The Future of the Booming Solar Power

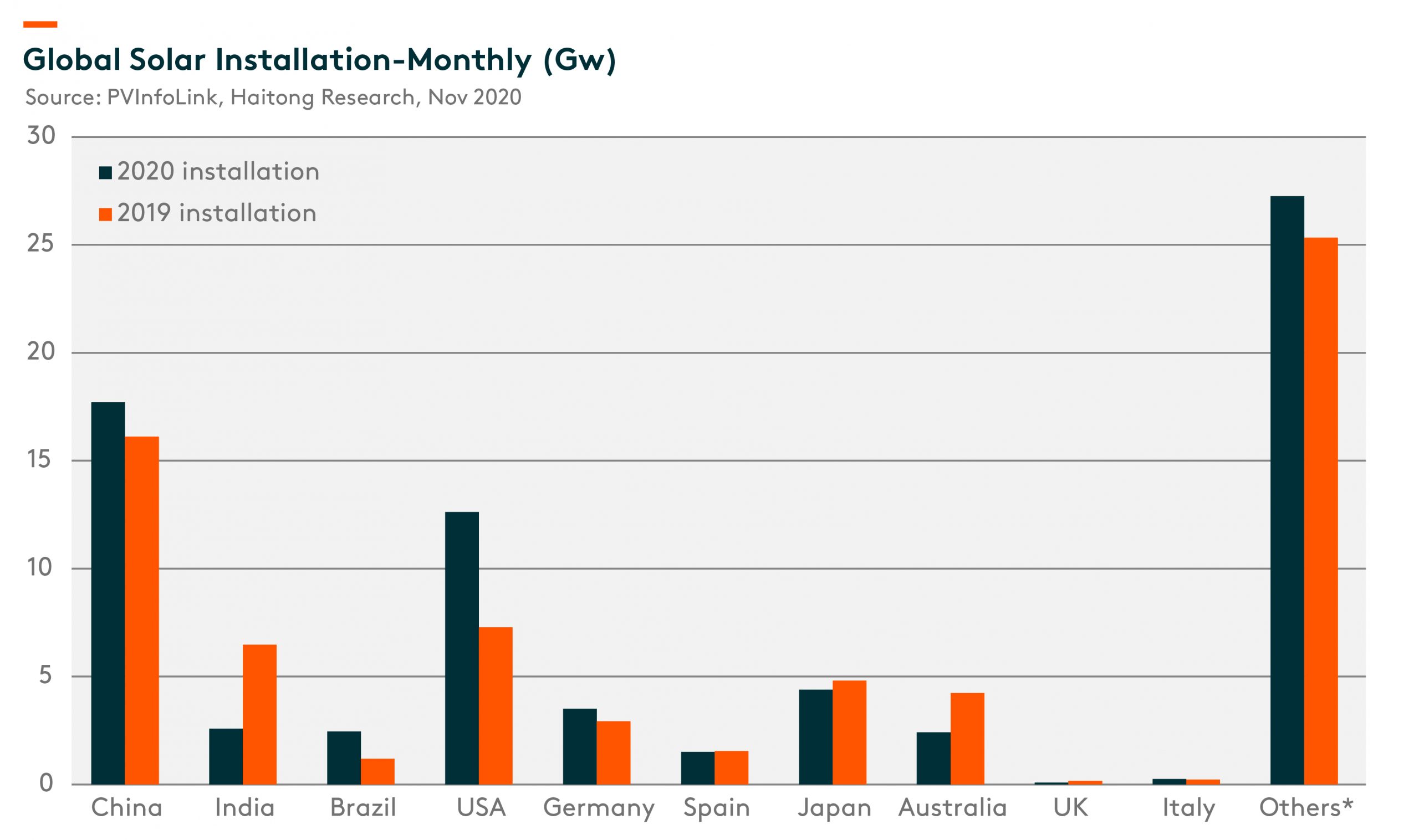

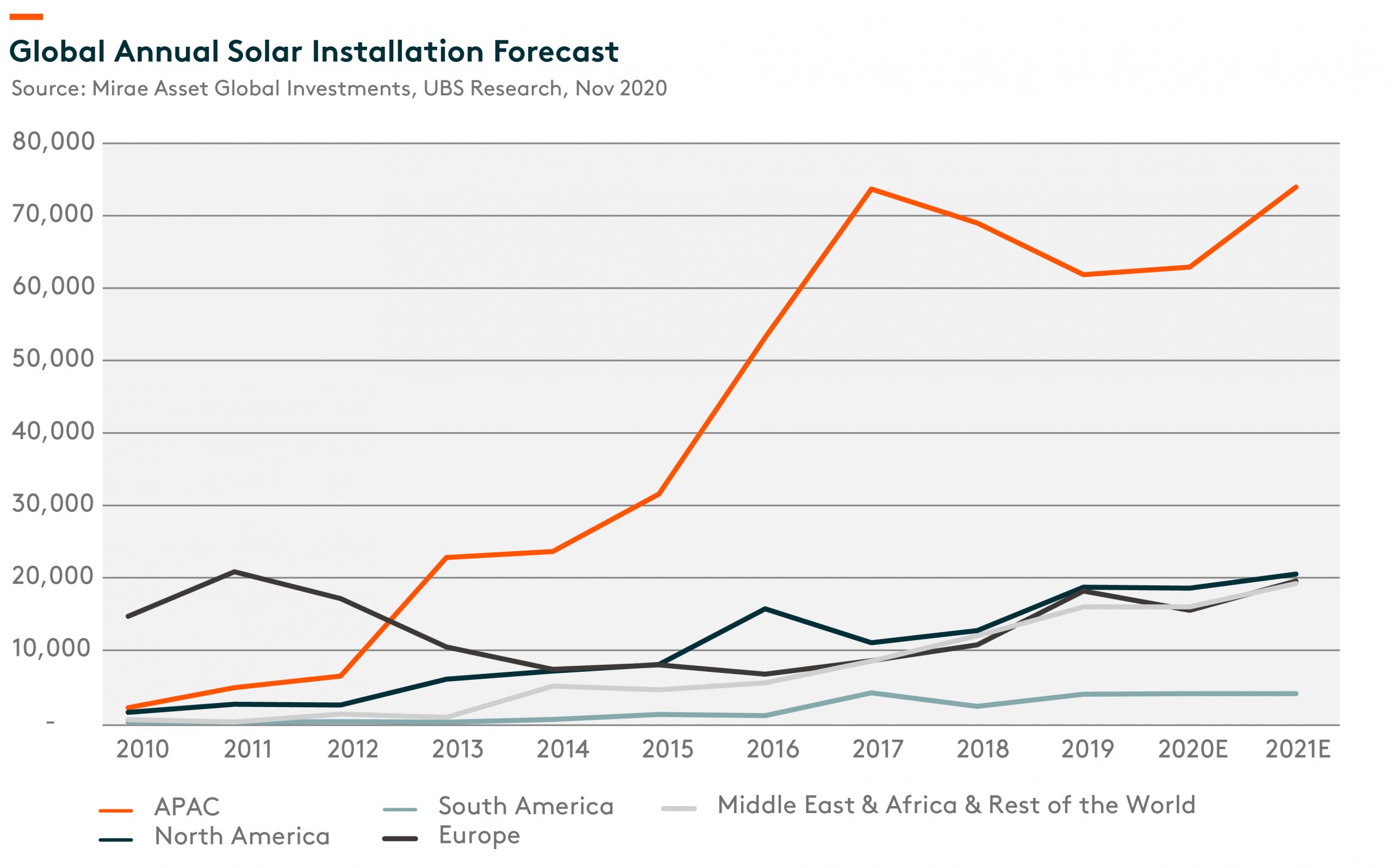

Solar installation in major countries recorded a high single-digit growth by the end of September, missing the expectation at the beginning of the year but much better than that in the worst time post covid-19 outbreak. Going forward, regarding the demand side, China, as the largest solar market in the world, is proactively taking more responsibilities in carbon emission reduction though they will cancel subsidy for utility-scale solar projects in 2021. The US is exposed to great solar resources and expects to see more solar demand as Joe Biden has won the election. India used to be the third-largest solar market but is significantly affected by covid-19 in 2020. Covid-19 also impacted some other major markets more or less, such as Europe, the Middle East region, and South America. We expect a moderate recovery in the regions post covid-19.

