Important Information

Investors should not base investment decisions on this website alone. Please refer to the Prospectus for details including product features and the risk factors. Investment involves risks. Past performance is not indicative of future performance. There is no guarantee of the repayment of the principal. Investors should note:

- The investment objective of Global X K-pop and Culture ETF (the “Fund”) is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive K-pop and Culture Index (the “Index”).

- The Index is a new index. The Index has minimal operating history by which investors can evaluate its previous performance. There can be no assurance as to the performance of the Index. The Fund may be riskier than other exchange traded funds tracking more established indices with longer operating history.

- The Fund is subject to concentration risk as a result of tracking the performance of a single geographical region or country (South Korea). The Fund may likely be more volatile than a broad-based fund, such as a global equity fund, as it is more susceptible to fluctuations in value of the Index resulting from adverse conditions in South Korea. The value of the Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory event affecting the South Korean market.

- The Fund’s investments are concentrated in companies in various industries and sectors including entertainment, communication services, internet, gaming, consumer staples, consumer discretionary as well as food. The business performance of these industries or sectors are subject to a wide range of risks. Fluctuations in the business for companies in these industries or sectors will have an adverse impact on the Net Asset Value of the Fund.

- The Fund may invest in small and/or mid-capitalisation companies. The stock of small-capitalisation and mid-capitalisation companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general.

- Underlying investments of the Fund may be denominated in currencies other than the base currency of the Fund. In addition, the base currency of the Fund is KRW but the trading currency of the Fund is in HKD. The Net Asset Value of the Fund and its performance may be affected unfavourably by fluctuations in the exchange rates between these currencies and the base currency and by changes in exchange rate controls.

- The borrower may fail to return the securities in a timely manner or at all. The Fund may as a result suffer from a loss or delay when recovering the securities lent out. This may restrict the Fund’s ability in meeting delivery or payment obligations from redemption requests. As part of the securities lending transactions, there is a risk of shortfall of collateral value due to inaccurate pricing of the securities lent or change of value of securities lent. This may cause significant losses to the Fund.

- The trading price of the Shares on the SEHK is driven by market factors such as the demand and supply of the Shares. Therefore, the Shares may trade at a substantial premium or discount to the Fund’s Net Asset Value.

- Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment.

Exploring the Investment Opportunities in K-wave: The Global Reach of K-Pop

The Global X K-pop and Culture ETF (3158) presents an exciting investment opportunity in the dynamic world of K-pop and Korean culture. With its global reach, cultural influence, cross-industry synergies, the rise of K-dramas and movies, the emergence of webtoons, and the sustainability of Korean goods, this ETF offers investors a chance to capitalize on the sustained growth and global demand for all things K-pop. By exploring the potential of this ETF, investors can tap into the thriving Korean entertainment industry and its associated sectors, while being mindful of potential risks and leveraging the opportunities presented by this global phenomenon.

The global phenomenon of K-pop, along with the vibrant and influential Korean culture, has captivated audiences worldwide. The cultural wave, characterized by its music, entertainment, fashion, beauty, cuisine, and more, has not only transformed the Korean entertainment industry, but also presents unique investment opportunities across various sectors. In this article, we will delve into the potential of investing in a K-Pop and Culture ETF, examining the key factors contributing to its sustainability and growth.

Why K-Pop and Culture Growth is Sustainable

The sustained growth of K-pop and Korean culture can be attributed to several factors. Firstly, the global reach of K-pop has created a massive and dedicated fan base, ensuring a steady demand for K-pop music, merchandise, and associated products. Additionally, Korean content, such as dramas and movies, will continue to grow thanks to strong support and investment by not only locals but also global streaming companies. Moreover, the cultural influence and soft power of K-pop have expanded interest in Korean culture as a whole, including its fashion, beauty, cuisine, and language. This broader interest creates a sustainable consumer base for various Korean goods and experiences. Furthermore, the cross-industry synergies resulting from collaborations between K-pop artists and other sectors contribute to the overall growth and sustainability of the K-pop and Korean culture ecosystem.

