Important Information

Investors should not base investment decisions on this material alone. Please refer to the Prospectus for details including the product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

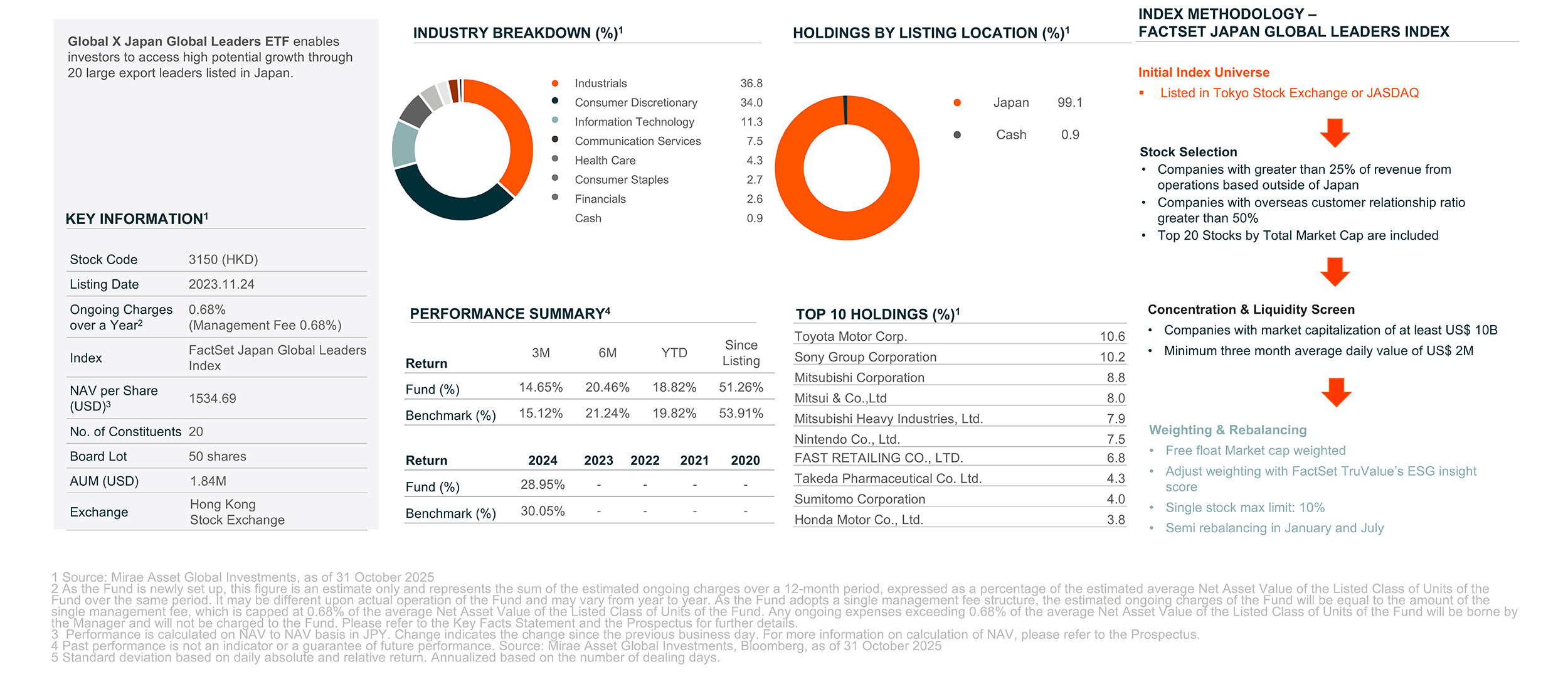

- The investment objective of Global X Japan Global Leaders ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the FactSet Japan Global Leaders Index.

- The Underlying Index is reconstituted annually. Securities that no longer meet the eligibility criteria may remain in the index until the next scheduled annual reconstitution. The index’s representativeness is not guaranteed to be optimised from time to time.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Japanese economy is heavily dependent on international trade and may be adversely affected by protectionist measures, competition from emerging economies, political tensions with its trading partners and their economic conditions, natural disasters and commodity prices.

- The base currency of the Fund is JPY but the trading currency of the Fund is in HKD. The NAV of the Fund and its performance may be affected by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

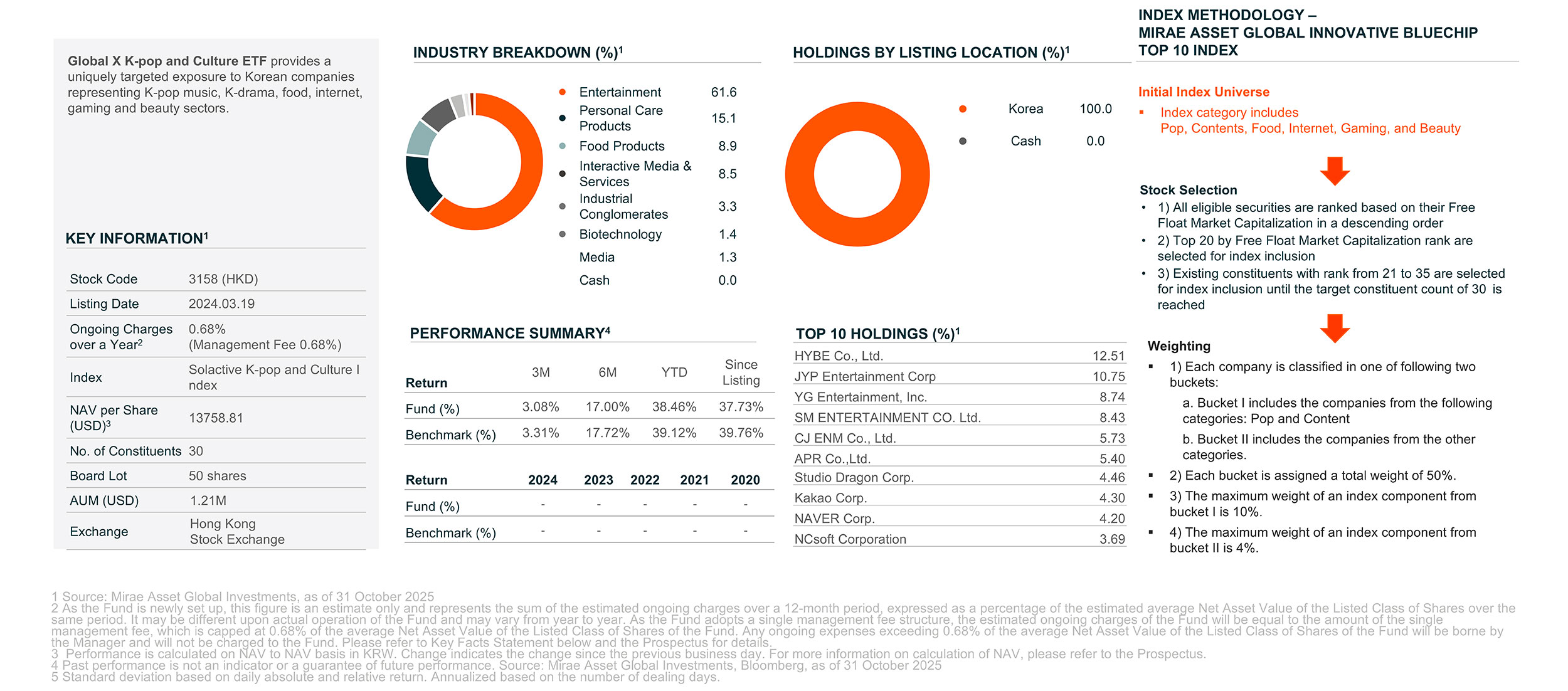

- The investment objective of Global X K-pop and Culture ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive K-pop and Culture Index.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The base currency of the Fund is KRW but the trading currency of the Fund is in HKD. The NAV of the Fund and its performance may be affected by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- The Fund may invest in small and/or mid-sized companies, which may have lower liquidity and their prices are more volatile to adverse economic developments.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

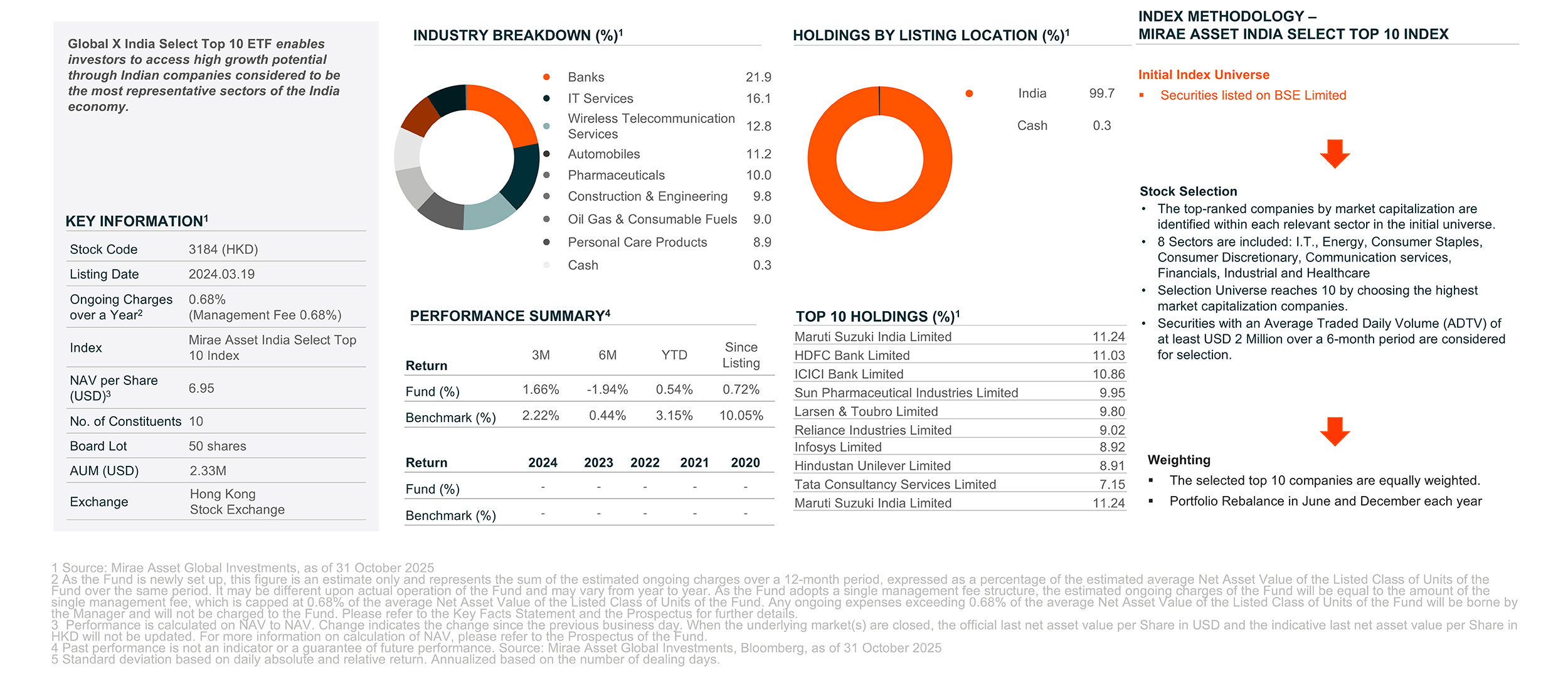

- The investment objective of Global X India Select Top 10 ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset India Select Top 10 Index.

- The number of constituents of the Underlying Index is fixed at 10. The Fund may hold more concentrated investment portfolio, leading to higher risks of volatility.

- The Fund is exposed to concentration risk by tracking a single region or country.

- The Fund is a FPI registered with the SEBI. SEBI’s rules and limits on FPI shareholding in some Indian companies can change and may affect the Fund’s performance. SEBI may also cancel the Fund’s FPI registration under certain conditions. If this happens, the Fund may not be able to invest in, hold, or sell Indian securities. The Fund might need to sell all its Indian holdings quickly, possibly at a big loss.

