Important Information

Investors should not base investment decisions on this website/material/video alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Little Giant ETF’s (the “Fund’s”) objective is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Little Giant Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund may invest in small and/or mid-capitalisation companies which may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- The Fund’s investments are concentrated in companies which are characterised by relatively higher volatility in price performance. The Sub-Fund may be exposed to risks associated with different sectors and themes including semiconductor, industrial, pharmaceutical, energy and technology. Fluctuations in the business for companies in these sectors or themes will have an adverse impact on the net asset value of the Sub-Fund. Some of the companies classified as the Little Giants have a relatively short operating history. Such companies also face intense competition and rapid changes could render the products and services offered by these companies obsolete, which may have an adverse effect on profit margins. They may be more susceptible to risks of loss or impairment of intellectual property rights or licences, cyber security risks resulting in undesirable legal, financial, operational and reputational consequences affecting those companies.

- The Mainland China is an emerging market. The Fund invests in Mainland Chinese companies which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risk, currency risks or control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility. Securities exchanges in the Mainland Chinese markets typically have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. All these may have a negative impact on the Fund.

- Listed companies on the ChiNext market and/or STAR Board are subject to higher fluctuation on stock prices and liquidity risk, over-valuation risk, less stringent regulation risk, delisting risk and concentration risk.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

Global X China Little Giant ETF (2815)

Investment Case for China Little Giants ETF

Global X China Little Giants ETF (2815) conducted semi-annual rebalancing in January 2025. 17 stocks are newly included after rebalancing and the same amount are excluded, with total market cap accounting for 30% of the portfolio. Among the 17 new inclusion, 3 are newly included in the China little giant universe during July 2024 – December 2024. In the January rebalancing, threshold for index inclusion is ~Rmb11bn in market cap, and ~11% in past 3 year average ROE. The majority of the turnover is mainly attributed to former constituents whose market capitalization has fallen out of the top 100 rankings.

Index Methodology and Portfolio Analysis

Ministry of Industry and Information Technology (MIIT) of China selected list of “Little Giant” enterprises, with key criteria including: 1) operate core business in specific areas/products across technology/manufacturing supply chain; 2) over 10% market share within sub-sector; 3) for companies with revenue >Rmb100bn, R&D expense/revenue >3%; for companies with revenue >500mn, R&D expense/revenue >6%. Over 14,000 companies are selected as ‘Little Giants’, among which over 1,000 are listed in China A-Share. Among all the listed little giants, top 100 stocks by market cap are eligible for index inclusion, and Top 50 stock ranked by ROE are selected as index constituents. Constituents are weighted by total market cap, with single stock limit of 5%.

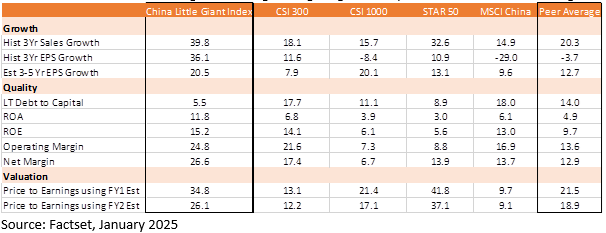

China Little Giants ETF is a portfolio consisting of high quality companies with solid growth trajectory. As it prioritizes ROE in index inclusion, China Little Giants Index has higher ROE and operating margin as compared to other broad-based and small cap China indices. The small cap and technology-oriented features also support higher realized and expected growth rates for Little Giant index. Valuation is undemanding considering the higher growth expectation, with its PEG ratio generally in line with peer average.

Key Building Blocks for China’s Manufacturing Excellence

China’s manufacturing industry has not only been a pivotal force driving China’s economic growth but also stands as a global powerhouse in manufacturing output. With over 30% of the global market share, China has solidified its position as the largest manufacturing hub in the world. However, after decades of rapid development, China’s economy growth in entered into “new norm”, switching gear from high-speed to medium-to-high speed growth, from an extensive model that emphasized scale and speed to a more intensive model emphasizing quality and efficiency, and technological innovation should be the core driving force at this stage. As niche leaders in their respective sectors, ‘Little Giants’ enterprises are serving as one of the key drivers for China’s transitions to high-end manufacturing, capturing higher value-add part in global supply chains.

Little Giant enterprises are leveraging supportive policies that encompass funding, subsidies, industrial resources, talent, and research perspectives. This enhanced enterprise service ecosystem positions Little Giants for sustained growth, propelling them towards becoming global leaders in their respective sectors.

Small Caps Offer Higher Return Potentials

The combination of small caps and technology features brings higher return potential for little giant portfolios. Historical data demonstrated outperformance of Small-mid cap vs Large cap indices across most regions globally thanks to the valuation premium under higher growth expectations, but this is not as prevalent in China over the past decade. Key reasons for the discrepancy include risks from domestic regulatory policies and potential re-escalation of US-China tensions, as well as subdued market sentiment.

With global central banks entering rate-cutting cycles, improved market liquidity and sentiments in China due to strong policy stimulus since September 2024, and ongoing initiatives to enhance the overall quality of listed companies, we find a more compelling investment proposition for small-cap companies in China. Thanks to higher earnings elasticity, high-quality SMEs have the potential to deliver substantial rebounds during capital reallocation and shifting market dynamics. This opportunity could become even more compelling as further signs of an improving economic outlook emerge. China Little Giants ETF offers an attractive opportunity for investors to ride on the potential China market recovery in a cost-efficient manner.

| Global X China Little Giant ETF (2815 HK) | |

|---|---|

| Listing Date | 20 November 2023 |

| Reference Index | Solactive China Little Giant Index 1 |

| Primary Exchange | Hong Kong Stock Exchange |

| Total Expense Ratio | 0.68% p.a. |

| Product Page | Link |

Source: Mirae Asset; Data as of January 2025

1. The Underlying Index is a net total return, total market capitalisation weighted index. A net total return index seeks to replicate the overall return from holding a portfolio consisting of the Index constituents and in the calculation of the Index considers payments such as dividends after the deduction of any withholding tax or other amounts to which an investor holding the Index constituents would typically be exposed. The Index is denominated and quoted in RMB.