Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. There is no guarantee of the repayment of the principal. Investors should note:

- Global X China Electric Vehicle and Battery ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Electric vehicle companies invest heavily in research and development which may not necessarily lead to commercially successful products. In addition, the prospects of Electric vehicle companies may significantly be impacted by technological changes, changing governmental regulations and intense competition from competitors.

- China is an emerging market. The Fund invests in Chinese companies which may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

Global X China EV and Battery ETF

Riding on EV, Humanoid Robot, and AI Developments

Benefiting from the strong China EV sales momentum, and the continuous product innovation by leading EV and battery makers, Global X China Electric Vehicle and Battery ETF recorded substantial gains over the past 1 year. We remain optimistic on China EV and battery market as bolstered by extended trade-in policy support, continued technology and product innovation, further rollout and application of intelligent features, and improving EV ecosystems. See more details in our China EV and Battery Outlook report. Additionally, recent positive developments in humanoid robotics and AI also have positive implications on China EV and Battery ETF as several of major constituents reside in relevant supply chains.

Humanoid Robots – China EV and Battery Names in the Supply Chain

Humanoid Robot theme has been gaining traction recently as bolstered by a few catalysts: 1) Elon Musk announced plans for massive production of Optimus Robot in 2026; 2) Unitree’s humanoid robot model gained massive tractions after its performance in China’s Spring Festival Gala, and several videos of Unitree G1 model performing complex tasks went viral on the internet globally; 3) Huawei officially engage in humanoid robot industry with the establishment of its innovative center in the end of 2024.

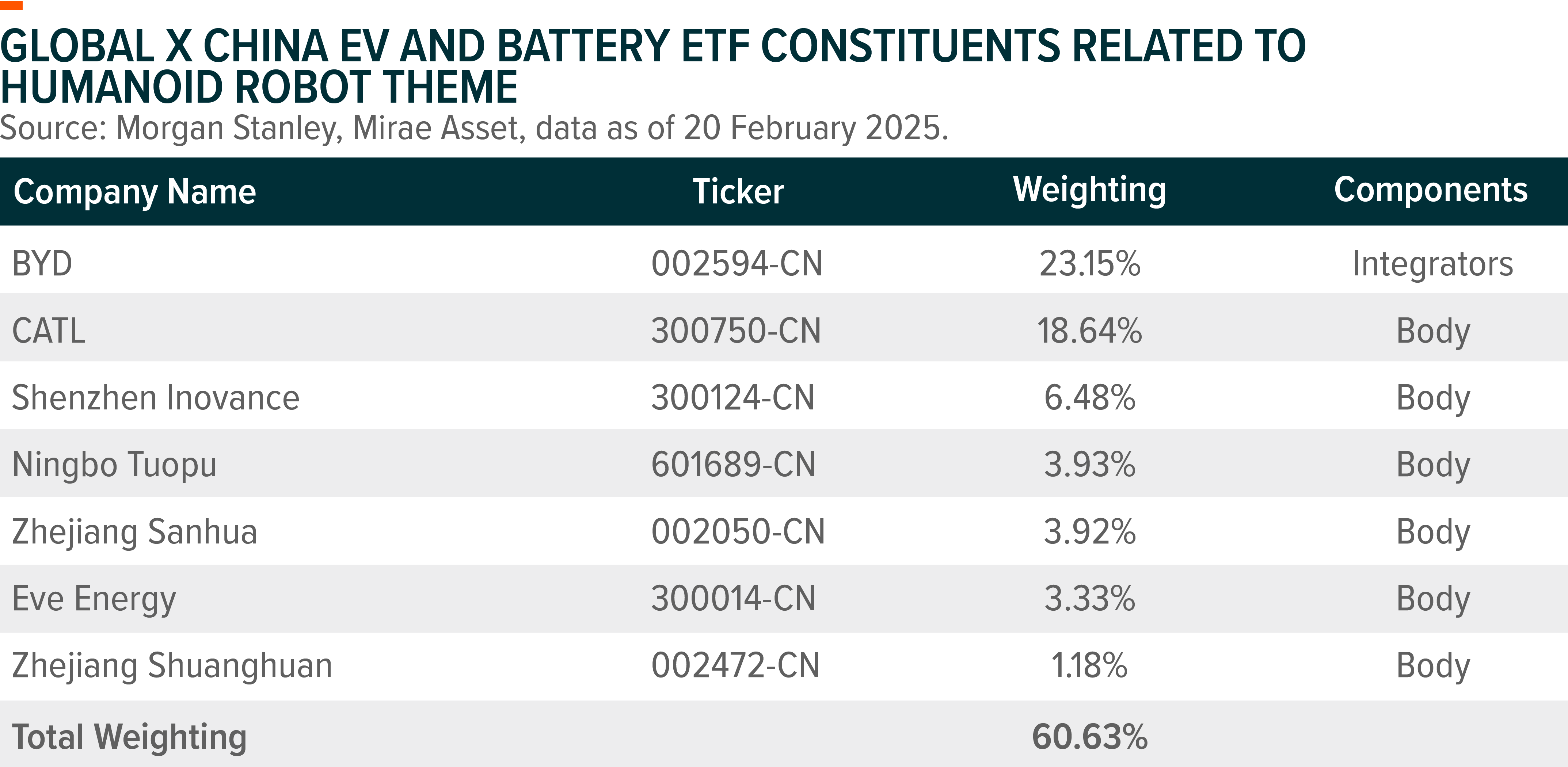

Leveraging their manufacturing expertise and product synergies, major automotive parts manufacturers such as Ningbo Tuopu and Zhejiang Sanhua have been integrated into the supply chains of leading humanoid robot manufacturers. Additionally, China’s largest auto manufacturer BYD has reportedly initiated its in-house humanoid project named “Yao Shun Yu” and has commenced the recruitment of talent specialized in robotics. Over 60% of the Global X China Electric Vehicle and Battery ETF constituents are embedded within the supply chain of humanoid robots, positioning them to potentially capitalize on the rapid growth of the billion-dollar humanoid robot market worldwide.

AI and Smart Driving – BYD is Bringing Smart Driving to Mass Market Models

DeepSeek success brings China’s technology and innovation capability back to global investors’ focus, this should also reignite spotlights on leading Chinese auto and battery makers who have been at the forefront of global product innovation. BYD debuted 21 new models, equipped with “God’s Eye” advanced smart driving system in its “vehicle intelligence strategy” conference held on 10 February. Through the new model launches, BYD is bringing smart driving functions to mass market models priced >Rmb100k. In addition, BYD also revealed plans to integrate DeepSeek into their models. We believe the implication on the broader China auto market is positive, as BYD, the largest mass-market player in China, is demonstrating its commitment to competing through enhanced value offerings rather than relying solely on aggressive price cuts.

| Global X China Electric Vehicle and BatteryETF (2845/9845) |

|

|---|---|

| Listing Date | 17 Jan 2020 |

| Reference Index | Solactive China Electric Vehicle and Battery Index NTR2 |

| Primary Exchange | Hong Kong Stock Exchange |

| Total Expense Ratio | 0.68% p.a.1 |

| Product Page | Link |

Source: Mirae Asset; Data as of February 2025.