- The base currency of the Fund is USD but the trading currency of the Fund is in HKD. The NAV of the Fund and its performance may be affected by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- Investment in Emerging Market, such as Indian market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The taxation of income and capital gains in India is subject to the fiscal law of India. The tax rate in respect of capital gains derived by a FPI on transfer of securities will vary depending upon various factors. Any increased tax liabilities on the Fund may adversely affect the Net Asset Value of the Fund. Any shortfall between the provision and the actual tax liabilities, which will be debited from the assets of the Fund, will adversely affect its Net Asset Value. For details, please refer to the section headed “Taxation in India” in the Prospectus.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

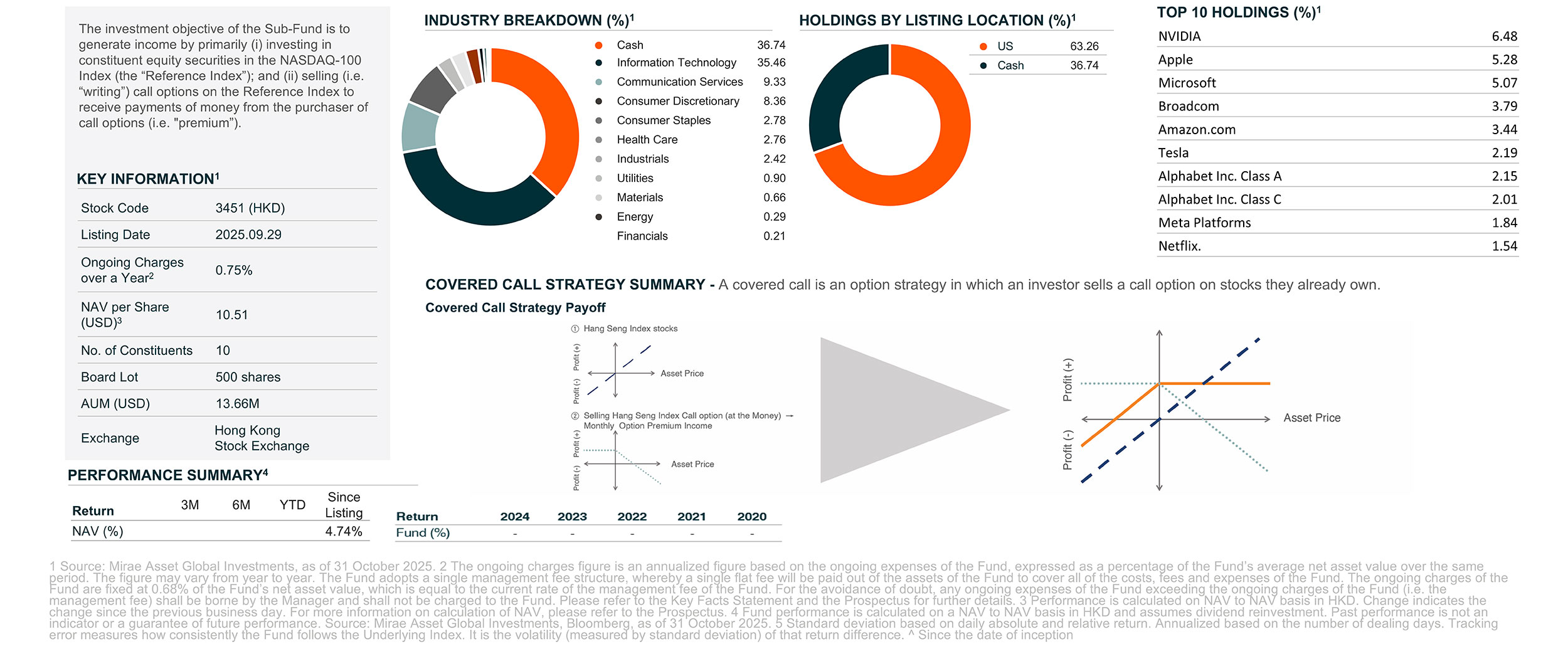

- The investment objective of Global X Nasdaq 100 Covered Call Active ETF (the “Fund”) is to generate income by primarily (i) investing in constituent equity securities in the NASDAQ-100 Index (the “Reference Index”); and (ii) selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “”premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations. If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the exchange may suspend the trading of options in volatile markets which may cause the Fund unable to write Reference Index Call Options at times.

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- The position of futures or options contracts held by the Manager may not in aggregate exceed the relevant maximum under relevant rules. If the position held or controlled by the Manager reaches the limit or the Fund grow significantly, the Manager will evaluate its position and consider closing out certain positions, which could restrict new share creation and cause the trading price to deviate from NAV.

- Investing in Reference Index Futures and writing Reference Index Call Options generally involve the posting of margin. If the Fund is unable to meet its investment objective as a result of margin requirements imposed by the CME and/or the Fund’s broker, the Fund may experience significant losses.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking the performance of securities in a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The Fund may be exposed to risks associated with different technology sectors and themes. A downturn in these sectors or themes may have adverse effects on the Fund.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

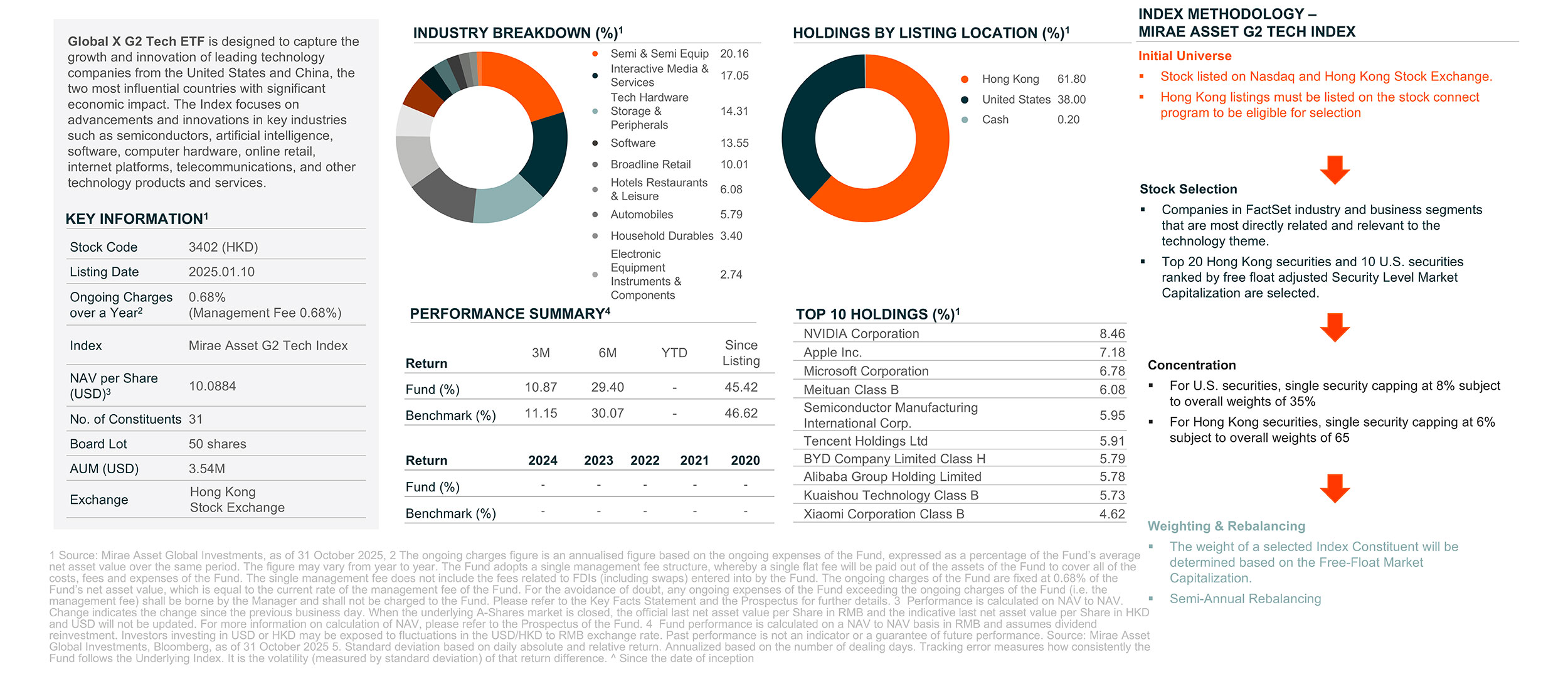

- The investment objective of Global X G2 Tech ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset G2 Tech Index.

- The Fund is exposed to concentration risk by tracking a specific region or country.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investors should note that Shareholders will only receive distributions in USD and not HKD, Shareholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

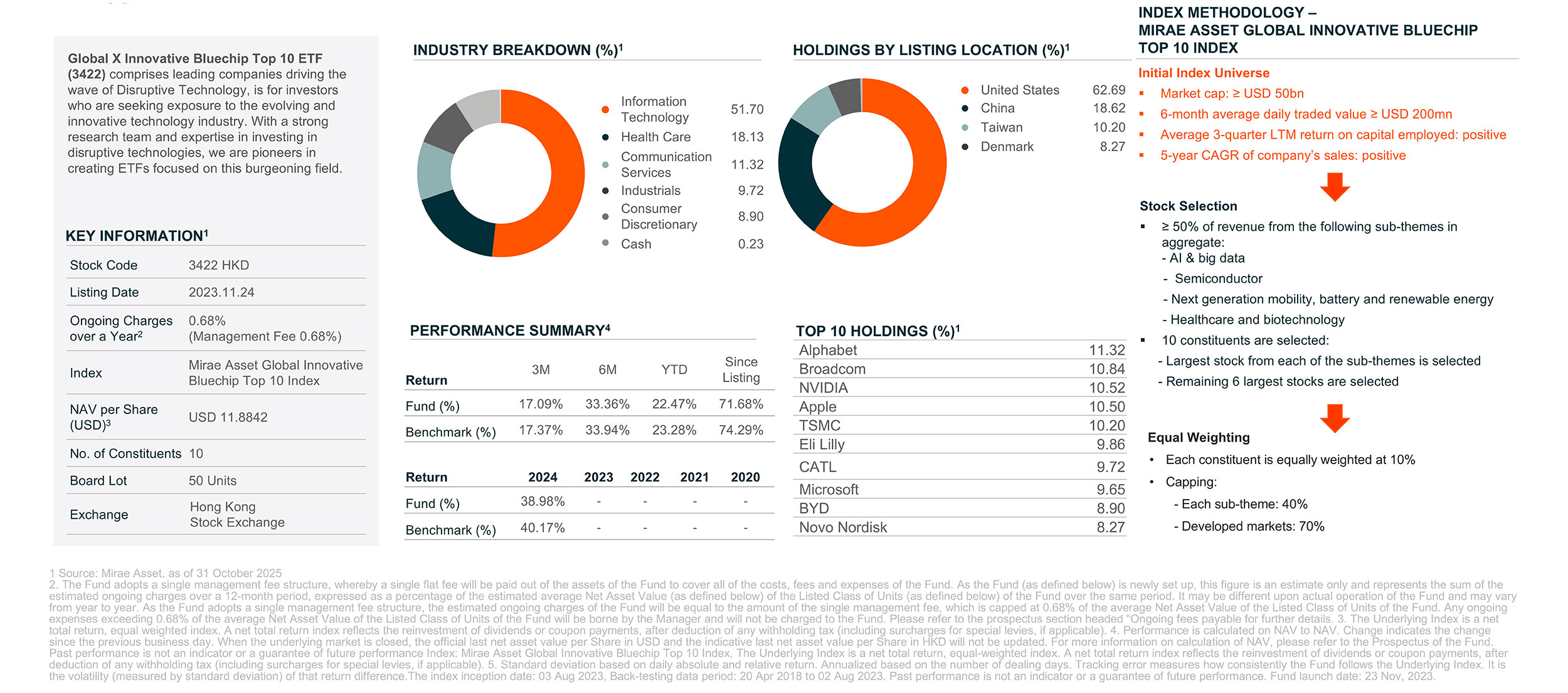

- The investment objective of Global X Innovative Bluechip Top 10 ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset Global Innovative Bluechip Top 10 Index.