The Global Reach of K-Pop

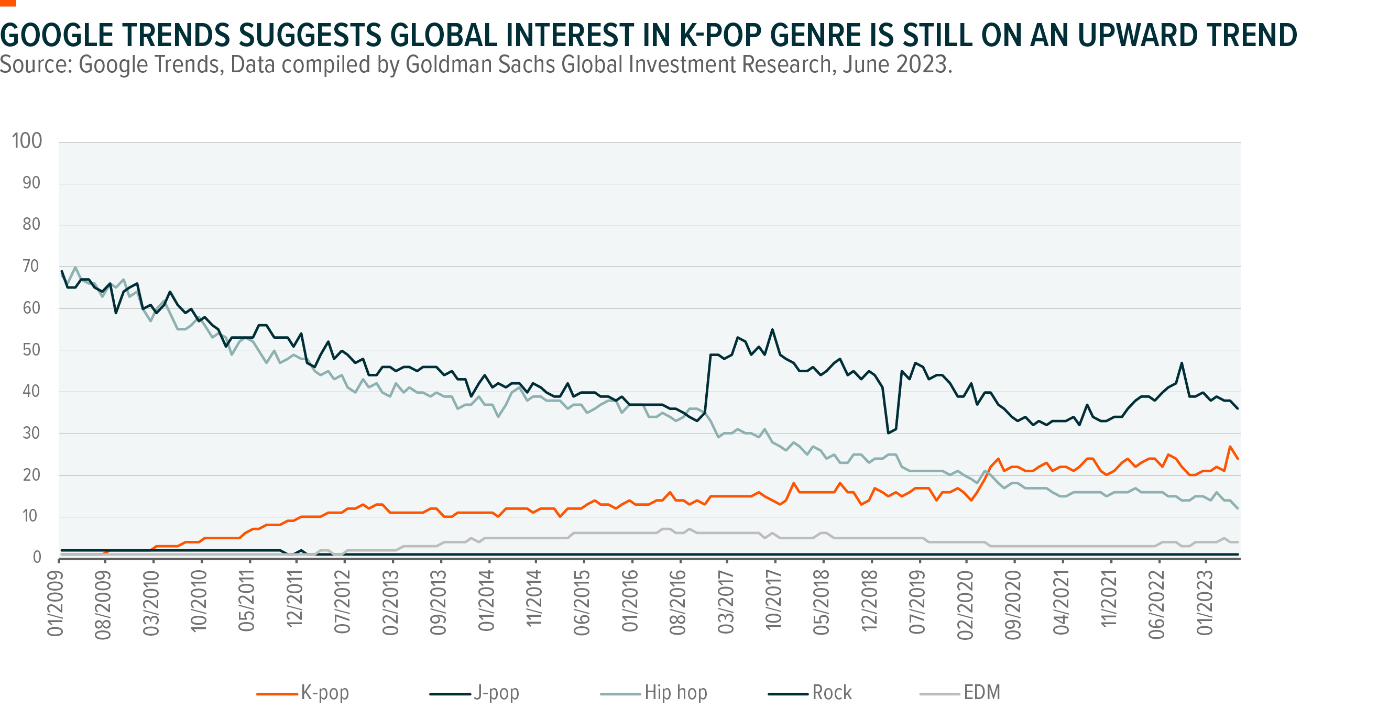

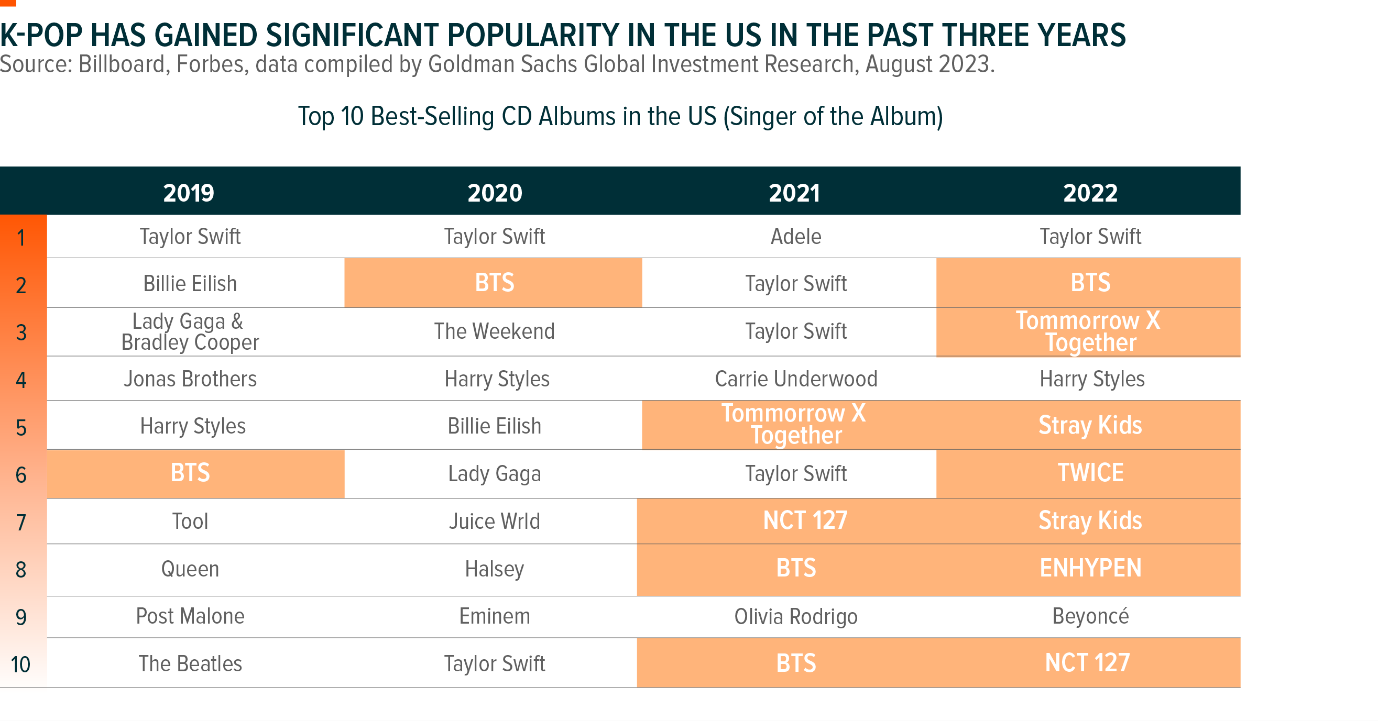

K-pop has transcended borders, captivating fans across continents. Its infectious melodies, captivating performances, and highly synchronized choreography have propelled K-pop artists to global stardom. The rise of social media platforms and streaming services has facilitated the widespread dissemination of K-pop music, enabling fans from around the world to connect and engage with their favorite artists. The global popularity has created a massive and dedicated fan base, providing a strong foundation for the sustainability of the K-pop industry.

