Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X K-pop and Culture ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive K-pop and Culture Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (South Korea). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations in value of the Index resulting from adverse conditions in South Korea. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the South Korean market.

- The Fund’s investments are concentrated in companies in various industries and sectors including entertainment, communication services, internet, gaming, consumer staples, consumer discretionary as well as food. The business performance of these industries or sectors are subject to a wide range of risks. Fluctuations in the business for companies in these industries or sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is KRW but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

Exploring the Investment Opportunities in K-wave: The Rise of K-dramas, Movies, and Webtoons

Korean dramas (K-dramas) and movies have gained significant international recognition, attracting a dedicated fan base. The movie ‘Parasite’ (2019) and the Netflix series ‘Squid Game’ (2021) have been sensational products globally, which played an eye-opening role for global audiences and led to increased interest in Korean content beyond Asia. The compelling narratives, talented actors, and high production quality have contributed to the global success of K-dramas and movies. Streaming platforms like Netflix, Disney+, and Amazon Prime have played a crucial role in introducing K-dramas to the global audience, allowing viewers to access and engage with a wide range of Korean content.

In fact, Korean content providers have been one of the key beneficiaries of the so-called ‘global streaming war’ because Korean dramas and movies provide the perfect solutions to these global platforms amid intense competition. Korea has a rich content source of so-called webtoons (i.e. digital comics originating from Korea) that can be used for movies and drama production. Webtoons are generally also very easy to make into series once the first one gains a good attraction and thus usually brings high returns on investments to platform companies with a good enough number of captive audiences globally. According to Netflix co-CEO Ted Sarandos, 60% of the platform’s viewers had already seen a Korean drama and the odds are high that many of those dramas were inspired by webtoons.1 Thus, we have been seeing increasing investments by global streaming companies in Korea, which will continue to create a virtuous cycle for the overall Korean content industry.

Cultural Influence and Soft Power Leading to Cross-Industry Synergies

K-pop serves as a powerful vehicle for promoting Korean culture and values on the international stage. Through their music, fashion, and performances, K-pop artists showcase the unique aspects of Korean culture, garnering interest and admiration from global audiences. The success of K-pop has paved the way for a broader interest in Korean culture, including its language, fashion, beauty, and cuisine. This cultural influence and soft power provide a unique advantage for investors looking to tap into the global consumer demand for Korean goods and experiences.

The influence of K-pop extends beyond the music industry. It permeates various sectors, including fashion, cosmetics, and entertainment. Collaborations between K-pop artists and fashion brands have led to successful clothing lines and endorsement deals. For instance, in recent years, an increasing number of Korean artists have become brand ambassadors for global luxury brands such as Channel, Louis Vuitton, and Dior. Moreover, the integration of K-pop in television dramas and movies has further amplified its reach, creating cross-industry synergies that enhance the sustainability of the entire ecosystem.