- The Underlying Index is an equal weighted index . The Fund may hold larger positions in smaller-cap constituents than a market-cap weighted index, leading to higher risks and potential underperformance.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investors should note that Shareholders will only receive distributions in USD and not HKD, Shareholder may have to bear the fees and charges associated with the conversion of such distribution from USD into HKD or any other currency.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

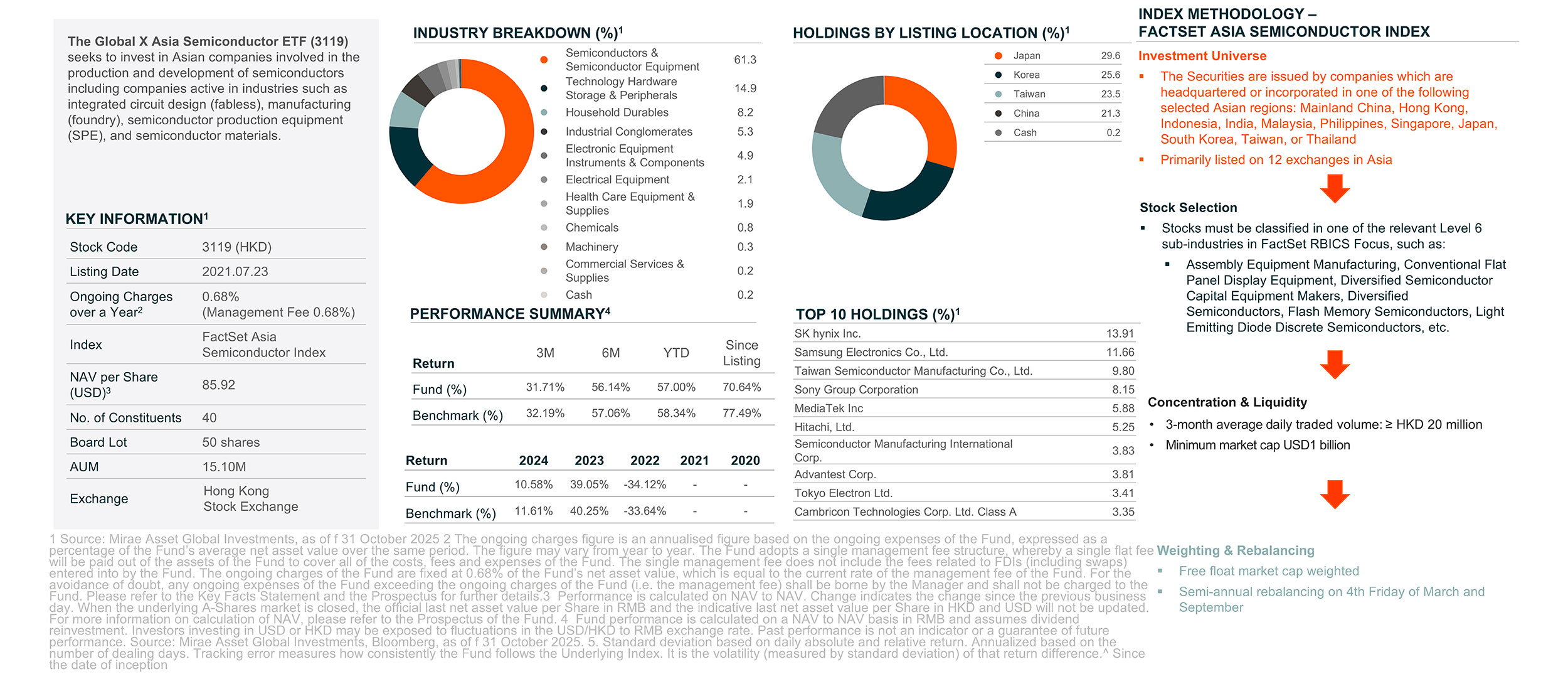

- Global X Asia Semiconductor ETF’s (the “Fund’s”) investment in equity securities is subject to general market risks, whose value may fluctuate due to various factors, such as changes in investment sentiment, political and economic conditions and issuer-specific factors.

- Semiconductor industry may be affected by particular economic or market events, such as domestic and international competition pressures, rapid obsolescence of products, the economic performance of the customers of semiconductor companies and capital equipment expenditures. These companies rely on significant spending on research and development that may cause the value of securities of all companies within this sector of the market to deteriorate.

- Some Asian securities exchanges (including Mainland China) may have the right to suspend or limit trading in any security traded on the relevant exchange. The government or the regulators may also implement policies that may affect the financial markets. Some Asian markets may have higher entry barrier for investments as identification number or certificate may have to be obtained for securities trading. All these may have a negative impact on the Fund.

- The Fund invests in emerging markets which may involve increased risks and special considerations not typically associated with investment in more developed markets, such as liquidity risks, currency risks/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk, currency devaluation, inflation and the likelihood of a high degree of volatility.

- The trading price of the Fund’s unit (the “Unit”) on the Stock Exchange of Hong Kong is driven by market factors such as demand and supply of the Unit. Therefore, the Units may trade at a substantial premium or discount to the Fund’s net asset value.

- The Fund’s synthetic replication strategy will involve investing up to 50% of its net asset value in financial derivative instruments (“FDIs”), mainly funded total return swap transaction(s) through one or more counterparty(ies). Risks associated with FDIs include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. FDIs are susceptible to price fluctuations and higher volatility, and may have large bid and offer spreads and no active secondary markets. The leverage element/component of an FDI can result in a loss significantly greater than the amount invested in the FDI by the Sub-Fund.

- As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund. The borrower may fail to return the securities in a timely manner or at all. The Fund may suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from realisation requests.

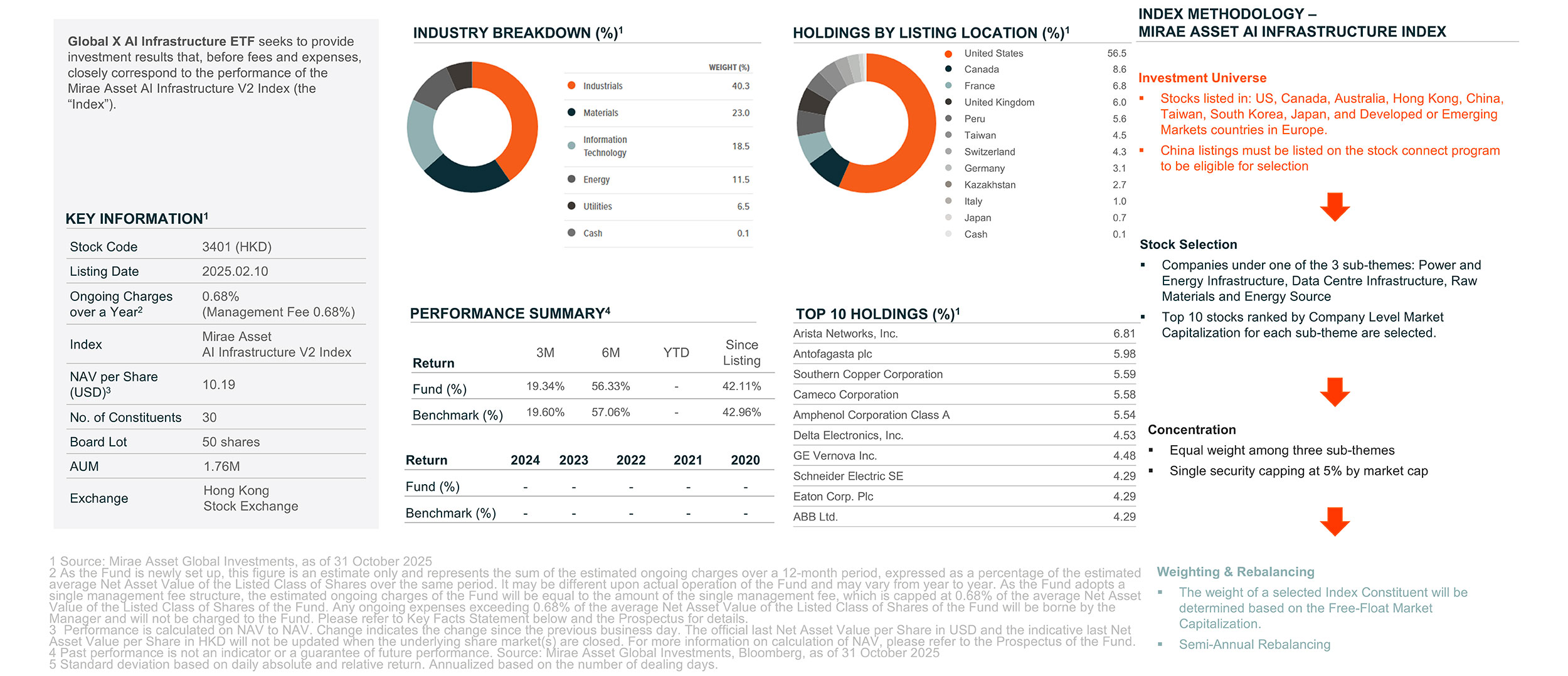

- The investment objective of Global X AI Infrastructure ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Mirae Asset AI Infrastructure V2 Index.

- The Index constituents may be concentrated in a specific industry or sector, which may potentially more volatile than a fund with a diversified portfolio.

- Investment in Emerging Market, such as A-share market, may involve increased risks and special considerations not typically associated with investments in more developed markets, such as liquidity risk, currency risks, political risk, legal and taxation risks, and the likelihood of a high degree of volatility.

- The Stock Connect is subject to quota limitations. Where a suspension in the trading through the Stock Connect is effected, the Sub-Fund’s ability to invest in A-Shares or access Mainland China markets through the programme will be adversely affected.

- Exposure to ADRs and GDRs may generate additional risks compared to a direct exposure to the underlying stocks, including the risk of non-segregation of the underlying stocks held by the depositary bank from the bank’s own assets and liquidity risks.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

- The investment objective of Global X S&P 500 Covered Call Active ETF (the “Fund”) is to generate income by primarily (i) investing in constituent equity securities in the S&P 500 Index (the “Reference Index”); and (ii) selling (i.e. “writing”) call options on the Reference Index to receive payments of money from the purchaser of call options (i.e. “premium”).

- If the value of the securities relating to the Reference Index held by the Fund declines, the premium that the Fund received for writing the Reference Index Call Option may reduce such loss to some extent. However, the downside of adopting a covered call strategy is that the Fund’s opportunity to profit from an increase in the level of the Reference Index is limited to the strike price of the Reference Index Call Options written, plus the premium received.

- The market value of an Reference Index Call Option may be affected by factors including supply and demand, interest rates. The Fund’s ability to utilise Reference Index Call Options successfully will depend on the ability of the Manager to correctly predict future price fluctuations. If an Reference Index Call Option expires and if there is a decline in the market value of the Reference Index during the option period, the premiums received by the Fund from writing the Reference Index Call Options may not be sufficient to offset the loss realised.

- The Reference Index Call Options in the OTC markets may not be as liquid as exchange-listed options. The Fund may find the terms of counterparties in the OTC markets to be less favorable than the terms available for listed options. Moreover, the exchange may suspend the trading of options in volatile markets which may cause the Fund unable to write Reference Index Call Options at times.

- The use of futures contracts involves market risk, volatility risk, leverage risk and negative roll yields and “contango” risk.

- The Fund employs an actively managed investment strategy. The Fund may fail to meet its objective as a result of the implementation of investment process which may cause the Fund to underperform as compared to direct investments in the constituent equity securities of the Reference Index.

- The Fund is exposed to concentration risk by tracking the performance of securities in a specific regions or countries.

- To the extent that the constituent securities of Reference Index are concentrated in securities of a particular sector or market, the investments of it may be similarly concentrated.

- The trading price of the Fund’s unit on the SEHK is driven by secondary market trading factors, which may lead to a substantial premium or discount to the Fund’s net asset value.

- The Manager may at its discretion pay dividends out of the capital of the Fund. Distributions paid out of capital, represent a return of an investor’s original investment or its gains and may potentially reduce the Fund’s Net Asset Value per Share as well as the capital available for future investment.

- The Fund may suffer from a losses or delays when recovering the securities lent out. This may potentially affect its ability to meet payment and redemption obligations. Collateral shortfalls due to inaccurate pricing or change of value of securities lent, may cause significant losses to the Fund.