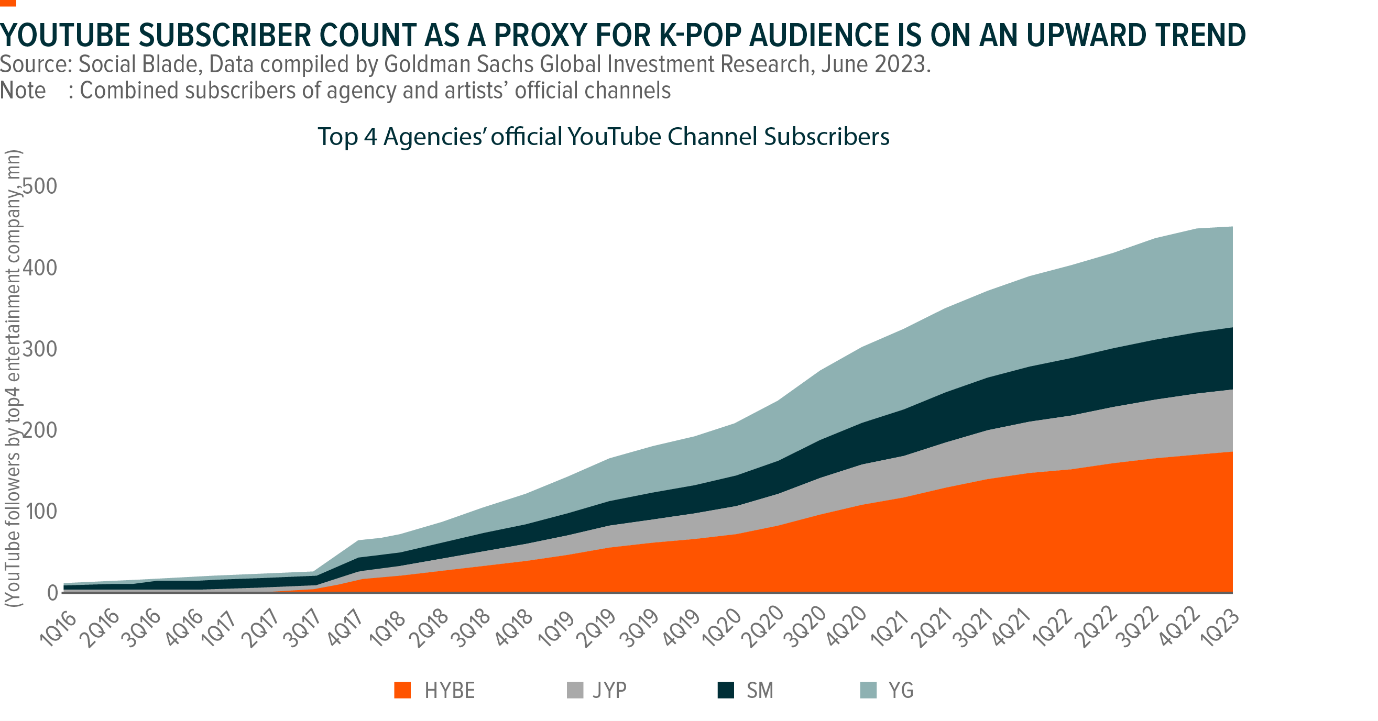

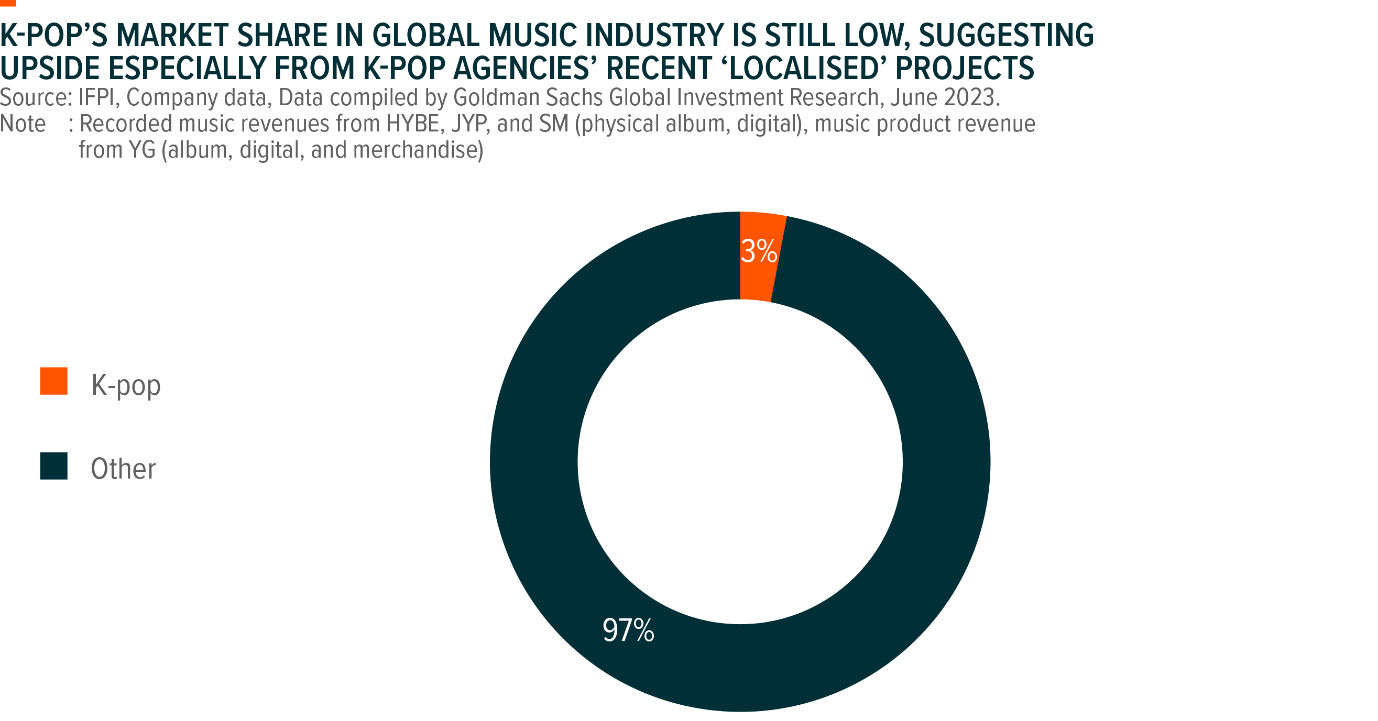

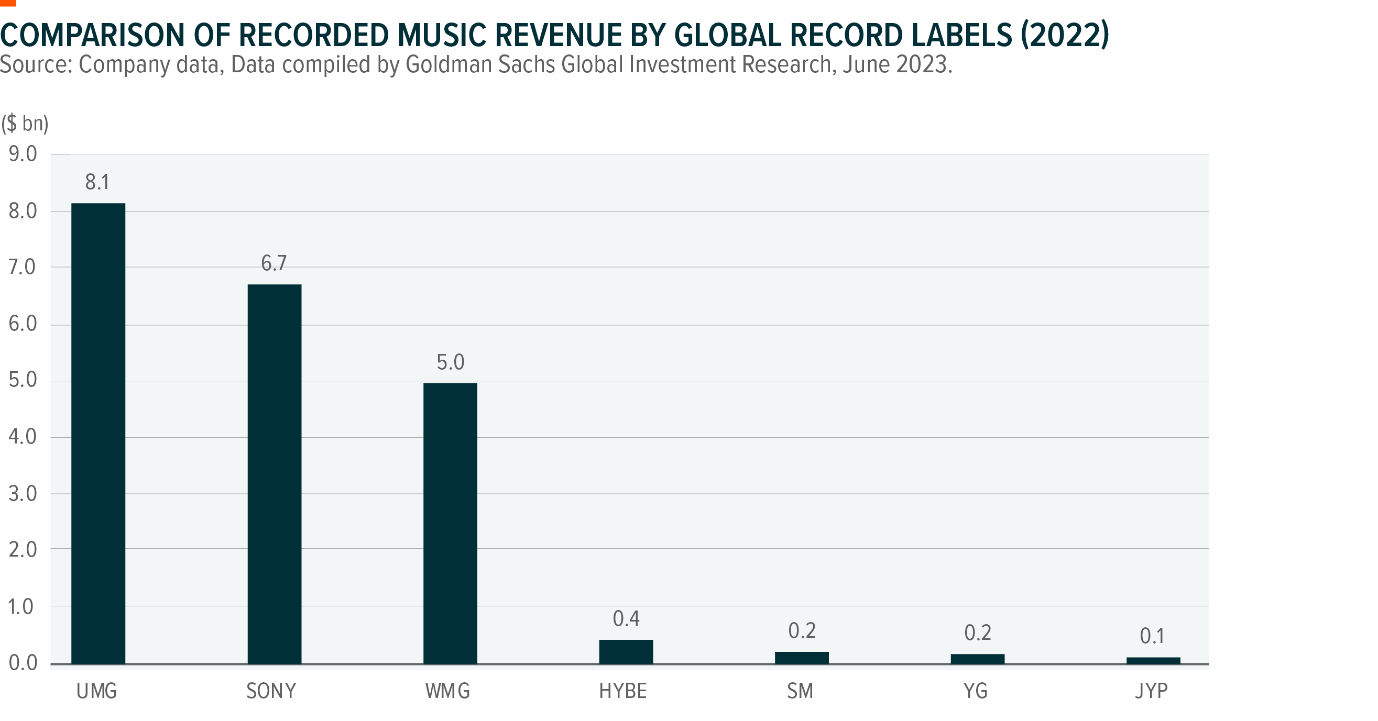

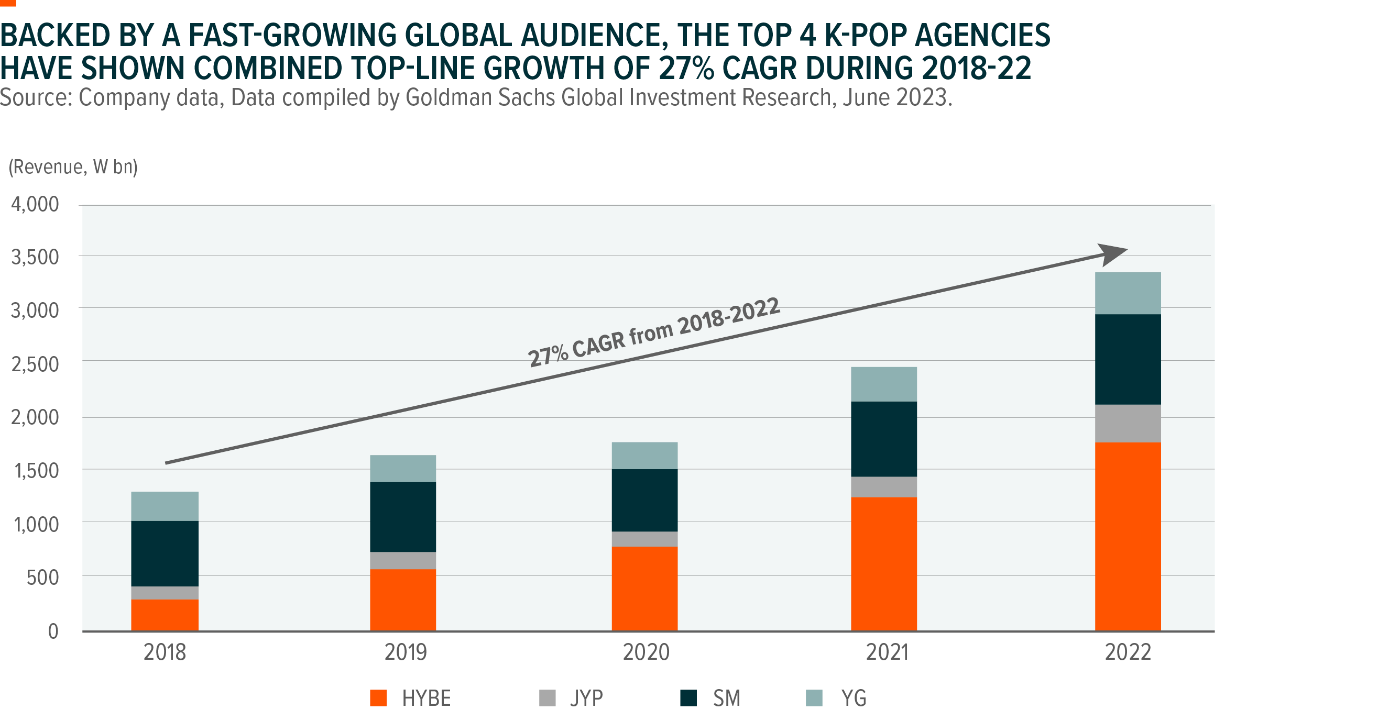

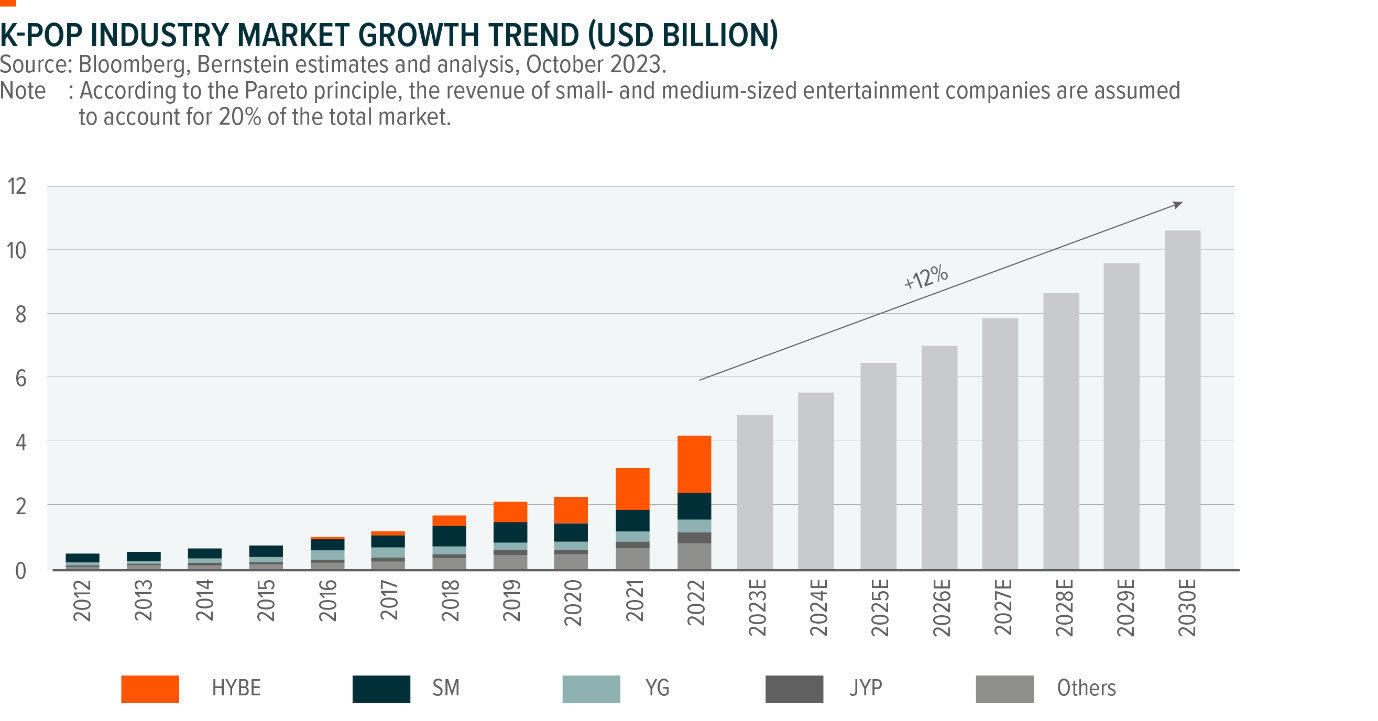

The robust growth of K-pop fans has scaled up revenue, extended the careers of artists, and expanded the artist line-up of agencies. Additionally, the shift from traditional music sales to digital streaming and the rise of merchandise sales, fan events, and brand partnerships is reshaping the industry into a multi-year growth story. The top line for the