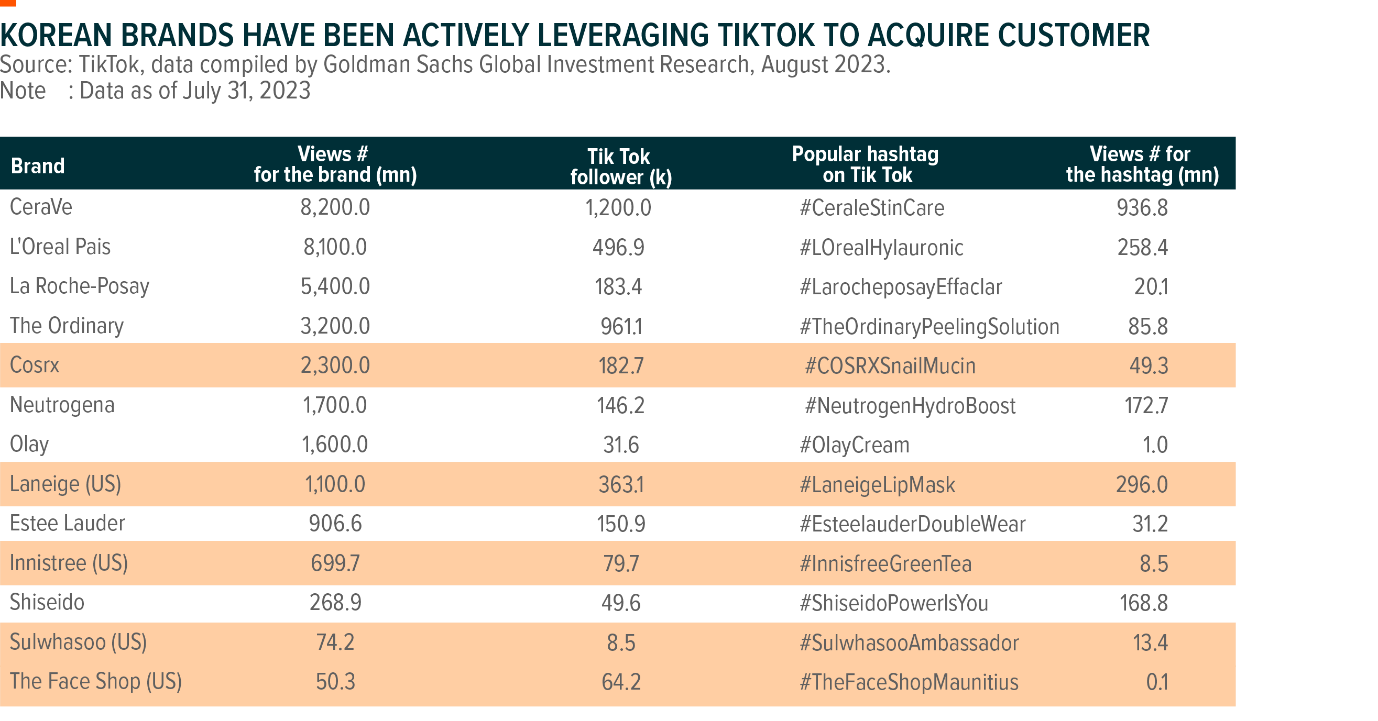

The improved brand perception of Korean goods and brands across various categories contributes to their sustainability. The widespread popularity of K-pop and Korean dramas has created a halo effect, positively impacting the perception of Korean products. Consumers associated the success and appeal of K-pop with the quality and innovation found in Korean goods. The trendiness and sophistication in Korean fashion, coupled with the innovation in cosmetics and skincare, attract global consumers. Korean cosmetics companies, both original design manufacturers (ODMs) and brand owners, have been at the forefront of innovation, introducing unique formulations, packaging, and skincare routines that have captured the attention of global consumers. The export-oriented approach of Korean companies further expands their consumer base, ensuring the long-term growth of Korean goods.

Investment Risks

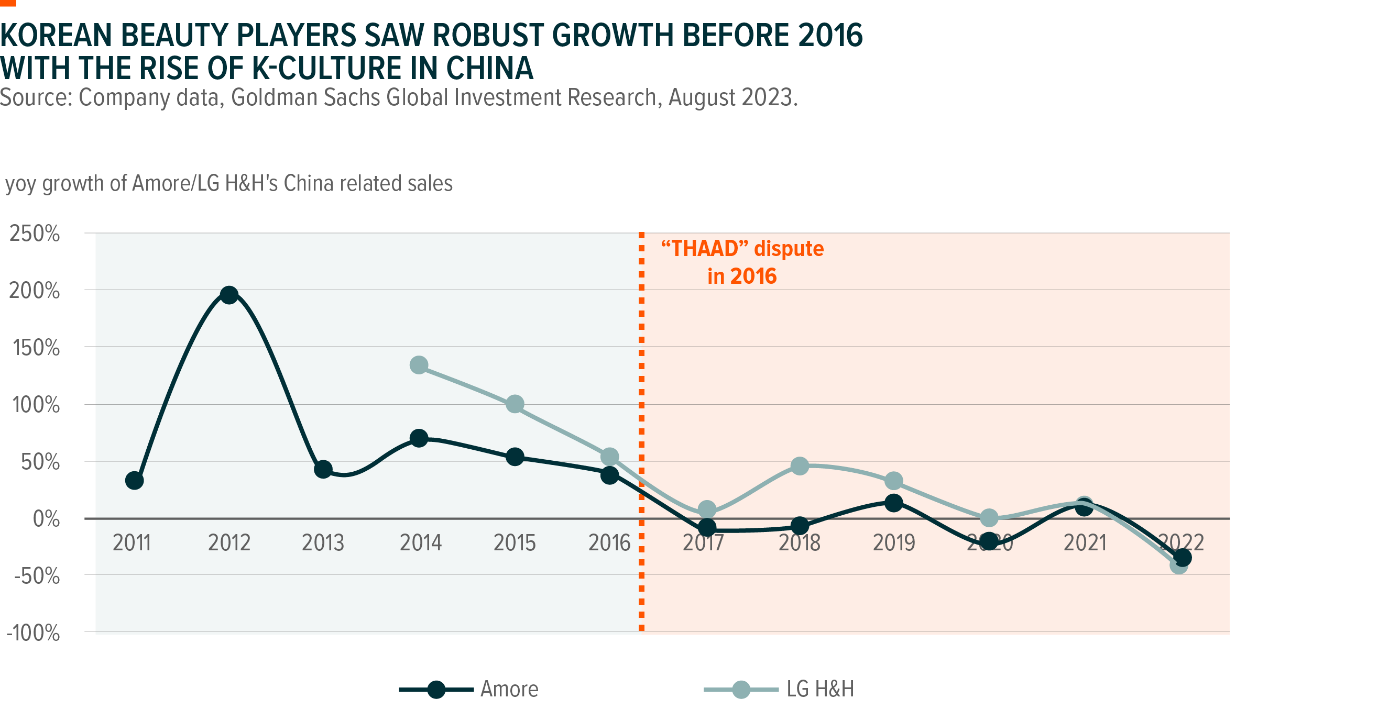

While investing in a K-Pop and Culture ETF presents opportunities, it is important to consider the associated risks. First, market saturation is a potential risk leading to increased competition and slower industry growth. This may be why leading entertainment companies are trying to make K-pop music with local artists and even produce beyond the non-K-pop genre. Second, changing trends and shifts in consumer preferences could also impact the success of specific K-pop acts or cultural trends. Third, geopolitical factors, such as tension between countries, could create uncertainties that affect K-pop’s growth and international reach. In fact, many Korean companies, from entertainment to consumer goods like cosmetics, used to rely highly on the Chinese market and were hit by geopolitical tension between the two countries due to the THAAD dispute in 2016. However, this accelerated companies’ progress in diversifying their geographical mix and fostered them to invest in other overseas markets. That said, such risk can arise from other countries and could impact companies in this ETF. Lastly, dependency on individual artists or groups poses risks, as their popularity and success can be subject to fluctuations. This is one reason why investing in this theme through an ETF provides a good way to diversify the risks.

Investing in Global X K-pop and Culture ETF (3158) offers a unique opportunity to participate in and capitalize on the sustained growth and global demand for K-pop and Korean culture. The global reach, cultural influence, cross-industry synergies, rise of K-dramas and movies, and the sustainability of Korean goods all contribute to the potential of this investment avenue. By staying informed and leveraging the opportunities presented by the thriving Korean entertainment industry, investors can position themselves to potentially benefit from the continued success and growth of the K-pop and Korean culture phenomenon.