Electric Vehicle Battery Materials: Separators

We have discussed cathode and anode materials in the electric vehicle (EV) battery supply chain. In this article, we would like to take a deep look at separator materials which are also an important part of EV batteries

Separator materials

A separator is a permeable membrane placed between a battery’s anode and cathode. The major function is to isolate cathode materials from anode materials to prevent short circuit while allowing for lithium ions to flow in the electrolyte between cathode and anode. Separators are a critical component in batteries as their structures and properties decide batteries’ performance which includes energy density, battery cycle life, safety, as well as cost.

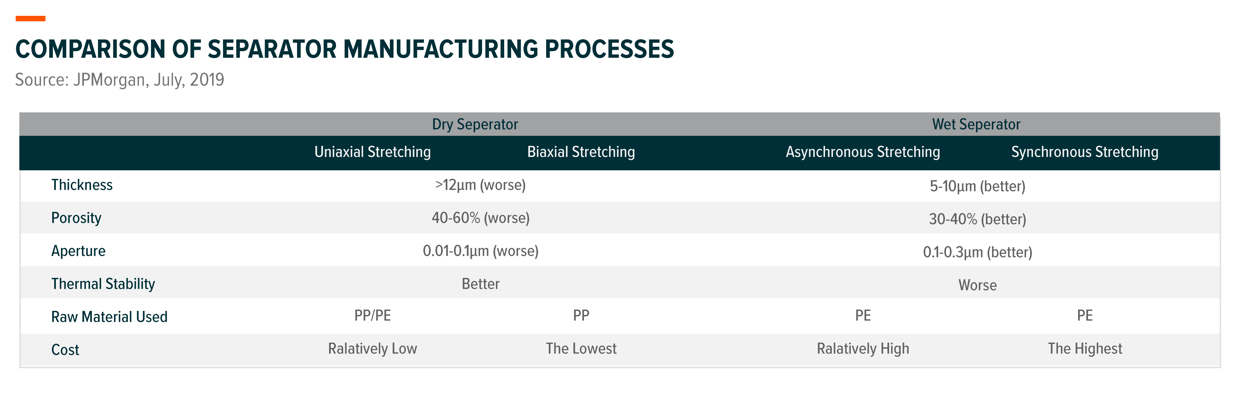

Separator manufacturing is based on micropore preparation technology and products evolve with production process innovation. Separators are usually produced via a dry or wet process, as well as coated separator by wet process. Exhibit 2 shows the difference between dry and wet processes. To summarize the table, it is a tradeoff between cost and properties given knowhow is no longer a constraint, just as many other manufacturing businesses. What drives the emergence of wet process is mainly the pursuit for higher energy density with thinner separators. Coated separator is one step further by coating ceramic base, polyvinylidene fluoride (PVDF), aramid and other adhesives on traditional wet separator base film in order to improve thermal stability and prolong the lifespan of separators, especially for high nickel batteries.

Nature of the business

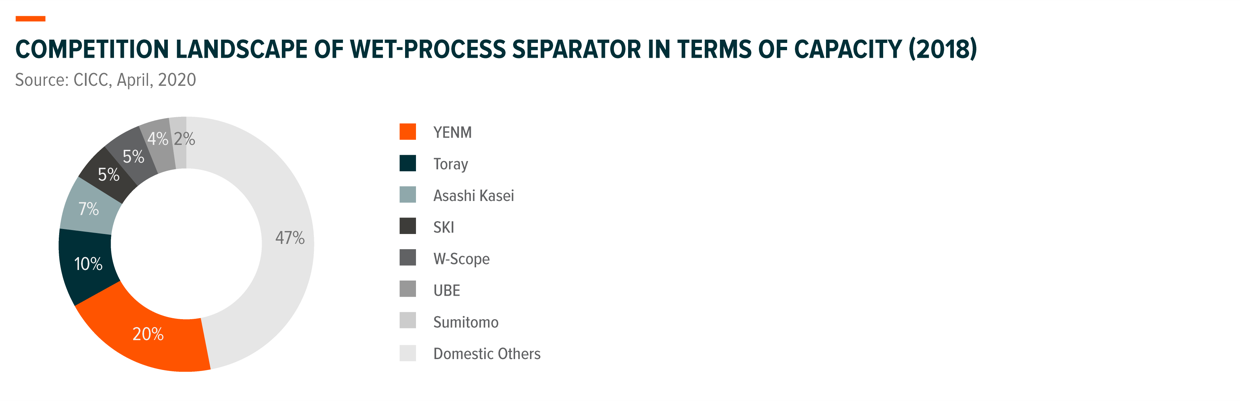

Separator manufacturing is a typical fine manufacturing business with four major inputs, namely raw materials, equipment, power and labor. Take a leading separator company, Yunnan Energy New Materials (YENM), as an example. Raw materials take up 57% of the total production cost, followed by manufacturing cost (equipment depreciation and amortization) at 20%, power at 16% and labor cost at 6%.1 Raw materials are polythene (PE) for wet separators and polypropylene (PP)/PE for dry separators. PE and PP are commodities produced mainly in Japan, Korea and the US. Japan Steel Works (JSW) is one of the key equipment manufacturers providing the whole automatic production line with great consistency and stability. Most of the Japanese and Chinese separator makers use JSW products. There are some Chinese equipment makers that produce dry separators, but generally speaking, Japan is taking the lead. Since battery makers have a high requirement on separators’ consistency and stability, most of the manufacturing process is done by machines automatically, which means separator manufacturing is not a labor intensive industry. It also explains why this sector is not dominated by Chinese players who usually have the cost advantage of cheap labor, but no such advantage of equipment or raw materials. Exhibit 3 shows the current competition landscape of separator industry.

Future for separators

Separator innovation has been slowly accompanying the changes of cathode and anode materials as well as EV battery cells. Cheap coated separator with specific properties to electrodes are one of the directions in the future, as battery makers strive for higher energy density. For example, separators coated with polymeric substances have become widely used in the so-called semi-solid batteries. They can help keep good lithium ion conductivity through the holes while the electrical insulation and electrochemistry properties are stable. However, the separator sector is also facing challenges from solid-state batteries that do not need separators. Though solid-state batteries are still far from mass production, we will keep a close eye on its development and the impact to the separator sector.