Global Market Outlook 2026

PART 1: G2 Tech World Has Arrived – Executive Summary

PART 1.1: G2 Tech World Has Arrived – in detail

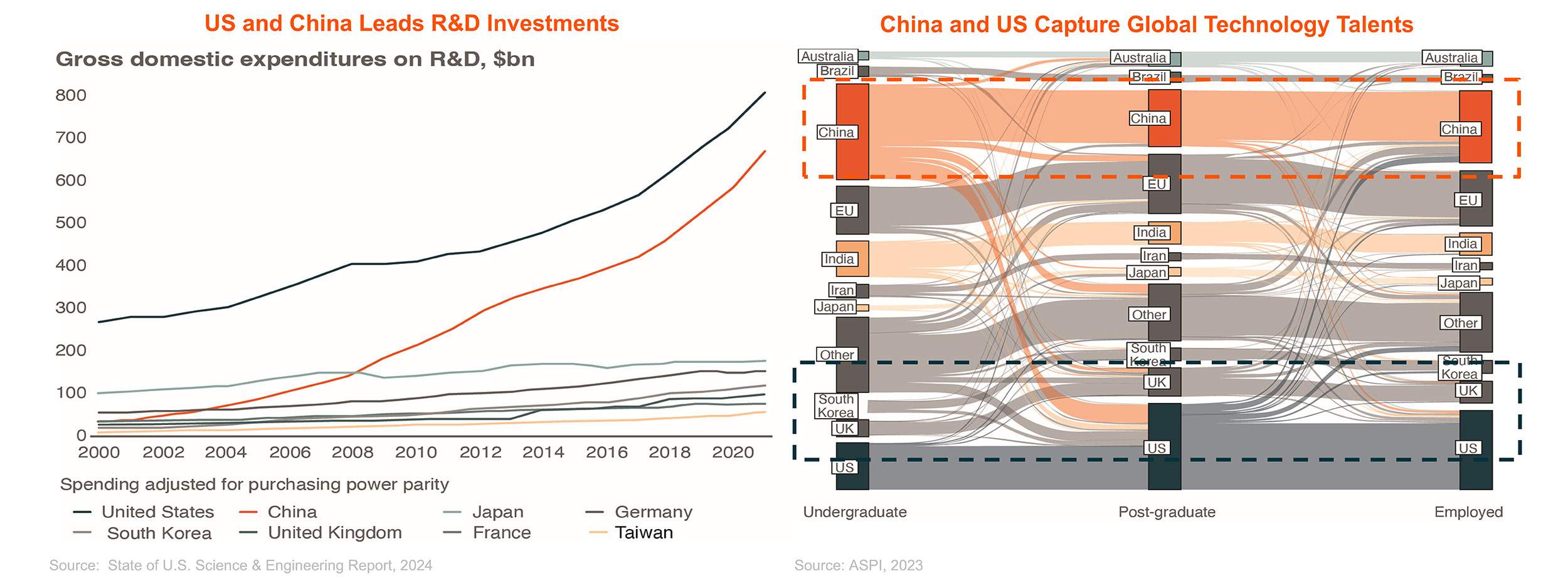

A G2 World – US and China Dominate High-end Technology

- We are expecting bipolar dominance between China and the US, especially in high-end technology areas

- US and China leaderships are characterised by their substantial investments in R&D and abundant talents

- US and China rank top in terms of high-impact publications in almost all critical technology areas.

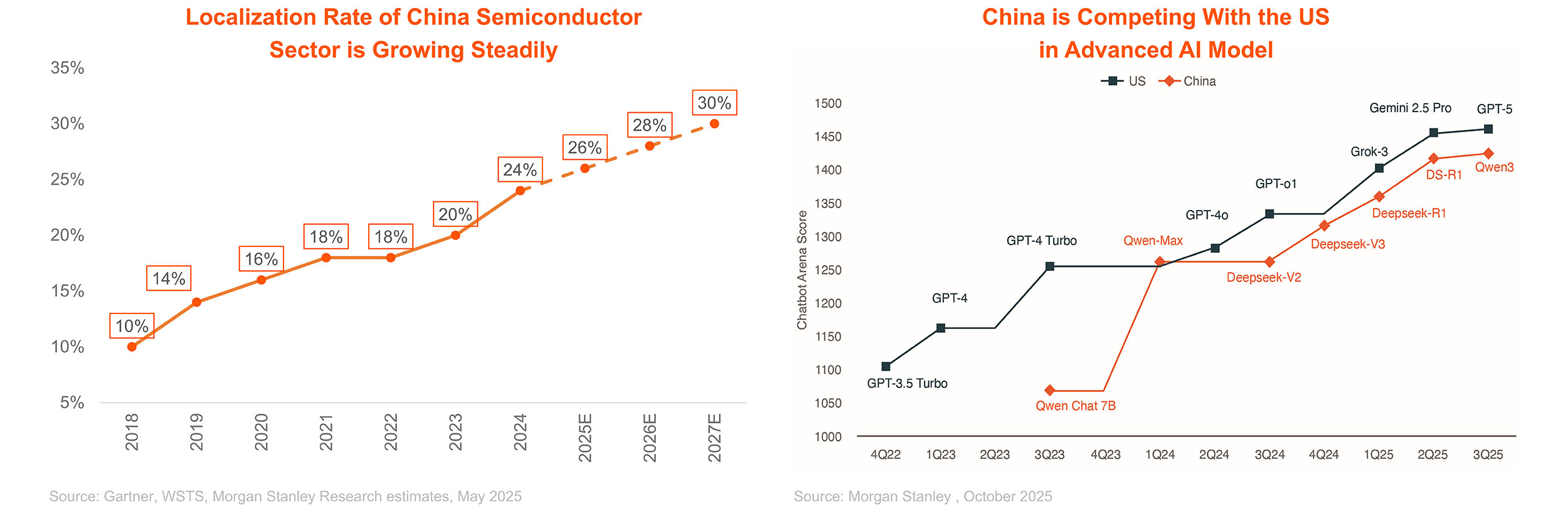

China’s Semiconductor Independence is Making Solid Progress

- Self-sufficiency for high-end technology such as Semiconductor, AI, and Biotech remains a strategic focus for China as outlined in 15th FYP.

- China is making progress in this regard. Continued US Chip ban and robust China AI demand is driving the rise in self-sufficiency ratio. In addition, China’s dominance in Rare Earths also brings strong bargaining power against US.

China’s Export Destination is Diversifying Away from the US

- Despite US tariff, China’s export is growing steadily in 2025. This is driven by successful export diversification, China’s manufacturing competitiveness, and a modestly weak CNY.

Chinese Companies are Edging Out Competitors in Global Market

- China is moving up global value chain, with high-end categories such as auto, batteries, and solar panel accounting for increasing export share

- China’s advantages in talent (educated but relatively cheap labor), capital (low borrowing costs for selected sectors), and policies (such as gov. supports in energy and land) lead to strong manufacturing competitiveness. By means of exports, Chinese goods are seizing control of foreign markets, edging out competitors through their dual advantages of cost-effectiveness and a progressively higher standard of quality.

Global X G2 Tech ETF (3402)

PART 2: AI Bubble Debate and Our Suggestion – Executive Summary

The debate over an AI bubble persists. We remain very constructive on the durability of AI investment themes but acknowledge valuation risks in core AI equities. Our preferred approach is to pivot toward AI infrastructure, where bottlenecks are shifting from semiconductors to data centers, power equipment, and ESS. These segments are critical enablers of AI scalability: Global X AI infrastructure ETF

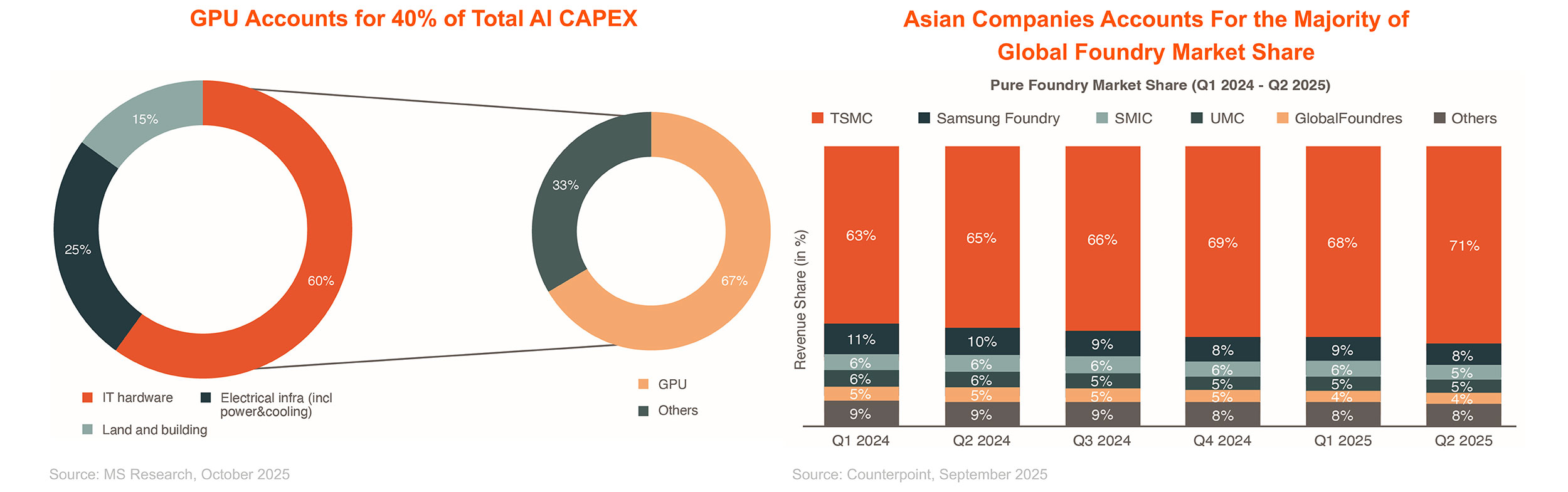

Recent developments underscore this thesis. Google’s TPU has validated its performance through Gemini and is now positioned for third-party commercialization—a credible challenge to Nvidia’s dominance. Amazon and others are accelerating proprietary chip development. Yet regardless of design, manufacturing remains concentrated in Asia: TSMC for fabrication and SK Hynix for HBM supply. Historically, NVIDIAcaptured most of the AI value chain economics; going forward, Asian semiconductor manufacturers are poised to claim a larger share: Global X Asia Semiconductor ETF (3119 HK)