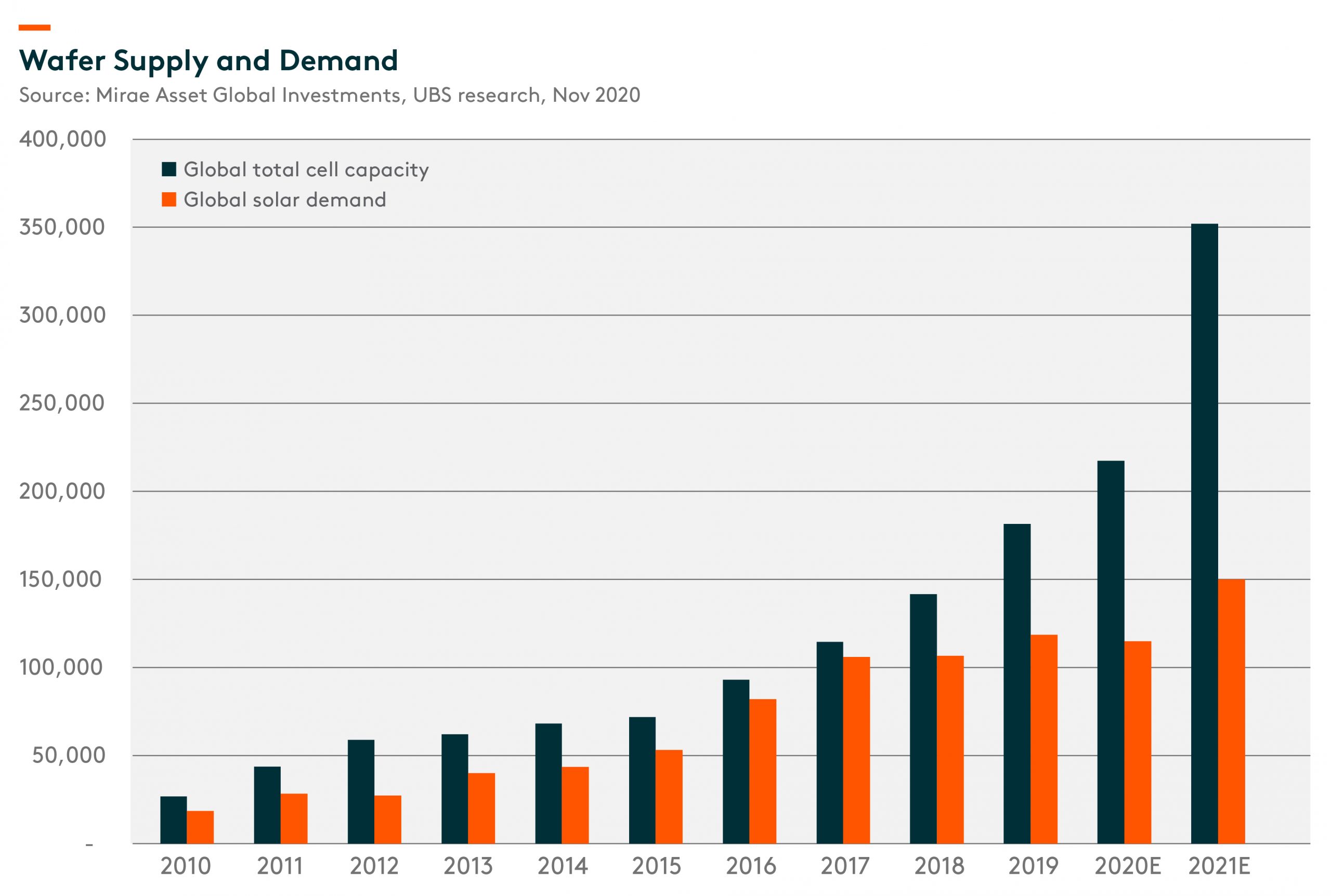

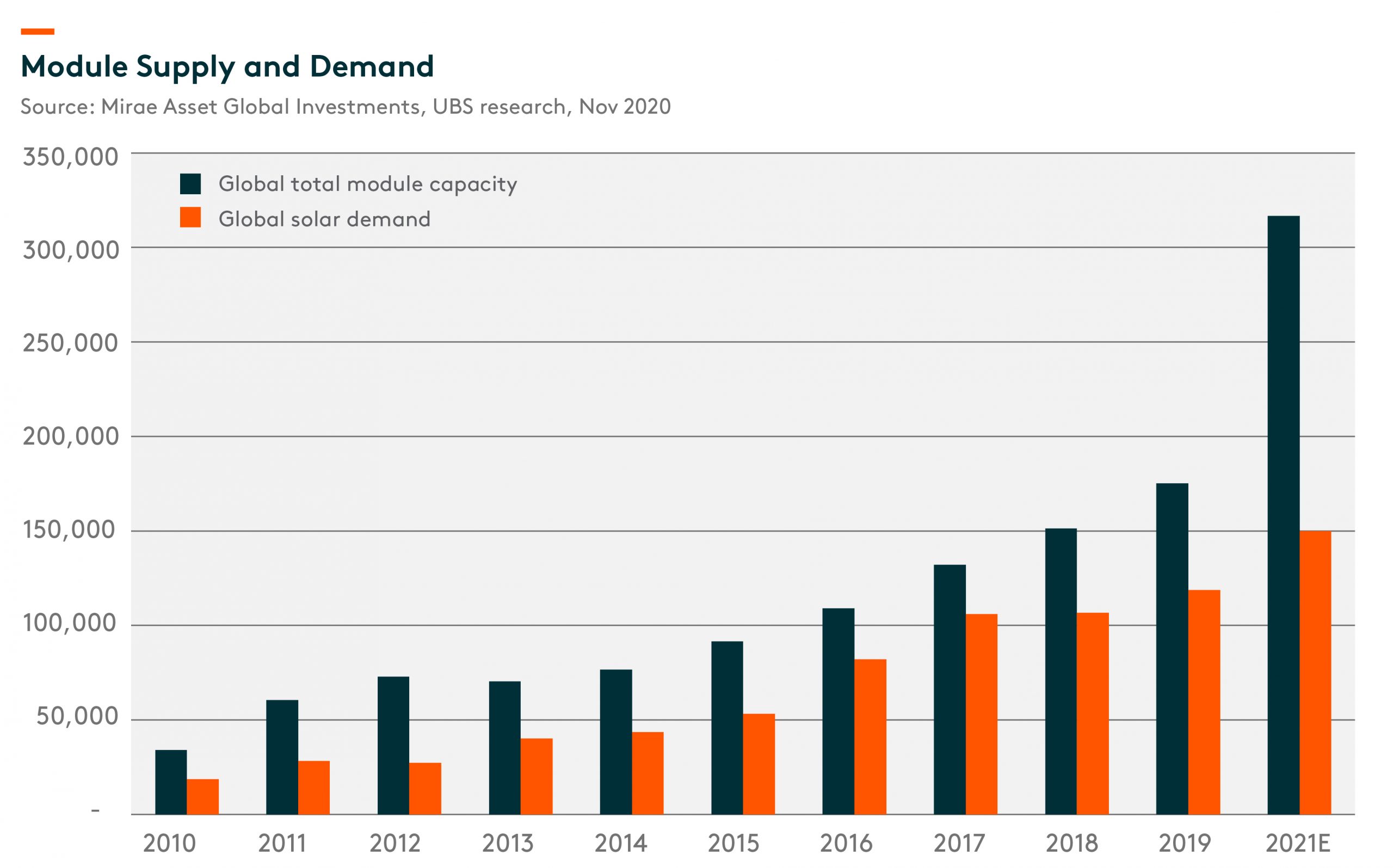

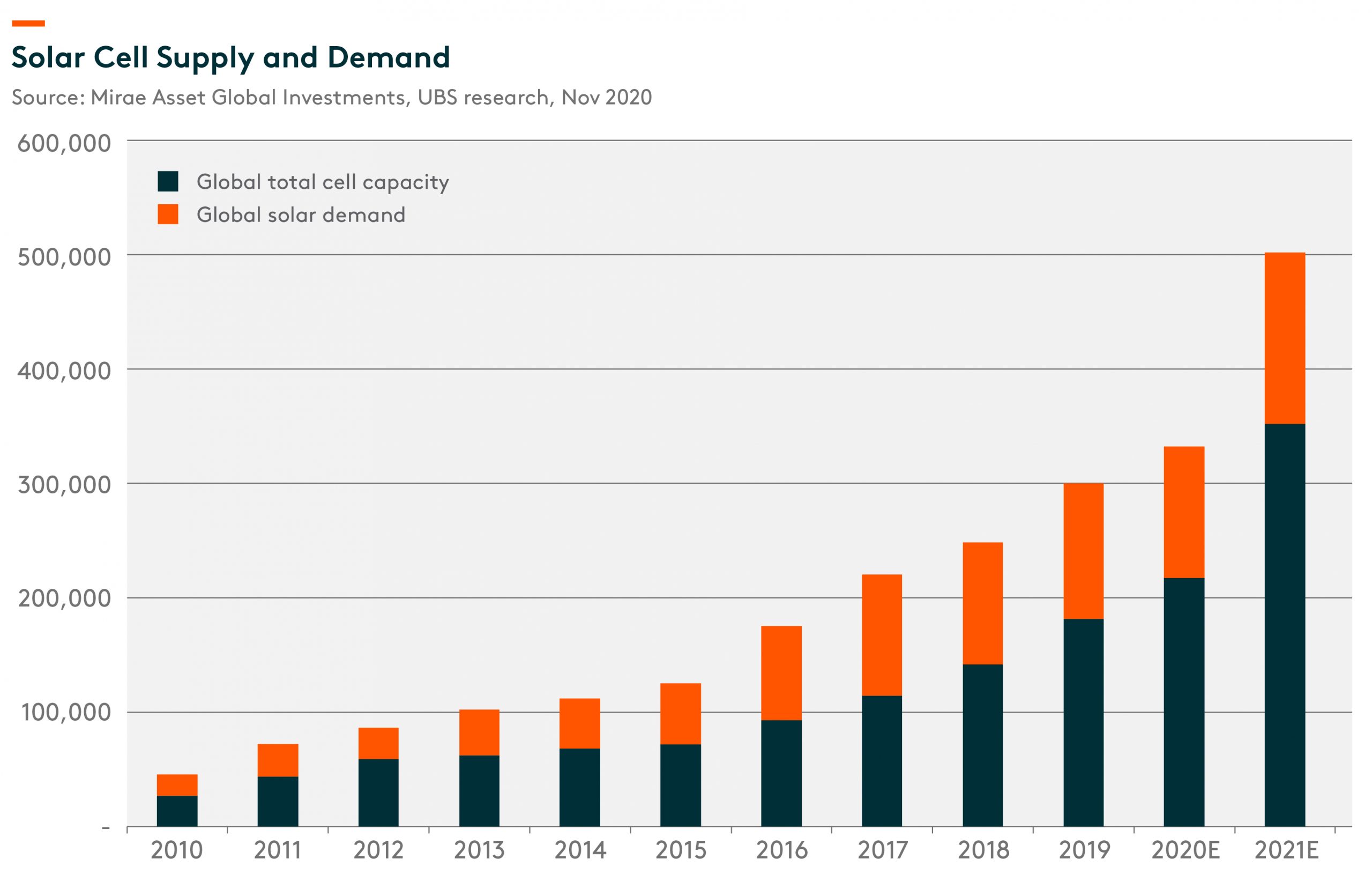

Supply-side is more visible than demand. The below graphs show the effective capacities in each part along the major solar supply chain in 2021. The supply and demand balance in the polysilicon end is likely to improve next year with the top five producers taking a total market share of over 2/3. Consolidation in wafer part is decelerating with the top 5’s total market share of nearly 80% next year. Wafer oversupply will probably take place in 2021, while the realized price depends on demand as well as how many effective capacities are put into operation each quarter. More capacities from second-tier wafer players, module makers, and wafer equipment producers will come out by the end of 2021. New capacities are mainly for M10 (182mm