS grew by 7.9% YoY. In addition to dividend payments, some companies are also opting to enhance shareholder returns through share repurchases. (Source: Company data, Mirae Asset *Note: Among 50 constituents, 46 companies have fiscal year end as of December 31st. 3 companies have fiscal year end as of March 31st. 1 company has fiscal year end as of June 30th. 1H25 Interim dividend here refers to dividend with ex-date from 2025-06-30 to 2025-12-31. FY24 Annual dividend here refers to dividend with ex-date from 2024-12-31 to 2025-06-30. Calculation is based on constituents and weighting as of 5 September.)

China Hongqiao Group (1378 HK) – Hongqiao did not announced interim dividend, but management guaranteed that the full-year dividend payout ratio for Hongqiao for 2025 will be no lower than that in 2024, which was ~63%. Furthermore, the board also announced a new share repurchase program with total value >HK$3bn, and repurchased shares will be cancelled. Despite no interim dividend, the guaranteed full year payout and new share repurchase plan will continue to enhance total shareholder return for the stock. LTM dividend yield is 6.3%*. Hongqiao’s share price goes up substantially YTD on elevated aluminium price with improving supply-demand dynamic. (Source: Company data, Mirae Asset *Note: LTM dividend yield in this session is calculated based on 29 August 2025 share price.)

Yue Yuen Industrial (551 HK) – Yue Yuen announced HK$0.4 dividend per share in 1H25, flat YoY despite net profits down 7% YoY. This indicates management commitment to shareholder return. LTM dividend yield for Yue Yuen is 9.5%. (Source, Company data, Mirae asset, September 2025)

Hang Lung Properties (101 HK) – Hang Lung announced HK$0.12 dividend per share in 1H25, flat YoY. Management anticipates its PRC tenant sales to narrow further or turn positive in 2H25 esp. against a low base in 3Q24, if no further significant deuteriation in consumer and business sentiments. New project completion should enhance recurring income resilience, supporting the dividend payment. LTM dividend yield for Hang Lung is 6.6%. (Source, Company data, Mirae asset, September 2025)

COSCO Shipping (1919 HK) – COSCO Shipping announced RMB0.56 dividend per share in 1H25 based on unchanged payout of 49%, +7.7% YoY. LTM dividend yield for COSCO Shipping is 12%. (Source, Company data, Mirae asset, September 2025)

Hysan Development (14 HK) – Hysan announced HK$0.27 dividend per share in 1H25, flat YoY. Management reaffirmed its target to stable dividend distribution policy going forward, and has no plan to issue scrip dividend in avoidance of potential shareholding dilution. LTM dividend yield for Hysan is 7.4%. (Source, Company data, Mirae asset, September 2025)

Orient Overseas (316 HK) – Orient Overseas announced US$0.72 dividend per share in 1H25, +14% YoY. LTM dividend yield for Orient Overseas is 12%. (Source, Company data, Mirae asset, September 2025)