PART 2.1: AI Bubble Debate and Our Suggestion – in detail

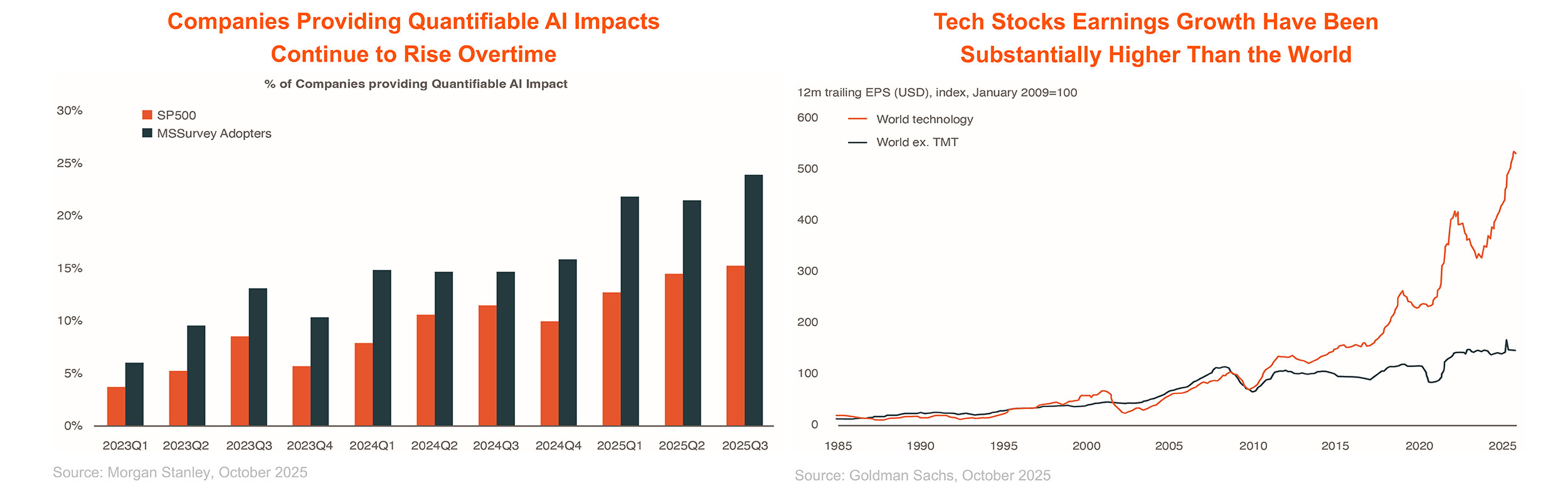

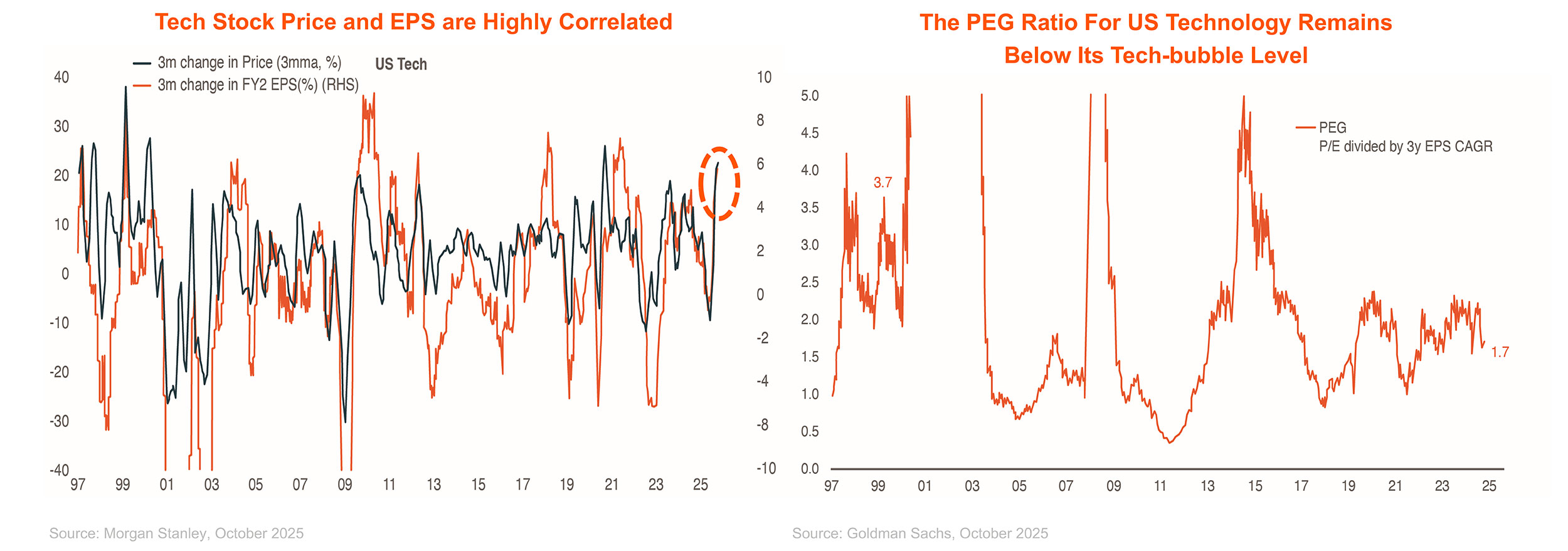

AI is Driving Revenue, Earnings, and Productivity Gains

- Amidst a three-year surge fueled by technological advancements, which commenced with the introduction of ChatGPT in November 2022 (coinciding with Nasdaq’s growth of over 100% since that time), increasing concerns have emerged regarding the potential for an ‘AI Bubble.’

- Despite the lofty valuations, our observation of AI actively generating productivity gains leads us to believe that AI may not be in a bubble, at least not in its current stage.

AI is Driving Revenue, Earnings, and Productivity Gains

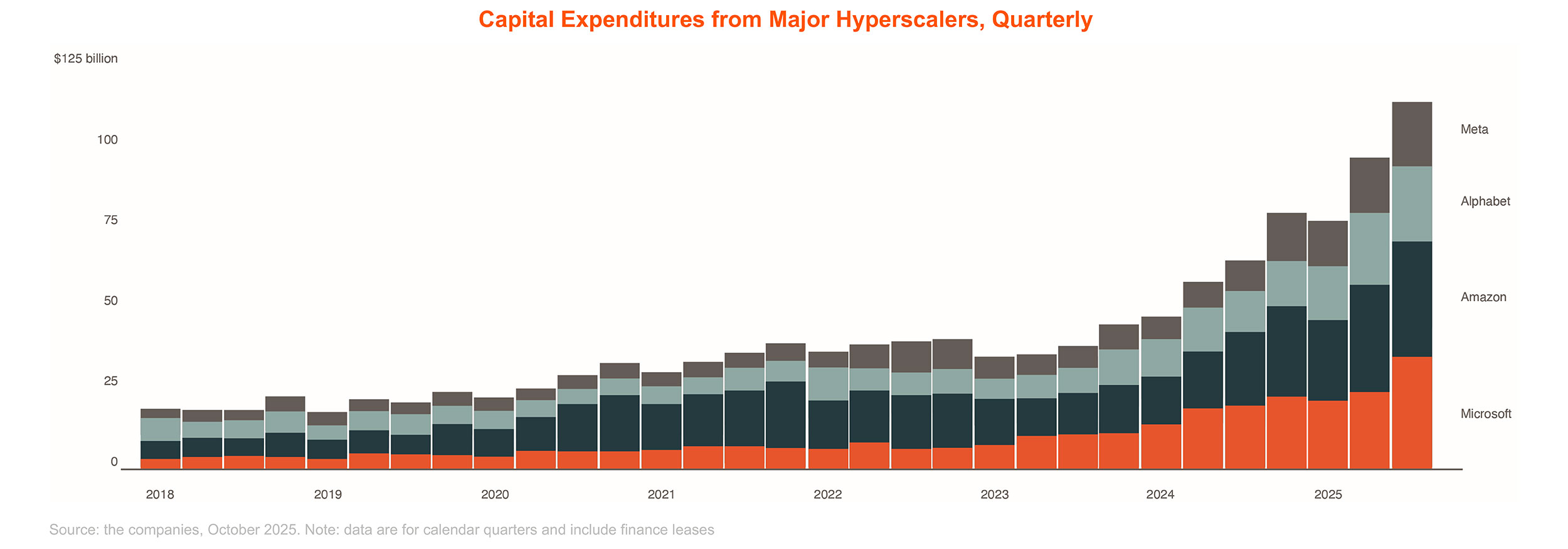

AI Data Center: Another Year of Investment Upcycle

- AI spending trending strong: the top 4 hyperscalers spent over $100 billion on AI Capex in 3Q25, as AI infrastructure demand continues to outpace supply.

- We expect a multi-year investment cycle supported by strong capex and government support.

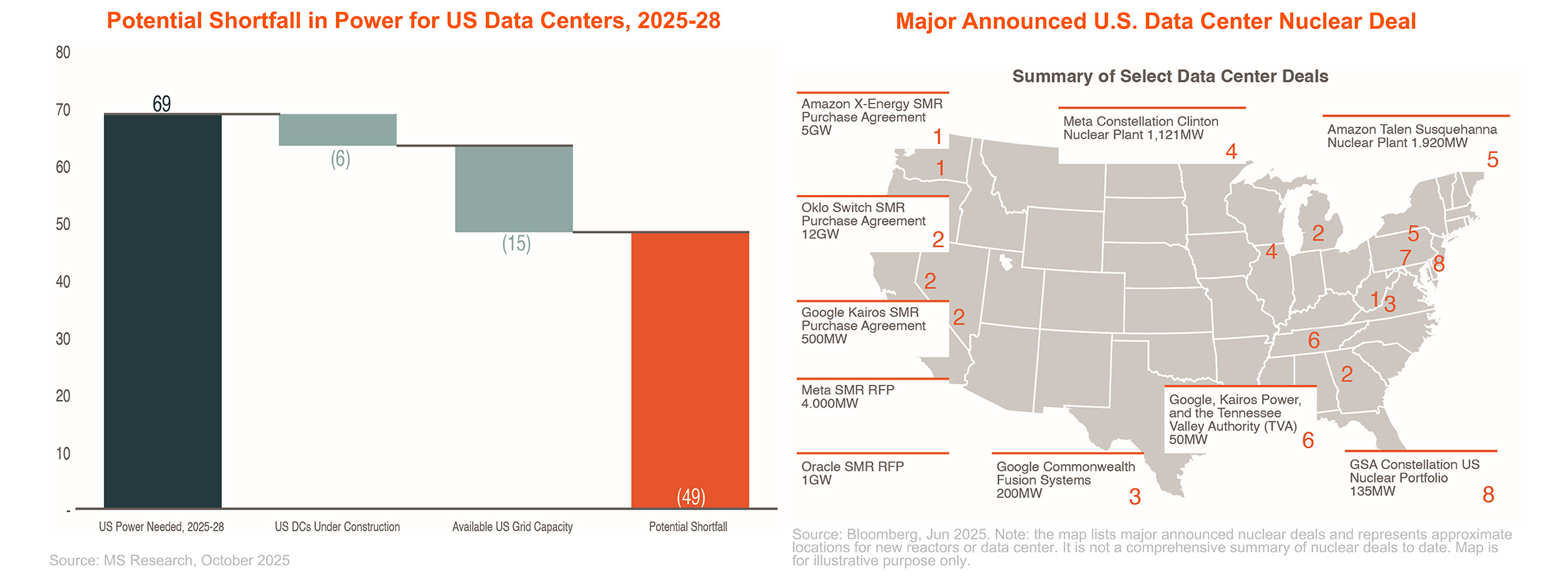

Power and Energy: Supply-Demand Imbalance Remains

- MS projects a 49 GW shortfall in U.S. power generation capacity by 2028, directly attributable to data center demand.

- We expect a nuclear energy renaissance supported by surging demand, supply-side crunch and deregulation.

Asia Semiconductor Companies Are Benefiting From AI CAPEX Boom

- After the re-escalation of trade war in October, US and China reached agreements on trade post President Xi-Trump meeting. Though the agreement could be fragile and subject to temporary escalation in the future, China has leveraged rare earth to enhance its bargaining power to counter US Tech barrier

Global X AI Infrastructure ETF (3401)

Global X Asia Semiconductor ETF (3119)

Global X Innovative Bluechip Top 10 ETF (3422)

PART 3: Cautious Outlook on U.S. Dollar in 2026 – Executive Summary

We maintain a cautious view on the U.S. dollar heading into 2026. Over the past decade, FX movements have increasingly diverged from traditional fundamentals—such as trade balances, real interest rates, and inflation—driven largely by geopolitics and capital flows. While geopolitical factors remain important, fundamentals cannot be ignored indefinitely. For example, LFP battery packs produced in the U.S. cost nearly twice as much as their Chinese equivalents, raising questions about the feasibility of a U.S. manufacturing renaissance under current FX conditions. Historically, the most effective way to address such imbalances and competitiveness gaps has been currency adjustment.