top four K-pop agencies (Hybe, JPY, SM, and YG) has grown 27% CAGR from 2018-2022.1 Yet, K-pop remains a niche genre, accounting for 3% global share in 2022 in the Western mainstream music market, which implies ample room for growth in the coming years.2

The key moat of the top K-pop agencies lies in their unique, systemized end-to-end approach to production, from talent acquisition and incubation to content development, allowing for visible and sustainable growth while building a high entry barrier. Thus, leading K-pop agencies see growth opportunities not only from exporting K-pop artists to global markets but also from creating/developing non-K-pop artists in local markets and even other genres of music in the global market by leveraging K-pop training systems. In fact, JYP already launched a global audition program this year called A2K (America to Korea) to train local artists under their K-pop training ecosystem. Hybe acquired Ithaka Holdings in 2021, with several famous artists, such as Justin Bieber, to tap into the global music market by collaborating with global artists. The company is also going through global auditions to create a music group for non-K-pop music as the company believes its competitiveness is in its training system, which can be applied across different genres of music in the global market. It will be interesting to see how successful their localization strategy works, which can further expand their total addressable market (TAM) beyond K-pop music and broaden the industry’s global footprint. Bernstein currently forecasts the K-pop industry market to grow 12% CAGR from 2023 – 2030E, which does not factor in the potential in the non-K-pop genre.3