x 182mm) and M12 (210mm x 210mm) silicon wafer, while the latter needs time to show the efficiency. A solar cell is fast-changing and less profitable in the solar supply chain. Technology plays a vital role in competitive landscape dynamics but is quite stable in a medium-term cycle. Thus, wafer makers and module players keep entering into cell production now to improve supply chain stability as well as margins. We can see in the graph below that Longi has added over 15GW of solar cell capacity in the last two years and ranked No.3 by 2021, followed by integrated solar materials makers like Jinko Solar and JA solar. After all, the solar cell is an intermediate part, driven by the downstream demand. That is, module makers and their sales channels determine the solar cell competition advantages within a technology cycle to some extent. Consolidation in module end is accelerating with the top 10 makers’ total market share increasing from 57% (2020E) to 64% (2021E). Most of the leading module players are adding capacities and building up sales channels in the coming years. It will highly impact the demand for cells and even wafers.

Related ETF

Global X China Clean Energy ETF is designed to offer investors efficient access to growth potential through companies critical to further advances and increased adoption of clean energy in China.

Other Key Features:

- Unconstrained Approach: The fund’s composition transcends the classic sector and industry classifications by tracking an emerging theme.

- ETF Efficiency: In a single trade, the fund delivers access to dozens of companies with high exposure to the clean energy theme in China.

Please click here for more information on the Global X China Clean Energy ETF.