Historically, global crises have reinforced U.S. dollar strength as investors flocked to safe-haven assets. However, recent structural trends suggest this pattern may not hold in the next downturn. Over the past decade, significant U.S. asset purchases by trade surplus economies have supported the dollar. Should risk sentiment reverse, repatriation flows could weaken this support, challenging dollar resilience. While a softer dollar may partially offset earnings risk for U.S. corporates—given that approximately 50% of NASDAQ 100 revenues are generated outside the U.S.—U.S. Treasuries remain vulnerable to currency depreciation, adding complexity to fixed-income allocations. Global X Nasdaq 100 Covered Call Active ETF (3451 HK) & Global X S&P 500 Covered Call Active ETF (3415 HK) offer a pragmatic hedge. This strategy combines equity exposure with option premium income, providing a cushion against potential market corrections while capitalizing on heightened volatility. Gold is likely to remain a good hedging tool against the dollar in 2026

PART 3.1: Cautious Outlook on U.S. Dollar in 2026 – in detail

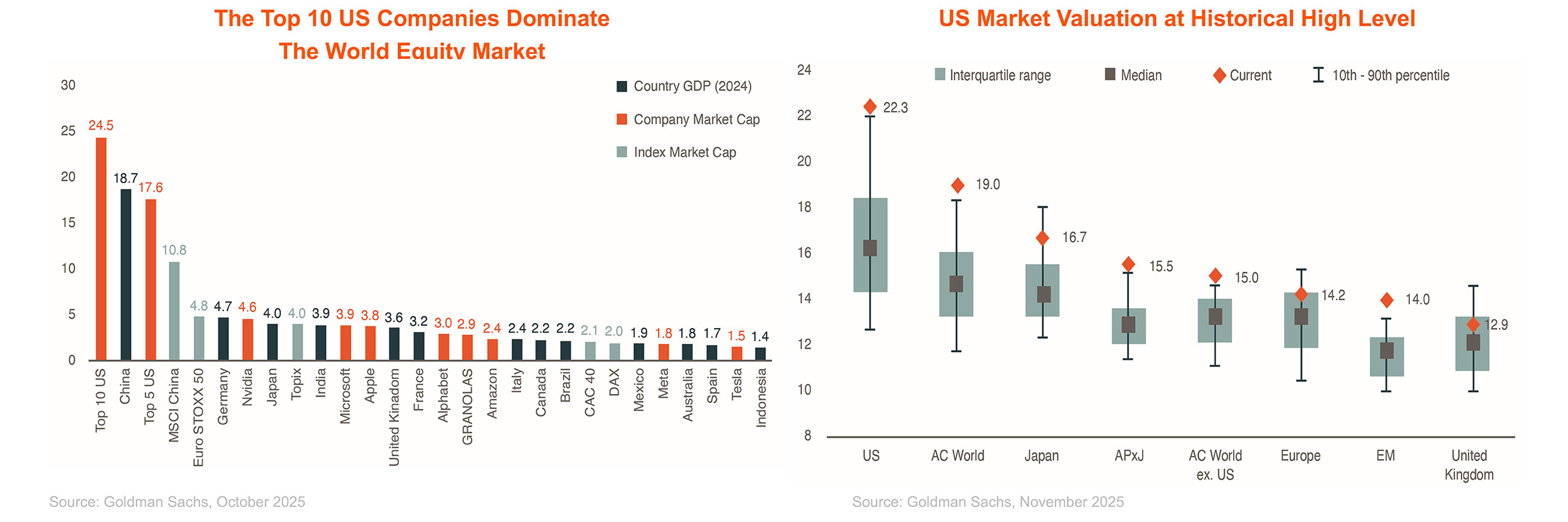

Valuation and Concentration is High

- We are cautious on the US equity market into 2026. Valuation for US market is at historical high level, making the market more vulnerable

- Although the current landscape does not indicate a bubble, the heightened market concentration and escalating competition within the AI sector emphasize the importance for investors to maintain a focus on diversification.

Diversification is Beneficiary After Prolonged US Rally

- US equity market bull run lasted for over 10 years, with the latest round driven by large tech companies.

- While EM has underperformed significantly over recent years, the combination of lower US interest rates, ongoing economic expansion and the prospect for further dollar weakness has helped to revive investor interest in EM. We see EM markets regaining momentum recently after years of underperformance

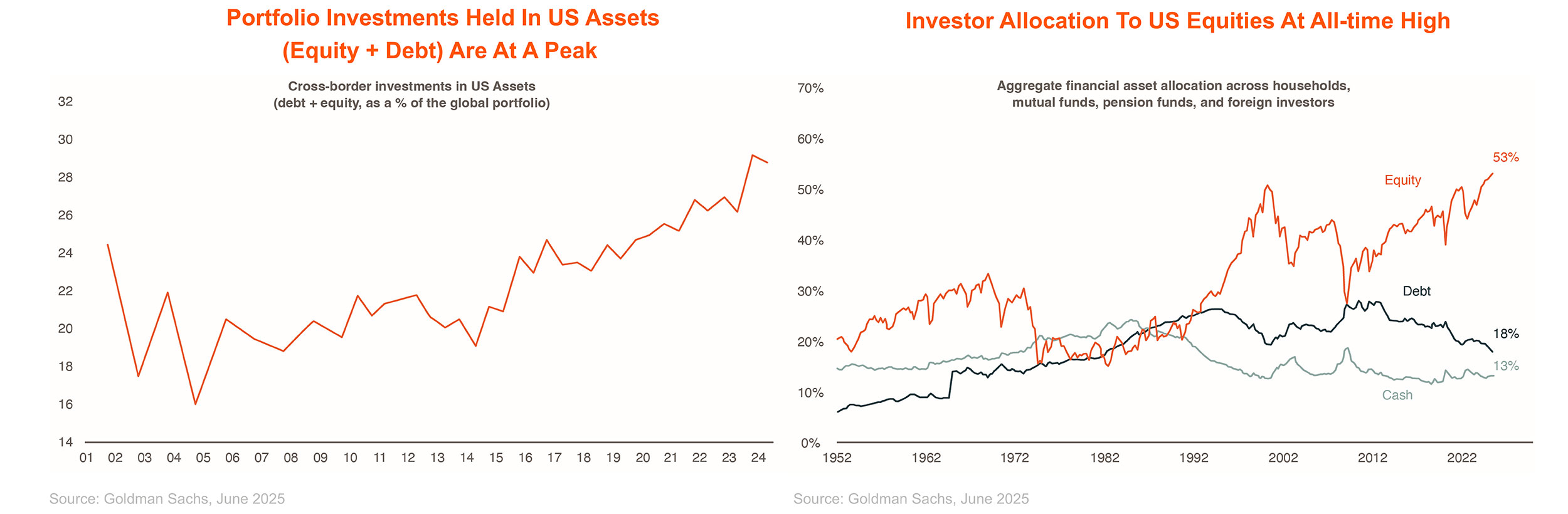

US Holdings at Historical High for Both US and Non-US Investors

- The prolonged US market rally, solid US economy and lackluster non-US market performance lead to strong inflow into US equity market over the past decade.

- After the buying stream, US asset holdings for non-US investors, as well as US equity holdings for US investors, are at historical high level. This implies risks for sell-off esp. for non-US investors with the recovery in EM market.

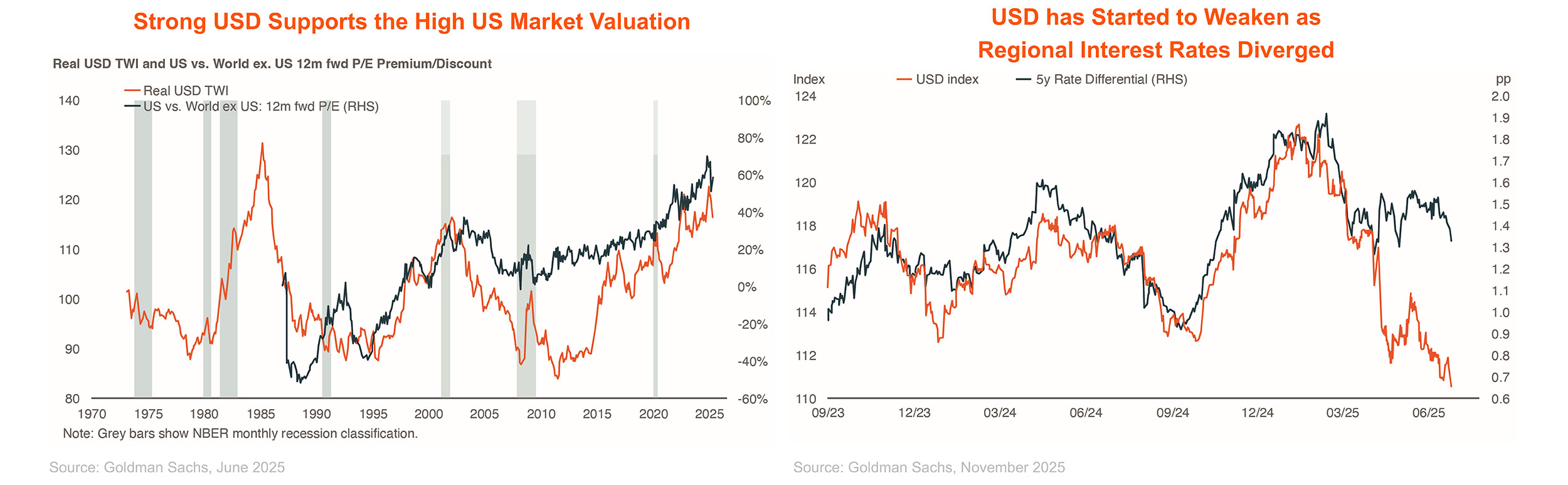

USD Tailwind Fading

- The increase in US asset returns, coupled with a stronger US dollar, created a virtuous cycle that grew over time and led to a rise in the P/E ratio of the US stock market.

- Since the start of 2025, resilient non-US economy, coupled with higher US deficits and greater uncertainty on policy have pushed up the risk premium on the US dollar. This leads to the depreciate of USD and makes non-US equities more attractive for USD-based investors, which is another driver of diversification flows.

US Strategy: Positioning for Volatility Through Covered Call

- There could be volatility ahead for US market. On the one hand, US large tech are delivering strong revenue and earnings growth, and reiterating commitments to AI investments.

- On the other hand, valuation and concentration is at historical high level, and USD as a tailwind for US market is showing signs of weakening.

- We recommend positioning US market through covered call to capitalize on the volatility.

HK Listed Covered Call ETFs Offer Tax Advantage vs US Listed Counterparts

- As non-US tax residents, HK investors usually are subject to a 30% US withholding tax (WHT) on cash dividends distributed by US ETFs. While partial claim of this tax may be possible through specific procedures and applications, the process is often complex.

Global X Nasdaq 100 Covered Call Active ETF (3451)

PART 4: Portfolio Diversifier – Gold

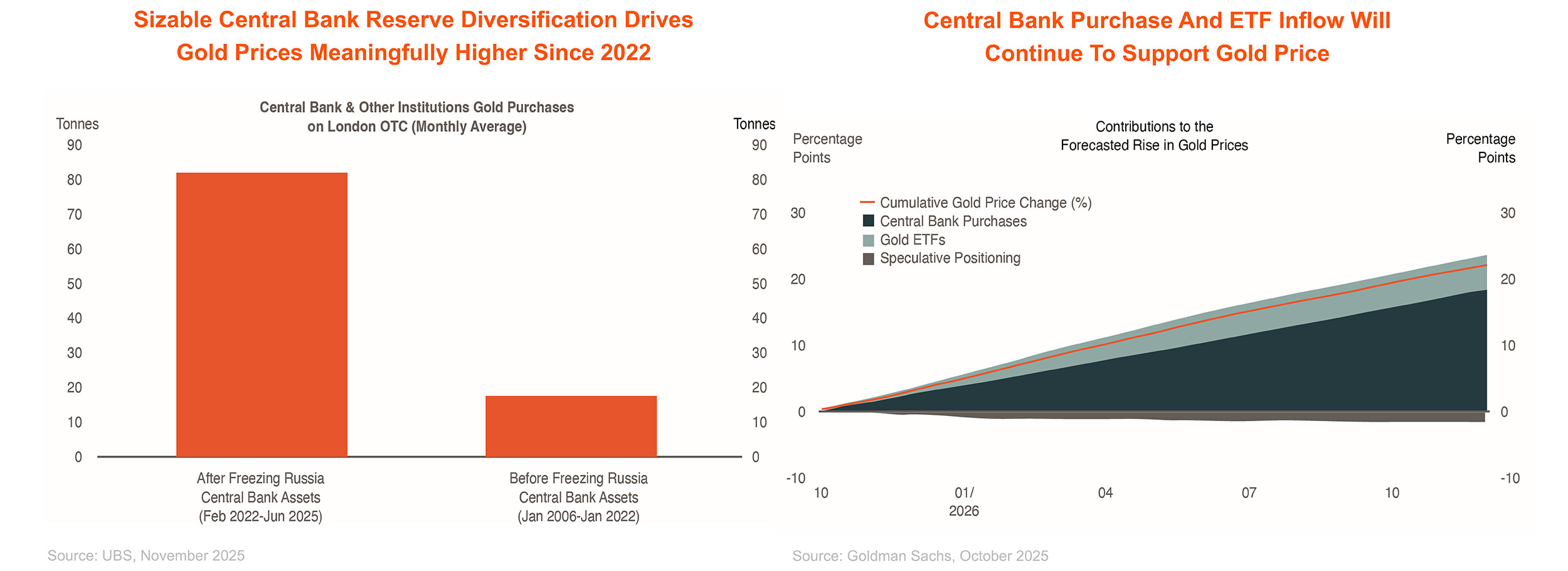

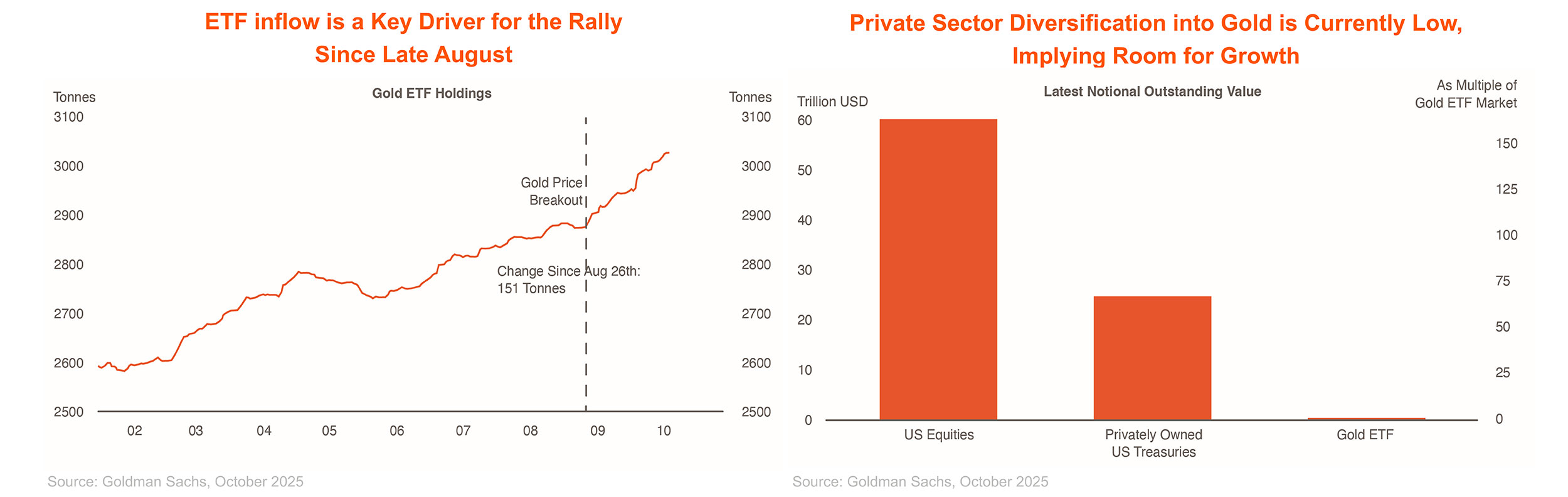

Gold is On A Bull Run

- Gold is on a bull run since 2023, gaining ~ 130%, as compared to ~80% for S&P500 (since 30 Dec 2022).

- Central Bank purchase has been a key driver for gold price. ETF flows into will remain strong as interest rates fall.

Gold as a Portfolio Diversifier

- Gold’s performance during times of crisis, and inflation hedging are some key themes driving plans to accumulate more gold over the coming year.

- In addition, the rising concerns over US institutional credibility, increased stock/bond correlation, and depreciation of the USD are prompting a growing number of global investors to seek alternative assets like gold to diversify their portfolios.

PART 5: Other Country Products

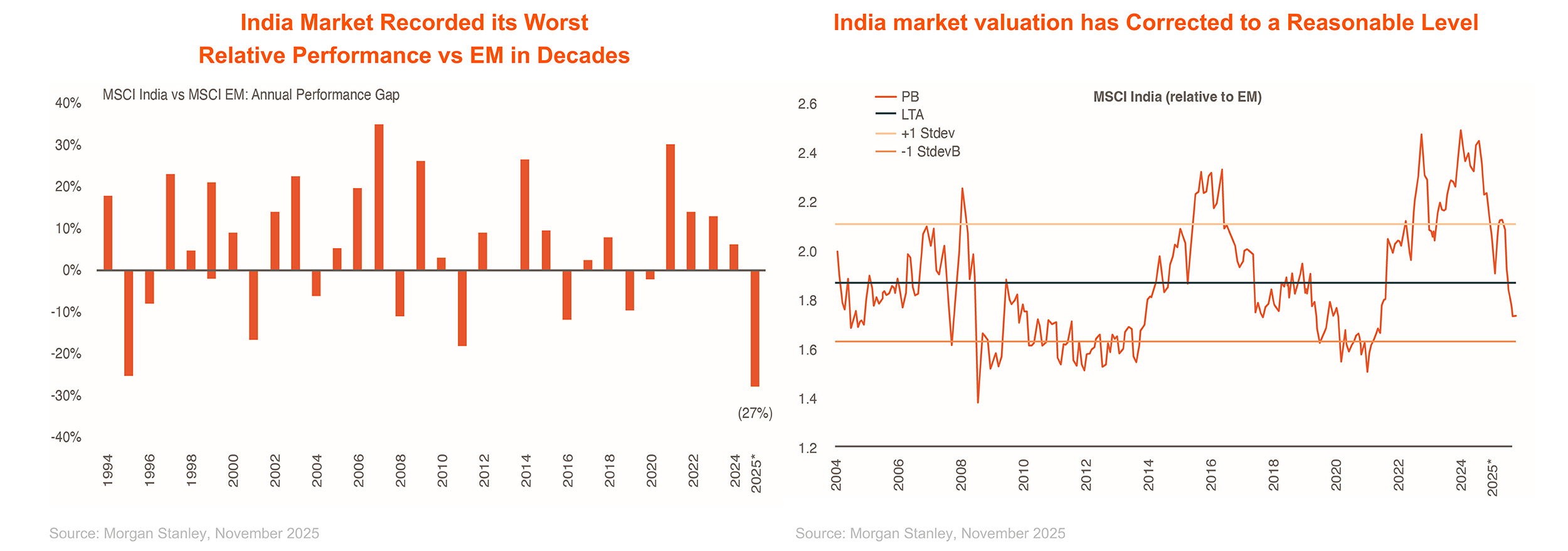

India Market Has a Soft Performance in 2025

- India market (MSCI India) recorded its worst relative performance compared to MSCI EM since 1994.

- The weak performance is due to India markets’ high initial valuation, growth slowdown, uncertainty around US trade policy, and the lack of companies related to AI theme.

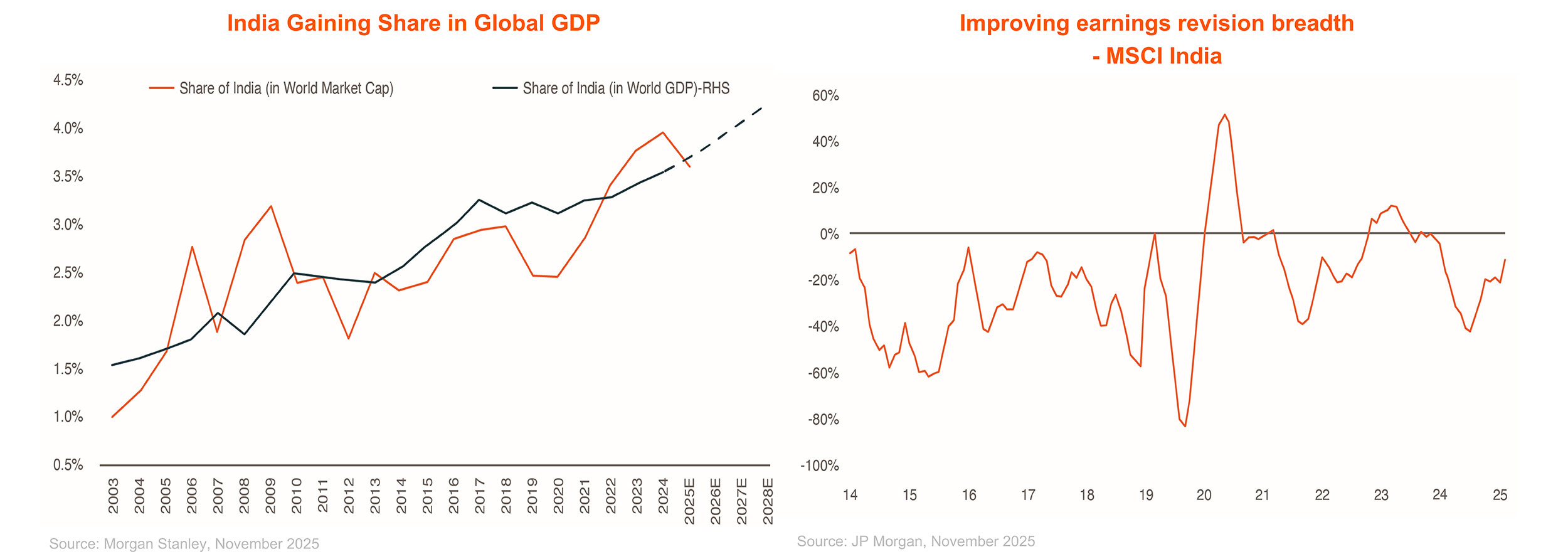

A Potential Turnaround Story in 2026

- Catalysts for a potential rebound include: 1. a potential US-India trade deal 2. a positive growth cycle backed by fiscal and monetary support, 3. mid-teens earnings growth, and 4. improved valuations

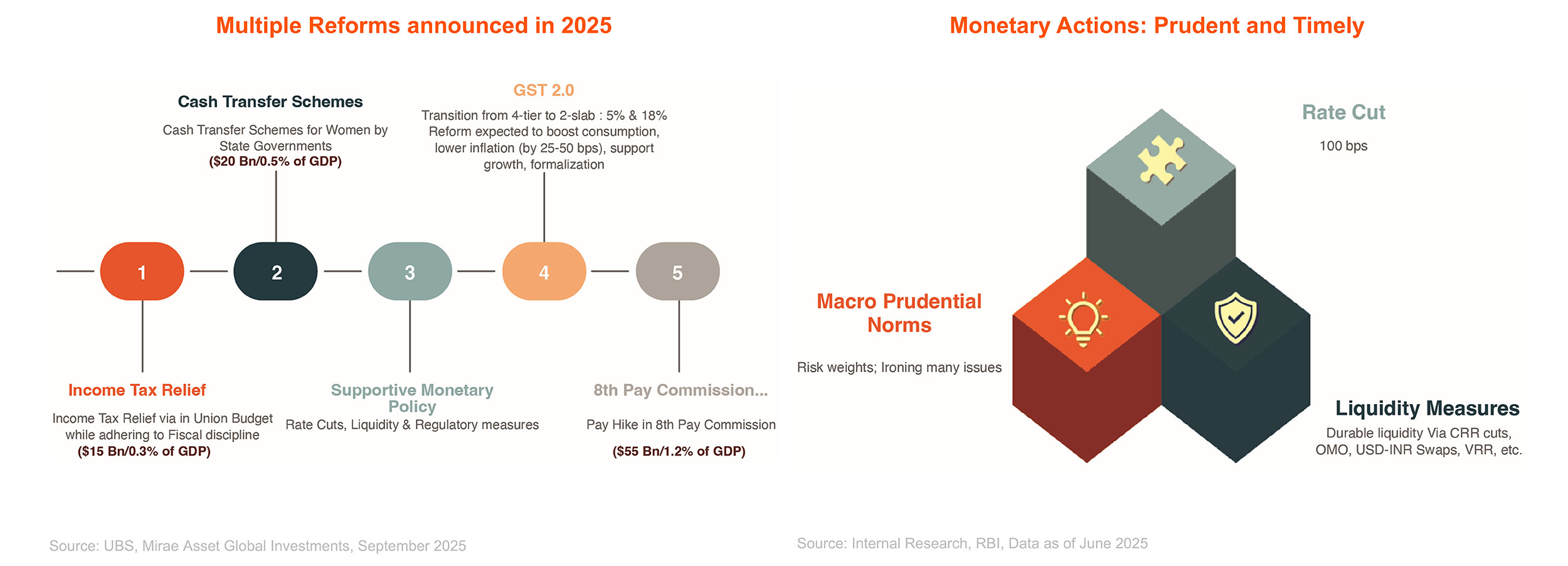

Fiscal Stimulus and Monetary Policies to Drive Growth

- Massive fiscal stimulus through multiple reforms in 2025

- The RBI has cut the policy rates by 125bps so far this year, providing ample liquidity in the system

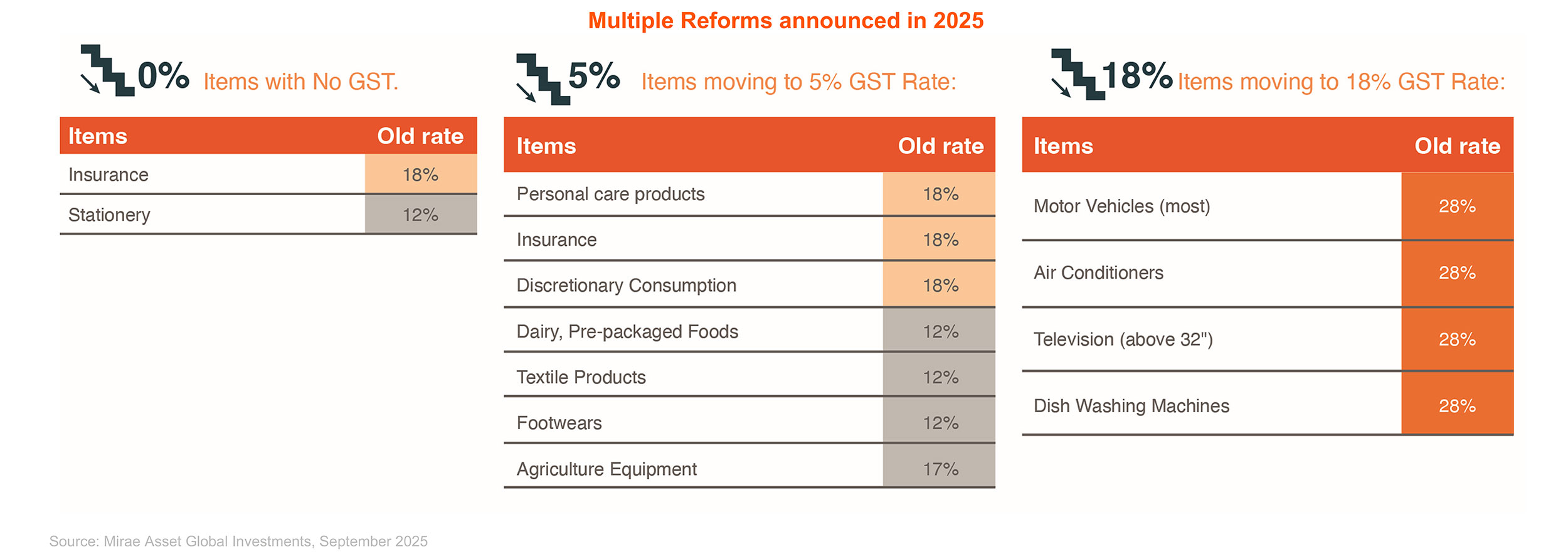

GST 2.0 – The Great Stimulus via Taxes

- GST reform expected to boost consumption, lower inflation, support growth, and foster formalisation

- Consumer gains from GST savings likely to fuel spending, adding 20-30bps to GDP growth in FY26

Global X India Select Top 10 ETF (3184)

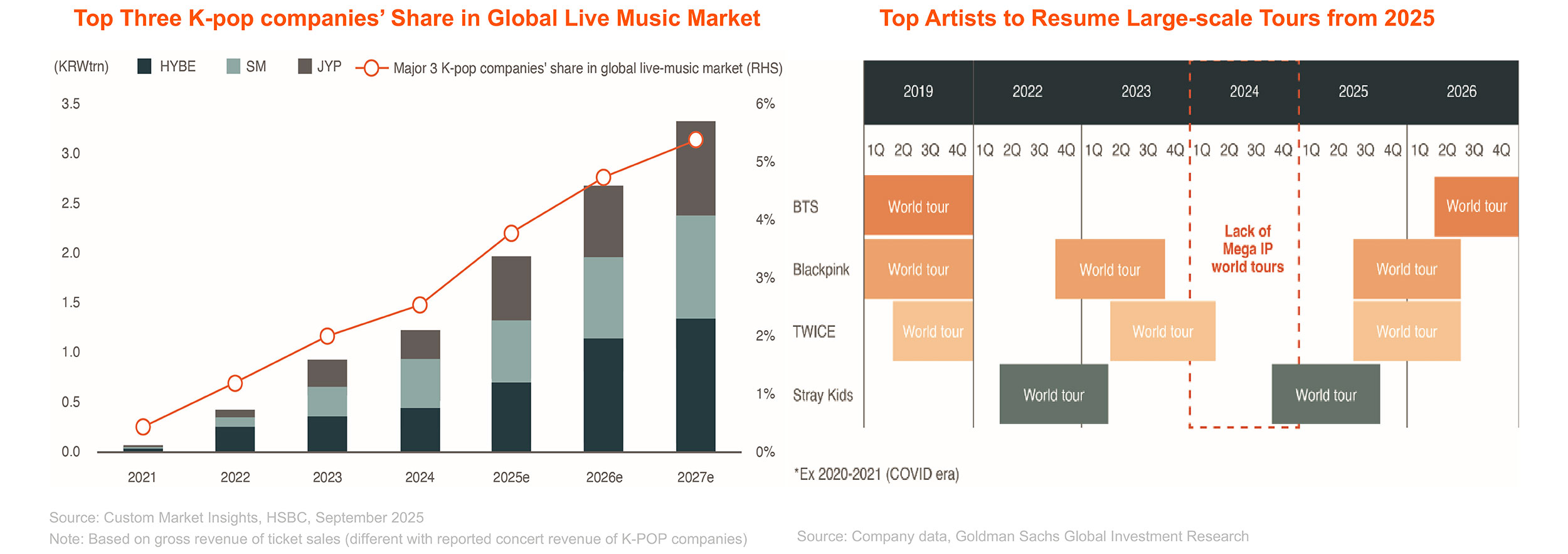

Global K-pop Content Boom

- Korean entertainment industry is set to benefit from continuous global expansion and potential China reopen.

- The sector fundamental is also strengthening thanks to top artists comeback since 2H25.

Korean Consumer Goods Riding on Growing Popularity of Korean Culture

- Korean consumer goods are benefitting from the growing popularity of K-wave.

- Food – Rising overseas demand linked to Korean celebrity influence and lifestyle adoption

- Cosmetics – US, Europe, and Southeast Asia as major growing markets

Global X K-pop and Culture ETF (3158)

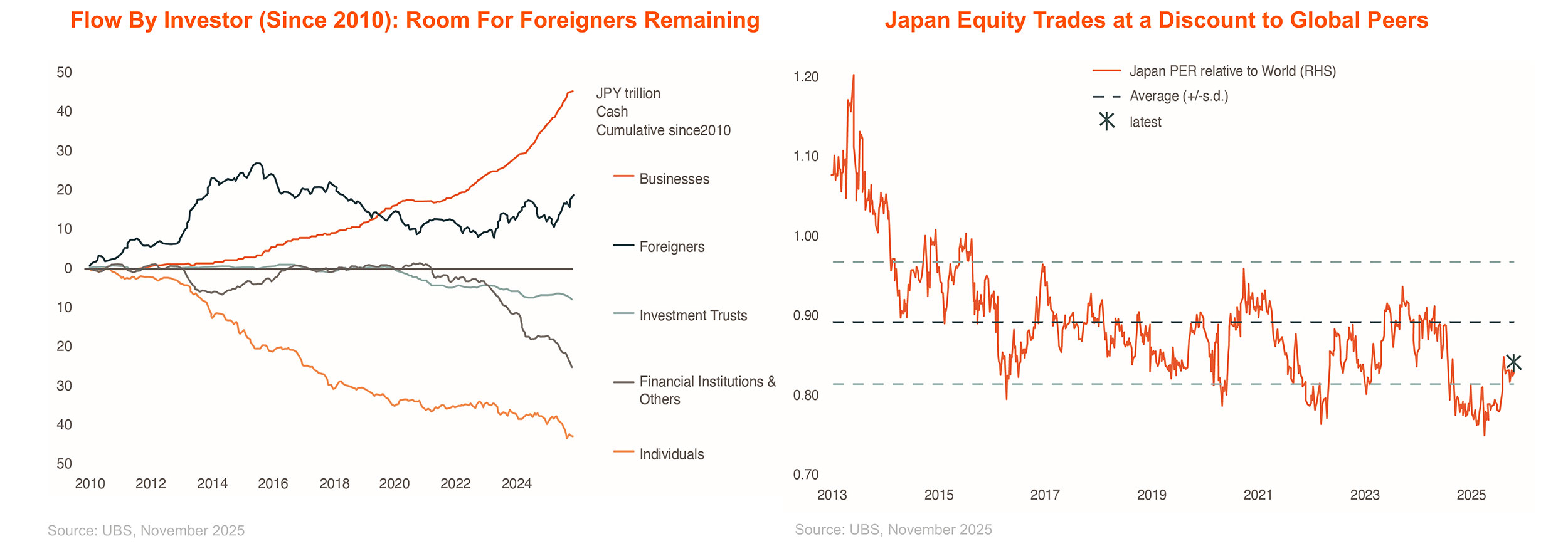

Japan Market Updates

- The Japanese equity story is driven by multiple factors, including domestic economy reflation, equity market structural reforms (TSE reforms), increase in foreign investor inflows, and resilient exports.

- Valuation is at a discount to global market. However, uncertainty stemming from external shocks remains elevated.

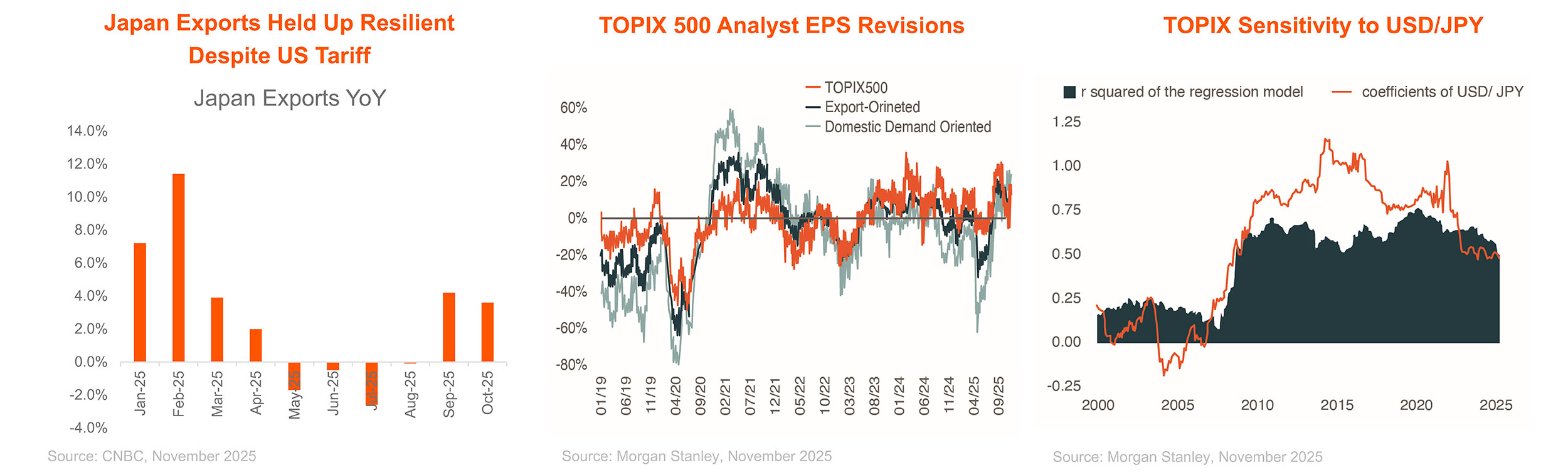

Japan Exporters Remain Resilient

- Despite US tariff uncertainty, Japan export holds up resilient YTD, driven by solid growth in export to other regions. EPS estimates for exporters revised up substantially from April trough, providing share price supports.

- In addition, While USD/JPY and Japanese equities have a positive correlation, the regression coefficient has trended lower over the past decade since Abenomics, suggesting that the exchange-rate sensitivity of exports has clearly declined.